Author: ChandlerZ, Foresight News

Original title: The RMB breaking 7 and the simultaneous occurrence of discounts on stablecoins to the US dollar , what does it really mean?

By the end of 2025, the foreign exchange market is undergoing a quiet but dramatic asset repricing.

In late December, the offshore yuan (CNH) exchange rate against the US dollar broke through the 7.0 mark during trading, reaching a high of 6.99, a new high since the third quarter of 2024. The onshore yuan also reached 7.0133 against the US dollar.

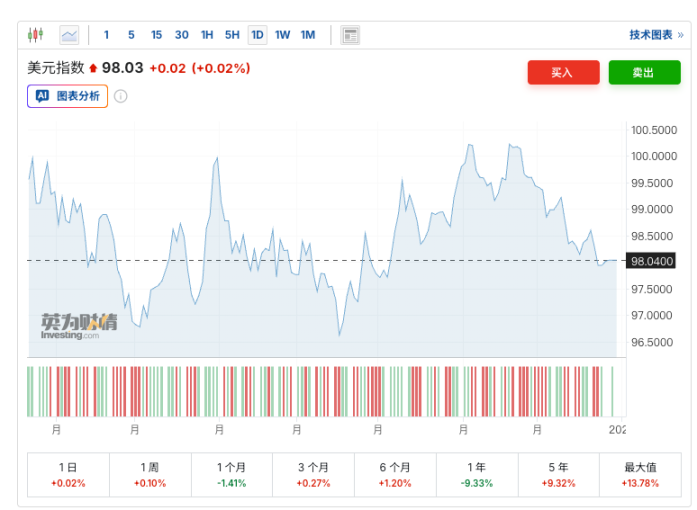

While the official exchange rate is still fluctuating around the 7.0 mark, the USDT OTC price had already fallen below 6.90 much earlier. As of press time, data from multiple exchanges shows that the USDT OTC price (buy 1) is approximately 6.83 yuan, representing a negative premium of 2.48% compared to the current exchange rate of 7.0040.

This inversion was almost unimaginable during the past three years of a strong dollar cycle.

The collapse of the dollar's "high ground"

The depreciation of the US dollar in 2025 is the most important external background for the strengthening of the RMB.

In 2025, the US dollar index plummeted by 9% throughout the year, marking its worst performance in eight years, which, to some extent, reflects a global capital market's re-evaluation of "US exceptionalism."

