Last week we reflected on the year that’s just gone by, this week we’re looking ahead with some predictions for the year to come.

I don’t often make predictions because I know just how difficult it is to predict anything in this world, let alone in crypto, but it seems like a good exercise to do and even if I might not hit too many nails on the head, I think I can make some directionally correct predictions.

The below list is a combination of predictions backed by evidence and research, and then some that are more gut feeling or instinct. It’ll be fun to come back at the end of 2026 and see how these play out.

Without further ado, 10 predictions for 2026:

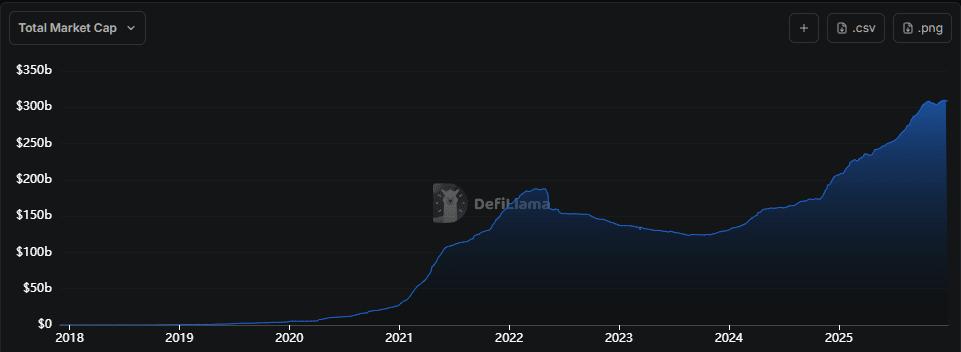

1. The stablecoin market cap exceeds $500b

In 2025 we saw the total marke cap of stablecoins grow from ~$200b to ~$310b. I don’t see this trend slowing down and think we end the year over $500b, perhaps even over $600b.

The GENIUS act passing in 2025 was a massive step in helping legitimize stablecoins, and I think we see more favourable legislation pass in 2026 that will further help increase the adoption of stablecoins.

We saw x402 payments launch as well and I think they remain a dark horse that will come out and surprise everyone with how significant they are. I wrote about them a few months ago in this post.

2. Gold tops, silver tops

Gold and silver have been on absolutely generational runs since the 2022 lows.

Many people expect this to continue, and they may well be right, but as one of my gut predictions — I am betting against their continued success. Nothing goes up-only forever, and corrections are inevitable. I think we’ve passed the point where gold is a consensus trade, and people started to look for “the next gold”. We’re now seeing silver explode, and people are looking to other metals for “the next silver”.

In addition, we have retail lining up to purchase physical bars and coins… as good as a top signal as any to me.

3. The 4 year cycle is proven wrong, as BTC rallies and hits a new ATH

2026 is do or die year for the 4 year cycle theorists. The theory is still alive with the peaks of a few months ago, so if we do indeed enter a prolonged bear market, and then resume a bull market in late 2026, then I would have to admit the 4 year cycle played out perfectly once again.

I maintain my stance that the 4 year cycle is broken / will break, and we’ll see evidence of that in the new year. The clearest evidence would be BTC hitting a new all time high in 2026, and I think that’s still very much on the cards. I’m not betting the bank on it, but I think it’s slightly more likely than not at this point.

4. Altcoins continue to bleed

Regardless of whether we have a bullish or bearish 2026, I think altcoins as a whole will continue to suffer. There are simply far too many of them, with so many more launching every day. There will of course be exceptions, but we will never again see a sustained rising-tide-lifts-all-boats type of alt season.

This means it’s more important than ever to hold the right tokens and have conviction in your holdings.

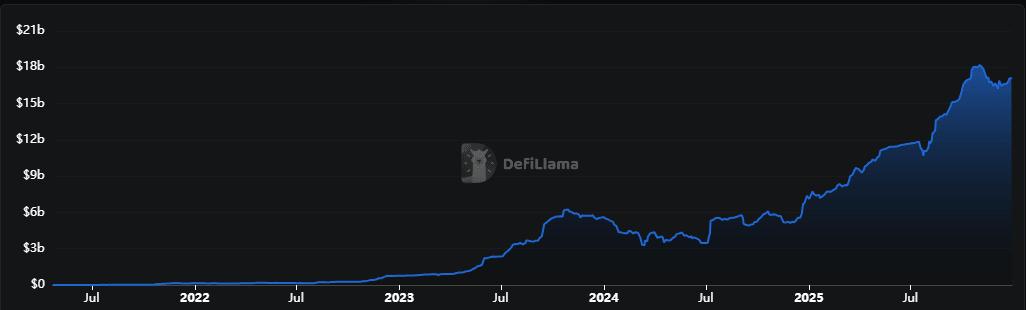

5. The RWA (Real World Asset) sector will grow to $50b

The SEC’s planned “innovation exemption”, and the upcoming CLARITY act, are both going to be massive tailwinds for the RWA sector. They’ll allow for clear regulation on what is and isn’t a security, and what assets are governed by the SEC vs the CFTC.

With this clarity, companies will have the legal safety and security to explore and experiment with an increasing array of crypto backed assets.

In other words, tokenizing everything.

We saw tokenized gold and tokenized treasury bills explode in 2025 and I think we’ll see more products take off in 2026.

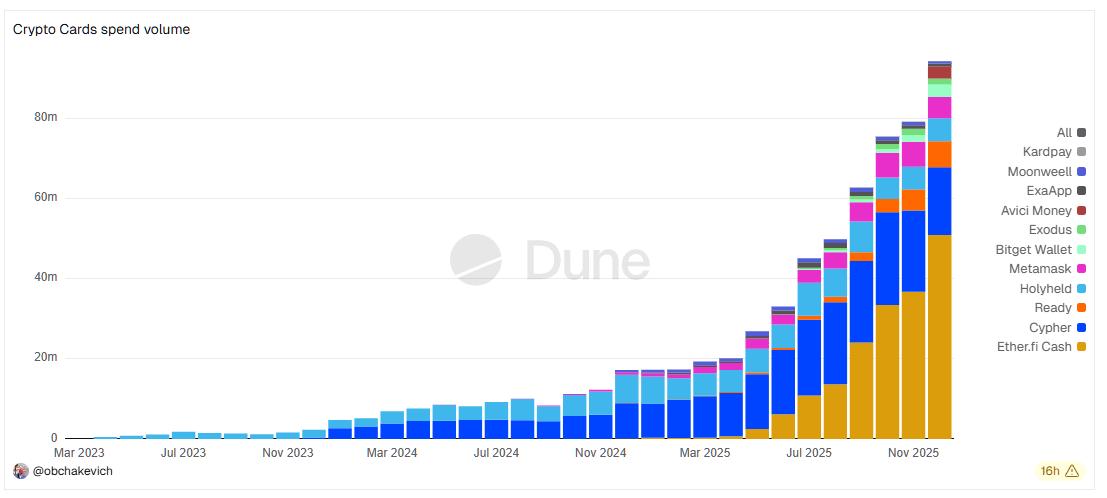

6. Neobank adoption significantly grows, with crypto card usage hitting $500m

I wrote about Neobanks a couple of months ago, and since then, adoption and usage has only grown:

Competition is heating up in the sector and almost every large crypto exchange and company is coming out with their own card, turning into a neobank. In addition, traditional neobanks are also adopting crypto.

This is part of a trend I am seeing where everyone wants to become an everything app (Coinbase offering stocks, Robinhood offering crypto, etc). Fun times ahead.