Zcash (ZEC) is one of the few Token that has shown a stable upward trend this year. Over the past 24 hours, the price of Zcash has been sideways, but it is still up nearly 30% over the past seven days, extending its three-month gain to almost 570%. Currently, the price of Zcash is facing resistance at the ascending channel, a level that has prevented any breakout attempts since the beginning of December 2023.

If there's another surge, the situation could be different. The current price structure is quite positive, but there's still a necessary confirmation factor before Zcash can get closer to the long-awaited $1,000 target.

Zcash tests ascending channel — but needs further confirmation.

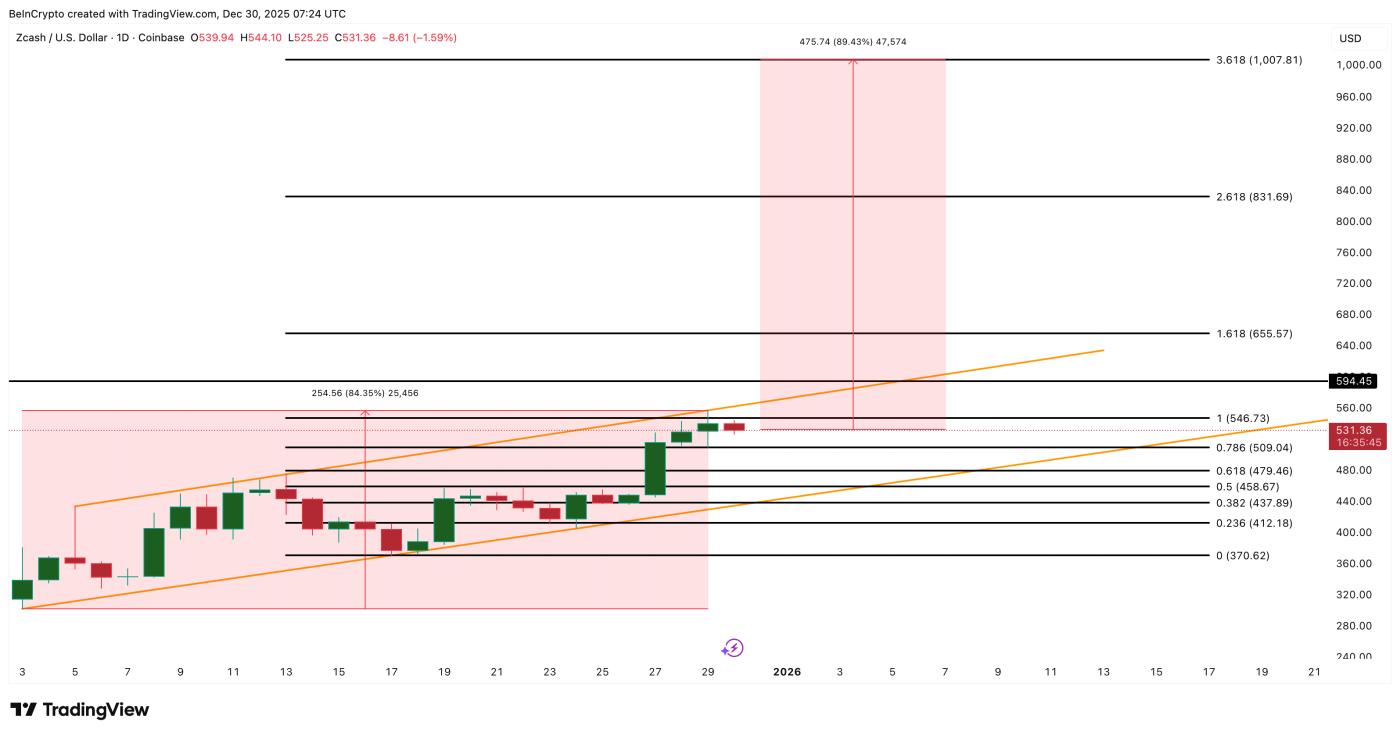

Zcash is currently trading near the upper boundary of the ascending price channel, which has led the uptrend since the beginning of December 2023. The price reacts each time it touches this channel, but to advance further, buyers need to push the closing price above the upper trendline on the daily chart.

The most significant shortcoming at the moment is the lack of confirmation regarding the flow of money into the market.

