Brazil is testing one of the oldest assumptions about crypto: that digital assets only thrive when the traditional financial system malfunctions.

With the benchmark Selic interest rate at 15%, among the highest in major economies, the Brazilian central bank maintains a very tight monetary policy. However, according to new research from the IMF, the country's financial system has not experienced major upheaval and remains stable. In particular, the credit market remains robust while the use of crypto continues to surge despite a favorable macroeconomic environment.

Why does accepting crypto in Brazil go against traditional macroeconomic logic?

Just days after releasing its Q2 2025 COFER data , the International Monetary Fund (IMF) has released another report, this time analyzing Brazil's macroeconomic outlook.

In the article, the IMF stated that the recent credit growth in Brazil “is not a failure of policy,” and noted that monetary policy transmission remains effective despite high interest rates.

“IMF research shows that recent credit growth in Brazil, against a backdrop of a 15% benchmark interest rate, is not a policy failure. Fintech companies and rising incomes are changing the landscape of access to finance. Meanwhile, monetary policy continues to work,” the IMF Chia in the post.

Bank credit is projected to increase by 11.5% in 2024, while the number of corporate bonds issued is expected to rise by 30%. These figures typically lead to a decrease in demand for alternative financial assets. According to conventional macroeconomic logic , this would be an unfavorable environment for crypto to thrive.

