Author: Jiawei | IOSG Ventures

A while ago, I came across a tweet by Jon. It’s amusing (lmao)

When we call Base “the BNB Chain for white people,” what are we really trying to say?

Haseeb, in his essay “Blockchains Are Cities,” compared Ethereum to NYC and Solana to LA. If we use the same lens, the picture becomes clearer.

BNB Chain feels like a port that never sleeps.

It runs on massive traffic from Binance. Cargo ships come and go. The market is loud. No one cares where you’re from. What matters is whether you can jump in right now. Everything moves fast. New projects launch every day. You don’t need to understand the city plan or believe in any ideology. You just need to know where the action is.

Base, on the other hand, is a new city in construction.

It inherits Ethereum’s values. Roads are being built. Communities are forming. Rules are debated again and again. There’s no port chaos here, but it attracts engineers and creators early on. They are not in a rush to get rich. They are asking a different question: if, in the next ten years, truly mainstream onchain apps are going to exist, where should they be born?

The same crypto world is splitting into different cities. With different people and very different ways of life.

Understanding these differences matters far more than arguing about which chain is “better.”

The Two Paralleled Cultures

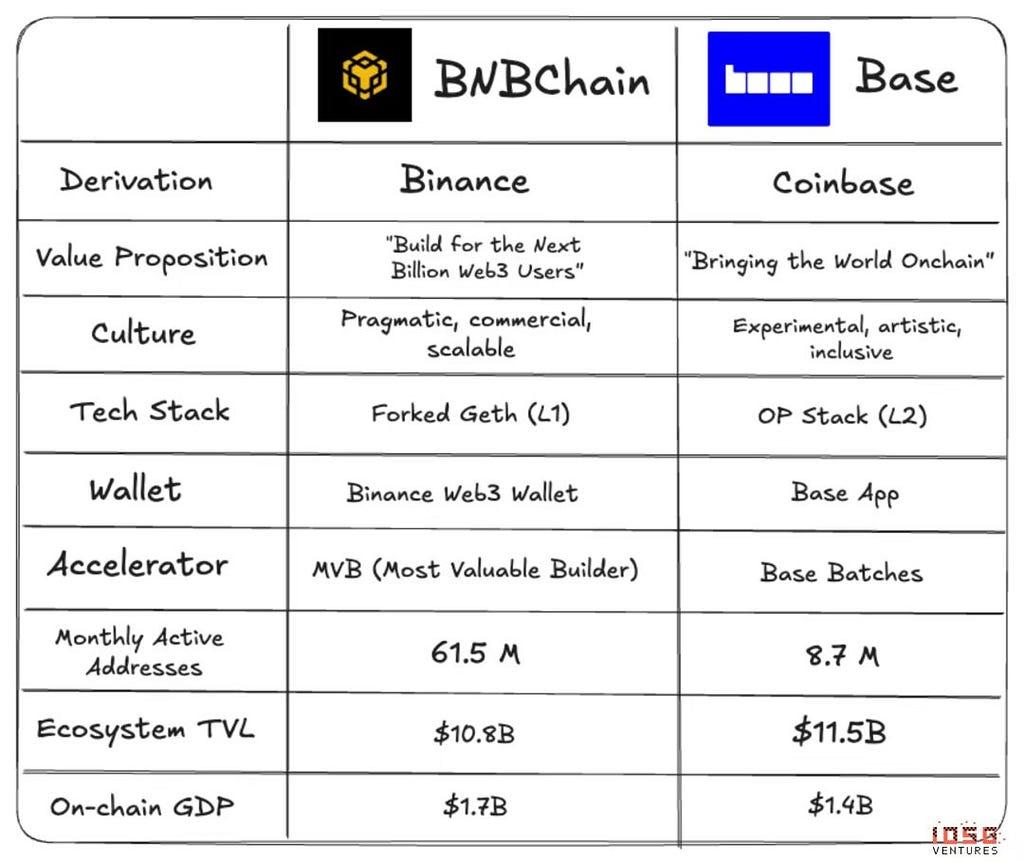

If you put BNB Chain and Base on the same map, they look like rivals. But if you switch the lens to users and culture, the picture changes. This is less about competition, and more about two worldviews growing in parallel.

