Overall, the crypto market in 2026 will be a new ecosystem characterized by sound regulation, institutional dominance, and clear division of labor among various sectors. While overall market volatility may be mitigated by institutionalization, internal competition will intensify. The key to success lies in building genuine commercial value and ecosystem barriers within specific vertical sectors, all within a compliant framework.

Article author and source: BitMart

I. Top Ten Predictions for 2026

1. Institutionalization of regulation and the entry of trillions of yuan in funds

With the enactment of the US GENIUS and CLARITY laws, the crypto industry will transition from a law enforcement-driven to a rule-driven golden age. This shift will unlock trillions of dollars in institutional funds, prompting banks to issue compliant stablecoins and RWA on a large scale on public blockchains, leading to an explosive growth of 100% in the scale of crypto asset custody compared to 2025.

2. Bitcoin becomes a global strategic reserve asset.

Bitcoin will officially shed its speculative label, with volatility dropping to S&P 500 levels, evolving into a global non-sovereign reserve asset. It is projected that at least five sovereign nations will incorporate it into their national treasuries, and institutional holdings will account for over 15% of the circulating supply, making it an indispensable digital safe-haven anchor on global corporate balance sheets.

3. Stablecoins dominate the global digital cash tier.

The annual settlement volume of stablecoins is expected to surpass Visa's annual processing volume, making it the world's largest 24/7 clearing network. Benefiting from favorable regulations, interest-bearing stablecoins will be highly integrated with tokenized deposits, becoming the fiat currency interface of the Web3 era and providing global users with an inclusive financial channel pegged to US Treasury yields.

4. RWA's Leapfrog Growth and Full Asset Transactions

The tokenized real-world asset (RWA) market is poised to surpass $500 billion, with 2% of global US Treasury bonds circulating through public blockchains. Crypto exchage will evolve into all-asset hubs, allowing users to seamlessly switch between cryptocurrencies, stocks, and bonds within a unified liquidity pool, achieving near-instantaneous cross-market asset and liquidity allocation.

5. The birth of a one-stop "financial super application"

The market will see multiple Web3 super apps with over 100 million users, integrating spot trading, memes, RWA, and traditional securities under a unified compliant account. These applications will completely bridge the gap between on-chain and off-chain environments, eliminating the need for users to understand private keys or gas fees. This will allow the Web3 user base to surpass 20% of the global internet population, enabling large-scale, seamless application.

6. Capital Revaluation in the DATs 2.0 Era

Digital asset finance companies (DATs) will evolve from passively holding tokens to actively operating on-chain banks, capturing excess returns through staking and restaking. The valuation of these companies will shift from net asset value to discounted cash flow (DCF) models, with their annualized cash flow returns expected to remain stable above 8%.

7. ETF diversification and the disappearance of investment thresholds

Spot ETFs will see a surge in adoption, moving from single-currency offerings to strategy-enhanced and thematic index ETFs. Over 50 products covering Altcoin portfolios, AI + DePIN, and other themes will be launched. Cryptocurrency ETFs will account for more than 5% of total global exchange-traded ETF assets, effectively removing the last obstacle for traditional pension funds and retail investors to participate in this emerging sector.

8. Prediction markets are evolving into risk pricing centers.

The prediction market will evolve from a native game theory tool into a global risk pricing infrastructure. Through probability pricing combined with financial game mechanisms, it will become a more accurate indicator of collective expectations than traditional polls, and its accuracy in predicting macroeconomic events will continue to surpass that of traditional institutions.

9. Substantial implementation of AI-powered intelligent economics

Leveraging protocols such as x402, AI agents will have independent wallets and initiate transactions autonomously, with over 30% of on-chain interactions being completed by AI. This machine-to-machine model supports settlements as low as $0.001 per transaction, completely solving the real-time payment challenges of computing power leasing and data procurement, marking the official synchronization of on-chain value flow with information flow.

10. Vertical Utility Differentiation in the Public Blockchain Sector

The competition among public blockchains will shift from a singular focus on performance to a professional landscape based on demand. Ethereum will dominate over 40% of institutional-grade settlement and security layers; high-performance chains like Solana will support social and payment interactions; and other specialized chains will focus on AI computing power and DePIN, forming a differentiated competitive loop.

II. Macroeconomic Review and Forecast

The global macroeconomic outlook for 2025 is characterized by high complexity and a complex interplay of multiple variables. The core theme remains the dynamic balance between inflation stickiness, economic growth resilience, and financial stability in a high-interest-rate environment.

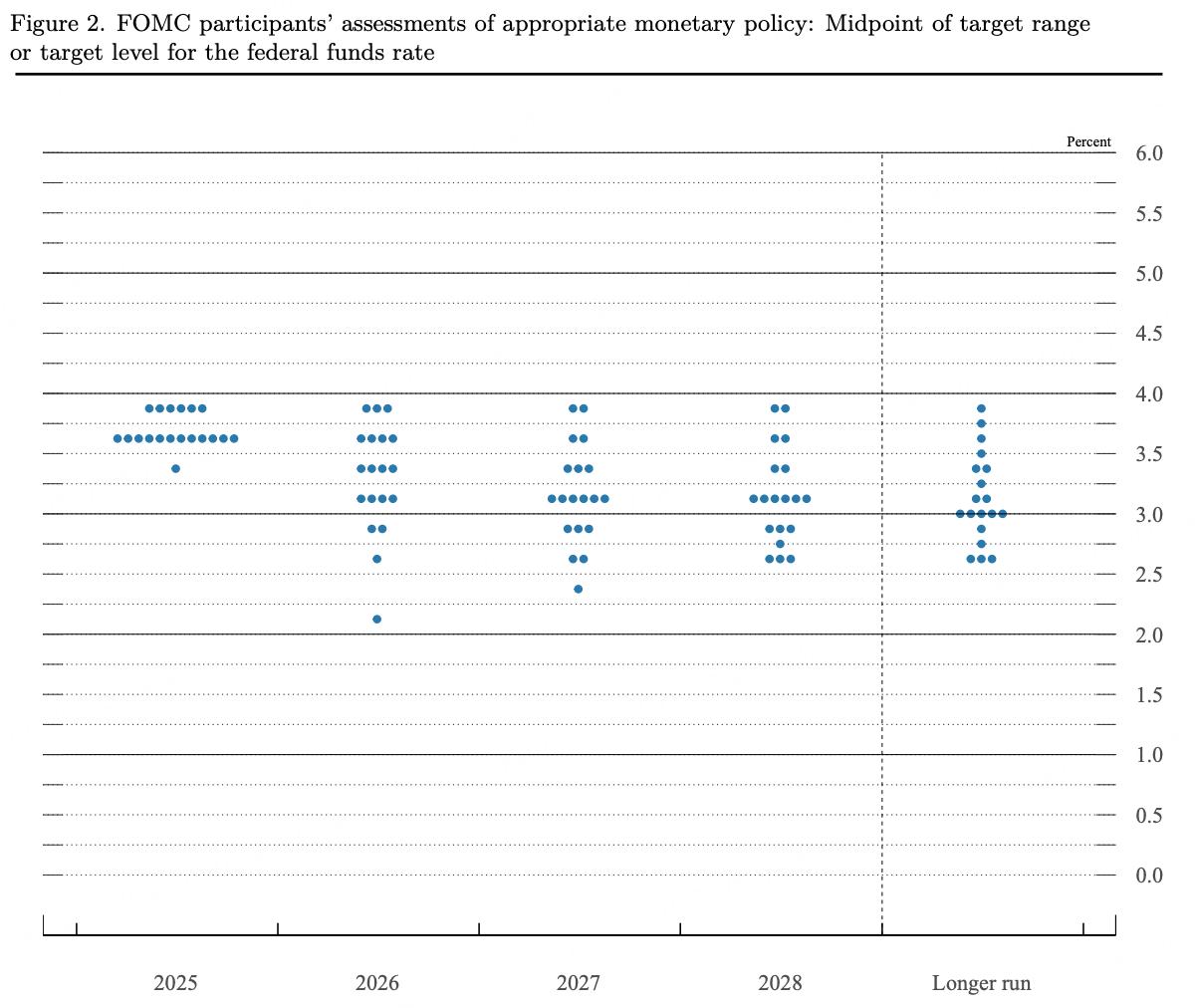

The Federal Reserve's policy stance is one of extreme restraint amidst a rate-cutting cycle. While supporting the economy through small rate cuts and a slowdown in balance sheet reduction (leaning towards a dovish stance), the pace of rate cuts has been slower than market expectations due to factors such as a hawkish shift in voting members, a rebound in inflation expectations, and interference from tariff policies. This demonstrates a firm and cautious position, indicating a readiness to pause rate cuts at any time to curb inflation. The Fed consistently emphasizes data-dependent principles in its policy meetings and communications, paying particular attention to core PCE, services inflation, and the tightness of the labor market.

At the beginning of the year, the federal funds target rate remained within a restrictive range, and the Federal Reserve repeatedly emphasized that it would not easily ease policy until inflation was "sustainably suppressed." Entering the second half of the year, with the narrowing of the labor market gap and a structural slowdown in economic growth momentum, the Fed's policy focus shifted from solely combating inflation to a balanced approach to its dual mandate. Although core inflation remained sticky due to global trade policy disruptions, against the backdrop of substantially high real interest rates, the Fed initiated a gradual interest rate cut process to prevent an unexpected economic slowdown. This move did not signal a return to a low-interest-rate era, but rather a discretionary correction of excessive tightening while ensuring that inflation did not rebound; the overall tone remained within a relatively tight "restrictive range."

In 2025, the US inflation process is stuck in an "asymmetric decline" stalemate. On the one hand, core commodity inflation continues to deflate due to the combined effects of supply chain redundancy and slowing global demand, effectively offsetting some price pressures; on the other hand,

Service sector inflation, constrained by the slow transmission of housing rents and the structural cost rigidity of labor-intensive sectors, exhibited strong downward resilience. Entering the second half of the year, market expectations for a new round of trade tariffs and expansionary fiscal policies intensified, significantly increasing the tail risk of double-dip inflation. This inflationary pattern led to a plateau in core CPI around 2.7%, forcing the Federal Reserve to maintain a gradual approach to interest rate cuts, ensuring that inflation expectations are not anchored by maintaining a restrictive interest rate range.