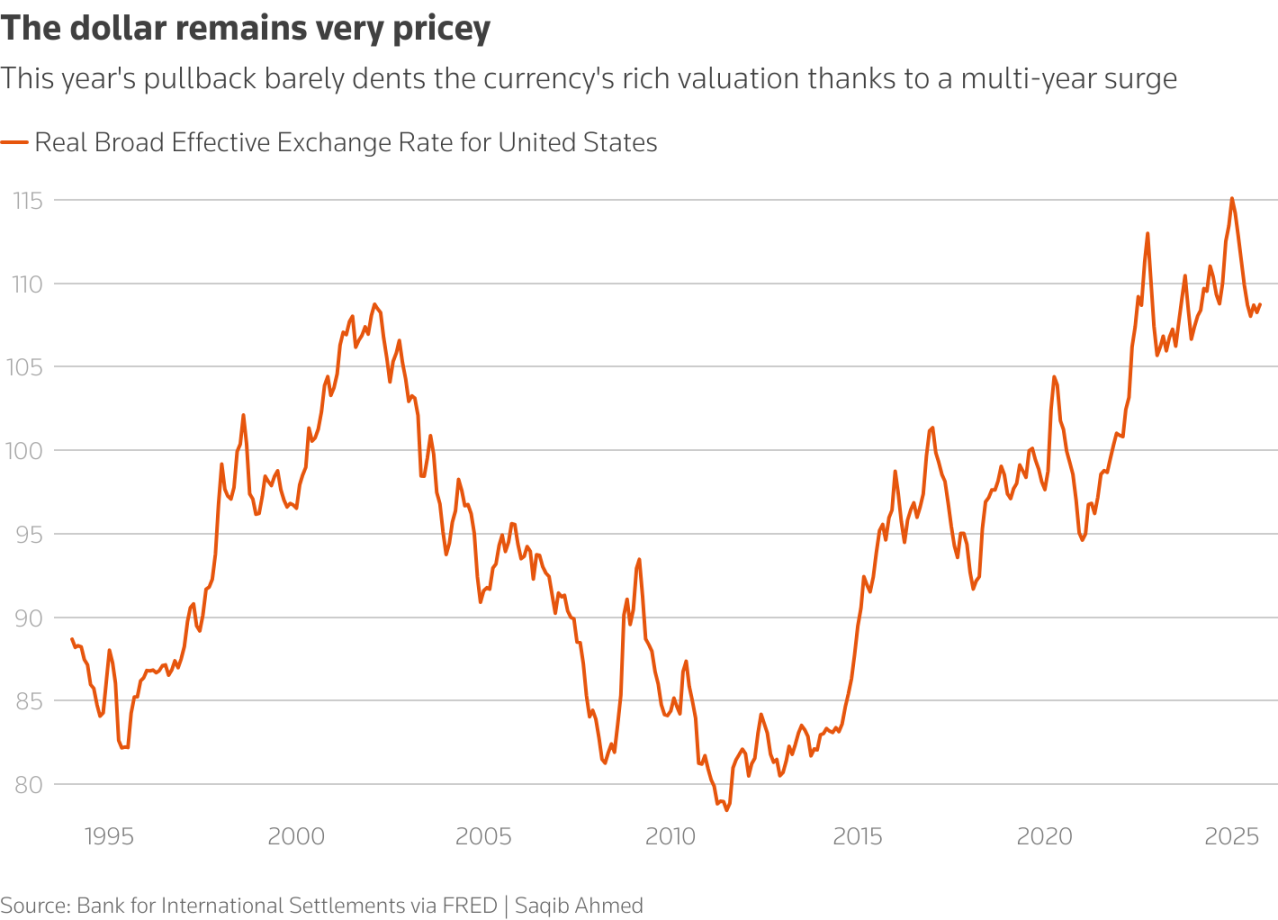

First, there's the pull of valuation regression. Although the dollar index has rebounded nearly 2% from its September lows, fundamentally, the dollar remains ridiculously overvalued. Data from the Bank for International Settlements (BIS) shows that as of October, while the dollar's real broad effective exchange rate (REER) had fallen from its January high of 115.1 to 108.7, it remains at an absolute high. Karl Schamotta, chief market strategist at global corporate payments company Corpay, bluntly stated, "From a fundamental perspective, the dollar is still overvalued."

The line chart shows that, due to years of continuous gains, this year's correction has had little impact on the dollar's high valuation.

Secondly, there are dovish expectations surrounding the new Federal Reserve. The market is pricing in a more accommodative 2025. With Powell's impending departure and the Trump administration's inclination towards low-interest-rate policies, leading candidates for his successor, including White House economic advisor Kevin Hassett and former Federal Reserve Governor Kevin Warsh, have all shown a clear dovish leaning.

In its year-end market report, Reuters pointed out that the decline in the dollar index was driven more by expectations of a Federal Reserve rate cut, a narrowing interest rate differential with other economies, and changes in risk premiums resulting from the US fiscal deficit and political uncertainty.

When the relative returns and safety premium of dollar assets are repriced, non-dollar currencies gain some upward potential.

Institutional consensus: Short-term upward momentum, but long-term competition intensifies.

With the psychological threshold of 7.0 breached, the biggest question in the market is whether this marks the beginning of a new long-term appreciation cycle for the RMB or just a short-term rebound driven by emotional venting.

Standing at the threshold of 2026, the consensus among mainstream institutions is becoming more sober: short-term momentum is upward, but long-term competition is intensifying.

Huachuang Securities believes that the core factor behind domestic supply and demand is foreign exchange settlement. While December's settlement data has not yet been released, logically, RMB appreciation itself influences corporate settlement expectations and behaviors. Coupled with the seasonal characteristic of typically stronger year-end settlements, these two factors may have jointly contributed to the stronger performance of domestic supply and demand factors during the second phase of appreciation. On the one hand, the continued appreciation of the RMB exchange rate will have a certain impact on corporate settlement decisions; on the other hand, year-end net settlements are typically stronger.

However, the macro research team at Guotai Haitong Securities also pointed out that the formation of RMB appreciation expectations is not without obstacles. Measured by gold purchasing power parity, the volatility in domestic capital expectations in 2025 is actually quite high. The trade friction in April once pushed domestic capital depreciation expectations to above 7.5, while the start of the Fed's interest rate cut cycle in September brought domestic capital appreciation expectations to around 7.0. The fundamental reason for this is that, given the lack of significant resilience in the domestic economy, most investors' attitudes towards a trend of appreciation remain somewhat wavering.

What are the reasons for the deep discount of USDT?

Crypto market data analyst @Phyrex_Ni believes there are three main reasons for the deep discount of USDT:

First, from a macroeconomic perspective, the RMB is currently appreciating strongly against the US dollar, and its strength has been sustained since the second half of 2025. Reasons include the continuation of the Federal Reserve's interest rate cut cycle, a weakening US dollar index, and improved Chinese economic data. Holding USDT is equivalent to indirectly holding US dollar assets, which will result in exchange rate losses against the backdrop of RMB appreciation. In other words, the market anticipates continued RMB appreciation, leading to some deviation in exchange rate movements, but this is not the primary reason; it is only a minor, secondary factor.

Second, China's regulatory policies have tightened significantly. In early December 2025, the People's Bank of China and thirteen other departments jointly issued a document to strengthen the crackdown on speculation in virtual currency trading, explicitly including stablecoins (such as USDT) within the regulatory scope, focusing on illegal cross-border fund flows, money laundering, and underground banking activities using USDT. This led many over-the-counter (OTC) merchants and traders to suspend or reduce operations, resulting in a tightening of market liquidity. Some holders, fearing account freezes or regulatory risks, rushed to sell USDT and exchange it for RMB, increasing supply while sharply reducing demand, directly depressing P2P prices. Historically, every regulatory upgrade in China (such as the 2021 ban) has led to a negative OTC premium for USDT; this time the impact is greater, so the deviation in the USDT-RMB exchange rate will be even larger.

Third: The overall volatility in the crypto market, coupled with negative regulatory news, has reduced demand for USDT from both retail and institutional investors. Some investors located in mainland China, seeking to mitigate risk, are hoping to quickly sell their USDT holdings, creating a negative premium cycle, similar to the current situation in China's real estate market.

With the dual pressures of a shift in the macroeconomic cycle and tightening regulatory boundaries, the one-sided hedging logic of holding US dollars and winning without effort over the past three years has completely failed.

For all market participants, the core task now is no longer betting on whether the next level will be 6.8 or 7.0, but rather breaking away from the path dependence on a one-sided appreciation of the US dollar. In the future, with significantly increased volatility, a return to risk neutrality is crucial.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush