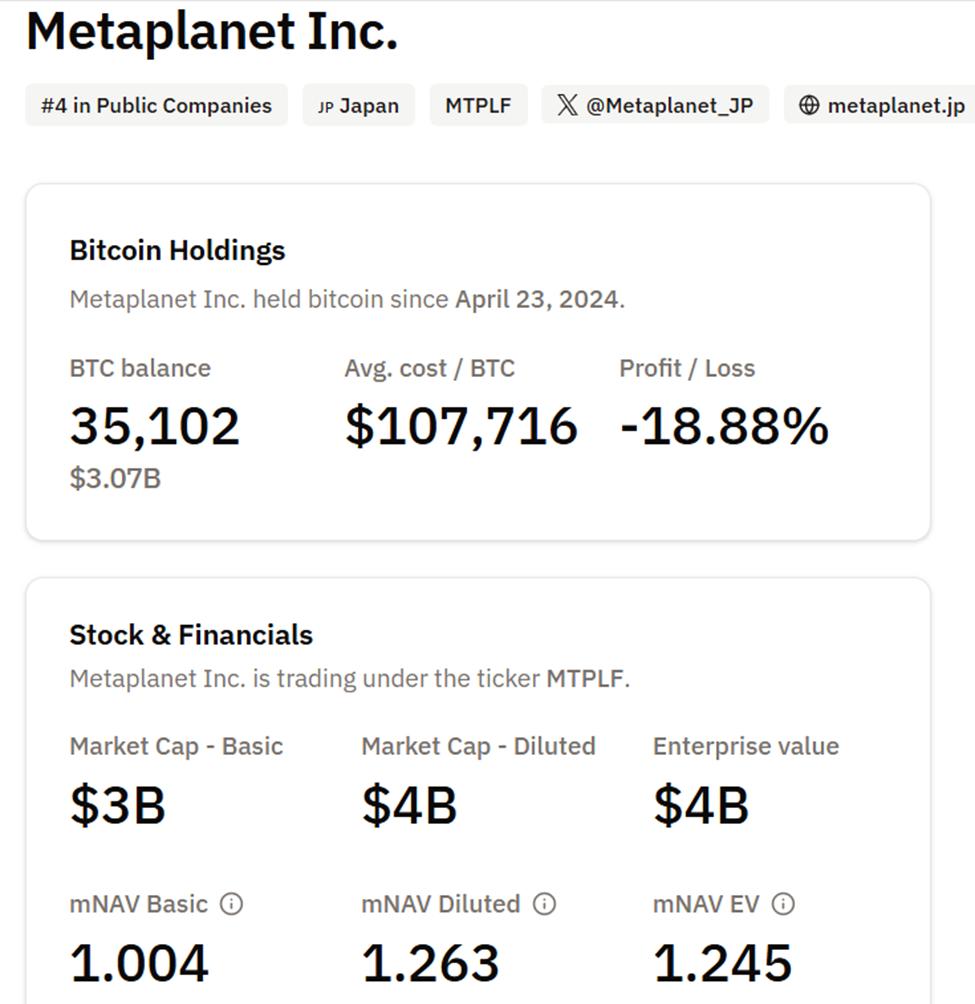

Metaplanet Inc. – a Tokyo-listed company – has just announced an accelerated pace in its Bitcoin holding strategy, reporting a BTC yield of 568.2% from the beginning of 2025 and a total accumulated holding of 35,102 BTC.

This information shows how Metaplanet is actively accumulating more Bitcoin, placing the company among the world's largest publicly traded Bitcoin holders.

Metaplanet buys more Bitcoin.

According to CEO Simon Gerovich, the company purchased an additional 4,279 BTC in Q4 2025, at an Medium price of approximately 16.33 million yen ($104,642) per coin.

Thus, Metaplanet's total investment in Bitcoin this year is approximately 559.7 billion yen, with an Medium price of 15.95 million yen (US$102,207) per BTC.

The accumulation of Bitcoin is part of the Bitcoin Treasury Operations strategy that Metaplanet officially began implementing in December 2024.

These additional BTC purchases were made through a combination of operating revenue, Capital, and the use of unsecured Bitcoin loans . This approach demonstrates a modern asset management strategy, combining market timing, equity management, and corporate financial instruments.

In Q4 alone, BTC yield reached 11.9%, contributing to the stability of the full-year results , following previous quarters of 95.6%, 129.4%, and 33.0% respectively.

Metaplanet's proprietary BTC Yield Index measures the increase in Bitcoin per fully diluted share, reflecting the impact of new share issuances. This helps investors assess the level of shareholder wealth accumulation from Bitcoin acquisitions rather than relying on direct net interest income.

The BTC Gain and BTC ¥ Gain metrics convert holdings into specific figures in BTC and Japanese Yen, illustrating the potential for asset value appreciation solely through the company's Bitcoin accumulation activities.

Metaplanet ranks 4th globally as companies accelerate investment in Bitcoin despite market volatility.

Despite outstanding returns, according to data from Bitcoin Treasuries, Metaplanet's portfolio market value is currently down 18.9%. This reflects Bitcoin's price volatility over the past year.

Amount of Bitcoin Metaplanet currently holds. Source: Bitcoin Treasureries

Amount of Bitcoin Metaplanet currently holds. Source: Bitcoin TreasureriesThe company emphasizes that BTC Yield is a KPI used to evaluate strategic effectiveness, not actual profit or conventional business performance. This indicator reflects the accumulation process, rather than traditional financial data.

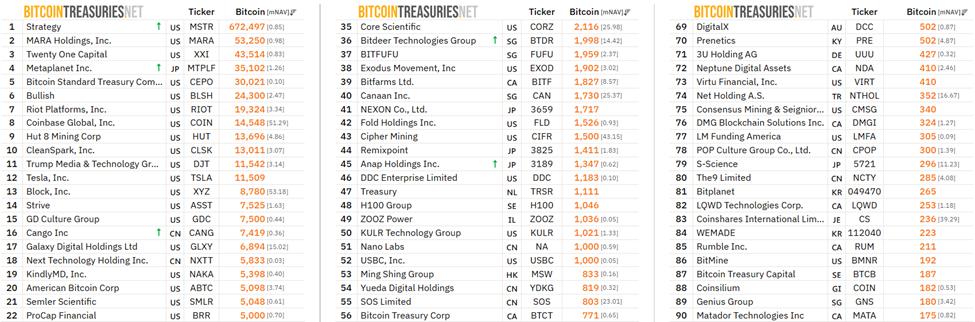

Currently, Metaplanet ranks 4th among companies holding the most Bitcoin in the world, after Strategy (672,497 BTC), MARA (53,250 BTC), and Twenty One Capital (43,514 BTC).

Companies holding the most BTC . Source: Bitcoin Treasureries

Companies holding the most BTC . Source: Bitcoin TreasureriesMetaplanet's combined approach of disciplined accumulation, Capital market operations, and financial leverage reflects the trend of Japanese and international businesses incorporating Bitcoin into their asset management portfolios, diversifying risk and increasing opportunities to benefit from this emerging trend.

This announcement further highlights the growing Vai of corporate funds in the Bitcoin market , where names like Metaplanet are quietly accumulating significant positions, while using indicators like BTC Yield to explain their strategy and performance to shareholders.

However, despite the impressive yield, investors need to clearly distinguish between the company's internal metrics and actual financial returns. This distinction is becoming increasingly important as large institutions participate in Bitcoin globally.

With 35,102 BTC under management and a record-high BTC yield, Metaplanet's quiet accumulation strategy in 2025 is transforming the company into a new force in the trend of corporate Bitcoin holdings. This shows that listed companies are increasingly XEM crypto as a strategic financial management tool rather than a purely speculative asset.