Digital asset investment products saw a net outflow of $446 million last week, bringing the cumulative outflow since the October 10th plunge to $3.2 billion. This demonstrates that investor confidence has not yet fully recovered following the recent price shock.

However, the cumulative fund flow since the beginning of the year has not significantly changed compared to last year. A total of $46.3 billion has flowed into digital asset investment products this year, remaining broadly similar to the $48.7 billion recorded during the same period in 2024. Despite this, total assets under management (AuM) have only increased by about 10% since the beginning of the year, suggesting that even after accounting for the inflows, the average investor has not experienced any tangible investment performance this year.

Regionally, capital outflows were widespread, with the United States being the most affected, recording a net outflow of $460 million. Switzerland also saw a small outflow of $14.2 million. Germany, on the other hand, showed a distinct trend, with an inflow of $35.7 million. This month alone, Germany recorded a net inflow of $248 million, indicating that local investors are capitalizing on the recent price weakness as a buying opportunity.

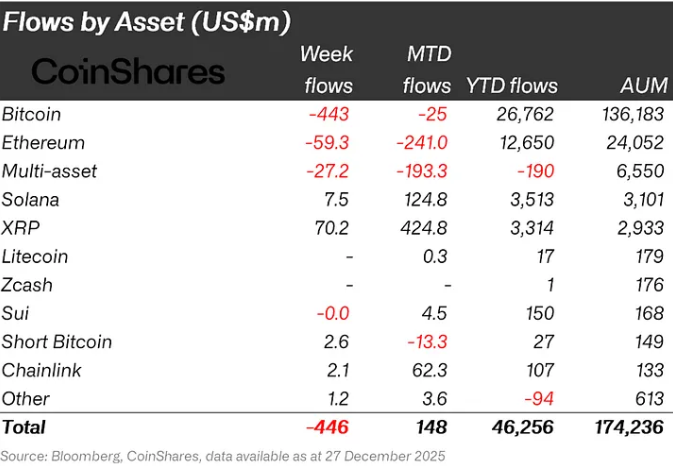

By asset, XRP and Solana saw the largest inflows last week. XRP saw net inflows of $70.2 million, while Solana saw net inflows of $7.5 million. Since the launch of their ETFs in the US in mid-October, XRP and Solana have recorded cumulative inflows of $1.07 billion and $1.34 billion, respectively, continuing to attract investor interest despite the overall market slump.

In contrast, Bitcoin and Ethereum showed distinct outflows during the same period. Bitcoin recorded a net outflow of $443 million last week, while Ethereum saw a net outflow of $59.5 million. Since the launch of the XRP and Solana ETFs, cumulative outflows have reached $2.8 billion and $1.6 billion, respectively. This demonstrates a distinct divergence in investment preferences within the digital asset market.

In summary, while overall investment sentiment toward digital asset investment products has yet to fully recover, selective fund inflows continue to occur in certain regions and asset classes, capitalizing on price corrections. This suggests that investors are increasingly adopting a selective approach, focusing on those with distinct relative attractiveness and growth narratives rather than the broader market.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.