Written by Glendon, Techub News

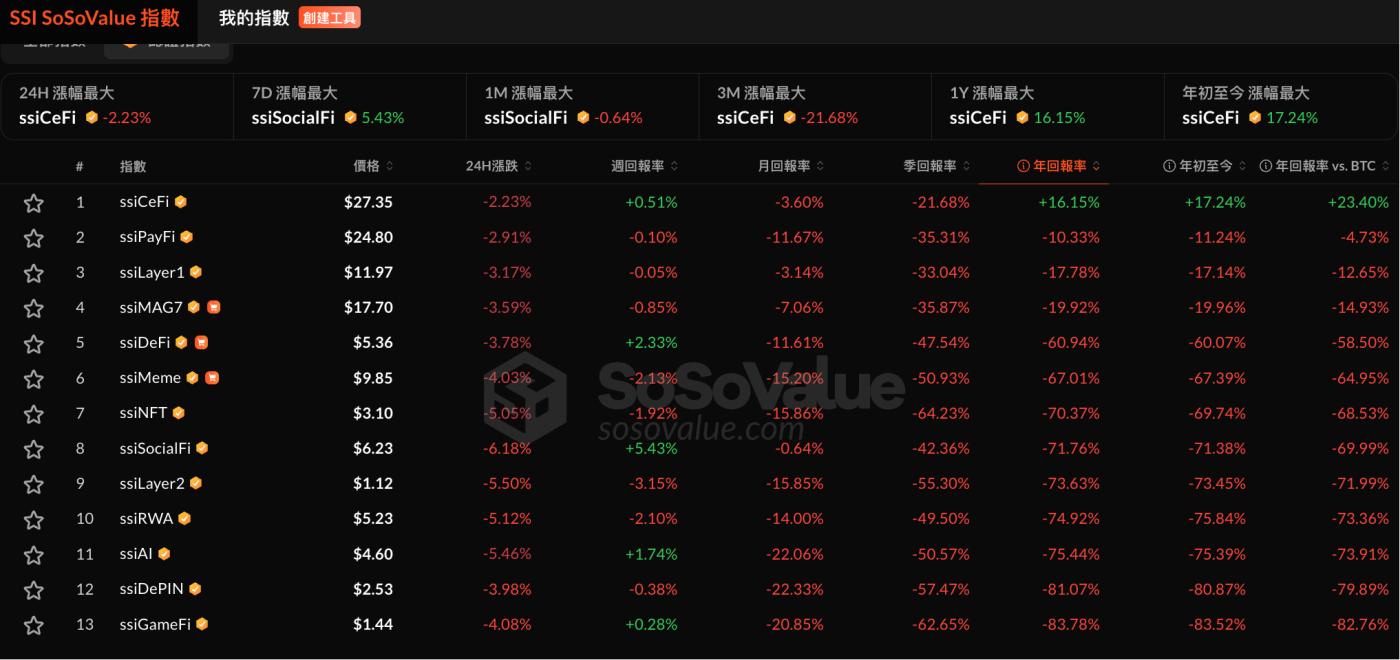

After briefly rebounding above $90,000 yesterday, Bitcoin fell below $87,000 again today, a daily drop of 3.76%. Meanwhile, the crypto market experienced another widespread decline. SoSoValue data shows that no sector was spared, with most sectors experiencing a 24-hour drop exceeding 3%. SocialFi, Layer 2, AI, RWA, and NFT sectors were hit particularly hard, with declines exceeding 5%.

Regarding institutional investment, the latest data from CoinShares shows that digital asset investment products saw a net outflow of approximately $446 million last week, bringing the total outflow since October 10th to $3.2 billion. Additionally, Bitcoin spot ETFs saw a net outflow of $782 million and Ethereum spot ETFs saw a net outflow of $102 million last week, both marking three consecutive weeks of net outflows. This undoubtedly indicates that institutional sentiment has not yet recovered.

However, the market seems to have become accustomed to this, given that the crypto market has been mired in a nearly three-month downtrend since the "10.11" flash crash. Bitcoin prices have been fluctuating and sliding from their highs, but each rebound has seemed weak.

