OKX Wallet released its 2025 Annual Report today (31st), revealing users' true investment preferences and fund flows based on on-chain data analysis. The report points out that on-chain user behavior has become more rational and pragmatic—small funds tend to chase short-term hot spots and new projects, while large funds prefer to make stable allocations in mature protocols.

Solana dominates DEX trading, with MEME coin being a major driving force.

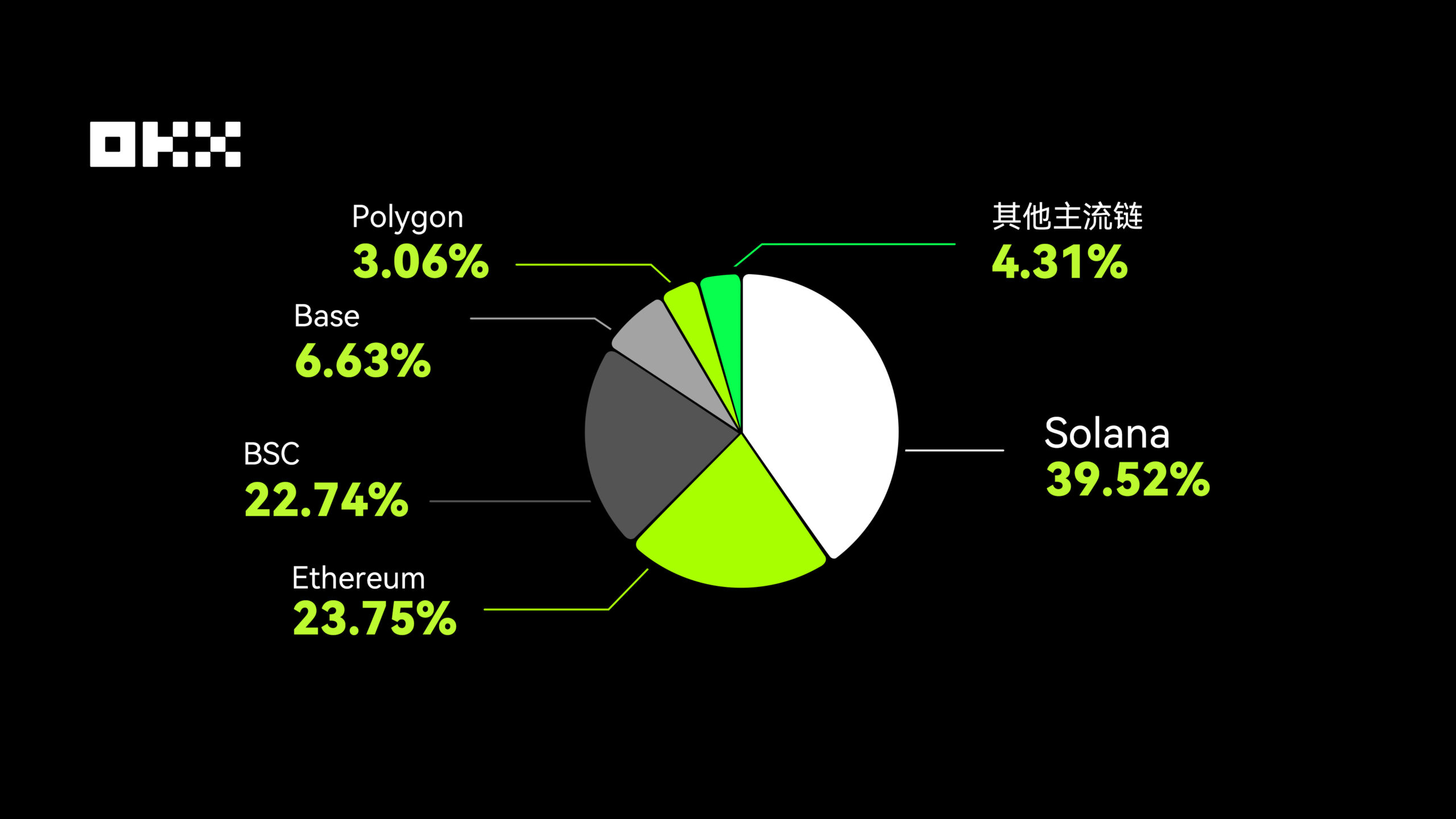

The report shows that decentralized exchange (DEX) trading volume is mainly concentrated on five public chains: Solana, Ethereum, BSC, Base, and Polygon . Among them, Solana's annual DEX trading volume is approximately 1.6 times that of Ethereum. With its advantages of low fees and high speed, it has become the main network for MEME coin trading, with a peak daily trading volume of nearly $2 billion in February.

