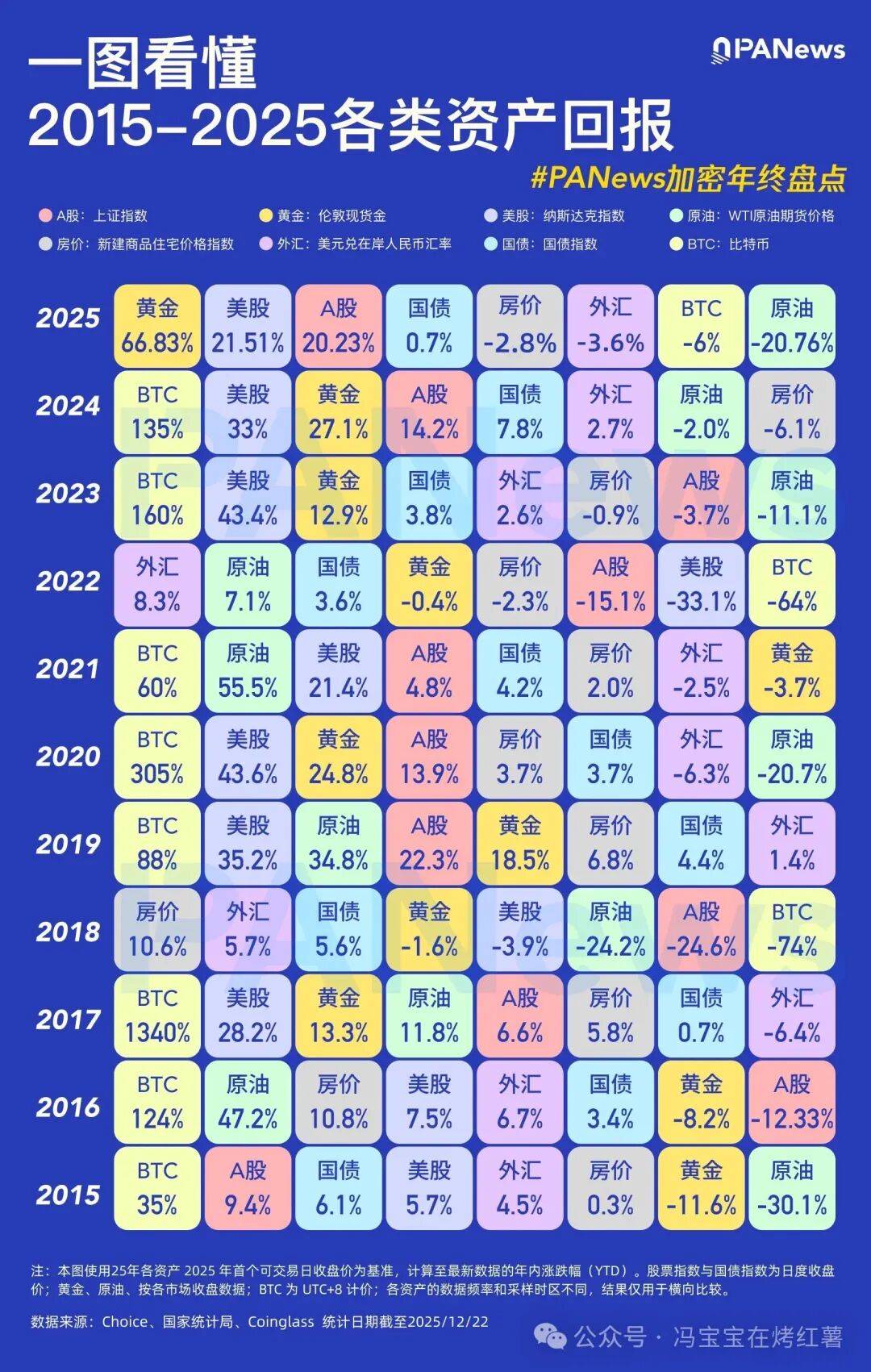

Market fluctuations were minimal; after a brief surge in the morning, prices began to pull back. Looking at the overall returns of various assets over the past 10 years, Bitcoin has seen a slight decline this year, while gold has led the market's focus on gains, with all precious metals experiencing a surge. Everything has its cycles; nothing can escape the cycle.