At their core, BNB Chain and Base represent very different user bases, traffic sources, and growth paths: One is rooted in Asia and emerging markets. The other grows out of Western developer communities. This is the natural outcome of crypto users splitting into different layers.

The BNB Chain user profile is very clear.

A large share comes from Binance’s massive retail base built over many years. For many of them, this is their first real onchain experience. They could be in Southeast Asia, the Middle East, and other emerging markets. Their focus is very practical:

Is gas cheap enough? Is it fast? Can I get into hot projects early?

For these users, a chain is not an ideology. It’s a tool. If it works, costs little, and offers a chance to make money, whether it is centralized is not a big concern. This explains why the BNB Chain ecosystem has always been built around efficiency, scale, and dense application coverage.

Base attracts a different crowd.

Many come from Coinbase or spill over from Ethereum. They tend to understand blockchains more deeply and are more willing to debate fundamentals. They care about how Base relates to Ethereum L1, how decentralized it really is, which L2 path it takes, and whether its culture and narrative feel “legitimate.”

To them, a blockchain is more than a transaction engine. It is a space for self-expression, community building, and creative experiments.

These differences in users shape everything. They give the two chains very different cultural DNA.

BNB Chain chose a path closer to web2 consumer internet. It focuses on ecosystem integration, pulling as many functions, apps, and use cases as possible into one system. For users in emerging markets, this “everything in one place” model lowers learning costs and decision friction. It also makes the onchain experience feel familiar.

Base looks more like an open lab. It leaves room and time for developers and creators. It does not rush to cover every scenario. Instead, it lets the right culture and tools settle first.

Seen this way, BNB Chain and Base are not fighting over the same users. They are growing in the environments they understand best.

They are not opposites.

They are two reasonable answers from the same industry, shaped by very different cultural contexts.

The Magic of Vertical Integration

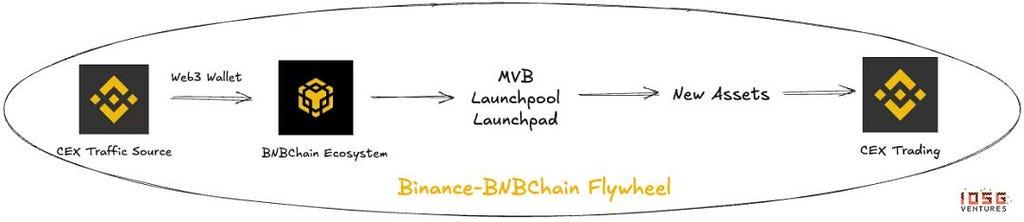

Over the past few years, large CEXs have almost all done the same thing.

They stopped being “just matching engines,” and pushed deeper into the stack — building their own chains and wallets.

The logic is simple:

If a CEX only meets users at the moment of “buy” or “sell,” user value is short and fragmented. But once a CEX controls the chain and the wallet, the user journey gets much longer. It turns into a loop, with many touch points and repeated interactions over time.

Every extra step raises switching costs and deepens user stickiness. This is the real goal of vertical integration: turning one-off trades into long-term relationships.

Even more importantly, this structure directly amplifies liquidity and volume.

New tokens and new projects are constantly born on chain. That is, at its core, a machine for creating new assets. The on-chain “asset pool” can flow straight into trading pairs and perps. Over time, it settles into recurring fee revenue.

Seen this way, both BNB Chain and Base are textbook cases of CEX vertical integration. They just amplify very different strengths.

BNB Chain’s edge comes directly from Binance.