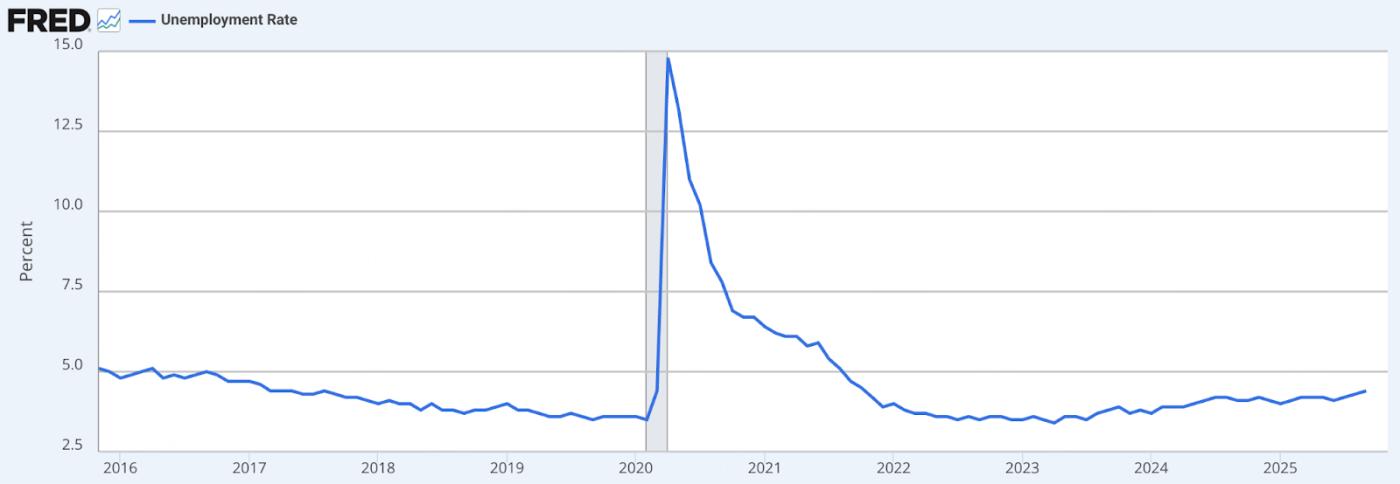

Compared to the slow decline in inflation, the labor market signaled a clearer weakening in the second half of 2025. The unemployment rate has steadily climbed from its low at the beginning of the year to 4.6%, reaching its highest level since 2021, indicating a substantial easing of the severe labor shortage in the post-pandemic era. Although non-farm payroll data remained positive, the internal structure has become severely divergent, with hiring momentum in the interest rate-sensitive manufacturing and financial sectors almost stagnant. Defensive pressures on the employment side are replacing the demand for inflation protection, becoming the decisive marginal variable driving the Federal Reserve to begin a phased interest rate cut at the end of the year.

Looking ahead to 2026, the US economy is expected to enter a recovery phase. While high interest rate pressures will continue to constrain the extent of consumption expansion, the structural robustness of the labor market and the repair of household balance sheets provide a solid buffer against recession. Monetary policy will maintain a neutral-to-loose but prudent stance, rather than returning to an era of extremely low interest rates. Meanwhile, rising sovereign debt pressures will force fiscal policy to become more targeted. Against the backdrop of global liquidity rebalancing, the stabilization of real interest rates will drive capital to shift from speculative premiums to certain growth, and the fragmented restructuring of geoeconomics will lead to a significant defensive divergence in growth performance among countries.

Data source: Federal Reserve Board, Summary of Economic Projections, December 10, 2025.

Against this macroeconomic backdrop, the external environment for the crypto market is expected to improve compared to previous cycles, but this improvement will be more structural than simply driven by liquidity. With the end of the interest rate hike cycle, real interest rates are expected to stabilize and decline, easing long-term valuation pressures on risk assets. Meanwhile, progress in the US regulation of stablecoins and crypto ETFs in 2025 will gradually bring crypto assets into a clearer regulatory framework. Entering 2026, the policy focus will shift from establishing regulations to implementation and coordination, thereby influencing institutional fund allocation. Overall, in 2026, the impact of macroeconomic factors on the crypto market will be more reflected in policy, capital structure, and institutional behavior. The crypto market is gradually evolving from a cyclical, narrative-driven speculative market into an alternative asset class deeply linked to global macroeconomic cycles.

III. Development Status of Major Public Blockchains

1.BTC

1.1 Market Performance

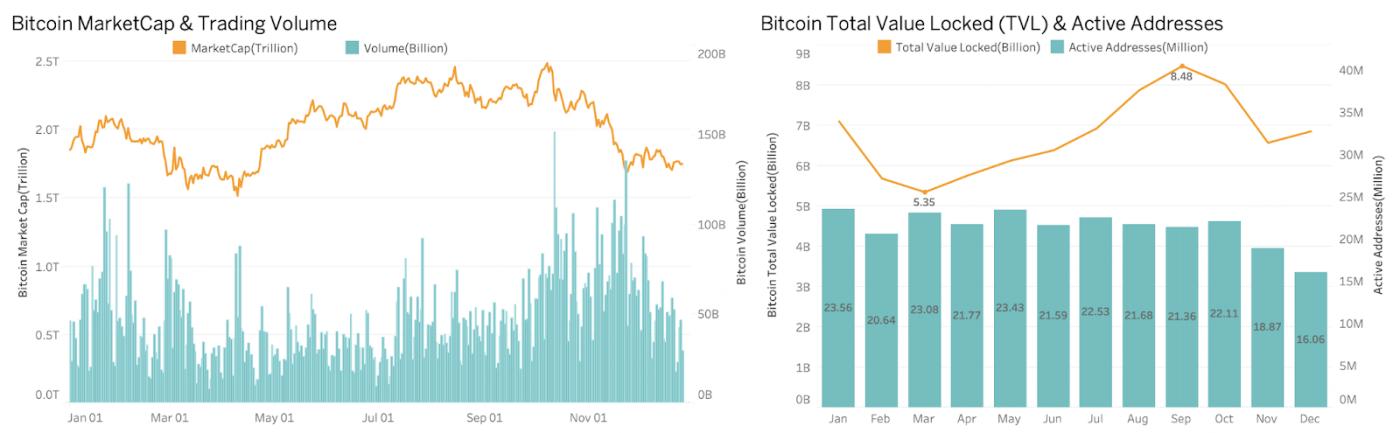

Data source: BitMart API

In 2025, Bitcoin's price exhibited a high-level, volatile trend. At the beginning of the year, after a brief surge to $109,000, Bitcoin quickly retreated to $74,000 due to market uncertainty caused by US tariff policies. Subsequently, market narrative shifted to expectations of interest rate cuts by the Federal Reserve, driving a strong, one-sided upward trend in Bitcoin from March to July, with the price climbing from approximately $80,000 to around $125,000.

However, the second half of the year saw a more dramatic turnaround. Impacted by a confluence of negative factors, including the historic liquidation of the cryptocurrency market on October 11th and the US government shutdown, Bitcoin's price continued to decline. By December, it closed at approximately $85,000, a nearly 33% drop from its year-to-date high. The year's performance clearly demonstrates that Bitcoin's price fluctuations are deeply anchored to global liquidity expectations and macroeconomic data, highlighting its increasingly prominent role as a macroeconomically sensitive asset.

1.2 On-chain data

Data source: CoinGecko, DeFiLlama

On the on-chain data level, Bitcoin's market capitalization expanded rapidly and remained high in the first half of the year, fluctuated at a high level in the third quarter, and declined significantly in the fourth quarter due to systemic risks, indicating that while the price center rose, volatility increased significantly. Trading volume was mainly concentrated at trend inflection points and periods of sharp fluctuations, especially during rapid declines, demonstrating Bitcoin's status as the core liquidity carrier in the crypto market.

TVL (Total Value Limit) and the number of active addresses rebounded during the upward phase and contracted during the downward phase. On-chain participation is highly sensitive to price changes, and overall demand remains primarily driven by trading and speculation, with limited long-term capital accumulation. In general, Bitcoin has entered a new phase characterized by "high market capitalization, high liquidity, and high volatility." ETFs and DATs, among other structural funds, mainly serve to reinforce the trend and provide temporary support, but their impact on on-chain activity and real-world usage demand remains limited. Looking ahead, Bitcoin's core position in the global risk asset system will be further consolidated, but the market is more likely to exhibit structural fluctuations within a high-level range rather than a one-sided trend.

1.3 BTC Spot ETF

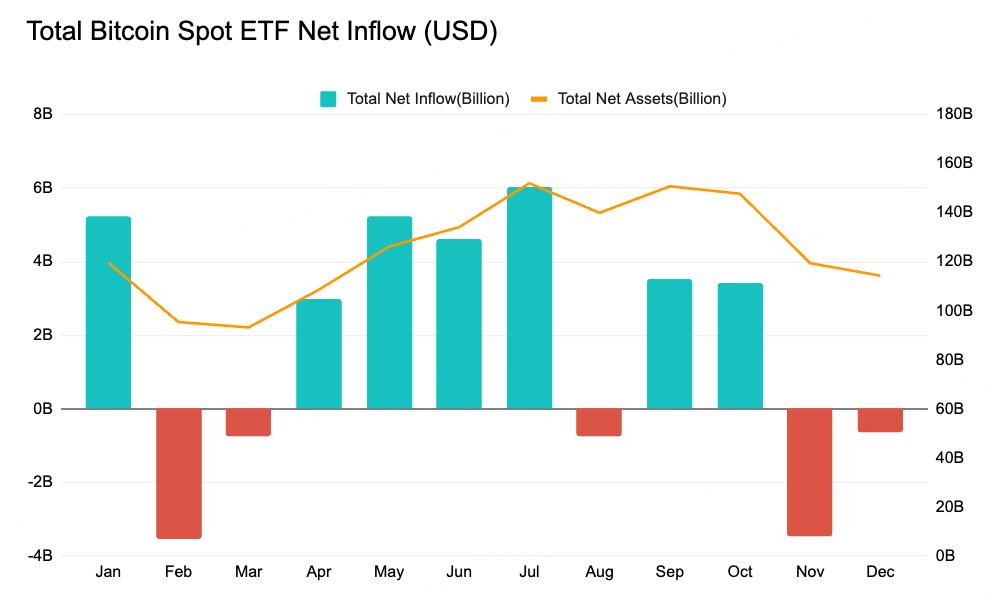

Data source: SoSoValue

Looking at the full-year data from 2025, the fund flows of BTC spot ETFs were highly correlated with tariff policies, interest rate cut expectations, fiscal uncertainty, and systemic volatility in the crypto market, reflecting the sensitive allocation characteristics of institutional funds to macroeconomic variables. At the beginning of the year, driven by expectations of a soft landing and interest rate cuts, BTC ETFs saw large-scale inflows, pushing prices upward in tandem. In February and March, repeated tariff expectations put pressure on risk assets, and ETFs experienced outflows, serving more as a means of risk mitigation and portfolio adjustment.

The macroeconomic environment improved in the second quarter, the path of interest rate cuts was repriced, and financial conditions eased marginally. BTC ETFs saw continuous inflows from April to July, pushing Bitcoin prices to new all-time highs. However, the black swan event of October 11th, coupled with the US government shutdown, significantly increased the ETFs' sensitivity to volatility, leading to a sustained and rapid outflow of funds.

Overall, the circulation changes of BTC spot ETFs in 2025 were mainly driven by the US macroeconomic cycle and market volatility: interest rate cut expectations determined the medium-term direction, tariffs and fiscal risks amplified volatility, and extreme events accelerated risk reduction, indicating that although Bitcoin has entered the institutional allocation system, it is still in the stage of transitioning from a high-volatility asset to a stable macroeconomic allocation asset.