OKX DEX Trading Volume Public Chain Distribution Structure | Image Source: OKX

Ethereum maintained its position as a diversified asset trading platform; BSC continued to attract new users through low barriers to entry, low costs, and strong traffic mobilization capabilities. OKX Wallet saw a 2.6-fold year-on-year increase in active DEX user addresses, primarily driven by the MEME coin trading boom, with user demand focused on "speed, flexibility, and on-chain information insights."

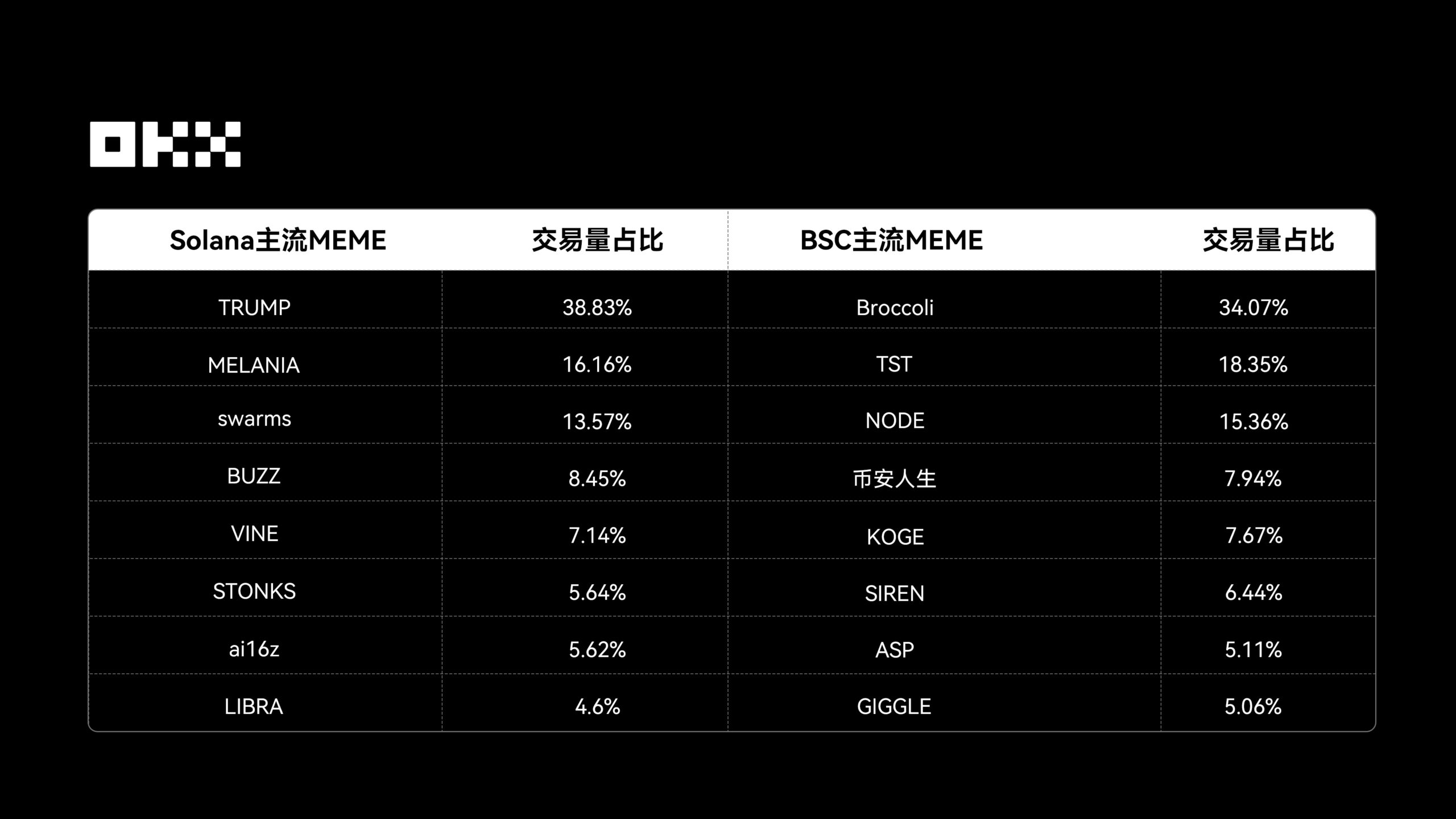

Regarding mainstream MEME projects, those on the Solana chain include Trump, MELANIA, and ai16z; while those on the BSC chain include Broccoli, TST, and NODE. The transaction volume of mainstream Solana MEMEs is approximately 3.6 times that of BSC .