As the largest CEXs in the world, Binance has unmatched user scale and liquidity depth. More importantly, it has the ability to distribute traffic instantly. Projects launching on BNB Chain rarely start from zero. They don’t need long education cycles or slow cold starts. Users move from the CEX to the chain with a few clicks, try new apps or tokens, and flow right back to trade. This near-frictionless loop makes BNB Chain feel like a high-speed highway built for applications.

Behind this is Binance’s strong CEX DNA.

It reacts fast to market trends, understands retail behavior deeply, and knows how to operate traffic at scale.

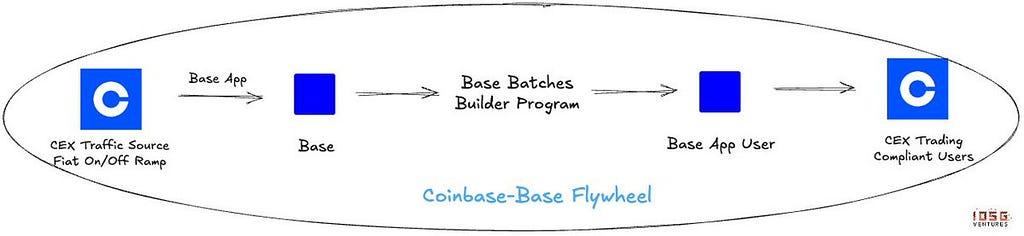

Base takes a very different path.

It doesn’t try to match BNB Chain’s speed. Instead, it builds on Coinbase’s long-earned strengths in the U.S. market: regulatory credibility, fiat onramps, and institutional trust. As the first publicly listed crypto exchange in the U.S., Coinbase’s experience surviving inside a strict regulatory framework is itself a rare asset.

For institutions, enterprise apps, and developers who care deeply about compliance boundaries, Base offers something else: a place where you can experiment safely and build for the long term. Add to that Coinbase’s deep involvement in the Ethereum ecosystem, plus years of investment in developer tools and infrastructure, and Base has developed a clear builder-first culture.

If BNB Chain is a highly efficient commercialization testbed, Base looks more like infrastructure built for the future.

One turns traffic into scale quickly. The other turns trust into an ecosystem over time.

Neither path is right or wrong. Each simply amplifies what it does best.

Wallet is The Endgame?

At launch, from the community perspective, Binance Web3 Wallet is not especially loved. But it is now undeniably the leader in frontline traffic.

For many Binance users, their first time using a web3 wallet comes from a very specific need: joining the IDO, farming an airdrop, or jumping into a hot project that is not yet listed on the exchange.

That’s when the built-in wallet shows up.

No seed phrase. No need to understand account models. You may not even realize you’re using a “separate wallet.”

From funding and swapping, to bridging, approvals, and onchain interactions, everything happens along a smooth, low-friction path.

This reflects what Binance has always been good at: turning complex financial actions into simple user flows.

That’s also why Binance Web3 Wallet fits BNB Chain so well: Trends move fast. Projects are dense. User activity is highly concentrated in short time windows.

In a 2025 onchain snapshot, Binance Wallet’s daily trading volume once reached around $92.6 million, capturing roughly 57.3% of wallet trading volume. That figure was even higher than the combined total of all standalone wallets.

Under the Binance Web3 Wallet system, the apps that break out tend to share the same traits: strong financial focus, short cycles, high-frequency interactions, and the ability to absorb exchange traffic quickly.

Coinbase Wallet (Base App) has a very different vibe.

According to recent data, Base App has reached around 11 million users, placing it among the top self-custody wallets globally.

From day one, it was designed as a product that can exist independently of the exchange.

That choice comes with a higher learning curve.

That mindset fits perfectly with Base’s broader direction. Base is not in a rush to push everyone into the next viral app. What it cares about more is whether users are willing to stay long term — using the same wallet, the same address, and slowly building an onchain identity.

That’s why many deep Base App users are also early users of Base-native apps. They are active in social products, creator tools and more. They care more about experience, community, and long-term narratives.

In the Base App and Base ecosystem, a different type of product grows more easily: retention-driven apps that care about UX, community, and long-term relationships. They don’t rush to monetize, but they are willing to patiently accumulate real users.

