Pi Coin is struggling to attract attention, indicating weak confidence among retail investors. This altcoin experienced a turbulent 2025, constantly facing selling pressure and showing few significant signs of recovery.

Despite occasional brief recoveries, market sentiment remains fragile. As we head into 2026, expectations for a sustained rebound for Pi Coin remain dim due to unstable demand signals.

Pi coin has not yet shown outstanding performance.

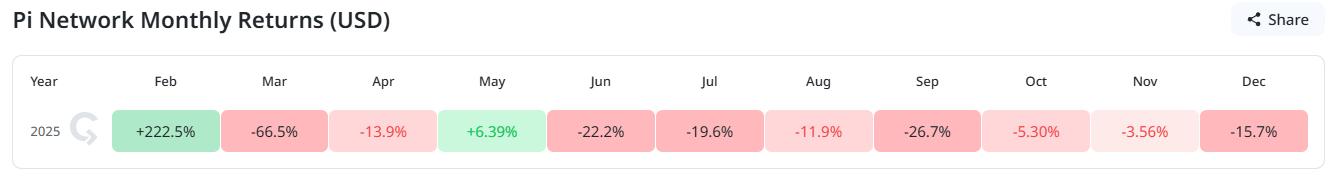

Monthly earnings data paints a bleak picture for Pi Coin's first year . Since its launch in February, the Token has been losing money for the majority of months. Only two months have been profitable, reflecting the coin's continuous loss of upward momentum.

The sharpest price drop occurred shortly after launch. In March, Pi Coin plummeted 66.5%, blowing away initial hopes for a mobile mining network. This sharp correction created a negative situation that has persisted to this day. Consistently weak monthly performance suggests that downside risk remains greater than upside expectations.

Want more Token analysis like this? Sign up for editor Harsh Notariya's daily Crypto newsletter here .

Pi Coin price performance. Source: Cryptorank

Pi Coin price performance. Source: CryptorankHowever, February 2026 could provide short-term momentum for Pi Coin as it celebrates its first anniversary – a milestone that often garners renewed attention from retail investors. Many new Token have experienced slight price surges thanks to this anniversary effect.

Investors lost confidence early on.

Capital flow indicators also explain why Pi Coin has been continuously weakening . Over the past year, the flow of money has been erratic between buying and selling without creating a clear trend, limiting any recovery efforts.

The Chaikin Money Flow indicator shows that selling pressure remains dominant. Since its launch, the CMF has touched the oversold level of -0.15 five times; while only reaching the overbought level of 0.20 three times – a sign that the sellers are still stronger.

Pi Coin's CMF indicator. Source: TradingView

Pi Coin's CMF indicator. Source: TradingViewEven if the CMF rises above 0, the recovery remains uncertain. Observations show that clear reversals in Pi Coin typically require the CMF to break above 0.20. Without this confirmation, price rallies can quickly lose momentum due to increased selling pressure.

What does Pi Coin need to recover?

Overall, Pi Coin still faces many challenges in regaining market confidence. The price needs to increase by approximately 1,376% to reach its historical peak of $2,994 set in early March. To achieve this, demand needs to change dramatically.

A potential recovery signal could emerge if Pi Coin breaks through and holds above the 23.6% Fibonacci Retracement level at $0.273, which Vai as support. This is the first technical zone separating the accumulation phase from the initial recovery.

Pi Coin price analysis. Source: TradingView

Pi Coin price analysis. Source: TradingViewStronger confirmation is still a long way off. To form a solid uptrend, Pi Coin needs to reclaim the support zone of $0.662. Before that, this altcoin remains in a prolonged accumulation phase, and confidence in its potential for a breakout is still low.

The PI price is unlikely to increase significantly.

In the short term, Pi Coin is maintaining some strength. The Token is still holding above the key support level of $0.199. This price level has been tested three times without any daily candle closing below it. This suggests there is buying pressure defending this area.

Maintaining this support helps Pi Coin sustain a positive trend in the short term. As long as it remains above $0.199, the downside risk will not be too high. Therefore, the cautiously positive outlook for the next few weeks remains unchanged.

To recoup its December losses, Pi Coin needs a 34% surge. If achieved, the price could reach the $0.272 region. In the short term, the immediate target is to reclaim support levels at $0.224 and $0.246.

Pi Coin price analysis. Source: TradingView

Pi Coin price analysis. Source: TradingViewReaching these milestones would indicate improving market sentiment. If prices create progressively higher Dip , this could attract speculative interest, especially if overall market conditions stabilize again. However, for this trend to be sustainable, confirmation from volume is necessary.

The risk of a price drop remains if investor confidence declines. If the price falls below $0.199, the positive outlook will no longer be relevant. In that case, Pi Coin could fall further to $0.188 or even lower, triggering a widespread sell-off and increasing losses.