After being hit by a series of factors including long-term holder selling, ETF outflows, and the decline of Digital Asset Treasury (DAT), the crypto market is considered to have entered a "bear market" cycle. However, the market is not without hope. It's worth noting that the downward trend in the crypto market eased in December. Compared to the crash in November (Bitcoin fell from $110,000 at the beginning of the month to $80,000), Bitcoin fluctuated within a range of $84,000 to $95,000 this month. Meanwhile, Bitcoin spot ETFs saw net outflows of $3.5 billion in November, but only about $1.1 billion in December, with both volatility and outflow volume significantly narrowing. Considering year-end risk-averse activities, these figures may suggest that selling pressure is easing marginally, and the market is brewing some positive changes.

Regarding the recent volatility in Bitcoin, Rick Maeda, a researcher at Presto Research, analyzed that Bitcoin's return to $90,000 yesterday was mainly driven by technical factors, rather than by any new catalysts. The $90,000 mark was a significant resistance level, and once Bitcoin stabilized above it, it likely triggered short covering and momentum-driven buying. Vincent Liu, Chief Information Officer of Kronos Research, also stated that after a period of consolidation, Bitcoin rebounded from a technical support level, and key price levels have now turned into support levels.

Therefore, the current market downturn is closer to a "structural reset" than a simple "bear market." With DeFi leverage clearing out, the market is gradually eliminating risks, and the trading range in December may indicate that the market is entering a transitional phase, awaiting a new catalyst. So, with the new year approaching, in this time of hope and uncertainty, what trends will the crypto market show in 2026? What potential positive factors exist?

What are the potential benefits for the crypto market in 2026?

One noteworthy phenomenon is that, despite the established fact that DAT has been declining for several months, the Bitcoin reserves held by global publicly traded companies (excluding mining companies) showed a significant increase in December. SoSoValue data shows that, as of December 29th (Eastern Time), publicly traded companies had spent approximately $2.064 billion in December to acquire approximately 22,600 Bitcoins. This increase surpassed the total amount of Bitcoin acquired by publicly traded companies from September to November, when they spent approximately $1.869 billion to acquire approximately 20,000 Bitcoins.

While this figure cannot compare to the peak of the DAT boom, it may indicate that the DAT market is poised for takeoff. Of particular note is the increasing investment from leading DAT companies. Strategy (formerly MicroStrategy) added $2.19 billion in cash reserves this month and spent over $2 billion to acquire 22,500 Bitcoins. As of December 28, Strategy held approximately 672,500 Bitcoins, with a total investment of approximately $50.44 billion.