End of Story

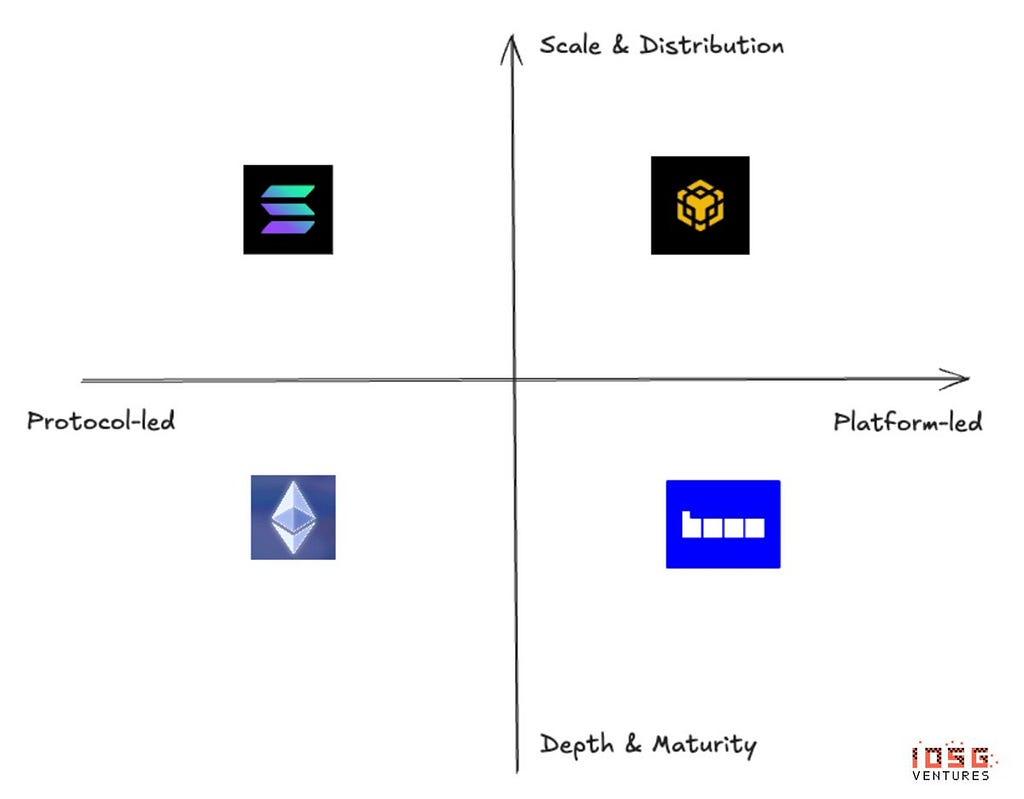

The future of the industry is likely to settle into two broad types of ecosystems:

- Platform-led super ecosystems (Binance, Coinbase)

- Community-led public infrastructure (Ethereum, Solana)

BNB Chain and Base will not replace each other.

Global crypto users are not a single, homogeneous group.

Emerging markets prioritize low barriers, high efficiency, and strong applications. Western markets care more about compliance, developer friendliness, and cultural alignment. These two sets of needs are not going away anytime soon.

A more realistic outcome is this: as wallets, bridges, and account abstraction mature, usage differences will continue to fade. Users will no longer “belong” to just one chain. They will move fluidly across ecosystems.

From this perspective, BNB Chain and Base look less like rivals and more like two cities in the same world. One pushes web3 toward a massive scale. The other pushes it toward a more mature form.

If early L1 competition was about fighting to become the ‘only one’ operating system, today’s competition looks more like different platforms co-building the onchain world.

In the end, the real winners may not be any single chain, but the teams and applications that understand both — and can move freely between them.

BNB Chain and Base: A Tale of Two Cities was originally published in IOSG Ventures on Medium, where people are continuing the conversation by highlighting and responding to this story.