Source: Bankless

Author: David Christopher

Compiled and edited by: BitpushNews

The debate between Coinbase and Robinhood has been discussed many times by observers—including us.

But a system update released by Coinbase on December 17th gave us reason to revisit this topic. The company announced 24/7 commission-free stock and ETF trading, native prediction market integration via Kalshi, and a decentralized exchange (DEX) aggregator with instant access to millions of tokens—clearly a step towards becoming an "everything app" that rivals Robinhood in breadth.

These announcements clarify the future Coinbase is building and allow for a more comprehensive comparison with Robinhood. Their competitive goal is now clear: to become the single platform for users to manage their entire financial lives. By controlling users' balances, they can control their behavior. But the ways they've built this "super app" theory reveal two very different philosophies – and 2026 will test which foundation is stronger.

HOOD (Robinhood)

Robinhood is building a financial super app in the old-school way—by constantly adding products until users can manage their entire financial life on one platform.

In addition to stock, options, and cryptocurrency trading, Robinhood offers its 3.9 million Robinhood Gold subscribers a suite of products that makes it comparable to a digital bank (neobank). This subscription service has seen 77% year-over-year growth and is bundled with a 3% cashback credit card, 3.25% cash interest, and 3% IRA (Individual Retirement Account) matching. Users' salaries, savings, investments, and daily spending are all centralized in a single interface—a data advantage that traditional brokerages cannot match.

This positioning becomes especially relevant when considering demographics—75% of Robinhood's 26.9 million depositors are under 44, a highly mobile-first and "financially conscious" user base. As Omar Kanji of Dragonfly and others have argued, this foundation helps the company become a major beneficiary of the projected transfer of over $10 trillion in wealth over the next decade, as older generations pass on their assets to younger generations. These inheritors are likely to integrate their assets into platforms they use daily—and Robinhood is making itself perfectly suited for everyday use.

Beyond its digital banking capabilities, Robinhood's revenue streams have become quite diversified. Options trading remains its cash cow. Cryptocurrency contributes 21% of total revenue. Net interest income accounts for 35% of revenue. And its prediction market business, conducted through Kalshi, generates $100 million in annualized revenue.

The data also supports this:

Transaction-based revenue grew by 129% year-over-year, primarily driven by cryptocurrencies.

Net income for the third quarter reached a record $556 million – a 271% year-over-year increase.

Operating expenses have remained flat since September 2022.

COIN (Coinbase)

Coinbase is also building a super app—but it has a distinct “crypto-native” flavor and harbors a second layer of ambition at its core.

On the front end, Coinbase aspires to be a single venue for users to manage their on-chain and off-chain financial lives, though currently it primarily focuses on the former. The December system update clarified this: 24/7 commission-free stock and ETF trading, prediction markets via Kalshi, and ongoing on-chain integrations for instant access to millions of tokens. Add to that direct deposits, high-yield savings through USDC lending rates, up to $5 million in lending for BTC (up to $1 million for ETH), and earning cryptocurrency rewards through debit card spending—the pieces of the super app are coming together.

Despite the drop in cryptocurrency prices, builders and deliverers are still in action.

However, Coinbase is not just building products for its own users. Its grander vision seems to be transforming every product it offers into plug-and-play infrastructure, powering all other institutions that come onto the chain.

The theory here is that traditional financial (TradFi) giants like JPMorgan Chase, Fidelity, and Morgan Stanley won't build their own crypto infrastructure. They'll outsource their operations to Coinbase because it's cheaper, they lack the technical expertise, and Coinbase boasts 13 years of proven security. Over 200 institutions are already using Coinbase's "Crypto as a Service" platform—meaning users might be trading cryptocurrencies at the front end of a traditional bank, but Coinbase handles everything behind the scenes.

This focus on infrastructure extends across the entire business. Coinbase holds Bitcoin and Ethereum for most major spot ETFs—a near-monopoly in the cryptocurrency custody space. They are allowing institutions to issue their own stablecoins using Coinbase's infrastructure. The acquisition of Echo brought fundraising and token issuance in-house. And the acquisition of Deribit captured approximately 90% of Bitcoin options open interest.

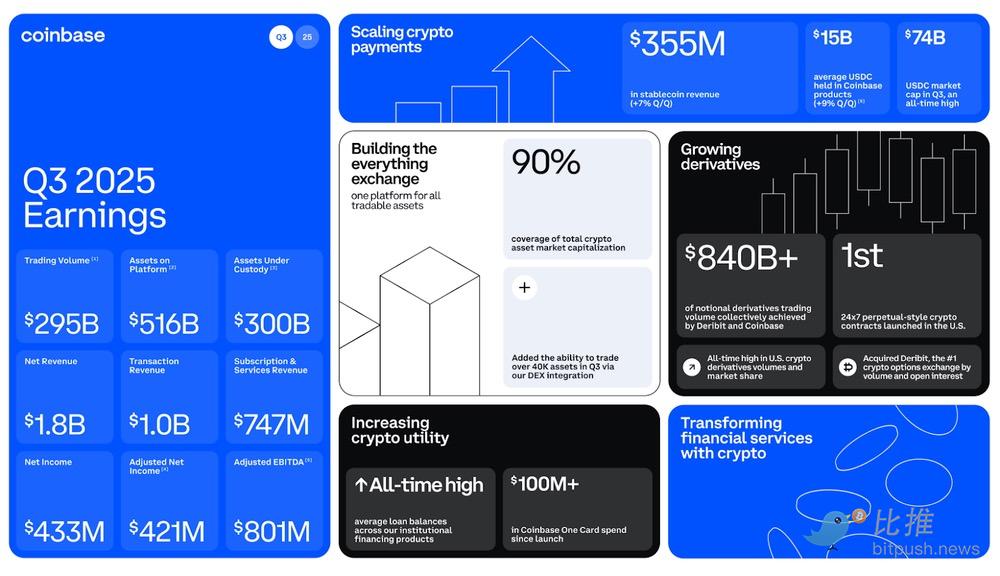

The revenue structure reflects this dual focus. Revenue for the third quarter of 2025 was $1.8 billion, with subscription and service revenue setting a quarterly record of $747 million (41% of total revenue). Stablecoin revenue from the USDC partnership contributed $354.7 million, a 44% year-over-year increase. Staking business brought in $185 million. Driven by ETF inflows, assets under custody exceeded $300 billion, with custody fees reaching approximately $143 million.