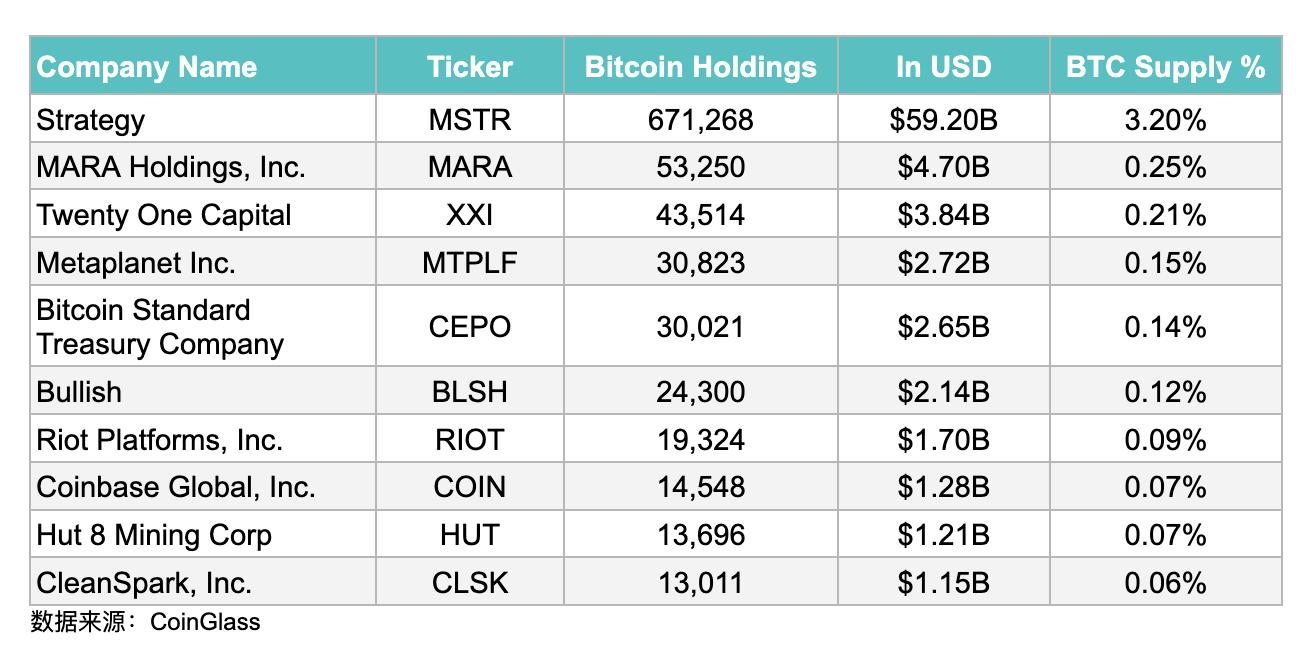

1.4 Value of DATs Company Holdings

Data on BTC DATs reserves in 2025 reveals a clear stratification in the Bitcoin allocation of listed companies. Strategy holds the top position with approximately 671,268 BTC, representing about 3.20% of the circulating supply. Despite a deep market correction, it continued to increase its holdings to solidify its market position. However, its stock valuation relative to its Bitcoin holdings has significantly compressed, with its mNAV falling to approximately 1.08 times, a recent low, reflecting declining market confidence in its "Bitcoin proxy stock" attributes. Overall, leading BTC DATs companies possess strategic advantages but also face the risk of high valuation volatility. A model solely reliant on BTC reserves exhibits high beta characteristics, amplifying returns during upward cycles but amplifying losses and valuation discount pressures during periods of volatility or decline. In contrast, diversified companies (such as Coinbase) demonstrate stronger risk buffering capabilities.

1.5 Outlook 2026

2026 will mark the official end of the "four-year cycle" theory for Bitcoin, with its price expected to reach a new all-time high in the first half of that year. With the full availability of spot ETFs through mainstream wealth management channels (such as Morgan Stanley and Merrill Lynch) and the unlocking of digital asset allocation in 401(k) retirement plans, Bitcoin will transform from a retail-driven speculative asset into an institutional-grade macro hedging tool. Against the backdrop of rising fiat currency credit risk, Bitcoin's status as a scarce digital commodity will be further solidified, and its volatility will structurally decrease as the options market matures, gradually converging with the pricing models of traditional macro assets.

At the capital structure level, Digital Asset Treasurys (DATs) are entering their 2.0 era, with Bitcoin becoming a significant component of corporate balance sheets. However, this also brings the potential risk of forced liquidation. If the market price experiences a deep pullback, highly leveraged institutional positions may face margin calls, triggering a chain reaction of selling even more severe than retail panic. However, from a medium- to long-term perspective, with the implementation of regulatory frameworks such as the Clarity Act, Bitcoin will no longer be merely a speculative tool, but rather a core financial infrastructure deeply embedded in the US and even global financial systems.

2.ETH

2.1 Market Performance

Data source: BitMart API

Compared to Bitcoin, Ethereum's price movement in 2025 exhibited significantly higher volatility. The year's performance can be divided into three phases: a deep correction, a strong recovery, and a pullback from highs. At the beginning of the year, affected by the overall decline in the crypto market, it fell from a 2024 high of $4040 to a 2025 low of $1447, a drop of over 65%. Entering the second quarter, as market expectations for a Federal Reserve interest rate cut intensified, funds began to flow back into the market. Simultaneously, Ethereum DATs companies, led by Bitmine and SharpLink, began accumulating large amounts of ETH. Driven by these two positive factors, Ethereum became the main driver of the mid-year surge in 2025. Its price rose from its April low to a relative high of approximately $4950, an increase of 242%. However, with the increased macroeconomic uncertainty in the second half of the year leading to a deep market correction, Ethereum's price experienced a rapid decline. By December, it had fallen from its August high to $2828, a drop of over 43%.

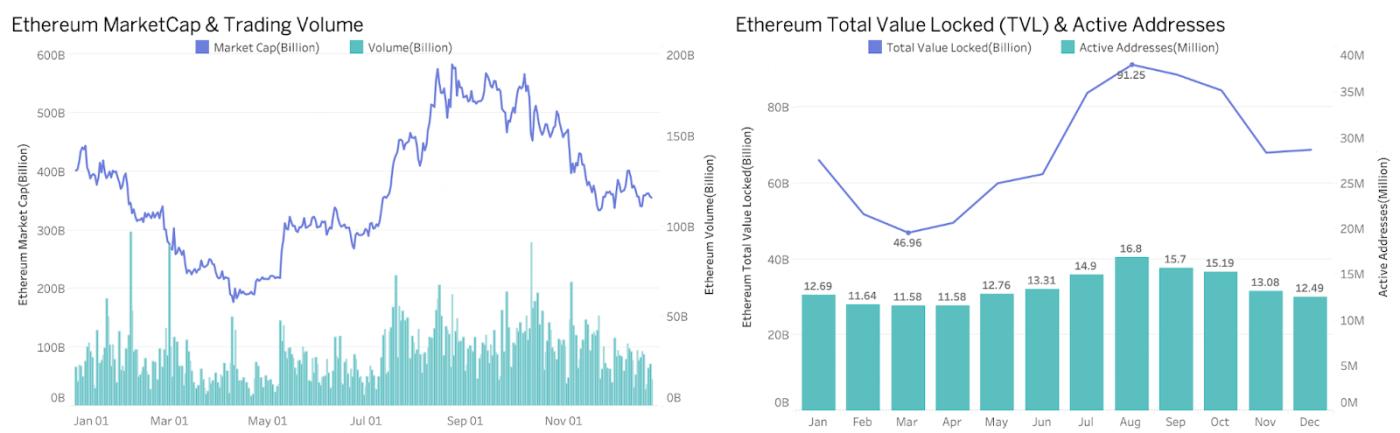

2.2 On-chain metrics

Data source: CoinGecko, DeFiLlama

At the beginning of the year, Ethereum's market capitalization continued to decline from a high of $444 billion, hitting an annual low of approximately $177.4 billion in April. During the same period, on-chain TVL and the number of active addresses declined simultaneously, indicating insufficient market confidence and a significant cooling of ecosystem activity. Starting in July, companies like BitMine and SharpLink began including Ethereum in their corporate strategic reserves, while Ethereum ETFs saw a significant inflow of funds, with a net inflow of $5.43 billion in July alone. This directly pushed the price of ETH to its annual high of approximately $4,953 in August. This concentrated influx of funds created a significant wealth effect and a siphon effect, causing market capitalization and TVL to rise rapidly in tandem. TVL reached its annual peak of $91.2 billion in August, and the number of active addresses also climbed to 16.8 million, indicating that the price increase had spread to the on-chain application layer, and ecosystem vitality had been temporarily activated. Entering the second half of the year, the market gradually shifted from a one-sided upward trend to high-level fluctuations and then evolved into a deep correction. After the historic black swan event that hit the crypto market on October 11, the price of Ethereum experienced a significant decline. By December, Ethereum's market capitalization had fallen back to approximately $340 billion, with its price already below the major cost basis of leading DATs companies. Meanwhile, the Ethereum ETF experienced net outflows for two consecutive months. This dual weakness in price and liquidity further impacted the on-chain environment, with the number of monthly active addresses rapidly declining to 8.34 million, nearly halved from its August peak. This reflects a significant contraction in market risk appetite, with speculative funds and some active users temporarily withdrawing. The Ethereum ecosystem faced considerable deleveraging and cooling pressure in the short term.

2.3 ETH Spot ETF

Data source: SoSoValue

In 2025, the flow of funds in the ETH spot ETF exhibited distinct phases and high volatility. After a small inflow at the beginning of the year, a significant outflow occurred in March amidst rising market uncertainty, reflecting the cautious attitude of early investors. Entering the second quarter, inflows increased significantly in May and June, especially in June with a net inflow of approximately $1.16 billion, pushing the total net assets of the New York ETF back above $10 billion, indicating that institutional and long-term funds were increasing their holdings during periods of price stabilization or rebound. July and August saw explosive net inflows, reaching approximately $5.43 billion and $3.87 billion respectively, driving the total net assets of the ETH ETF to a high of approximately $28.58 billion for the year, showing a significant increase in institutional demand after the ETH price recovery. However, the ETF subsequently experienced a large outflow due to the impact of October 11th, especially in November with a net outflow of approximately $1.42 billion, dragging down the total net assets to approximately $19.15 billion.

2.4 Value of DATs Company Holdings

The significant price surge of ETH in 2025 was closely related to the large-scale accumulation of Ethereum reserves by companies like BitMine and SharpLink. These companies adopted a similar balance sheet accumulation strategy to Strategy's previous approach with BTC, continuously purchasing ETH through private placements and other financing methods. BitMine, in particular, continuously expanded its ETH reserves to approximately 4.07 million, representing about 3.37% of the total ETH supply, with a holding value of $12.12 billion, far exceeding other companies. Following closely were SharpLink Gaming and The Ether Machine, holding approximately 863,000 and 496,700 ETH respectively, to support their liquidity deployment and ecosystem participation. Coinbase's ETH inventory largely served the needs of exchange operations and network services, rather than a purely asset appreciation strategy. Overall, listed companies' ETH holdings included both strategic players actively betting on the growth of the Ethereum ecosystem and participants based on operational needs or diversified asset allocation. This differentiated approach indicates that ETH is increasingly being incorporated into corporate asset and liability management frameworks, no longer merely a trading or speculative target, but a core digital asset with strategic value and ecosystem synergy.

This corporate hoarding behavior generated a significant supply-demand shock effect: large-scale corporate buying not only increased market expectations for ETH but also strengthened institutional confidence in Ethereum as a core digital asset, leading to a strong rebound in ETH prices after several phases of correction, and even breaking through an all-time high in August. This surge partly reflects the positive market response to these companies' accumulation strategies and the linkage effect between ETF inflows. Therefore, it can be argued that a key driver of ETH price increases in 2025 was the pace of institutional ETH hoarding, represented by companies like BitMine and SharpLink—they not only directly boosted demand through their own buying but also indirectly amplified upward price momentum through increased market sentiment and institutional participation.

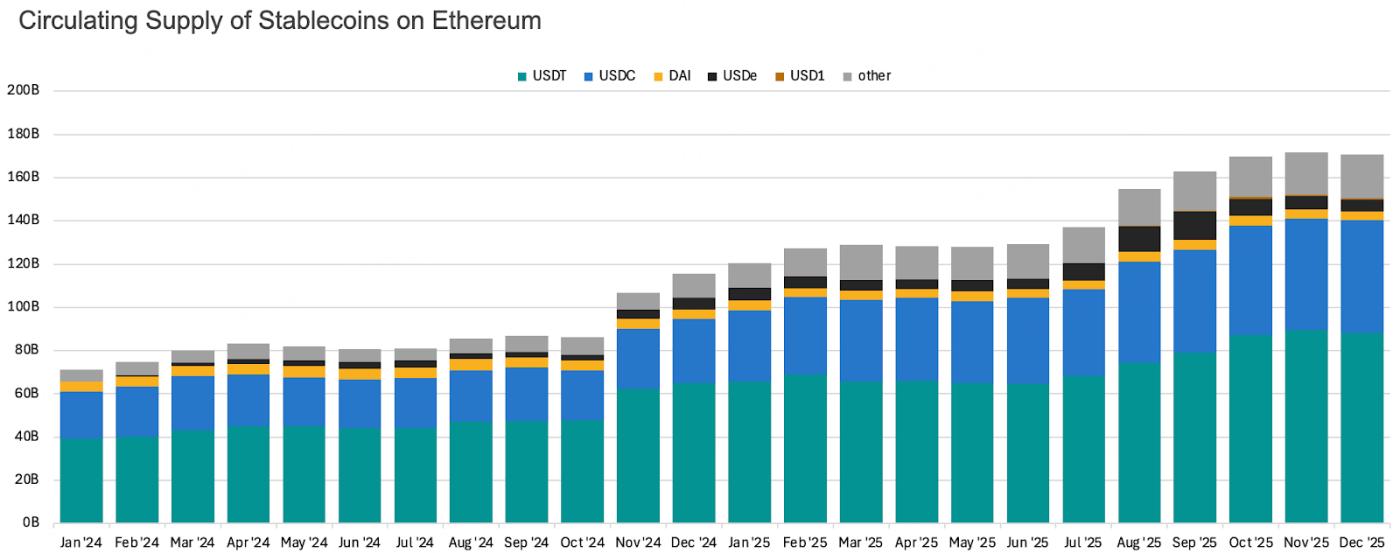

2.5 Stablecoin Circulation

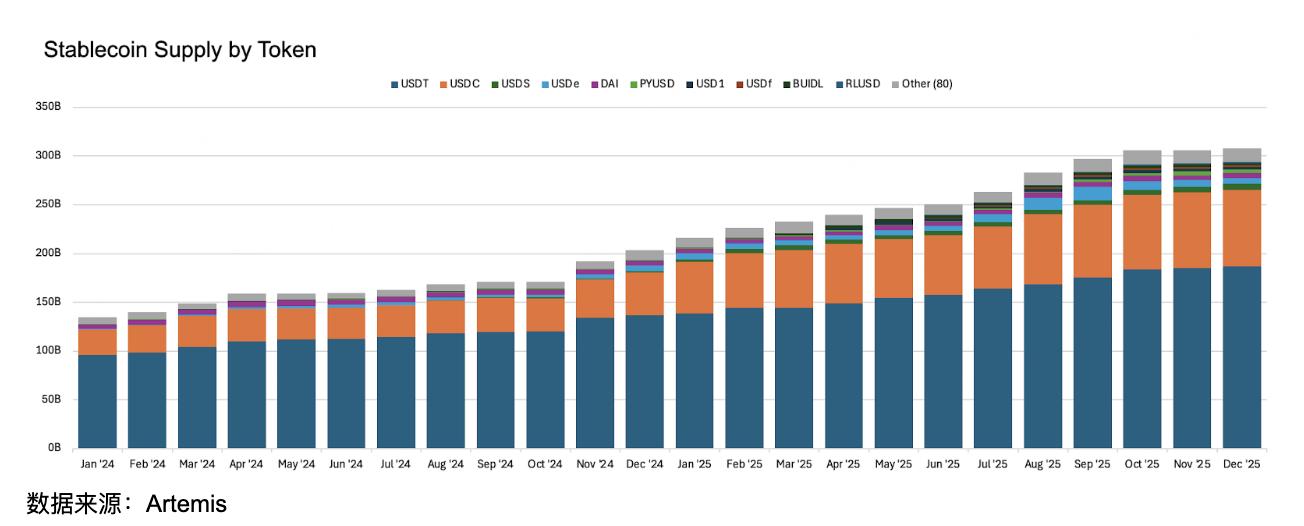

Data source: Artemis

Compared to 2024, the circulating supply of stablecoins on the Ethereum blockchain saw a significant increase in 2025. Total circulating supply broke historical highs in the second half of the year and continued to expand, injecting unprecedented liquidity depth into the entire DeFi and trading ecosystem. This directly echoed the trend of ETF inflows and market recovery during the same period. Structurally, a more robust dual-dominant + diversified pattern emerged: USDC, with its solid compliance foundation, experienced a strong recovery and a significant rebound in circulating supply, reshaping its balanced competitive relationship with USDT; while USDT, with its unparalleled network effect and cross-chain penetration, continued to maintain its dominant share. Together, they constitute the core pillars of ecosystem liquidity.

At the level of mechanism innovation, interest-bearing stablecoins, represented by USDe, based on new structural designs such as cash arbitrage, achieved a breakthrough from scratch, with their circulating scale rapidly growing from zero to billions of dollars, once becoming the third largest stablecoin in the Ethereum ecosystem. However, after the black swan event on October 11th caused price de-pegging, the stability and risk exposure of its underlying mechanism were questioned by the market, the trust base was significantly weakened, and the circulating supply shrank sharply. Overall, Ethereum remains the most mature DeFi ecosystem and the most concentrated liquidity network among all public chains, and stablecoins are still mainly issued and circulated on Ethereum. With the marginal easing of the regulatory environment in 2025 and the gradual implementation of stablecoin-related legislation, the path for compliant funds to enter the market has become clearer, and it is expected that stablecoins will continue to be issued and circulated on the Ethereum network in the future.

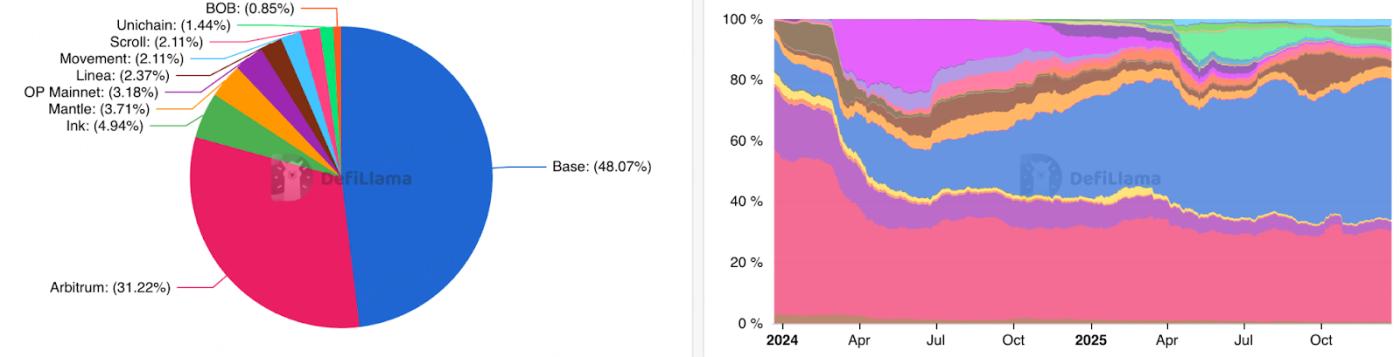

2.6 Layer 2 Ecosystem

Data source: L2BEAT

While Layer 2 remains one of the most important sectors in the Ethereum ecosystem in 2025, its total value (TVL) has declined by approximately 24.6% over the past year, indicating a continued weakening of ecosystem vitality. The prolonged lack of new narratives has resulted in a certain degree of regression for the entire Layer 2 ecosystem compared to 2024. Although some established projects, such as Linea, officially launched their tokens and listed them for trading this year, insufficient market confidence failed to generate widespread attention to the sector, leading to a sharp drop in price shortly after opening. As of December, three months after its launch, Linea's price had cumulatively fallen by over 80%, reflecting the continued predicament of insufficient liquidity and concentrated investor hesitancy in the Layer 2 market in the short term.

Data source: DeFiLlama

Despite the overall lackluster performance of Layer 2 crypto, Base's development in 2025 remains noteworthy, as it successfully established a leading market share. Base was undoubtedly one of the most active Layer 2 projects this year. At the beginning of the year, with the emergence of projects like Virtual and Zora, Base attracted significant attention and new users, continuously expanding its ecosystem. Mid-year, Base capitalized on market momentum by launching the Perp Dex project Avantis and the prediction market project Limitsless. Subsequently, Base's CEO announced plans for a token launch, further boosting market confidence. Throughout 2025, Base remained a focal point in the crypto market, with its ecosystem development and user growth resulting in a TVL (Total Value Limit) of 47.16%. Looking ahead, Base's token issuance is expected to bring significant benefits to its ecosystem, users, and developers. Leveraging Coinbase's compliance advantages and mature ecosystem, Base is poised to continue attracting market attention back to the Layer 2 space.

2.7 Outlook 2026

Ethereum will complete its transformation into an institutional-grade financial infrastructure in 2026. With the implementation of the Fusaka and Glamsterdam upgrades, and the subsequent Hegota upgrade optimizing execution layer performance, the efficiency of collaboration between the Ethereum mainnet and Layer-2 will significantly improve, and L2 throughput will reach new orders of magnitude. Simultaneously, the L2 market will enter a period of consolidation and reshuffling, with chains possessing strong ecosystems or exchange backing, such as Base, Arbitrum, and Optimism, gaining a dominant position, while L2 chains lacking practical utility may be eliminated by the market.

In terms of value capture, Ethereum will become the preferred settlement layer for Real World Assets (RWA) and institutional-grade DeFi. Projects such as BlackRock's BUIDL fund and JPMorgan's JPMD have demonstrated its composability advantages in a compliant environment, and the surge in tokenized government bonds and credit volume in 2026 will bring robust demand for Ethereum's block space. Furthermore, with regulators clarifying that liquidity staking does not constitute a securities transaction, staking yields will become the default allocation mode for institutions holding ETH, which will further compress the circulating supply and raise the long-term value center of the asset.

