The source of any market rally is not on social media platforms, but in a small number of wallets.

Written by: Ugo

Compiled by: Luffy, Foresight News

In February 2024, I entered the world of Meme coin trading with $80, only to lose it all. I've had this kind of disastrous experience twice.

It was then that I realized I hadn't figured out the ins and outs of the market at all and had been using the wrong methods all along.

I then reinvested $50, this time using a wallet tracking strategy. In less than a year, by February 2025, that $50 had grown into over $1 million.

Early pitfalls

My logic for buying Meme coins used to be very simple: "This coin has interesting memes, good promotional content, and a clean official website, so I just bought it."

Admittedly, this method can occasionally make some money, but most of the time, it's no different from pure gambling. You have no solid evidence or objective reason to judge what specific price the coin can rise to.

If you want to make consistent profits, you need to find a way to get key information before the market starts to move, instead of following the trend after it has already risen.

I used to be obsessed with all sorts of rumors circulating on platforms like X and Telegram groups: "This coin will definitely reach a market capitalization of $100 million this week, just wait and see." Later I realized that most of the people posting these things were paid trolls, or they had already hoarded 15% of the circulating supply at a low price. You excitedly jump in, only to end up being the one left holding the bag.

If your profit-taking target is not based on real information, then your actions are merely passively responding to the interests of others, rather than truly following market rules.

Turning the tide of battle by tracking wallets

I quickly realized that my previous operations were missing a crucial element. I kept watching the operations of top traders and wondering, "How can they predict market movements while I can't?" So I had to find a solution.

Wallet tracking completely revolutionized my understanding of trading. I no longer try to guess market tops and bottoms, chase various trending narratives, or let the hype on platforms like X lead me by the nose. Instead, I focus on just one thing: where exactly is smart money flowing?

The origin of any major market rally doesn't lie on social media platforms, but rather in a small subset of wallets. These wallets are either the initial offering wallets of projects, wallets with large holdings, or early institutional wallets. Insiders, KOLs, industry leaders, market makers, newly opened anonymous wallets… all reside in these addresses.

I don't rely on a stroke of luck in a single trade, but rather on repeatedly capturing replicable market patterns.

At that moment, I finally understood: I don't need to be smarter than the market, I don't need to incorporate any subjective judgment, and I don't need to pay attention to market speculation. I just need to keep a close eye on the data, analyze the flow of funds, and then decisively execute my trading strategy.

From then on, my goal became crystal clear: to build a trading system that reacts only to the movements of smart money, rather than blindly following rumors.

Practical Methods for Tracking My Wallet

Keep an eye on KOLs' wallets

When I first started out in February 2024, wallet tracking was actually quite simple. Back then, almost no one changed their wallet address frequently.

All you have to do is find the hidden wallet addresses of those KOLs who truly have influence and traffic, and then follow their instructions. That's all.

They accumulated shares at low prices → then loudly shill → causing the price to surge tenfold instantly.

Using this method, I turned $50 into $5,000 in the first month. Then, in the second month, $5,000 became $30,000.

For example, on February 24th: a project team issued a token specifically for a KOL (Key Opinion Leader). This industry leader quietly accumulated a position using multiple hidden wallets when the token's market capitalization was only $20,000. When the market capitalization rose to $30,000, I followed his lead and bought in. Subsequently, he went on a massive promotional campaign in Telegram groups and on the X platform, instantly pushing the token's market capitalization past $400,000. I took profits in batches at that price.

Later that day, the token's market value surged to $1 million, and I took the opportunity to cash out again. In just a few hours, my initial investment had increased approximately 30 times.

At that time, my principal was still very small, so I didn't have to worry about insufficient liquidity and could withdraw cleanly and completely.

Tracking the Cabinet's Wallets

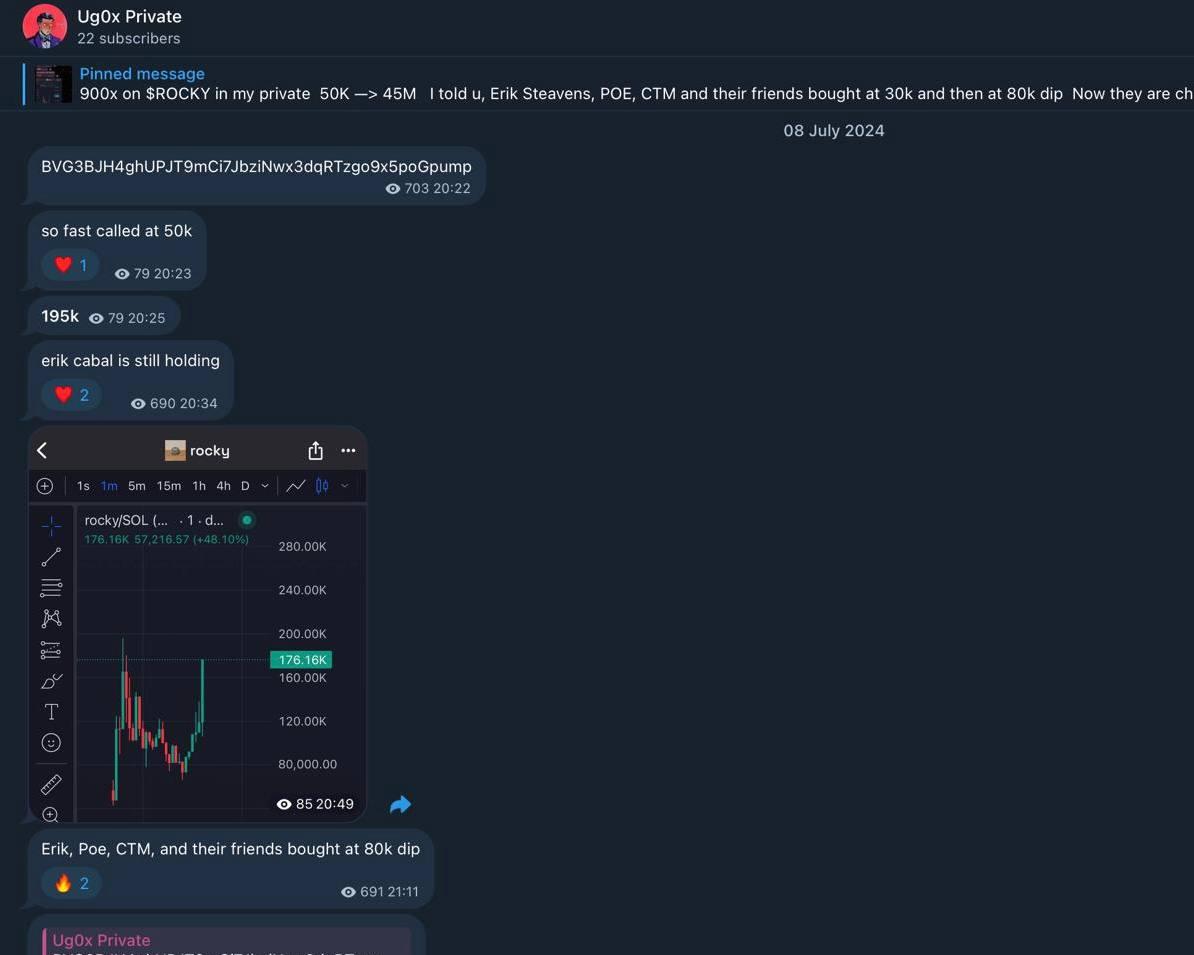

A few months later, I stopped focusing on individual KOLs and started tracking the wallet movements of conspiracy groups (small operational teams). At that time, people were changing wallet addresses more and more frequently, and tracking the consensus of a group of people was much more reliable than looking at a single wallet. For example, ten different people's wallets, all belonging to the same circle, were simultaneously performing the same operations.

This signal gives me a confidence far greater than that of a single wallet.

The events surrounding the token _2024111120230_ on July 8, 2024, serve as an excellent example. At that time, Erik Steavens, POE, DOGEN, and CTM were all quietly buying in the token's market capitalization range of $10,000 to $80,000.

Upon seeing this signal, I was certain that this was no coincidence; they were definitely preparing for a surge in prices.