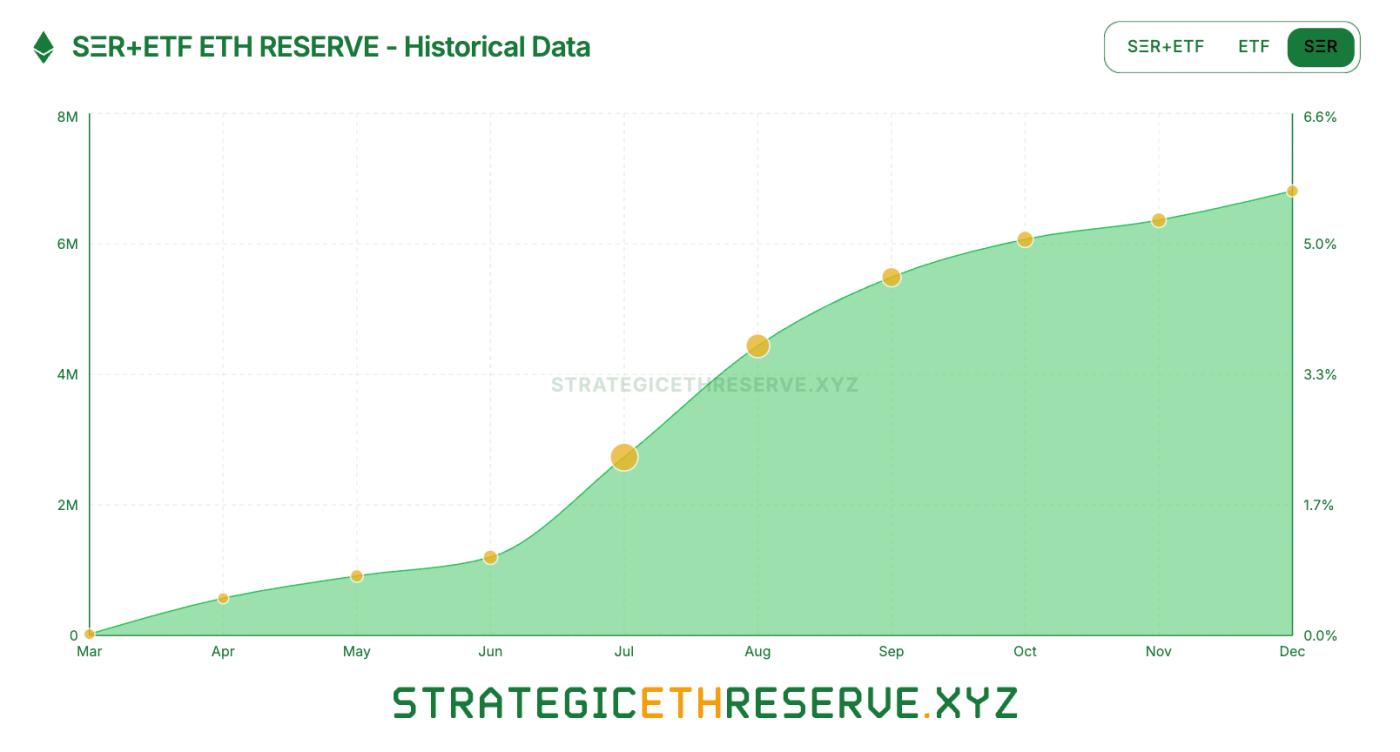

In addition, the Ethereum DAT market is also showing a slow but steady growth trend. According to data from Strategic ETH Reserve, as of the time of writing, the total Ethereum reserves are approximately 6.8127 million, an increase of about 7% from 6.3647 million in November.

Among them, Ethereum treasury company BitMine's investment is comparable to Strategy's. Currently, the company holds approximately 4.1105 million Ethereum, accounting for about 60% of the total Ethereum reserves. Moreover, BitMine's ambitions extend beyond Ethereum treasury; it is also targeting the native Ethereum staking market. In a post yesterday, it stated that as of December 28th, BitMine had staked 408,627 Ethereum, worth approximately $1.2 billion. In addition, BitMine is developing a custom infrastructure specifically designed for native Ethereum staking, namely the US-based Ethereum validator network MAVAN, with plans for full launch in the first quarter of 2026.