3. Solana

3.1 Market Performance

Data source: BitMart API

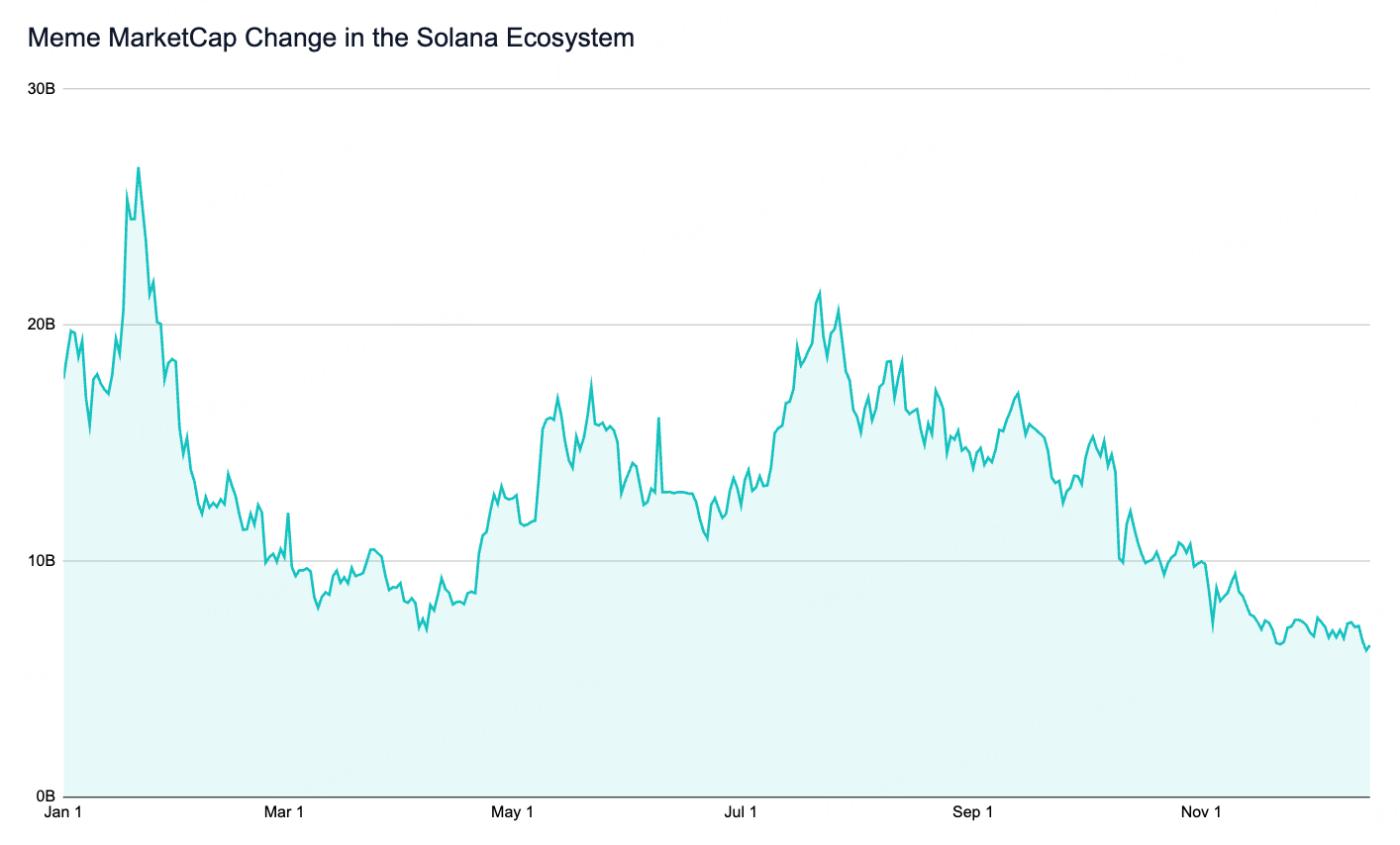

In 2025, Solana's price performance lagged behind the other two major asset classes. At the beginning of the year, SOL's price fell from a high of $294 and failed to return to previous highs. Unlike BTC and ETH, which benefited from increased liquidity from ETFs and DATs in this cycle, Solana's ETF didn't officially launch until October, resulting in a lack of stable buying support throughout the year. Simultaneously, Solana's continuous token unlocking increased market selling pressure, exacerbating the price slump. Even in August, when BTC and ETH both hit new highs, SOL hovered around $253 before quickly falling back. Furthermore, the market capitalization of projects heavily reliant on the Meme track within the Solana ecosystem continued to shrink, and its market share was partially eroded by competitors like BNB and Base, further suppressing SOL's price performance. Overall, throughout the year, Solana's lack of external funding support and limited internal ecosystem growth significantly weakened its performance compared to BTC and ETH.

3.2 On-chain metrics

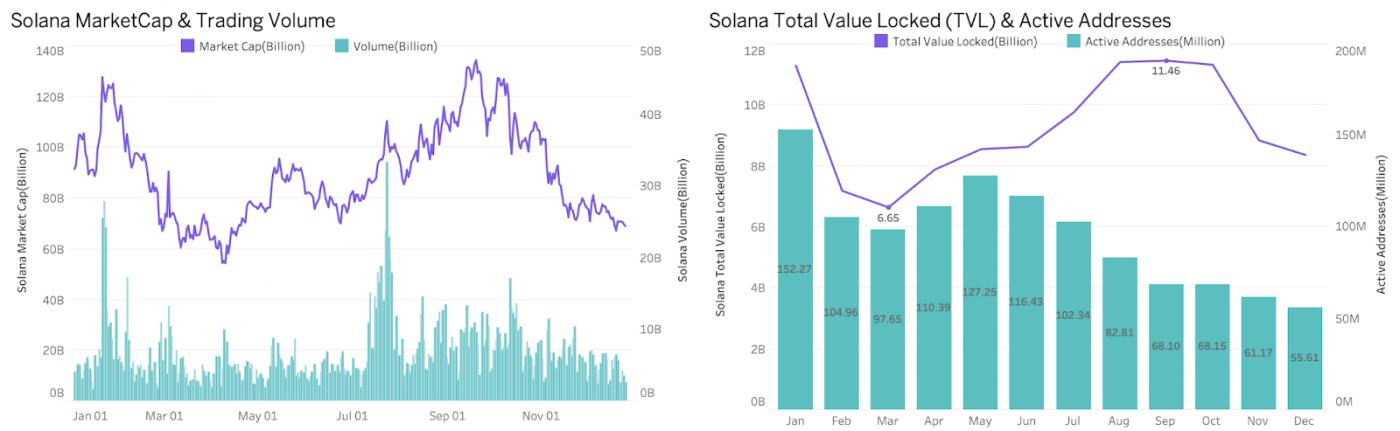

Data source: CoinGecko, DeFiLlama

In early 2025, SOL experienced a correction based on high market capitalization and activity, with a rapid decline in market capitalization, contraction in trading volume, and a significant drop in TVL and active addresses, indicating insufficient on-chain funds and user retention after the hype surrounding the Ai Agent Meme faded. From Q2 to mid-Q3, SOL saw a recovery, with market capitalization and price rebounding, reaching a high for the year between July and September. Trading volume increased significantly, and TVL rebounded to its peak, indicating a renewed inflow of funds into DeFi and on-chain applications. However, the number of active addresses continued to decline, mainly due to the diversion of Meme popularity to BNB Chain. In Q4, SOL entered a downward and deleveraging phase, with market capitalization, trading volume, and TVL declining, and the number of active addresses falling to a low for the year, indicating weakened on-chain participation.

In summary, the Solana market in 2025 was essentially a highly volatile cycle driven by price and meme narratives. Its strengths lay in its high trading activity and ability to quickly attract venture capital, but its weaknesses included insufficient user retention, long-term TVL accumulation, and inadequate price support from non-speculative applications. Solana exhibited a significant amplification effect during upward phases, while experiencing equally sharp pullbacks during periods of risk contraction. In conclusion, Solana remains one of the most active and sentiment-sensitive public chains in the crypto market, but its ecosystem stability and sustainability still heavily depend on market risk appetite and the cyclical inflow of meme funds.

3.3 ETF Circulation

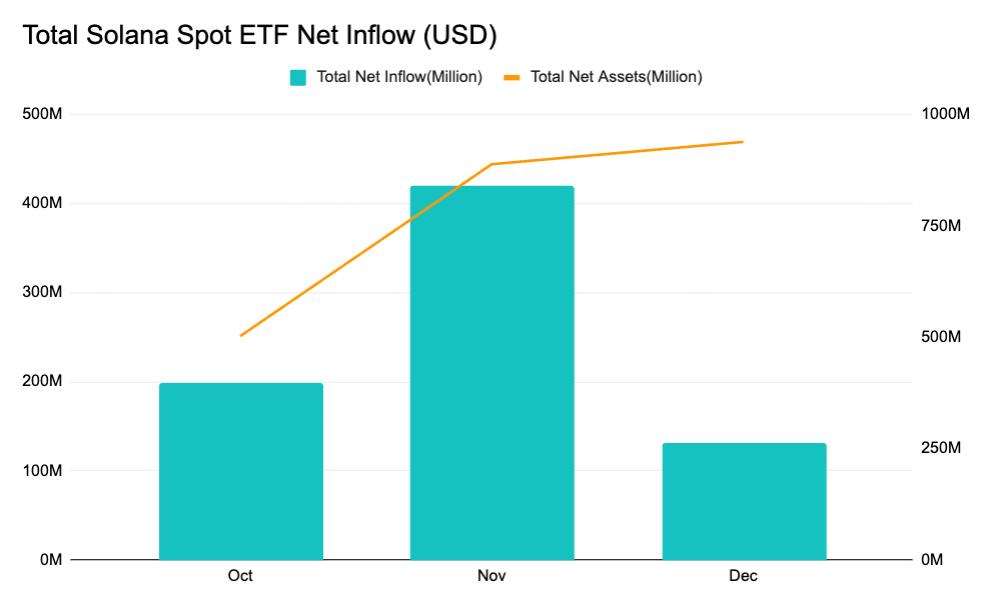

Data source: SoSoValue

The first Solana spot ETFs officially launched on October 28th, and by December, their assets under management had reached approximately $920 million. Due to their relatively short time on the market, the Solana ETFs have not yet generated sufficient sustained buying interest in 2025, thus limiting their impact on SOL's price performance that year. However, the fund flow structure still presents some positive signals: despite a temporary weakening of SOL's price after listing, ETF funds showed a contrarian net inflow trend, indicating that some medium- to long-term funds are gradually accumulating Solana positions at lower levels, laying the groundwork for future price recovery and ecosystem valuation restructuring.

3.4 Meme Changes within the Ecosystem

Data source: CoinMarketCap

In 2025, the Solana ecosystem's meme sector experienced explosive growth at the beginning of the year, followed by a gradual cooling down. This was primarily due to a combination of factors, including changes in the competitive landscape, insufficient internal ecosystem dynamism, and a lack of new meme narratives. Firstly, the AI Agent brought significant attention and market capitalization growth to the Solana meme sector at the beginning of the year. However, with the overall correction in the crypto market, the market capitalization of related meme assets plummeted, causing the Solana meme market capitalization to fall by more than 50% from its peak. Later in the year, the Solana ecosystem regained some momentum due to Pumpfun's token launch and the rise of Bonkfun, briefly boosting on-chain meme trading volume and participation. However, this surge lacked sustainability.

Meanwhile, the external competitive landscape has changed significantly. Taking BNB Chain as an example, by leveraging the influence of its founders CZ and He Yi to continuously generate trending topics, such as Chinese memes and Binance-themed memes, it successfully attracted a large amount of attention and capital. The diversity and high topicality of these sectors led to several blockbuster memes for BNB Chain, diverting meme users and hot money that might have flowed to Solana. This further contributed to the decline in the market value of Solana memes.