Solana and BSC mainstream MEME trading data | Image source: OKX

Cross-chain liquidity and the DeFi investment landscape

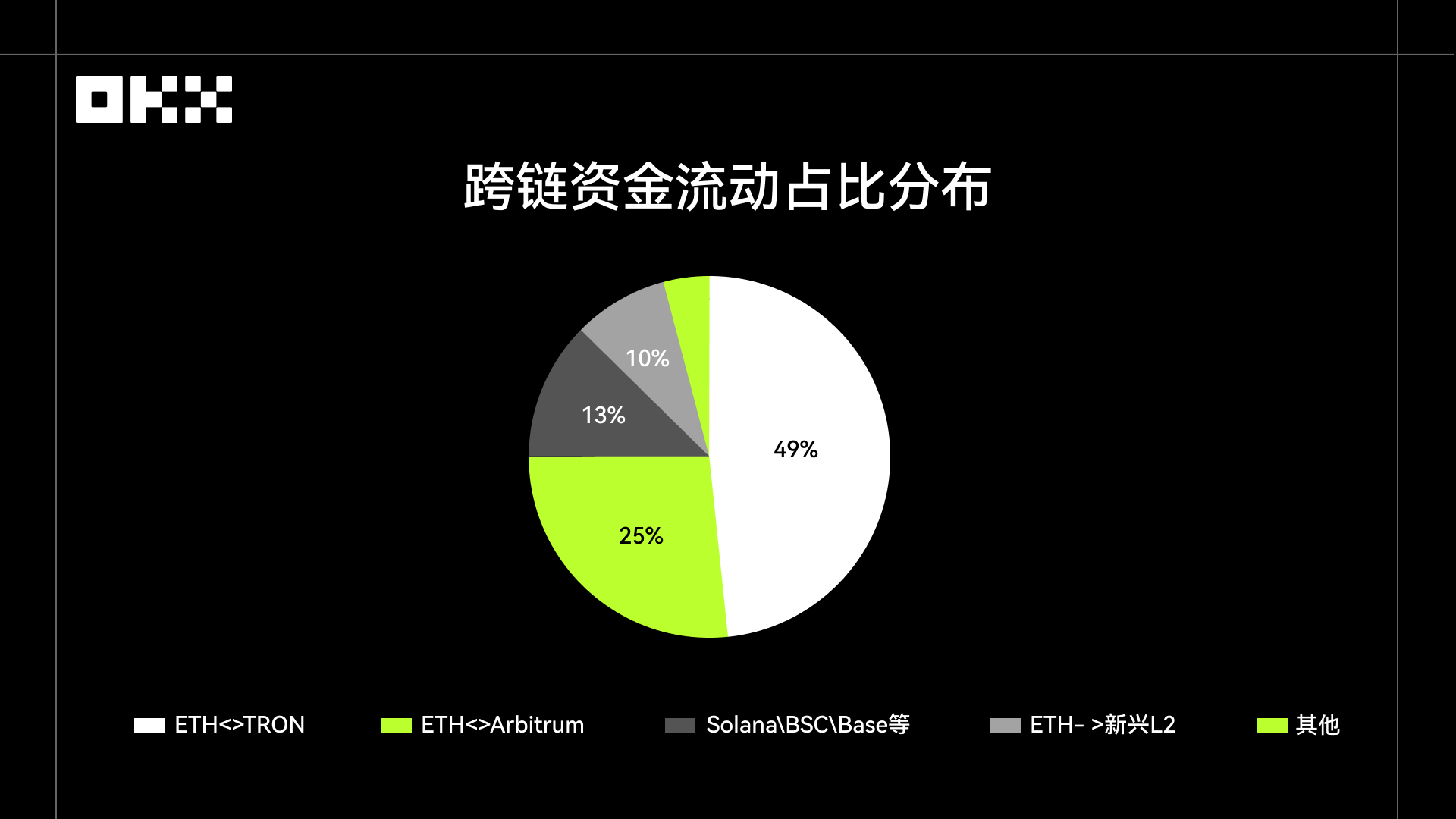

In terms of cross-chain fund flows, two-way cross-chain transactions between Ethereum and TRON account for nearly half of the total flow , forming the most crucial fund channel. Cross-chain transactions between Ethereum and Arbitrum account for over 25%, with the four major chains contributing approximately 70% of cross-chain flows in total.