Robinhood's grand vision is to be the go-to place for all aspects of personal financial life, while Coinbase is playing two games at once: building the best crypto super app for its own users, while also becoming the backend that powers crypto products for everyone else.

Divergence in crypto strategies

Both companies see cryptocurrency at the heart of their super-application ambitions, but their approaches reflect their respective origins.

Robinhood views cryptocurrency as an alternative asset class alongside stocks and options. It's a revenue driver that fits perfectly into its existing product suite. The acquisition of Bitstamp ($200 million) provided it with global licenses and institutional infrastructure. Tokenized equities—currently around 800 listed in the EU, including private companies like OpenAI and SpaceX—expand its product offerings. The real test will be the success of the Robinhood Chain, which should make many of these tokenized equities more versatile (e.g., for lending), although we currently have very little detail about the extent of “DeFi” or other on-chain activity the chain will support.

In addition, Robinhood faces more direct limitations, such as token selection. In the United States, fewer than 50 tokens are available for users on the platform, while Coinbase indirectly (through Jupiter and Base) offers an almost unlimited number of tokens and directly supports more than 200 tokens.

Coinbase's approach to cryptocurrency is clearly different, offering everything from its own Layer 2 network to the various products mentioned in the previous section. It has set the standard for "crypto-specific" products to the point that it now appears to be shifting its focus to building a track that others can use. We've seen x402 aiming to become the industry standard for agent-to-agent (A2A) payments, and Coinbase announcing it will offer a "Stablecoin-as-a-Service" platform for companies to create whitelisted stablecoins, with Coinbase managing all the technical complexities. From issuance to trading to custody, Coinbase controls every stage of the asset lifecycle.

2026 Outlook

Both companies have very aggressive roadmaps—and there is increasing overlap between them.

Coinbase's December 2025 system update is a strong intrusion into Robinhood's territory with its stock and ETF trading beyond traditional market hours (thanks to tokenization) and the announcement of perpetual stock contracts launching next year. Native Kalshi integration brings prediction markets. In addition, there's Coinbase Business, a cryptocurrency-powered all-in-one business operations platform, and Coinbase Tokenize, an end-to-end platform for institutional tokenization.

Robinhood's 2026 plans delve deeper into crypto infrastructure. Tokenized shares will be traded 24/7 via Bitstamp in early 2026 and will become withdrawable and composable in DeFi by the end of 2026. In prediction markets, Robinhood is transitioning from a distribution partner to launching its own marketplace. The platform hopes to offer cryptocurrency staking services, but this is pending regulatory approval. It also has ambitions to "socialize" trading through Robinhood Social, an upcoming news feed where traders can post content and showcase their actual trades and profits/losses. And of course, there's Robinhood Chain.

The challenge facing Robinhood Chain will be building a developer ecosystem—an area where Base has already established momentum. A crypto-native culture is difficult to artificially create.

Summarize

Perhaps a better framework here is "COIN and HOOD" rather than "COIN vs. HOOD". These two companies occupy different tracks, and although they have contact, their operations do not completely overlap.

Robinhood is both a "super app" bet and a bet on the transfer of demographic wealth. With 75% of its users under the age of 44 and a full-stack digital bank keeping assets on the platform, the company promises to become a new hub for deposits, spending, investing, and speculating.

Coinbase, on the other hand, is betting on technological transformation. It's betting on the global economy migrating to on-chain, with Coinbase becoming the infrastructure layer that powers everyone else—from ETF custody and stablecoin backends to crypto-as-a-service for traditional banks.

Both face risks. Robinhood's generous Gold incentives (3% matching, 3% cashback, 3.25% cash interest) are costly and have shown vulnerability to rate cuts—which were recently 4-5% and are directly pegged to the Federal Reserve's rates. Tokenization adoption is a matter of issuer decision, beyond Robinhood's control. For Coinbase, user growth remains a significant risk, with its monthly active users stagnating since 2021.

Moreover, both companies' stock prices are likely already high. These two stocks have been major market winners over the past few years—as of this writing, Coinbase (COIN) is up approximately seven times from its 2022 lows, and Robinhood (HOOD) is up a staggering 15 times. Despite recent pullbacks from their all-time highs, their valuations remain high after such astonishing gains. This is something investors should seriously consider.

Ultimately, while both companies are building financial super apps—and in the process constantly encroaching on each other's territory—their visions actually serve different goals.

Robinhood is committed to building a one-stop financial platform—allowing users to manage all their financial needs, including bank deposits and withdrawals, daily spending, transactions, and investments, all from the same place without leaving the platform.

Coinbase focuses on building the infrastructure that enables everyone to get on-chain – it has indeed created a crypto super app for its own users, but more importantly, it is becoming the backend track that financial institutions, fintech companies and even traditional banks rely on when entering the crypto space.

One aims to be your financial home, the other aims to be the underlying conduit for everyone's financial home. Both have the potential to succeed.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush