Corporations are increasingly turning to Ethereum Staking to generate passive income, thereby tightening the supply of Ether available for sale on the open market .

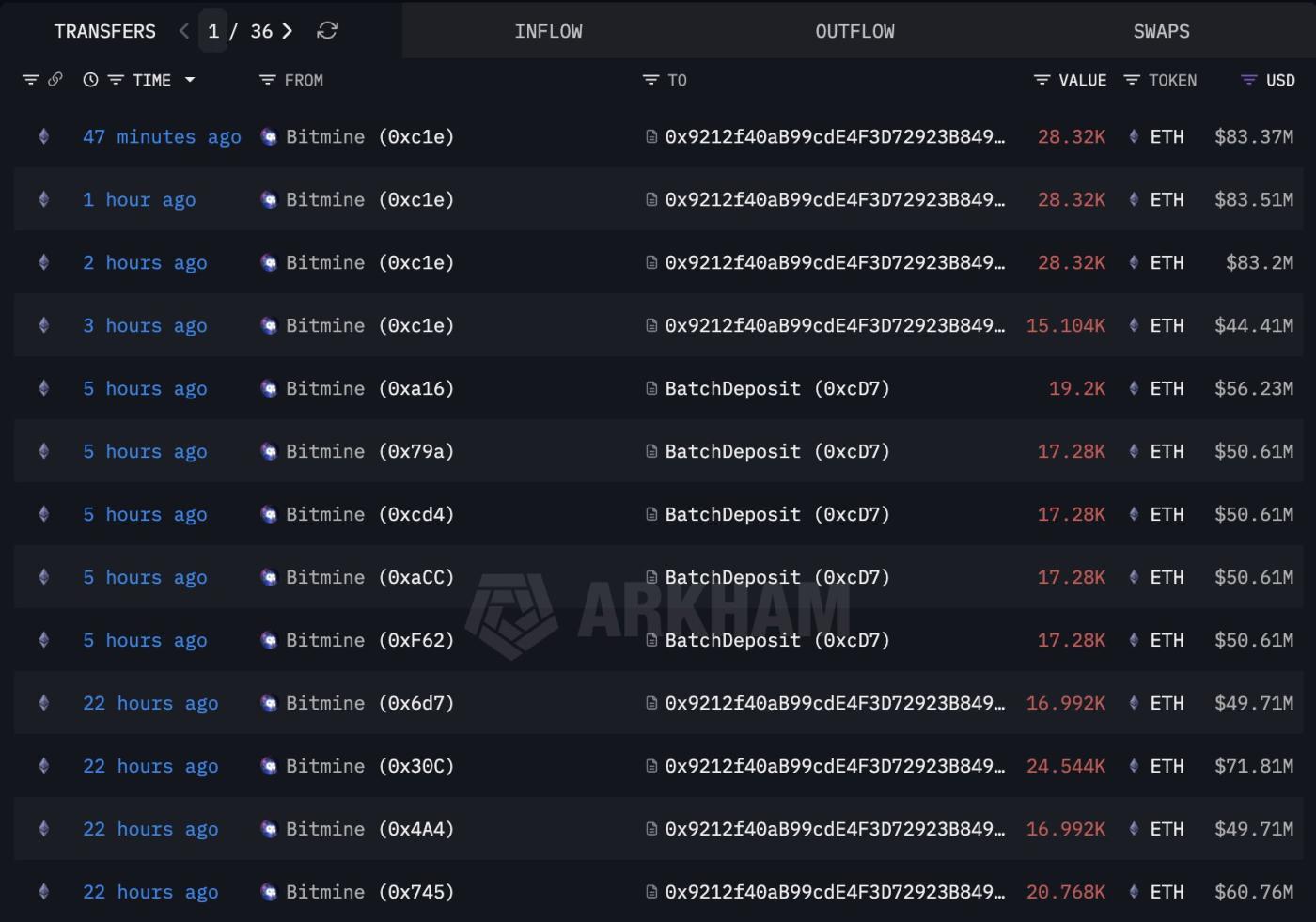

BitMine Immersion Technologies – the largest holder of enterprise Ether – Stake 342,560 ETH , worth over $1 billion, in the two days prior to Sunday, according to data from Lookonchain .

Staking is the process of locking ETH into Ethereum's proof-of- Stake network to secure the blockchain, in exchange for a passive APY yield of approximately 3–5% per year .

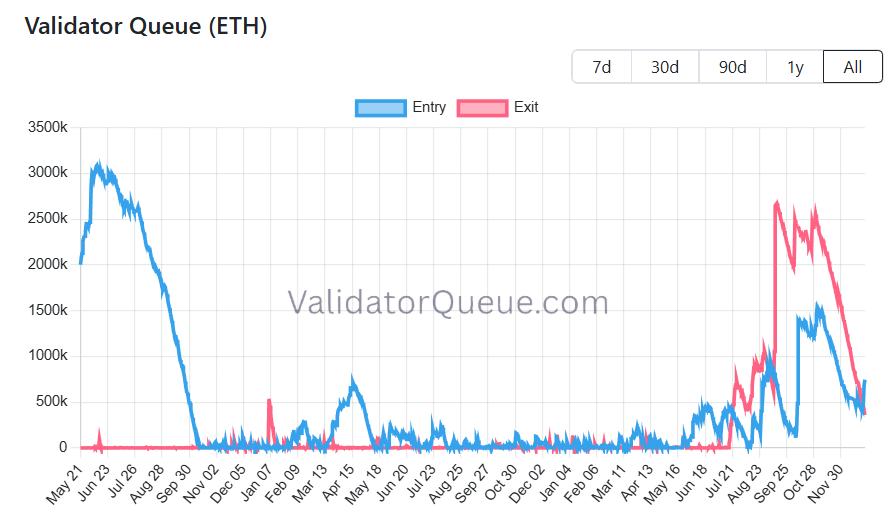

BitMine's Stake ETH worth $1 billion also significantly impacted Ethereum's validator queues : for the first time in over six months, the entry queue nearly doubled the exit queue , as previously reported by Cointelegraph .

According to the validatorqueue, the in-entry queue is currently 12 days and 20 hours with 739,824 ETH waiting to be Stake, while the withdrawal queue is 6 days and 2 hours with 349,867 ETH waiting to be withdrawn. This indicates that nearly twice as many entities want to Stake ETH for passive income compared to the number of validators waiting to withdraw, reflecting greater long-term confidence in Ether. A larger withdrawal queue is often a signal that validators want to withdraw ETH, possibly to sell it.

Corporate treasuries hunt for Ether yields.

Many leading Ether holding companies are Stake a significant portion of ETH to generate passive income, including SharpLink Gaming , Bit Digital , and The Ether Machine .

SharpLink Gaming – the second-largest holder of Ether – said it has Stake “almost all” of its ETH holdings and generated 9,701 ETH in Staking rewards, equivalent to $29 million , according to the company's dashboard.

The Ether Machine – ranked third with $1.49 billion in Ether – has Stake its entire onchain treasury and consistently ranks in the top 5% of validators for Staking reward efficiency, according to an announcement in October.

The increasing amount of ETH being Stake is reducing the supply of sellable Ether , which is XEM as positive for the long-term value of the second-largest cryptocurrency by market capitalization.

Despite this, the highest-performing group of traders (“ smart money ”) tracked by blockchain analytics platform Nansen is still reducing its spot ETH holdings. Over the past week, smart money sold a net $4.26 million worth of ETH across 53 wallets , while whales bought a net $11.6 million . Public figures also bought nearly $6 million worth of ETH , with new wallets purchasing over $517,000 , indicating continued demand for Ether from new investors .