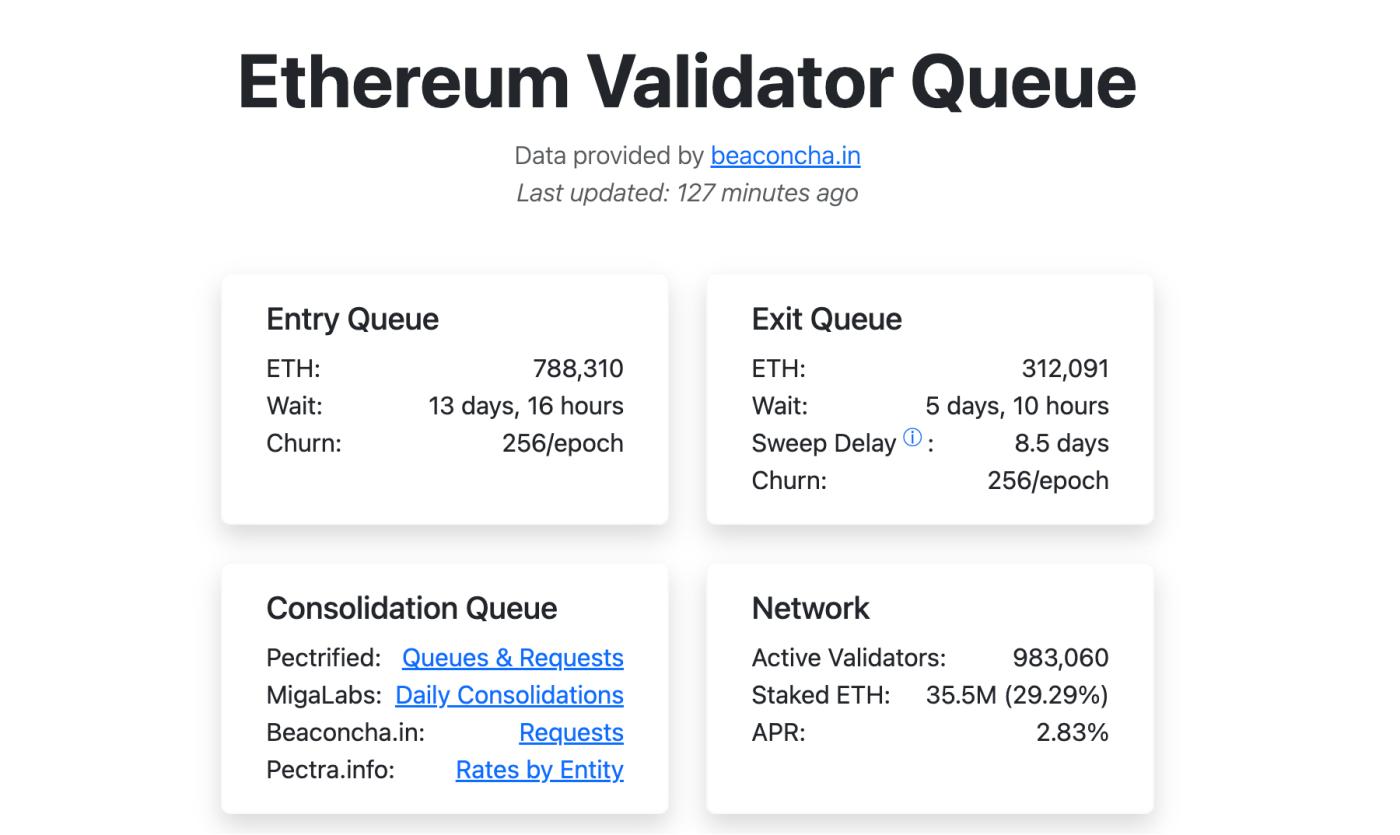

This move will undoubtedly bring new vitality and opportunities to the Ethereum ecosystem. Perhaps driven by the Ethereum Pectra upgrade and the active promotion by institutions such as BitMine, Ethereum staking demand is currently rebounding significantly. For the first time in six months, the size of the Ethereum validator "entry queue" has surged to more than double the size of the "exit queue".

According to the latest data from the Ethereum Validator Queue, approximately 788,300 ETH are currently queued waiting to join the Ethereum validator network, with an estimated waiting time of nearly 14 days, while only about 310,000 ETH have exited the queue. As of this writing, the total staked Ethereum amount is approximately 35.5 million ETH, representing 29.29% of the total supply, with over 980,000 active validators. Previously, the network's exit queue peaked at 2.67 million ETH on September 13th. This metric is undoubtedly an important signal regarding market fundamentals, reflecting both a return of market confidence in the Ethereum ecosystem and indicating that the Ethereum network's security is continuously improving, entering a phase of capital accumulation and increased liquidity.

Besides the leading DAT companies, Trump Media (owned by Trump), Vanadi Coffee (a Spanish listed company), and Trend Research (founded by Jack Yi, founder of Liquid Capital) have also actively increased their holdings of Bitcoin or Ethereum this month. Institutional activity has increased compared to the previous months, indicating that institutional confidence in the market is gradually strengthening.

Furthermore, the tokenization sector, closely linked to institutional investors, is also quietly emerging. A report by Cantor Fitzgerald shows that the total value of Real-on-Chain Asset (RWA) tokenization achieved a remarkable threefold increase in 2025, reaching $18.5 billion, and is projected to surpass $50 billion in 2026. While the RWA market is still in its early stages, its applications have already expanded extensively into multiple sectors. According to data aggregator RWA.xyz, the tokenized goods market is worth approximately $4 billion, growing by 11% in the past month, including tokenized goods such as Tether Gold (XAUt) and Paxos Gold (PAXG).