Cross-chain fund flow diagram | Image source: OKX

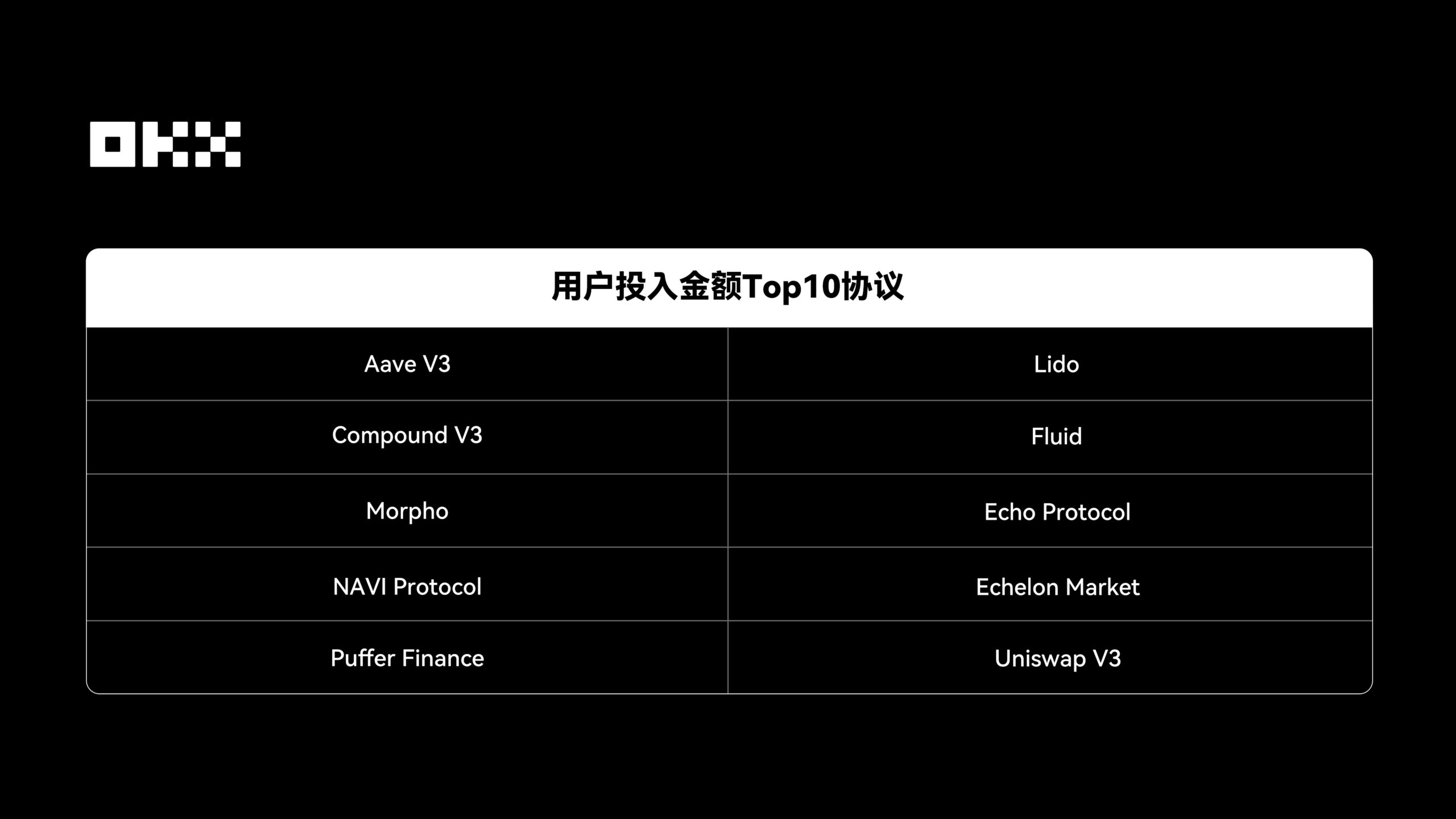

In DeFi investment, funds are concentrating on leading protocols. Aave V3 has over $200 million in investment , and the other top 10 protocols all have over $20 million, covering multiple areas such as lending, staking, and liquidity.

Top 10 DeFi Protocols by Investment Amount | Image Source: OKX

In terms of asset allocation, stablecoins (USDC, USDT) remain the core underlying assets. Notably, xBTC has become one of the fastest-growing DeFi investment products this year , reflecting the accelerating trend of "Bitcoin DeFiification." Regarding public blockchain distribution, Ethereum has received the most investment, followed by AVAX, SUI, and SOL, indicating that users have formed a configuration structure of "multi-chain division of labor and collaborative operation."