The Chaikin Money Flow (CMF) indicator, which measures buying power based on price and volume, showed a slight downward trend from December 27th to December 31st, 2023, despite rising prices. This is a mild bearish divergence signal, indicating a slowdown in Capital inflows despite rising prices, dampening growth confidence.

Zcash model: TradingView

Zcash model: TradingViewWant to Also Read insights on Token like this? Sign up for editor Harsh Notariya's daily Crypto newsletter here .

The CMF, still above the zero line, needs to break above its own trendline and create a higher high above 0.13 to confirm the strength of the money flow. If this happens, the price of Zcash could continue to rise. The return of large investors could be the catalyst for this breakout. However, the next indicator suggests that large money flows are showing signs of returning to the market.

Whales accumulate, smart investors increase their holdings.

Trading data on the spot market is beginning to show the first signs of support.

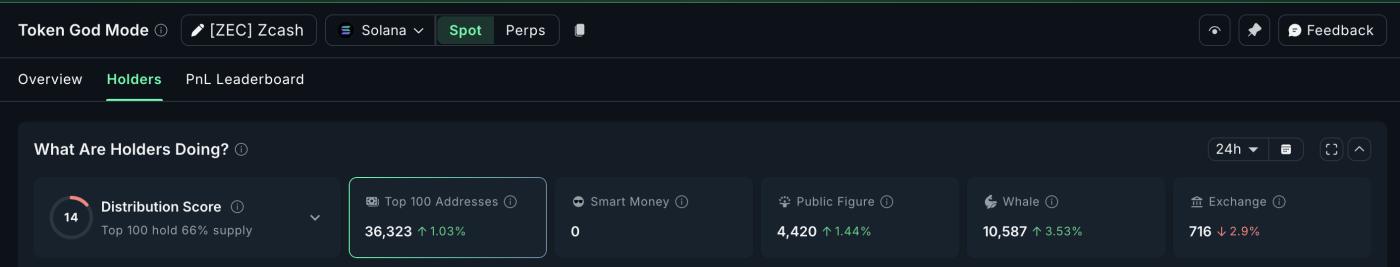

On the Solana chain , Zcash whales increased their holdings by 3.53% in just 24 hours, bringing the total to 10,587 ZEC, or approximately 361 ZEC, worth nearly $191,000 at current market prices.

Large investors (top 100 wallets) also bought an additional 1%, raising their total holdings to 36,323 ZEC. The additional purchases amounted to approximately 360 ZEC, worth around $190,000. While the whales haven't bought aggressively yet, they have returned to the market. This indicates that the accumulation process is restarting.

Sharks begin accumulating: Nansen

Sharks begin accumulating: NansenThe ZEC balances on exchanges also reflect this. The supply of ZEC on exchanges decreased slightly over the past 24 hours, signaling continued accumulation by individuals and institutions, and decreasing liquidation on the selling side. Despite the small fluctuations, the direction remains crucial at this point.

The Derivative market also echoed this trend. Smart trading positions (accounts not held by retail investors) increased their net buying by 22.48%. Large institutional investors remained in a selling position, but the volume of buy contracts increased faster than sell (up 745%), which is quite rare when the market is so close to resistance levels, unless they are expecting a breakout.

Long positions increased sharply: Nansen

Long positions increased sharply: NansenThis is important because large investors (sharks) are often the driving force behind strong CMF price increases. If large capital inflows continue, the CMF trendline could be broken, confirming a breakout signal for Zcash from its current price channel.

Is the Zcash price target of $1,000 still achievable?

ZEC is currently trading below the first trigger threshold at $546. If the price closes above this threshold, the path to $594 will be wide open. This is where the real "battle" for Zcash price begins.

If the price surpasses $594 along with confirmation from the CMF, the price pattern from the ascending channel, targeting an 84% increase, will push Zcash closer to $831 or higher. This is the stepping stone. After that, the trend could continue to the $1,007 region according to the Fibonacci extension, representing an 89% increase from the current price.

Zcash price analysis: TradingView

Zcash price analysis: TradingViewThe price levels at which Zcash fails to hold the $509 mark are also crucial. If Zcash fails to hold the $509 level, the upward momentum will weaken. A loss below $479 would signal a neutral trend. A drop below $437 would completely break the price channel, rendering the upward plan ineffective.

As long as ZEC remains above $479, the price channel remains valid. If it breaks above $594 and receives support from the CMF, a breakout signal will be confirmed.