On December 30, 2023, the U.S. Federal Reserve (Fed) injected an additional $16 billion into the U.S. banking system, marking the second-largest liquidation injection since the COVID-19 crisis. This money was provided through overnight repurchase agreements (repos), bringing the total value of Treasury bonds purchased through repos in December to $40.32 billion.

The scale of this move has sparked debate about potential tensions in short-term Capital markets, while also raising questions about how increased global liquidation will impact risky assets, including Bitcoin.

The Fed's December liquidation injection reveals rising pressure beneath the surface of record global liquidation .

According to data from Barchart, the Capital injection on December 30th was second only to the emergency measures implemented during the pandemic in terms of scale.

Financial commentator Andrew Lokenauth also expressed concern, stating that such large Capital injections only make things look "okay" on the surface. In another post, Lokenauth compared the situation to banks promising assets they don't actually fully control.

He explained that organizations currently need cash to meet obligations related to goods and collateral mismatches.

The Fed's overnight repo function allows eligible partners to exchange Treasury bonds for cash at a fixed interest rate, giving the Fed better control over short-term interest rates in the market.

Although the Fed typically uses repo transactions at the end of each quarter and year, the total value of repo transactions in December, at $40.32 billion, was still very large. According to Bluekurtic Market Insights, this represents a form of ongoing “ liquidation support,” noting that the demand for this committed Capital remained high throughout the month.

Overall, analysts believe that the increase in repo transactions is mainly due to banks facing balance sheet constraints at the end of the year, rather than signaling a crisis. As reporting season approaches, banks are forced to tighten Capital control standards, making them less willing to lend in the private repo market.

When this happens, financial institutions choose the Fed as a “safe haven.” However, this over-reliance on the central bank for Capital also reveals underlying tensions or caution within the financial system.

Besides repo deals, investors are also paying attention to the minutes of the latest Federal Open Market Committee (FOMC) meeting. Experts at Markets & Mayhem highlighted a key point: the reserve management program, often referred to as “non-quantitative easing,” could see the Fed purchase up to $220 billion in Treasury bonds over the next 12 months to ensure the banking system has sufficient reserves.

Policymakers also affirmed that this buying activity was solely aimed at controlling interest rates and managing liquidation, and was in no way a sign that the Fed would soon ease monetary policy.

Prolonged high interest rates clash with record global liquidation as Bitcoin trades sideways.

The FOMC meeting minutes also showed that the Fed maintained a cautious stance . The majority believed that further interest rate cuts would only be appropriate if inflation continued to fall as projected. Some members even warned that cutting interest rates too soon could prolong high inflation or undermine the Fed's credibility.

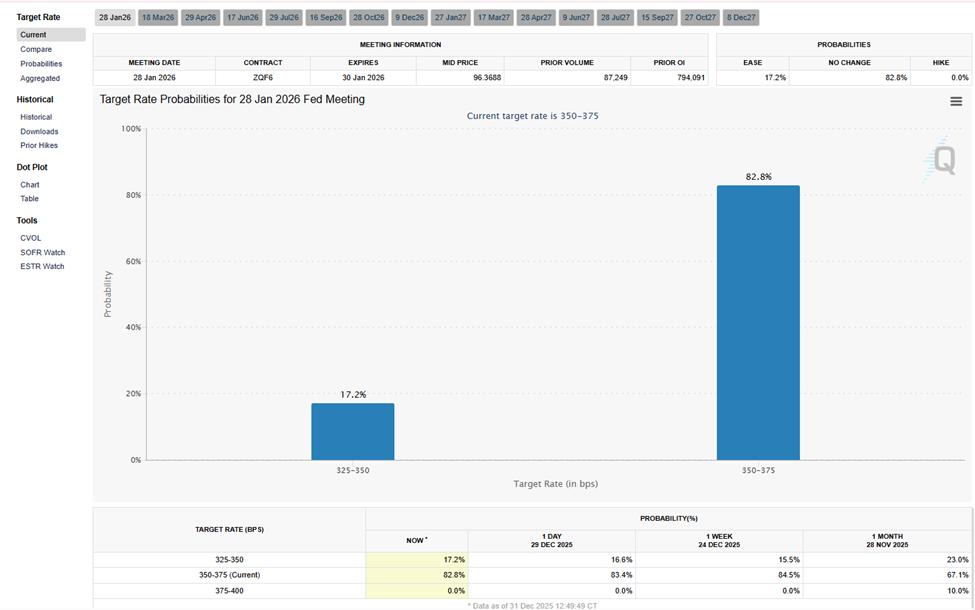

Therefore, the market currently predicts that the earliest a Fed interest rate cut can be expected is March 2026, reinforcing the narrative of "persistent high interest rates" despite increasing liquidation .

The probability of the Fed cutting interest rates. Source: CME FedWatch Tool

The probability of the Fed cutting interest rates. Source: CME FedWatch ToolAt the time of writing, global liquidation has reached a new record high. According to data from Alpha Extract, total global liquidation has increased by approximately $490 billion. This increase is due to:

- Mortgage conditions are improving.

- Public spending flows are like implicit quantitative easing measures, and

- A coordinated easing of monetary policy by major economies.

Global liquidation chart. Source: Alpha Extract on X

Global liquidation chart. Source: Alpha Extract on XChina typically starts the new year with a strong liquidation injection, while in the West, changes to regulations on bank ownership of Treasury bonds could also ease existing restrictions.

According to many experts in the crypto field, "global liquidation is increasing sharply," and Bitcoin is likely to follow this trend in the future. In fact, past expansions in global liquidation have often been accompanied by positive developments in risky assets , including cryptocurrencies.

However, the market reaction has been relatively quiet. Bitcoin continues to fluctuate within a narrow range around $85,000 – $90,000 with low liquidation and volatility.

Bitcoin (BTC) price fluctuations. Source: TradingView

Bitcoin (BTC) price fluctuations. Source: TradingViewThis "mismatch" clearly reflects the current context, where abundant liquidation clashes with high interest rates, regulatory uncertainties, and a cautious sentiment following a turbulent year.

Could the surge in money flows in December mark a significant turning point? The Fed is quietly adding support to the financial system, even as it maintains it's not easing policy. However, the direction of these money flows may be far more important than what's explicitly stated.