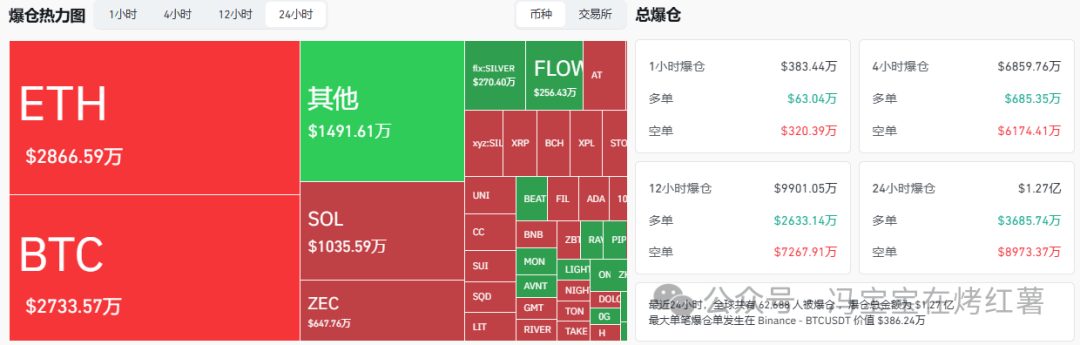

In the past 24 hours, a total of 62,688 people across the network have had their positions liquidated, with a total liquidation amount of $127 million. Long positions were liquidated for $36.8574 million and short positions for $89.7337 million.

BTC

After a period of consolidation, Bitcoin began a rebound. Today's pullback did not break below 88,300, and the hourly candlestick closed above this level. Currently, the price action is forming a triangle pattern, which looks like a potential breakout. However, this surge has been too rapid and intense, making it unlikely that the price will hold its ground.

There's a good shorting opportunity: Enter a short short in the current price range of 89,000-90,000, with a stop-loss at 91,000. Firstly, the price has already accelerated upwards on a smaller timeframe, which could be a false breakout to lure in more buyers; secondly, the 90,000 level remains a strong resistance level with heavy selling pressure, making a breakthrough difficult.

Today's key points: Bitcoin's resistance levels are around 89400, 90000, and 91500. If the hourly close breaks below 88300, the support levels are around 87400, 86700, and 85800.

ETH

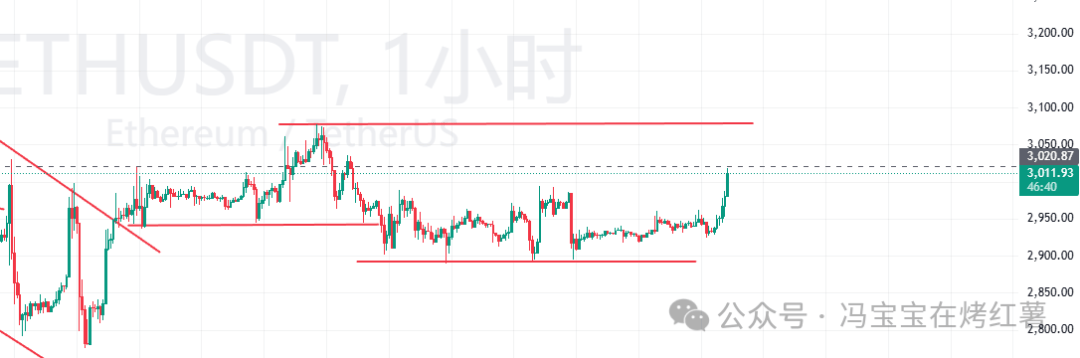

Ethereum rebounded after a short period of consolidation, showing strong momentum but remaining within a trading range. For long, the key resistance level is in the 3050-3070 range; failure to break through this level will likely lead to another pullback. The current price around 3015 is near the 4-hour MA120 resistance level. The recent rapid rise has accelerated, and such sharp increases are prone to resulting in a "long upper shadow" candlestick pattern. A close with a long upper shadow could signal a potential shift to a downward trend.

Therefore, shorting during a rebound offers a relatively high cost- short ratio. Unless the price strongly breaks through the upper resistance zone, the probability of a trend reversal is low.