3.5 Outlook 2026

In 2026, Solana will solidify its leadership in consumer applications and the agent economy with its high-performance paradigm. With the full adoption of the Firecanver validator client and the completion of the Alpenglow upgrade, the network will achieve sub-second transaction confirmation (approximately 100 milliseconds) and the potential for millions of TPS, eliminating throughput bottlenecks for high-frequency applications. Solana will no longer rely solely on memes but will shift towards a diversified on-chain economy comprised of high-performance decentralized exchanges, cross-border payments, and the DePIN project. In the payments sector, Solana is rapidly penetrating traditional financial tracks, with the involvement of giants like PayPal and Western Union making it a global settlement hub for USD stablecoins. In particular, based on protocols such as x402, Solana will support a massive machine-native financial system, allowing for low-cost, instant micropayments between AI agents. Although the inflation proposal (SIMD-0411) may face the risk of withdrawal, its strong network effect and increasingly mature market microstructure will attract more professional market makers to migrate from centralized exchanges to the Solana DEX.

4. BNB

4.1 Market Performance

Data source: BitMart API

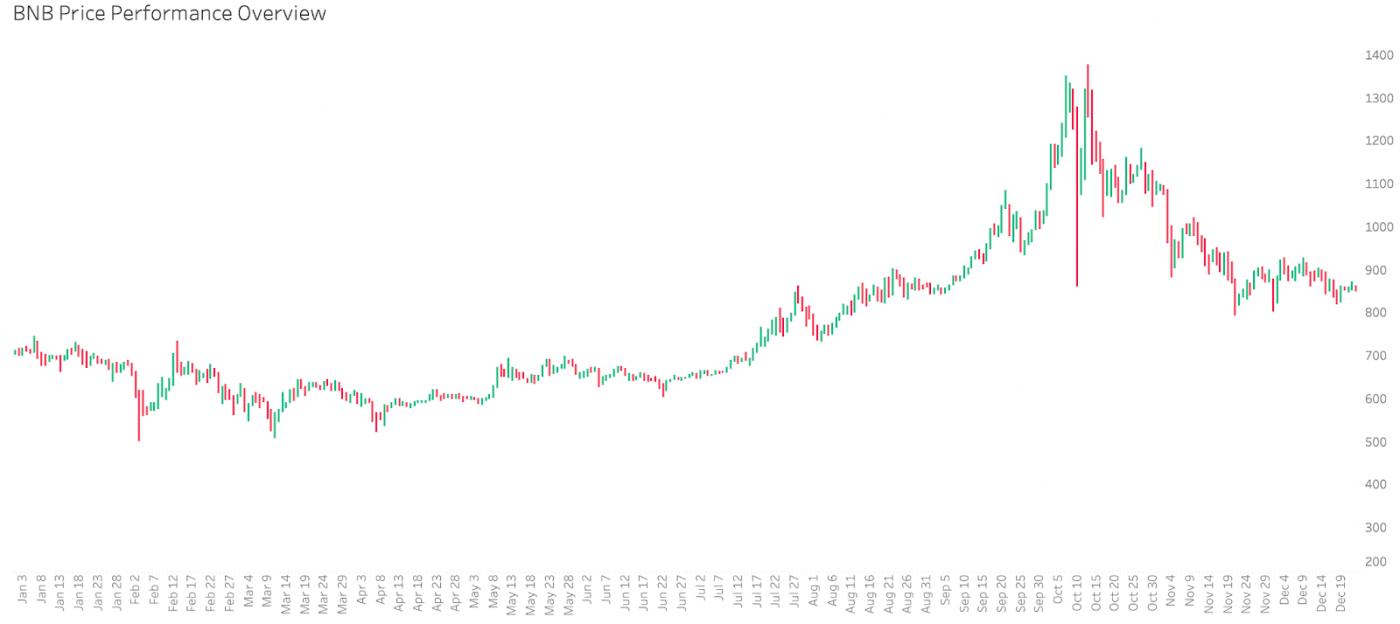

2025 was a strong year for BNB. Its price rose steadily after bottoming out at around $509 in April, breaking its all-time high of $1370 on October 13th, representing a gain of over 169%. This surge was primarily driven by the continued development of the Binance ecosystem and effective market operations: the launch of Binance Alpha attracted a large number of users, while founder CZ and co-founder He Yi leveraged their industry influence to actively generate buzz on Twitter, successfully boosting activity in the BNB Chain's meme section—for example, numerous trending memes such as "Chinese Memes" and "Binance-themed Memes" emerged, significantly increasing market attention and investor participation.

Although the price of BNB subsequently fell due to the overall correction in the crypto market, the adjustment was relatively limited. The price is currently stable at around the level at the start of the upward cycle in August, demonstrating strong resilience and ecosystem support.

4.2 On-chain metrics

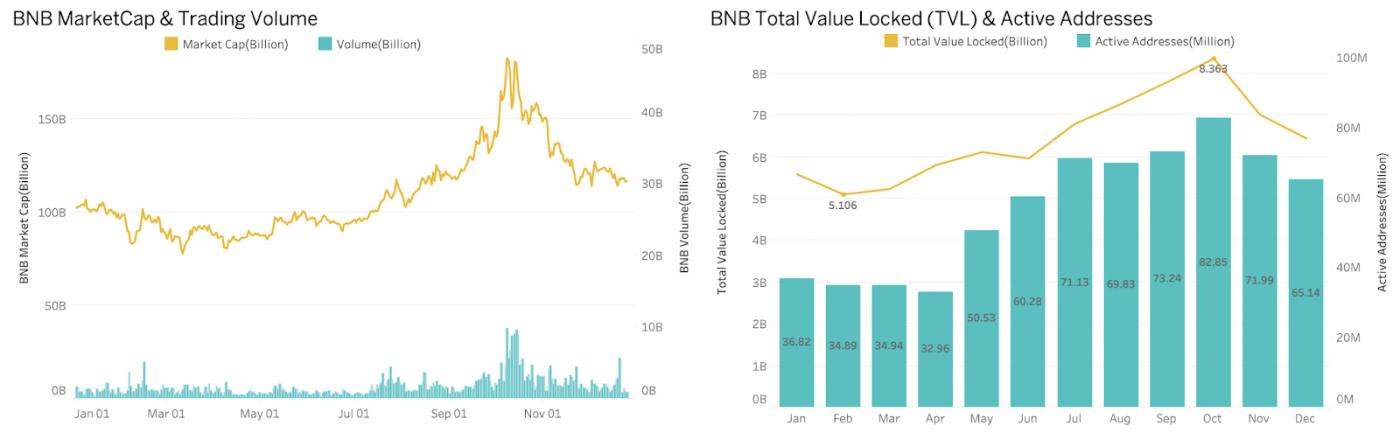

Data source: CoinGecko, DeFiLlama

BNB Chain's growth in 2025 was not driven by short-term sentiment or speculation, but by a positive feedback loop consisting of "increased user activity - increased transaction volume - TVL and market capitalization expansion". Although there was a phased correction after October, the user base, transaction frequency and basic liquidity center have clearly shifted upward, laying a higher starting point for subsequent ecosystem and capital inflow.

From a market performance perspective, BNB's market capitalization exhibited a structure of "first fluctuating, then accelerating, and then falling back": It hovered around $100 billion at the beginning of the year, then fell back to the $80-90 billion range from February to April; starting in June, it entered an upward trend with increased on-chain activity, surging to approximately $180 billion in early October amid a significant increase in trading volume, before subsequently falling back to approximately $120 billion. The simultaneous increase in trading volume, meme activity, and on-chain interaction indicates that the rise was driven by genuine transaction demand.

In terms of on-chain fundamentals, TVL peaked at approximately $8.36 billion in October before declining, while the number of active addresses reached a high of approximately 82.85 million during the same period, significantly higher than Solana's figures. Although TVL fell back to approximately $6.5 billion in December and activity cooled somewhat, it was still significantly higher than the mid-year level, indicating that BNB Chain has completed an overall increase in its user and liquidity base.

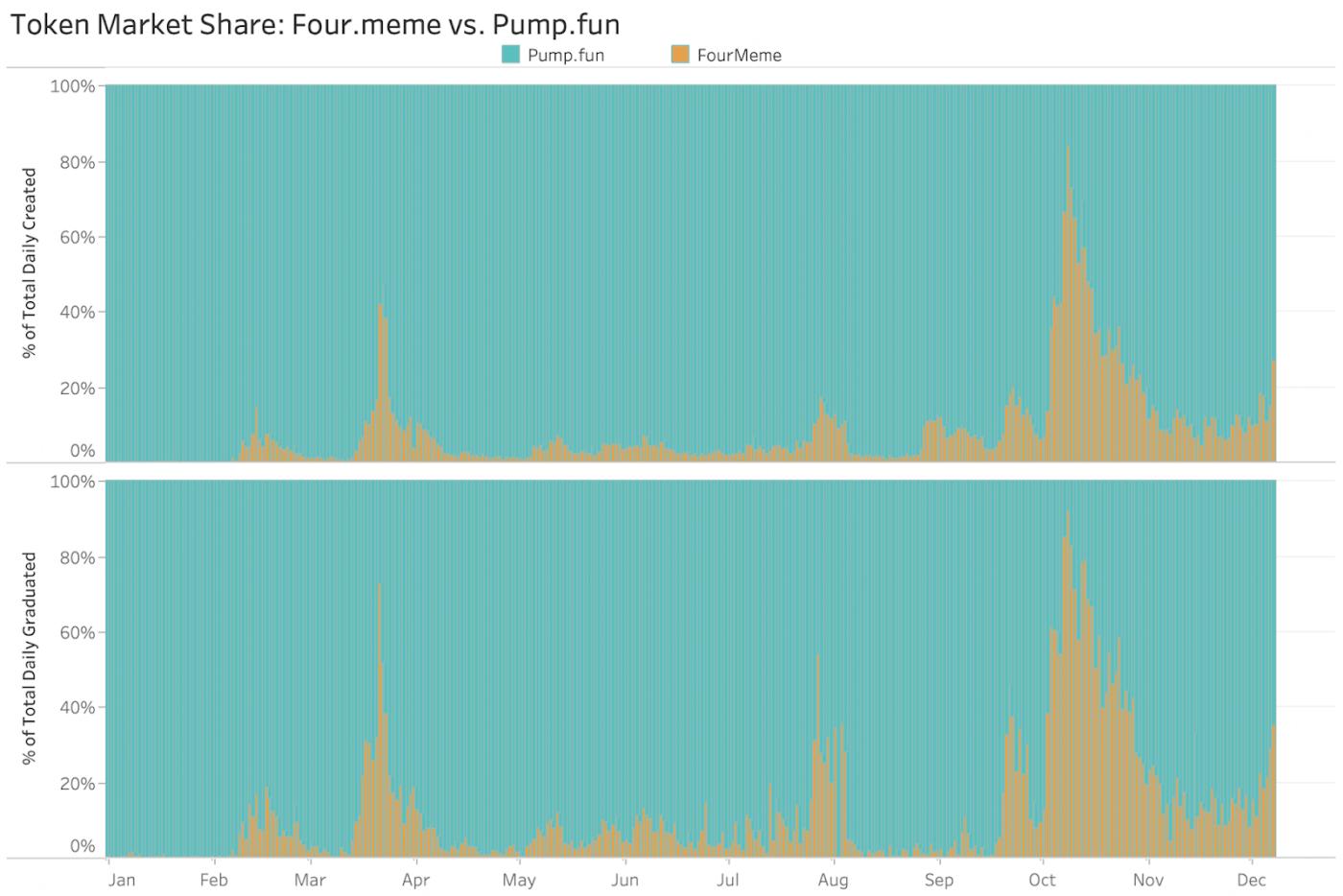

4.3 Comparison of BNB Meme and Solana Meme

Data source: Dune

At the beginning of the year, Pump.fun on the Solana chain dominated, but starting from the second quarter, the FourMeme platform within the BNB Chain ecosystem saw its market share steadily climb, eventually overtaking Solana and establishing its lead in the second half of the year. This shift directly reflects the intertwined fates of the two public chains, Solana and BNB Chain, in 2025: After the hype surrounding AI Agent Memes faded, Solana faced issues with insufficient on-chain real funds and user retention, leading to a continuous decline in active addresses and BNB Chain capturing its funds and attention; while BNB Chain successfully attracted a large number of new users and trading volume through various Binance-themed memes, achieving a historic leap in on-chain activity.