I bought 2.8% of the circulating supply of this token when its market capitalization was $40,000.

In the following days, this group of bigwigs joined forces to pump the price, and the token's market value soared to $45 million.

I took profits in batches between $2 million and $10 million, with an average exit price of around $6 million.

This trade multiplied my initial investment by 150 times. Although I could have made 1100 times my initial investment if I had held at the peak, I strictly adhered to my exit plan. I'm already very satisfied with the first six-figure profit I've ever made from this trade.

Track new wallets, project wallets, and wallets with large holdings.

By January 2025, the cryptocurrency market was experiencing unprecedented trading activity, but wallet tracking was becoming increasingly difficult. To continuously obtain firsthand insider information, I had to constantly optimize my methods and adapt to changing circumstances.

Tracking the wallets of these insiders hinges on identifying their new wallets that have recently withdrawn funds from centralized exchanges like Binance. This means precisely tracing the transfer records and timestamps of funds between multiple Binance addresses. While this process is time-consuming, it is absolutely worthwhile.

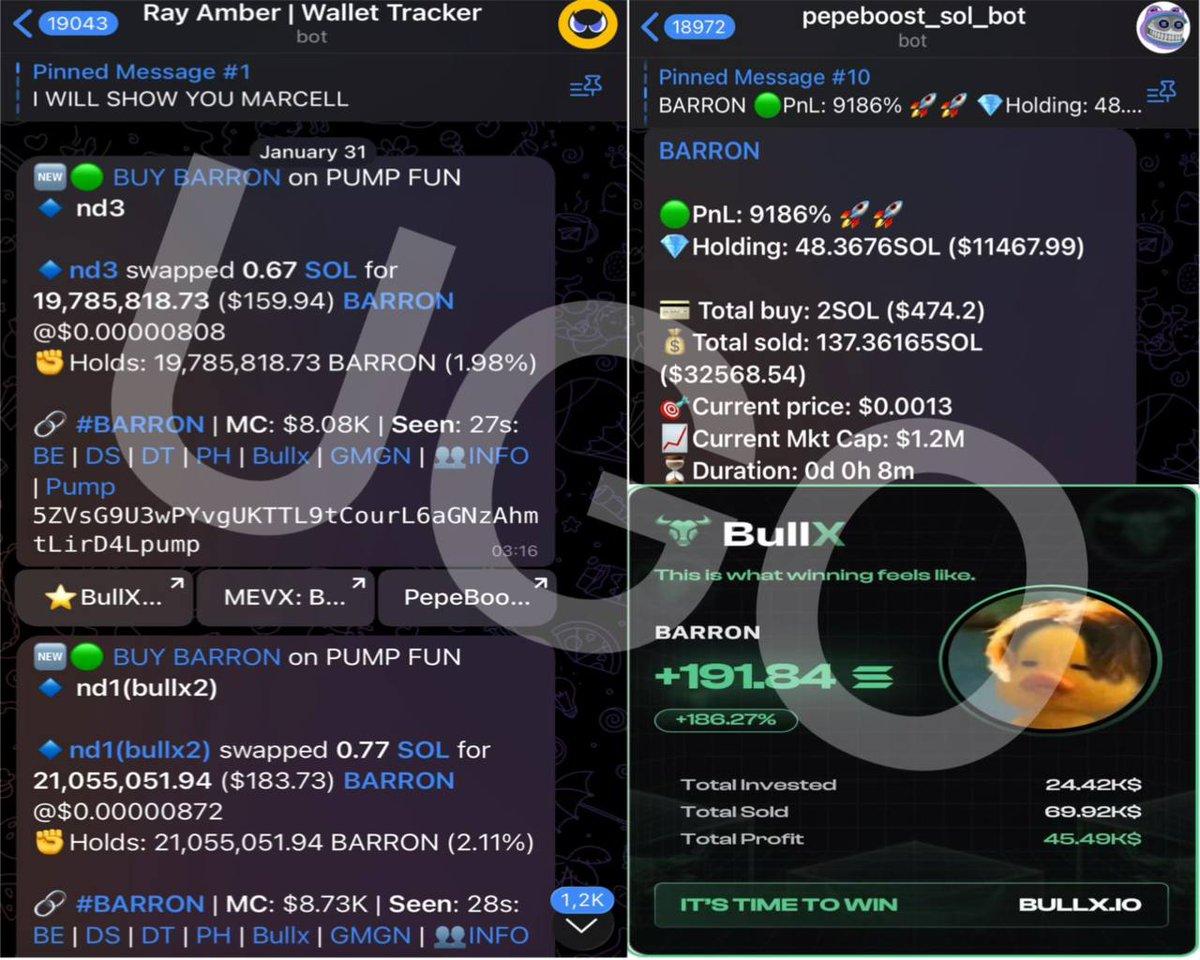

For example, I was closely tracking Marcell's wallet activity, so I could see his wallet being newly topped up every day. On January 31st, he personally issued and held a large amount of the token.

I established my position in three wallets when the token's market capitalization was between $15,000 and $25,000. About three minutes later, Marcell started posting messages shill surge. I quickly took profits and exited the market when the market capitalization was between $1 million and $2.5 million.

This was one of the fastest trades I've ever made: an initial investment of $1,300 resulted in a profit of over $110,000. (The trading platform BullX shows my initial investment as $24,000 because I later added to my position in this wallet on dips, maximizing my profits.)

Tracking market maker wallets

A market maker wallet is a wallet address directly controlled by the token project team. It is mainly used to manipulate the price of the token to profit for the project team or the token itself.

Common manipulation tactics include: triggering stop-loss orders by placing large buy or sell orders to fleece retail investors, or causing a 30% drop in the price within minutes to induce panic selling and allow new investors to enter the market at low prices.

However, market makers often start transferring tokens between wallets shortly after the token is issued. If these wallets are not newly opened or are easily identifiable, we can directly track the project team's movements and accurately capture every opportunity they have to issue new tokens.

This is how I operated the token transaction on January 31, 2025, with the timeline $HOOD.