Today's key focus: Ethereum is watching the 2960 level, with resistance levels at 2993, 3031, and 3078. If the hourly close breaks below 2960, support levels are around 2923, 2893, and 2857.

Copycat

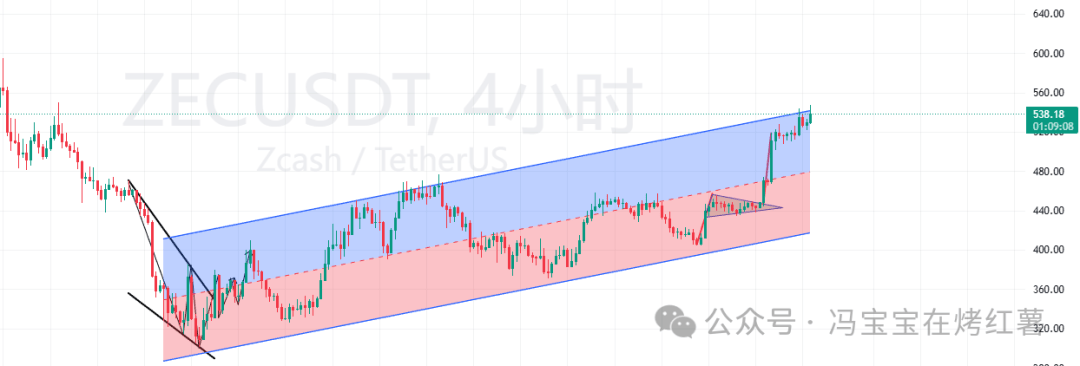

Cryptocurrencies like ZEC and BCH that buck the trend and surge are highly manipulated, with price fluctuations entirely controlled by large investors. While mainstream coins like BTC and ETH are falling, these two are rising sharply against the trend. This isn't a bull market catch-up rally; it's clearly aimed at short sellers. If you dare to short them, these large investors will fleece you.

Once the major players have wiped out the short sellers and established their own short positions, this upward trend will come to an abrupt end. Short these tough coins is not so easy to handle.

Just as Musk revealed, Bill Gates lost over 10 billion yuan short Tesla, which confirms that short is far more dangerous than long: with the same initial price of 100 yuan, a drop of 5.9 yuan after five 10% limit-down days is only 5.9 yuan less, while a rise of 16.1 yuan after five 10% limit-up days is 16.1 yuan more. Long short can lead to endless losses.

$BCH

BCH is currently experiencing short-term upward volatility, approaching a strong resistance level at the daily moving average, with a low probability of a breakout. The 4-hour chart shows a bearish divergence and a rising wedge pattern, indicating a potential top in the shorter timeframes. A pullback is likely initially, and unless there is a strong breakout with significant volume, it will likely continue its downward trend. Shorting in the current 615-630 range short good value, with a first target of 570.

$ZEC

ZEC's flag pattern bullish signal took effect a few days ago, accelerating the price increase and invalidating the rising wedge pattern. Currently, it's trading within an upward channel, with the price approaching the upper resistance level. While a short-term pullback is expected, a second upward move is anticipated afterward, and the overall trend remains bullish, with room to reach the previous high. A break above the previous high could lead to a new all-time high.

$zoria

Today I discovered another AI project built on Eliza Cloud. These types of projects generally have low market capitalizations right now, but one of them will definitely emerge as the absolute leader in the future. I'm optimistic about the $zoria development team; they've been working very hard to update and improve their projects. Although it's still relatively new with a low market capitalization, I'm betting on its future; I'm betting it will be the leader.

$BNB

First, watch 857. If the hourly closing price holds above this level, the next resistance levels are 872, 884, and 896. If the hourly closing price falls below 857, the next support levels are 847, 834, and 821.

$SOL

First, watch 126. If the hourly closing price holds above this level, the next resistance levels are 130, 132, and 135. If the hourly closing price falls below 126, the next support levels are 123, 121, and 119.

New coins to watch:

① $RVV: If a crash occurs later, a rebound is expected.

② $ZBT: We are observing whether it can drive a new round of cryptocurrency price increases. We are currently monitoring it closely.

③ $AT: If it crashes later, it is expected to rebound.

④ WhiteWhale on the Sol chain: I've added it to my watchlist and am ready to capitalize on any rebound opportunities.