Top 10 DeFi Investment Products | Image Source: OKX

Top 10 DeFi Public Chains Invested In | Image Source: OKX

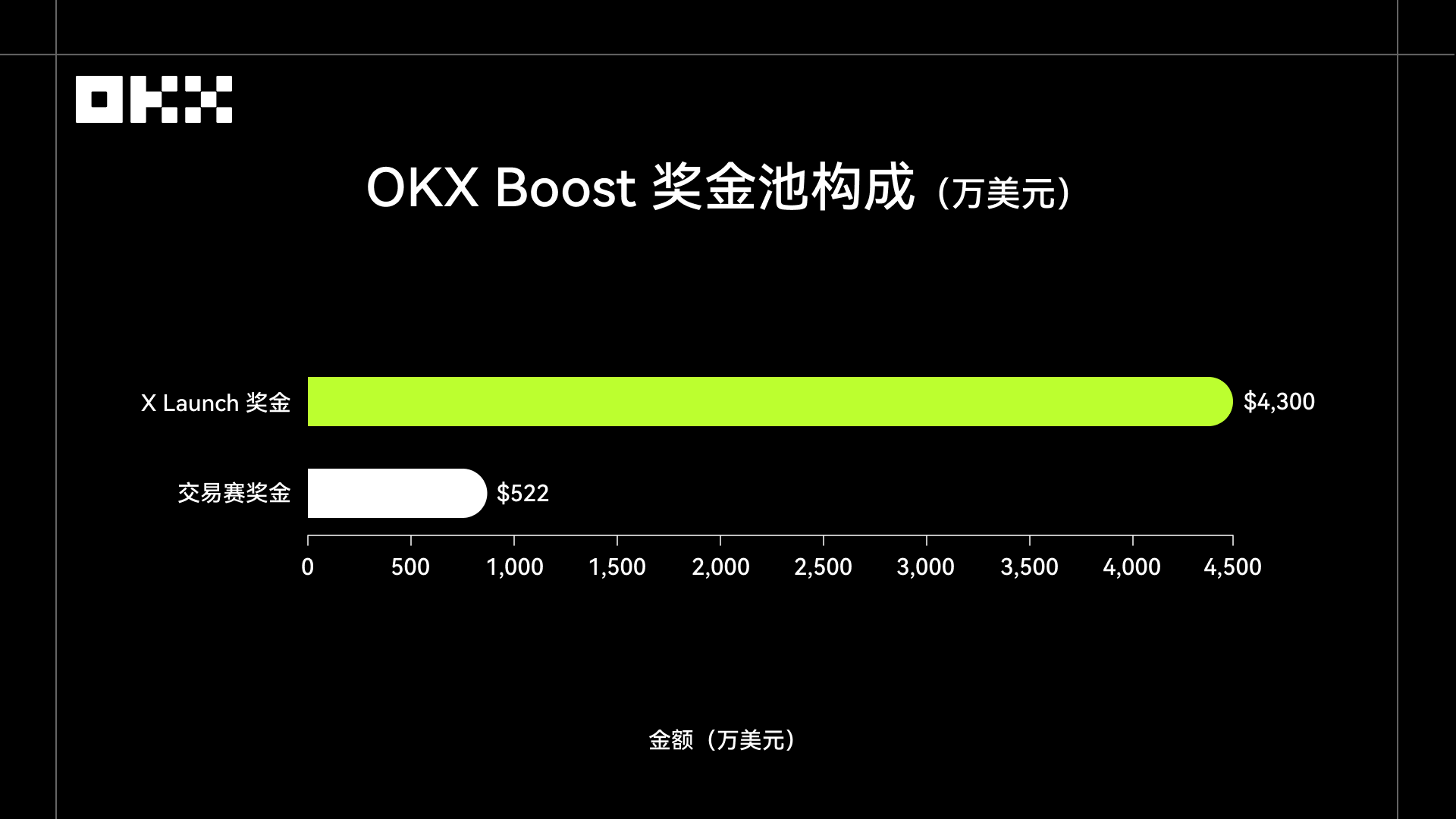

OKX Boost has distributed over $43 million in prizes.

Since its launch in September, the OKX Boost platform has completed 37 X Launches as of December, distributing over $43 million in prize money; it has also held 22 trading competitions with a total prize pool of $5.22 million. The average total return per user is close to $1,200 , with smaller participants typically achieving higher returns.

OKX Boost Rewards Data | Image Source: OKX

The report concludes that in 2025, on-chain user behavior will tend to be more rational and pragmatic, and users who truly profit will be able to combine market understanding with a balance between making steady investments in leading protocols and seizing short-term opportunities.