Market Update aims to provide readers with the latest market reports and key digital asset data.

Article author: 0xArthur

Article source: ME News

The crypto market saw widespread gains, with the SocialFi sector rising 3.48% in the last 24 hours. Within the sector, Toncoin (TON) rose 4.18%. Meanwhile, the CeFi sector climbed 2.65%, with Canton Network (CC) rebounding sharply by 21.59% and Binance Coin (BNB) rising 2.65%.

In other sectors, Layer 1 rose 2.46% in the last 24 hours, with Solana (SOL) up 3.80% and Zcash (ZEC) up 4.38%; Meme rose 1.44%, with Pepe (PEPE) up 2.89%; DeFi rose 1.12%, with Uniswap (UNI) up 3.90%; and PayFi rose 0.73%, with Dash (DASH) up 2.02%.

Only the Layer 2 sector fell by 0.24%, but Zora (ZORA) rose by 9.15%.

The crypto sector indices, which reflect the historical performance of the sector, show that the ssiSocialFi, ssiCeFi, and ssiLayer1 indices rose by 3.61%, 2.51%, and 1.88%, respectively.

ETF Directional Data

According to SoSoValue data, Bitcoin spot ETFs saw a net outflow of $782 million last week (December 22 to December 26, Eastern Time), with none of the twelve ETFs experiencing net inflows.

The Bitcoin spot ETF with the largest net outflow last week was BlackRock ETF IBIT, with a weekly net outflow of $435 million. IBIT's historical total net inflow has reached $62.06 billion. The second largest was Fidelity ETF FBTC, with a weekly net outflow of $111 million. FBTC's historical total net inflow has reached $12.098 billion.

As of press time, the total net asset value of Bitcoin spot ETFs was $113.53 billion, with an ETF net asset ratio (market capitalization as a percentage of Bitcoin's total market capitalization) of 6.49%, and a historical cumulative net inflow of $56.62 billion.

According to SoSoValue data, the Ethereum spot ETF saw a net outflow of $102 million last week (December 22 to December 26, Eastern Time).

The Ethereum spot ETF with the largest net inflow last week was the Grayscale Ethereum Mini Trust ETF (ETH), with a weekly net inflow of $34.22 million. The total historical net inflow of ETH has now reached $1.51 billion.

The Ethereum spot ETF with the largest net outflow last week was BlackRock ETF ETHA, with a weekly net outflow of $69.42 million. ETHA's historical total net inflow has reached $12.6 billion. The second largest was Grayscale Ethereum Trust ETF ETHE, with a weekly net outflow of $47.54 million. ETHE's historical total net outflow has reached $5.1 billion.

As of press time, the Ethereum spot ETF has a total net asset value of $17.73 billion, with an ETF net asset ratio (market capitalization as a percentage of Ethereum's total market capitalization) of 5.01%, and a cumulative net inflow of $12.34 billion.

BTC Directional Data

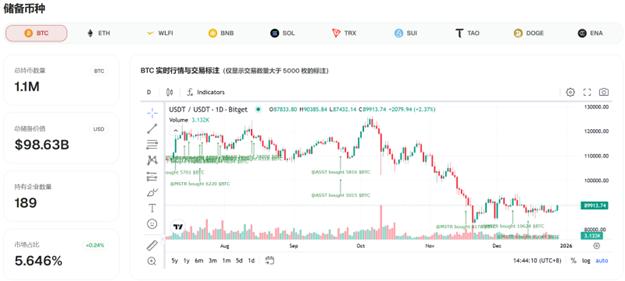

According to CoinFoundry data, 189 listed companies currently hold a total of 1,124,045 (+0.02%) Bitcoins, accounting for 5.65% of the total Bitcoin supply. Among them, Strategy (MSTR) holds 671,268 BTC, accounting for 59.7% of the total holdings of listed companies, and Tesla, Inc. (TSLA) holds 11,509 BTC, accounting for 1.02% of the total holdings of listed companies.

Stablecoin data

According to CoinFound data:

USDT market capitalization: US$199.08 billion

USDC market capitalization: US$76.1 billion

USDS market capitalization: $10.84 billion

USDe's market capitalization: $6.36 billion

PYUSD market capitalization: $3.78 billion

USD1 market capitalization: $3.23 billion

Market Dynamics

Caixin: Financial "experimentation fields" such as Bitcoin and stablecoins will not be set up in Hainan, China.

The Hong Kong Monetary Authority (HKMA) has confirmed that it will fully implement new bank capital regulations based on the Basel Committee on Banking Supervision's (BBS) standards for crypto-assets in Hong Kong from January 1, 2026.

UK financial institutions: Stablecoin regulatory positioning and payment integration will be core issues in UK crypto regulation in 2026.

$810 million in PYUSD was transferred between wallets.

Summarize:

Overall, against the backdrop of a moderate upward trend in the crypto market, the stablecoin market remained generally stable without significant volatility. Of particular note was a large-scale institutional-level fund flow in PYUSD, involving substantial escrow transfers between Ethena Labs and Copper Custody. This may suggest a strategic fund allocation between DeFi protocols and institutional custodians, but it did not have a substantial impact on overall market stability. (Source: CoinFound)

RWA Directional Data

According to CoinFound data:

Market capitalization of commodities: $3.97 billion

Market value of government bonds: US$1.21 billion

Institutional fund market capitalization: US$2.98 billion

Market capitalization of private lending: $28.67 billion

US Treasury bond market capitalization: $8.88 billion

Corporate bond market value: $260 million

X-Stock's market capitalization: $620 million

Market Dynamics:

The Hong Kong Monetary Authority (HKMA) has confirmed that it will fully implement new bank capital regulations based on the Basel Committee on Banking Supervision's (BBS) standards for crypto-assets in Hong Kong from January 1, 2026.

HashKey Holdings Limited (3887.HK), in collaboration with the Digital Finance Lab at the Hong Kong University of Science and Technology, released the "Top Ten Trends in the Digital Asset Industry in 2026." The report highlighted the strong support for AI and blockchain integration, asset tokenization, and stablecoin infrastructure, reflecting the industry's continued focus on the deep integration of blockchain technology and finance.

Bitfinex executive: RWA's total market capitalization will grow to trillions of dollars within the next decade.

Summarize:

At the end of the year, the overall market remained relatively calm, with no major events or sharp price fluctuations. The market mainly saw gains, and with 2026 fast approaching, RWA is expected to continue to lead the crypto sector as regulatory clarity deepens (EU MiCA, relevant US legislation) and institutions continue to enter the market.