Welcome to the Morning Crypto News Roundup in the US – your source for the most important crypto market news of the day.

Brew a cup of coffee, relax, and think beyond the daily price fluctuations of Bitcoin. Perhaps the story isn't about when to buy or sell, but rather about how the company's structure helps accumulate value gradually over time. This is the argument Jeff Walton, Chief Investment Officer at Strive, makes regarding MicroStrategy (MSTR) – a stock that appears to follow Bitcoin's price but is actually a machine that gradually increases the amount of Bitcoin per share year after year.

Crypto news today: Strive's chief investment officer, Jeff Walton, Chia why buying MSTR at 2.5 times mNAV still outperforms buying spot Bitcoin.

Jeff Walton, Chief Risk Officer at Strive and founder and CEO of subsidiary True North, argues that most investors fundamentally misunderstand MicroStrategy (MSTR).

Looking back on his 2021 purchase, Walton asserted that the stock should not be considered a Derivative investment in Bitcoin. He argued that investors should view MSTR as a machine designed to increase the amount of Bitcoin per share over the long term.

Walton Chia that he started buying MSTR in June 2021 at approximately 2.5 times mNAV, when the stock had already fallen by 50% from its previous value.

"I didn't expect the stock to drop another 80% from where I bought it," he wrote , as MSTR has fallen nearly 90% since its February 2021 peak.

At the end of 2022, the company was trading at nearly 1.3 times its mNAV, holding 129,999 Bitcoin while its debt at times even exceeded its assets. Despite the "heavy losses on paper," Walton insisted that MSTR's fundamental calculations had never been broken.

"The company holds hard assets, the debt terms aren't overly stringent, and structurally, what's coming for crypto is positive," he said, citing examples of halving cycles, ETFs, elections, and changing interest rates.

By mid-2023, Walton said he had gone "all in," believing that Capital structure was what mattered, not just price volatility.

According to Walton, that belief is what helped long-term investors survive the worst price correction in crypto stock history.

How have time and structure changed MicroStrategy's risk problem?

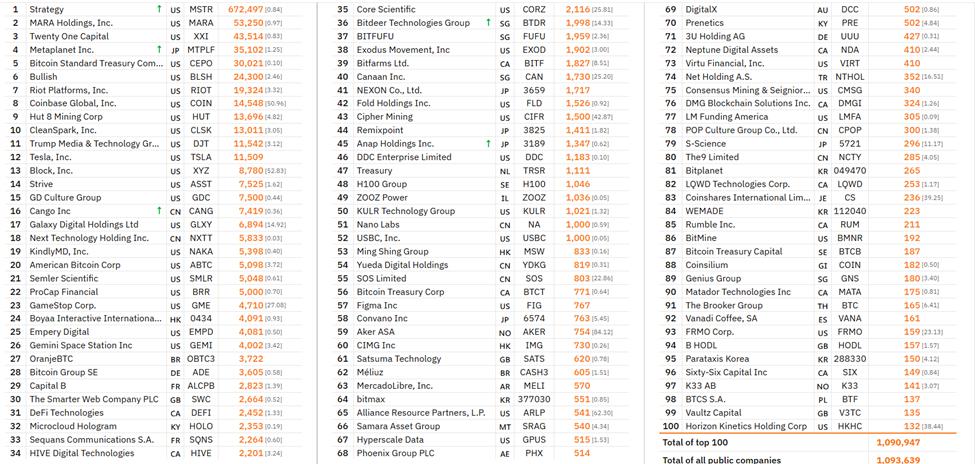

And by the end of 2025, Walton stated that MicroStrategy would own 672,497 Bitcoin . Notably, this is more than 12 times the amount held by the second-largest publicly traded company in Bitcoin.

Top 100 listed companies with the largest BTC reserves. Source: Bitcoin Treasures

Top 100 listed companies with the largest BTC reserves. Source: Bitcoin TreasuresMore importantly, he said, the level of risk of the stocks he initially bought has changed dramatically.

“The value of 1x NAV per share is now 160% higher than when I bought the stock at 2.5 times mNAV back in June 2021,” Walton Chia , adding that the current Dip NAV is now higher than his initial Capital .

According to him, activities in the Capital market have gradually helped reduce the risks of common stocks, while significantly increasing exposure to Bitcoin per share.

From this, Walton believes that the shares he bought in 2021 could structurally outperform Bitcoin, even if the company doesn't buy any more BTC .

“Every share I bought in 2021 now has significantly more exposure to Bitcoin than when I initially bought them,” he said, emphasizing that much of this increase comes from dilution, the issuance of preferred stock, and long-term debt – not just the simple increase in Token price.

This perspective has received support from experts, who argue that investors are essentially buying an entire system, not just leveraging the price of Bitcoin.

“Bitcoin is an asset to hold. MicroStrategy is a dedicated operating system for accumulating Bitcoin based on momentum from the mass market,” one analyst commented .