4.4 BNB Ecosystem

BNB Chain builds a highly synergistic composite ecosystem around DeFi, AI, RWA, and Memes. Through the mutual reinforcement of funds, users, and narratives, it forms a positive feedback growth flywheel and, driven by deflationary mechanisms and community consensus, moves from a phased burst to more sustainable long-term growth.

Memes emerged as the core growth engine in 2025. In the first half of the year, BNB Chain's meme trading activity surpassed Solana and Ethereum, becoming a significant on-chain traffic portal. Projects like "Binance Life" demonstrated the power of Chinese community co-creation and social sharing; their success was not accidental but a concentrated manifestation of a low-barrier trading environment and content dissemination mechanism. BNB Chain further streamlined the issuance, trading, and liquidity migration paths of memes through tools like Four.Meme and Binance Wallet Meme Rush, building a standardized meme incubation and amplification mechanism. Regarding liquidity and project supply, Binance provided comprehensive support to ecosystem projects through the Alpha program, forming a robust liquidity closed-loop system that enabled high-quality projects to gain substantial trading depth and user exposure early on. During the Binance Wallet event, 396 Alpha projects were launched, including 46 exclusive TGE tokens and 14 Booster projects, forming a highly concentrated asset supply pool. The Alpha program has created a clear path for asset growth: from on-chain testing and DEX trading to futures and main board spot trading, significantly reducing the friction costs of new assets entering the mainstream market and strengthening BNB Chain's advantages in new asset discovery and pricing efficiency.

Furthermore, BNB Chain is also expanding its focus to institutional-level sectors such as RWA and derivatives. It has attracted institutions such as BUIDL, Ondo, and CMB International to join, gradually forming a one-stop tokenization solution. Meanwhile, perpetual contract protocols, represented by Aster, are rapidly gaining traction, making derivatives the third major core narrative after memes and stablecoins.

4.5 Outlook for 2026

Looking ahead to 2026, BNB Chain will propel itself from a single high-performance transaction chain to a comprehensive on-chain asset platform, completing a crucial leap. Leveraging its deep synergy with the Binance ecosystem, its closed-loop advantages in traffic, capital, and application scenarios will be further strengthened, enabling the network to efficiently support meme assets, mature DeFi applications, and the continuously expanding Real-World Assets (RWA) sector simultaneously. As a key infrastructure component of the distributed RWA market, BNB Chain is expected to attract higher-level and larger-scale assets to its platform due to its strong liquidity foundation.

Meanwhile, with the accelerated integration of AI and encryption technologies, BNB Chain will increase its investment in agent-friendly infrastructure, focusing on building a low-cost payment and settlement network adapted to AI applications. Leveraging its cost advantages and high compatibility, it aims to control key traffic and settlement gateways in the AI-driven on-chain economy. By 2026, BNB Chain's ecosystem focus is expected to further extend to RWA tokenization and institutional-grade services, relying on high liquidity and low friction costs to gradually establish its important hub position connecting traditional financial assets and the crypto world.

IV. Review and Prediction of Popular Tracks

1. Meme: From P/E to P/A: Reshaping Meme's Valuation Model

Entering 2025, the Meme sector underwent a historic transformation, evolving from a speculative symbol at the end of a bull market to a core investment theme throughout the year. The fundamental reason lies in the shift in capital structure and asset pricing logic—with VC tokens generally overvalued and facing unlocking pressure, funds systematically flowed to Meme assets with strong dissemination attributes and fair issuance mechanisms, forming a new consensus that "attention equals liquidity." At the beginning of the year, breakthroughs in AI Agent technology propelled Meme projects like ai16z to combine technological narratives with viral spread, achieving a collective explosion of on-chain AI themes. In the middle of the year, cultural assets, represented by Chinese community Memes like Binance Life, experienced a concentrated surge, demonstrating that the Eastern community regained some pricing power. At the end of the year, Meme tokens related to the x402 protocol, which aims to build an autonomous payment network for the AI Agent economy (such as PING), gained market favor. The valuation model of the Meme sector also underwent a paradigm shift, moving from the traditional P/E logic to the P/A (Price/Attention) model, with attention becoming the core value carrier.

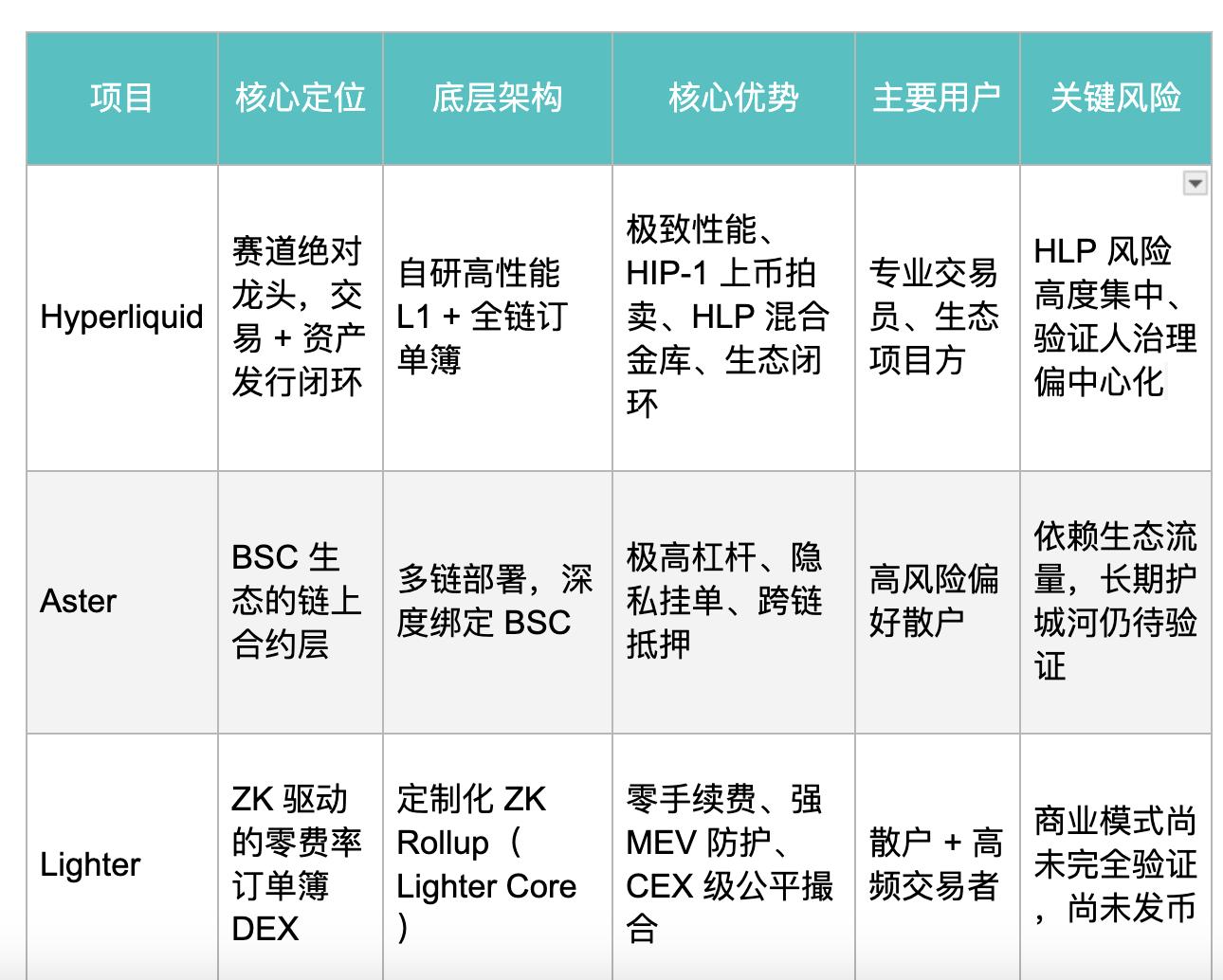

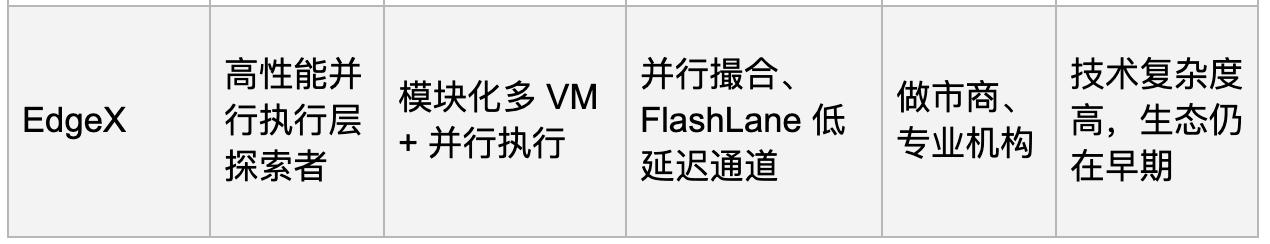

2. Perp DEX: From Application Optimization to Infrastructure Competition

In 2025, the Perp DEX sector completed a return to its core valuation and competitive logic. The market gradually de-emphasized "passive liquidity" indicators such as TVL, shifting its focus to OI (Open Interest) and fee revenue to truly reflect trading activity and commercialization capabilities. High OI represents sustained demand for trading, while stable fee revenue demonstrates the protocol's long-term viability in a low-incentive environment. This indicates that Perp DEX has moved from a narrative-driven stage to a mature competitive stage centered on trading depth, execution quality, and a closed-loop business model.

On-chain transparency was further productized in 2025, giving rise to advantages distinct from centralized exchanges (CEXs) – whale monitoring and copy trading. Leading DEXs integrated "smart money tracking" and "one-click copy trading" into their interfaces, increasing user stickiness and trading frequency, forming a long-term moat against centralized exchanges. The difference between projects within the sector is no longer "whether it is a DEX," but rather reflected in the underlying execution architecture, target user group, and ecosystem closed-loop capabilities.

Hyperliquid, with its self-developed high-performance L1, full-chain order book, closed-loop asset issuance, and HLP mechanism, remains the strongest project in the sector, suitable for professional users seeking depth and efficiency. However, its concentrated structure brings systemic risks. Aster relies on the BSC ecosystem's advantages, exhibiting strong short-to-medium-term growth potential, but its long-term independent competitiveness is limited. Lighter represents a technology ceiling-type approach, excelling in fairness and MEV resistance, but its business model is still being validated. EdgeX focuses on optimizing underlying infrastructure, providing performance potential for high-frequency and professional trading, but market acceptance and ecosystem development still require time.

Overall, the competition in Perp DEXs in 2025 has shifted from application feature optimization to a full-blown arms race in underlying infrastructure. Key future variables include the maturity of sovereign underlying infrastructure, the construction of global liquidity networks, compatibility with institutional and professional traders, and contributor economic design. The era of simple DeFi protocols is over; Perp DEXs are rapidly evolving into vertically integrated on-chain financial infrastructure, and the RWA track is expected to become a significant source of asset growth for these high-performance platforms in the next stage.

3. Real-World Assets (RWA): The Evolution from Asset On-Chain to Financial Composability

Data source: RWA.xyz

In 2025, the Real-World Assets (RWA) sector completed a crucial leap from narrative to large-scale implementation, becoming the most certain growth engine in the Web3 space. Data shows that its total market value achieved a leapfrog growth, marking the industry's complete departure from the proof-of-concept stage and entry into an explosive growth period driven by institutional capital and clear regulation. This explosive growth essentially stems from RWA's unique positioning: in the global growth narrative, it has become a rare convergence point of value consensus between traditional capital (Old Money) and crypto capital (New Money). Driven by clear regulatory pilots and profit demands, the two have combined their efforts, propelling the market's rapid expansion.

The market's asset structure exhibits a diversified and healthy pattern of "one dominant player and many strong contenders." Among them, tokenized US Treasury bonds (approximately $8.7 billion) serve as the absolute leader, acting as the on-chain anchor for the "risk-free rate" and a core entry point for institutional investors. Meanwhile, significant growth in categories such as private lending, institutional alternative funds (approximately $2.5-2.6 billion each), and commodities (approximately $3.3 billion) indicates that RWA is successfully penetrating from standardized public market assets into the non-standard and alternative investment fields that address liquidity pain points, demonstrating the universality of its technology. More importantly, the surge in the number of active on-chain addresses and holders signifies that RWA assets have transformed from static allocations into active financial elements frequently combined and traded in DeFi, achieving a paradigm shift from "asset on-chaining" to "asset utilization."

The core driving force behind this shift is the investment logic of "cumulative returns." The market focus is no longer on "whether it can be put on-chain," but rather on "how to efficiently combine them after on-chain." By combining RWA assets (such as the inherent returns of US Treasury bonds) with DeFi protocols (such as lending and staking), a dual-engine approach of "real-world native returns + on-chain financial returns" has been achieved, significantly improving capital efficiency. Under this logic, two complementary core players have emerged in the sector: asset-side players, represented by Ondo Finance, focus on providing compliant and secure standardized yield assets (such as tokenized government bonds), acting as traditional liquidity gateways; while infrastructure-side players, represented by Plume Network, are dedicated to building a dedicated execution environment native to RWA, solving the liquidity and composability issues of non-standard assets by integrating issuance, trading, and DeFi combination. Together, they are propelling RWA towards becoming a "Web3 Wall Street" that combines institutional-grade quality with on-chain programmability. Looking ahead, with the further maturation of the regulatory framework, the RWA sector is expected to deeply integrate with high-performance DeFi platforms, becoming their most important source of assets and giving rise to more complex on-chain derivatives and structured products.

4. Stablecoin Sector: Three Differentiations and Functional Evolutions under Compliance Requirements

2025 marked a historic turning point for the stablecoin sector. With the implementation of key regulatory frameworks such as the US GENIUS Act and the EU MiCA, stablecoins shed their status as "gray market financial instruments" and entered a new era of highly compliant and institutionalized competition. Their role also underwent a fundamental transformation: from a medium of exchange within the crypto market to the foundational currency layer of the entire on-chain financial system. Against this backdrop, the stablecoin market in 2025 exhibited both a surge in total supply and a structural reshaping. In terms of total supply, the circulating supply saw a significant increase compared to 2024. While this was certainly due to the shift towards looser global monetary policy, the most direct driving force was the regulatory breakthrough. A clear legal framework eliminated compliance concerns for traditional financial institutions, attracting large-scale institutional investment.

Structurally, the logic of market competition clearly diverges into three paths, forming a complete picture of three types of competition:

- Compliance and Trust: Represented by Circle (USDC). Its core is building institutional trust, acting as a compliance bridge for traditional capital to enter the blockchain. USDC's strong recovery and IPO in 2025 signified its rise to become a financial infrastructure priced by traditional capital markets. Its planned ArcChain further demonstrates its ambition to build "monetary-grade cloud services."

- Yield-driven: Represented by Ethena (USDe). Essentially, it tokenizes strategies such as basis trading, providing on-chain returns far exceeding traditional government bonds in bull markets and high-volatility environments, making it a veritable "engine asset" of DeFi. However, its model is highly sensitive to market conditions, exhibiting "rise followed by fall" volatility, making it a highly elastic cyclical tool.

- Application Experience: Represented by payment infrastructures such as Plasma and Stable Protocol. They do not attempt to redefine currency, but rather focus on solving the "last mile" user experience problem, such as promoting the penetration of stablecoins in emerging market payments and everyday scenarios through extremely low costs or gas abstraction.

In summary, the core growth logic of stablecoins in 2025 has shifted from serving crypto transactions to meeting the "institutionalized needs" of the traditional world for compliant on-chain settlement tools. The market has evolved from a contest of "who can issue dollar tokens" to a long-term battle of "who can define the ultimate form of the dollar on-chain." Compliant assets determine the entry point for funds, yield-generating assets determine liquidity activity, and application infrastructure determines user retention. The final outcome of this battle may not be a single winner, but rather an ecosystem that achieves a dynamic balance between compliance, yield, and user experience. This lays a solid capital and institutional foundation for stablecoins to be more deeply embedded in global trade, payments, and DeFi in 2026.

5. Privacy Sector: Defensive Asset Revaluation in the Era of Transparency

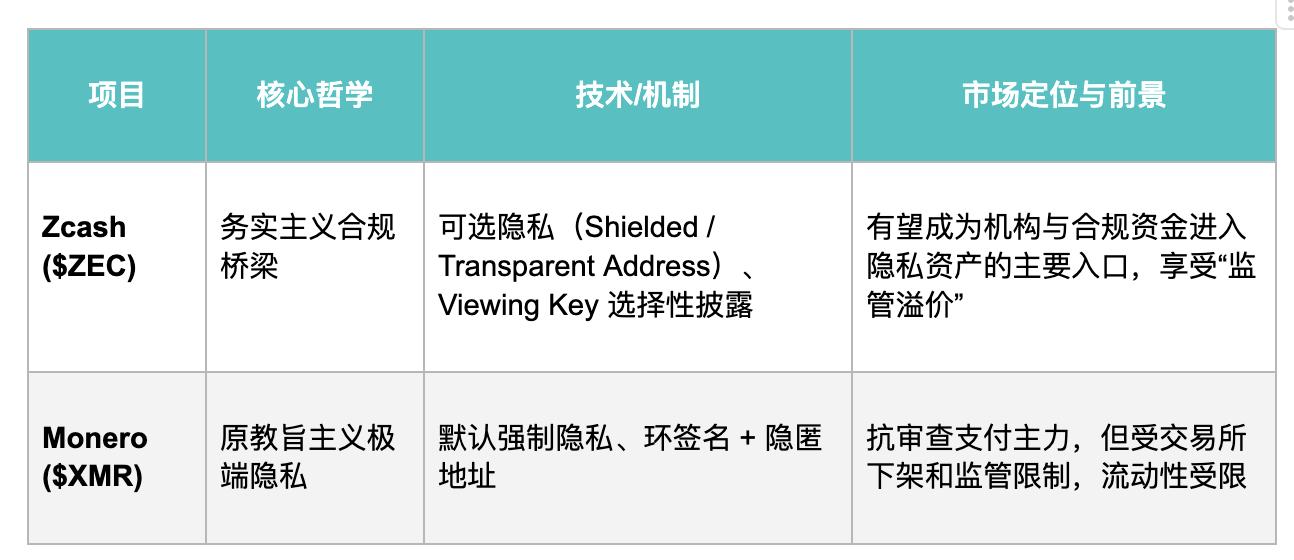

In the fourth quarter of 2025, the privacy sector experienced a historic resurgence. Marked by the surge in Zcash ($ZEC) from a low of around $35 to a peak of $750 in November (an increase of over 2200%), the market underwent a complete revaluation of privacy assets. With highly industrialized on-chain monitoring, address profiling, and fund tracing, privacy is no longer seen as a "cover-up tool" for the black and gray markets, but has been redefined as a scarce defensive asset within the Web3 ecosystem, used to hedge against regulatory, censorship, and information exposure risks. The essence of this rally is not simply a catch-up, but rather a growing market awareness that completely transparent blockchains are not suitable for all financial and commercial scenarios, and that privacy is becoming a necessary patch for on-chain integration into the "real economy."

Core Game: The Divergence of Privacy Coin Paths

In 2025, a clear divergence emerged within the privacy cryptocurrency space, with Zcash and Monero representing two major privacy coins that are heading towards completely different ecosystems. Zcash's advantage lies in its "understandability by regulators," sacrificing some purity for a space to survive within the regulatory framework; Monero's advantage lies in its "uncensorability," but the compliant market is almost completely closed, and liquidity is highly limited. The competition among privacy coins has evolved from a technological battle to a battle of survival strategies.

The Rise of ZK Privacy Infrastructure

If privacy coins primarily address "personal transaction privacy," then the real breakthrough in 2025 will be the privacy infrastructure sector driven by zero-knowledge proofs (ZK). This branch doesn't emphasize complete anonymity, but rather "verifiable but invisible," making it more suitable for institutions, RWA (Real-Time Transaction Analysis), and enterprise-level financial scenarios. The core advantage of the ZK privacy approach lies in avoiding direct regulatory conflict, serving RWA, enterprise settlement, and privacy-focused DeFi, and being more readily accepted by TradeFi, institutional, and government systems. However, its disadvantages include high technical complexity, high development costs, a user experience still weaker than traditional blockchains, and a token value capture path that is still in its early stages.

The future of the privacy sector will be defined by both regulation and real-world financial needs. The EU's Anti-Money Laundering Regulation (AMLR) in 2027 will be a key watershed moment, posing a significant challenge to mandatory anonymity coins like Monero, while auditable Zcash and "verifiable but invisible" ZK (zero-knowledge proof) infrastructure are expected to become compliance standards. Therefore, the core value of this sector will no longer be anonymous transfers, but rather providing privacy protection for real-world assets (RWA) and enterprise-level finance. ZK technology can verify transactions without revealing trade secrets, thus becoming a "productivity layer" supporting the development of on-chain finance, while traditional privacy coins may play more of a value storage role in specific scenarios.

2026 Hot Track Predictions

1. Real-world assets (RWA)

By 2026, tokenized U.S. Treasury bonds and money market funds will establish themselves as the core of the on-chain financial system as a "low-risk anchor" and "on-chain cash," becoming the preferred tool for institutions to compliantly obtain on-chain returns and connect traditional finance with DeFi, and driving RWA into a stage of scaling and mainstream adoption.

Building on this foundation, RWA's asset structure will expand from solely government bonds to include private credit, tokenized stocks, and alternative assets. Technically, it will shift from "off-chain packaging" to native on-chain issuance and automated settlement. Simultaneously, synthetic perpetual contracts will accelerate their development, providing higher liquidity and leveraged exposure for assets such as stocks, interest rates, and commodities. The fusion of stocks and crypto-native derivatives will give rise to the emerging field of stock perpetual contracts. With 24/7 trading, high leverage, and higher liquidity, these contracts are gradually evolving from a niche DeFi product into a mainstream trading tool for both institutional and retail investors. However, due to their heavy reliance on funding rate mechanisms and price oracles, ther