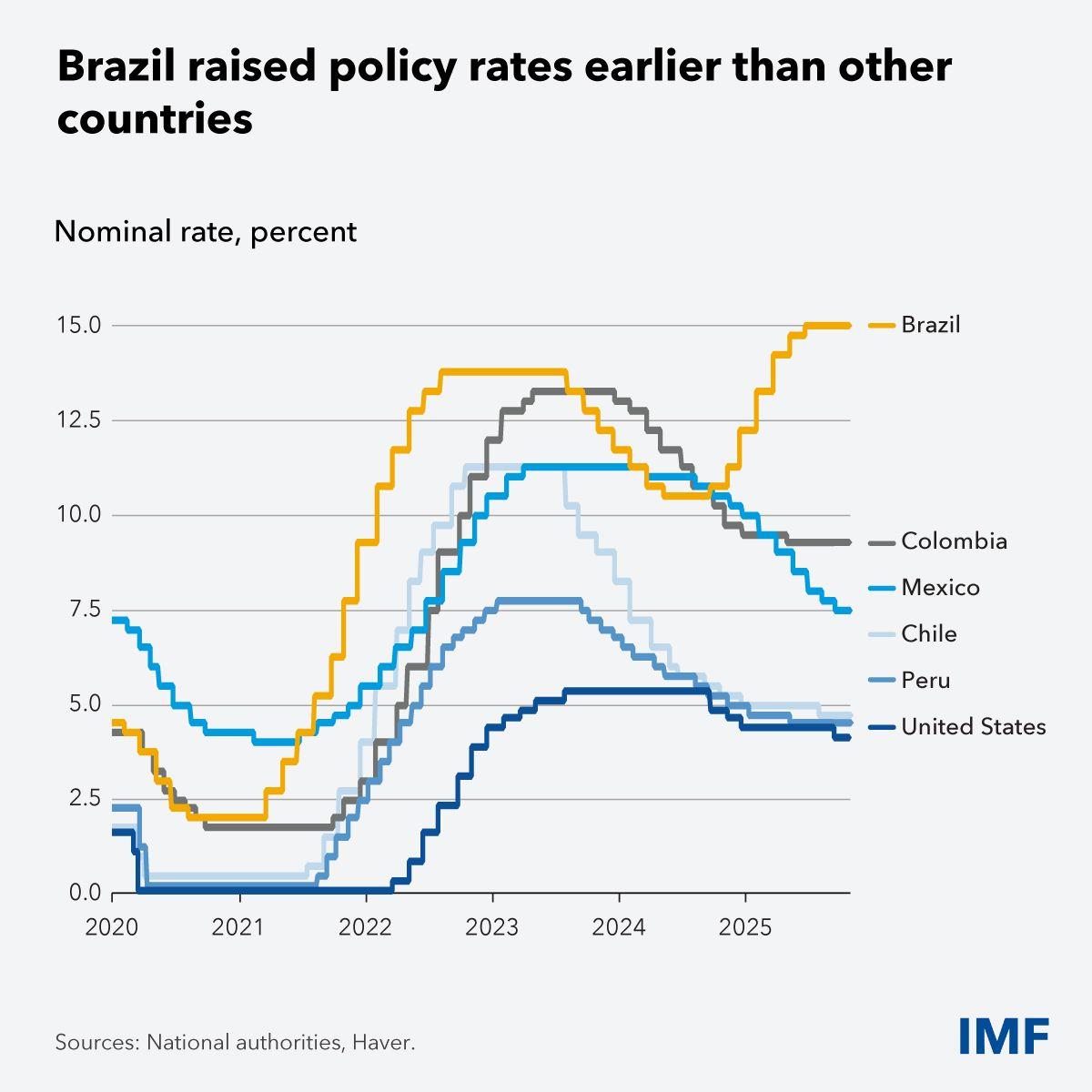

Brazil raised its policy interest rate earlier and more aggressively than its peers, reaching 15% in 2024-2025 (Source: IMF).

Brazil raised its policy interest rate earlier and more aggressively than its peers, reaching 15% in 2024-2025 (Source: IMF).However, crypto-related activity in Brazil is projected to increase by 43% year-on-year (YoY) in 2025, suggesting that the reality of crypto usage in the country differs significantly from traditional macroeconomic theories.

An efficient system that still operates on the blockchain.

According to the latest Article IV consultations from the IMF, it is emphasized that the Central Bank of Brazil “has done its part.”

- The tightening policy has been reflected in lending interest rates.

- Credit growth began to slow down, and

- Although inflation expectations remain high, they are being proactively controlled.

Rising incomes, low unemployment rates , and the rapid growth of fintech companies have contributed to sustained credit demand despite high interest rates.

Digital banks and fintech companies now account for approximately 25% of the credit card market in Brazil, expanding financial access for the population without compromising the effectiveness of monetary policy.

However, the rapid growth of crypto is not due to people rebelling against the traditional financial system, but rather it is increasingly becoming a natural extension of that system.

Citing Mercado Bitcoin – the largest cryptocurrency exchange in Latin America – market experts point out that the younger generation of investors is a key driver of growth in the Brazilian crypto market.

The proportion of investors aged 24 and under has increased sharply by 56% year-on-year, mainly due to the development of stablecoins and digital bond products instead of chasing speculative altcoins.

Digital fixed-income products generated approximately $325 million in profits in 2025, directly competing with the high interest rates offered by carry-trade strategies in Brazil.

Total crypto volume increased by 43%, while lower-risk crypto products saw a surge of 108%, indicating a shift from speculation to more structured and planned investment.

Medium income investors are allocating a large proportion of their assets to stablecoins , while lower-income investors still favor Bitcoin in the hope of higher returns.

Bitcoin continues to be the most traded digital asset in Brazil, followed by Ethereum and Solana; an estimated 18% of investors diversify their portfolios across multiple cryptocurrencies.

These actions have refuted the notion that people's use of crypto is simply due to inflation, a currency crisis, or failed policy.

Traditional finance is starting to change.

Large financial institutions are also adapting to this trend. Itaú Unibanco, Latin America's largest private bank, has recommended that clients allocate 1% to 3% of their portfolios to Bitcoin , XEM it as a diversification and hedging tool rather than a speculative approach.

This bank assesses Bitcoin as having a low correlation with traditional assets, while also Vai as a decentralized and globally traded "store of value." This recommendation also aligns with the views of major asset managers in the US.

With Mercado Bitcoin expanding into Tokenize income and equity products, including its launch on the Stellar network, the lines between traditional finance and blockchain technology are becoming increasingly blurred.

Experience in Brazil has shown that the view that crypto only thrives in crisis systems is no longer accurate. In fact, it reflects a new phase of adoption driven by utility, accessibility to returns, and portfolio diversification, even when monetary policy is functioning in the right direction.

The next major debate topics will likely no longer revolve around inflation or interest rates, but rather around issues of privacy, transparency, and regulation. As crypto becomes increasingly integrated into the regulated financial system, discussions are shifting from macro-level failures to who will control this infrastructure.

The crypto boom in Brazil isn't a case of "fleeing the crisis." It's a convergence of two worlds, and this could be the biggest, most disruptive change happening today.