The project team releases a new token roughly every month. They completed a large-scale holding when the token's market capitalization reached approximately $2 million, and I decisively bought in at that price, getting ahead of the top KOLs' shill. A few hours later, I took profits when the market capitalization was between $80 million and $120 million, resulting in a return of about 50 times my initial investment.

Meanwhile, while dealing with the initial profit-taking, I took advantage of the large-scale selling by market makers to re-enter the market with a heavy position, earning a 40% to 70% profit in just a few minutes.

The total profit for that day reached a staggering $152,000. Prior to the ASTER token trading in September of the same year, January 31st had consistently been my most profitable trading day.

My Ironclad Rules of Trading

I always strictly adhere to money management rules. For example, the capital invested in each transaction will never exceed 5% of the total position, and I will flexibly adjust the risk exposure based on the quality of the trading opportunity and my own level of confidence.

When trading using a wallet tracking strategy, never use large positions. Once the targets you are tracking discover your existence, they can easily turn around and fleece you.

You also need to learn to put yourself in others' shoes, think from the perspective of the people you are tracking, understand their interests, operating habits, and rhythm control. Only in this way can you minimize the risk of being taken advantage of and achieve continuous and stable profits.

Of course, I strictly adhere to my trading plan and never let emotions dictate my decisions. In fact, I rarely encounter problems in this regard because I started learning forex trading at the age of 14, and discipline is deeply ingrained in my bones.

That being said, I've also experienced the painful lessons of profit retracement several times. But these setbacks didn't break me; instead, they became my driving force. Fueled by this unwillingness to give up, I studied even harder, constantly refining my trading skills.

at last

I'm not writing this to show off. On one hand, I want to use it as a diary to reflect on my growth five years from now. On the other hand, I also hope to inspire and help more people, letting them understand that as long as you are willing to take the initiative to change and put in the effort, there is always a way to achieve your goals.

I must clarify one point: I never use these tracking techniques to target friends or people around me. Everything I do is purely to understand the underlying logic of market operations and then follow the trend.

I am also very grateful to those I followed and to the project teams that truly put their hearts into their work. I always approached transactions with reverence, without any hostility. I also sincerely thank all the friends I've met along the way; they have given me so much help. Thank you all, and thank God for his blessings.