The most attention-grabbing sector recently has undoubtedly been tokenized stocks, whose total market capitalization has surged to a record high of $1.2 billion. Token Terminal considers tokenized stocks "the stablecoins of 2020," believing they possess enormous growth potential. Meanwhile, many industry insiders are comparing this trend to the DeFi boom of early 2020, predicting a large-scale on-chain rollout of global stocks to benefit from faster settlement speeds, 24/7 trading, and divisible ownership.

It's worth noting that the tokenized fund sector has also developed rapidly. BlackRock's first tokenized money market fund, BUIDL, has paid out over $100 million in dividends, indicating that tokenized securities have moved beyond the pilot and proof-of-concept stages and are now being used in practice. In mid-December, Wall Street giant JPMorgan Chase also launched its first Ethereum-based tokenized money market fund with an initial capital of $100 million, further validating the strong institutional demand for tokenized asset allocation. Therefore, 2026 may be a crucial turning point for tokenized assets, moving them from proof-of-concept to large-scale application.

Another sector that cannot be ignored is the prediction market. In recent months, almost all sectors of the crypto market have experienced capital outflows, but the prediction market has emerged as a rising star, attracting a great deal of capital against the trend. In particular, Polymarket and Kalshi have successively received $2 billion in strategic investment from Intercontinental Exchange (ICE) and a $1 billion Series E funding round led by Paradigm, respectively, with valuations exceeding $10 billion.

Currently, competition in this sector is exceptionally fierce. Polymarket has been approved to return to the US market, Kalshi has brought thousands of prediction markets onto the blockchain via Solana, and the up-and-coming BNB ecosystem prediction market Opinion has achieved a cumulative nominal trading volume exceeding $10 billion in just 55 days since its launch, demonstrating rapid growth. These examples all indicate that prediction markets are on the verge of explosive growth, with enormous future potential, and are expected to become another growth engine for the crypto market.

Conclusion

In summary, the current crypto market is supported by numerous favorable factors. Besides the internal market factors mentioned earlier, these include the Clarity Act (for regulating the crypto market), which is expected to be submitted to the Senate for revision in January, and macroeconomic policy factors such as the Federal Reserve's interest rate cuts. However, the key question is when these factors will translate into crucial catalysts driving the crypto market upward.

Overall, the long-term bullish outlook for the market remains strong. However, in the short term, these positive factors are insufficient to drive a full recovery in the crypto market. On one hand, the crypto market is still in a correction phase; market sentiment has eased somewhat, but it remains in a state of "extreme panic." On the other hand, the market is currently experiencing year-end fund inflows and holiday season, with institutional investors commonly withdrawing funds and adjusting their portfolios. The significant withdrawal of funds from risky assets such as Bitcoin has led to a substantial decrease in market liquidity, putting continued downward pressure on prices.

Therefore, barring any major catalysts, liquidity in the crypto market is expected to remain weak in January. Bitcoin, as a bellwether for the crypto market, has short-term support in the $84,000 to $84,500 range. A break below this key support level could trigger further market panic, potentially pushing the price down to the November low of $80,000.

A 10x Research market weekly report analysis points out that the implied volatility of Bitcoin and Ethereum dropped significantly at the end of the year, indicating that the market expects their prices to stabilize and not fluctuate as drastically as before. This means that the selling pressure that has lasted for months is gradually easing, market sentiment is slowly shifting from panic to caution, and institutional investment will become more rational.

In summary, despite the current weak price trend in the crypto market, it is clear that on-chain structure and institutional participation are steadily strengthening. In the short term, Bitcoin may continue to fluctuate between $84,000 and $95,000, with intense competition between bulls and bears within this range. However, there is also the possibility of Bitcoin stabilizing and rebounding, and capital inflows returning. Looking ahead to early 2026, the market will focus more on key areas such as ETF funding, DAT data, prediction markets, the tokenization market, and US policy and regulation. Once these positive factors successfully translate into key catalysts, market confidence will be greatly boosted, potentially triggering a new bull market cycle driven by institutional investors.