From Walton's perspective, price volatility even becomes a factor for growth – acting as "fuel" to increase the amount of Bitcoin per share, rather than increasing the risk of the investment.

But is this a structural advantage or simply a cyclical trade?

Matt Cole, CEO of Strive, shares Walton's view, recently Chia that MSTR has outperformed both Bitcoin and gold over the past five years. According to Cole, this remains true even when Bitcoin is at $75,000 or 1x mNAV.

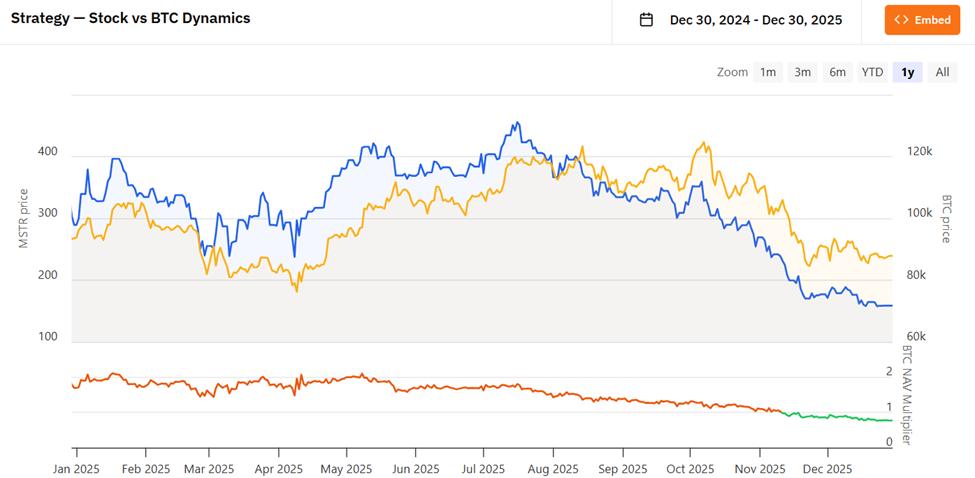

However, not everyone believes that structural advantage will last. Some counterarguments suggest that while MSTR has clearly outperformed Bitcoin over the five years leading up to mid-2025, it has declined more sharply during the correction in the latter half of the year. Furthermore, MSTR has been trading around or below 1x mNAV in recent weeks.

From another perspective, Barchart points out that MicroStrategy is the worst-performing Nasdaq-100 stock in 2025, down approximately 65% from its peak amid a prolonged crypto winter.

Critics like Peter Schiff have refuted the entire strategy , arguing that Strategy's Medium Bitcoin purchase price yields only a rather modest annual return.

Other opinions warn that if the mNAV condition remains below 1x, Strategy may have to sell Bitcoin, a scenario that CEO Phong Le himself has acknowledged as mathematically plausible, although the management emphasizes that this possibility is very low.

Nevertheless, there are signs that large institutions remain interested in this market. Some industry insiders say that major US banks are considering partnering with Strategy, while Michael Saylor argues that bank involvement, not price, will be the big story for Bitcoin in 2026.

Will MSTR's structure help the company weather market cycles? Walton argues that timing and the allocation of Capital are the deciding factors, not "timing."

Chart of the day

Strategy (MSTR) stock performance against BTC YTD. Source: Bitcoin Treasureries

Strategy (MSTR) stock performance against BTC YTD. Source: Bitcoin TreasureriesByte-Sized Alpha

Here are some of the most prominent crypto news stories in the US today:

- Metaplanet reports a BTC investment return of 568.2% for 2025 when the number of Bitcoin held reaches 35,102 .

- Grayscale lists six promising privacy coins , including Zcash and several others.

- Why is XRP still at risk of a 41% drop despite active buying by many retail investors?

- Gold prices recorded their sharpest decline in over two months: Is the "metals season" over?

- The CEO of Bitwise believes Bitcoin could be the solution to Iran's deepening currency crisis.

- Michaël van de Poppe explains why most altcoins are unlikely to survive until 2026 .

- Lighter launched the LIT Token , with 25% of the supply distributed through an Airdrop.

Overview of the crypto stock market before the market opens.

| Company | Closing price on December 29th | Situation before the opening session |

| Strategy (MSTR) | 155.39 USD | 155.99 USD (+0.39%) |

| Coinbase (COIN) | 233.77 USD | 234.39 USD (+0.27%) |

| Galaxy Digital Holdings (GLXY) | 23.16 USD | 23.47 USD (+1.345) |

| MARA Holdings (MARA) | 9.49 USD | 9.50 USD (+0.12%) |

| Riot Platforms (RIOT) | 13.21 USD | 13.30 USD (+0.76%) |

| Core Scientific (CORZ) | 15.08 USD | 15.09 USD (+0.066%) |