As 2026 begins, the global digital asset market faces a turbulent macroeconomic environment, demanding that investors make significant strategic decisions that go beyond simple price fluctuations. We stand at a historic turning point where the actual flow of liquidity behind the Federal Reserve's monetary policy intersects with a political turning point. Of particular note is Bitcoin, as a leading indicator of liquidity recovery, which is being the first to sense market changes, foreshadowing the beginning of a major upward trend.

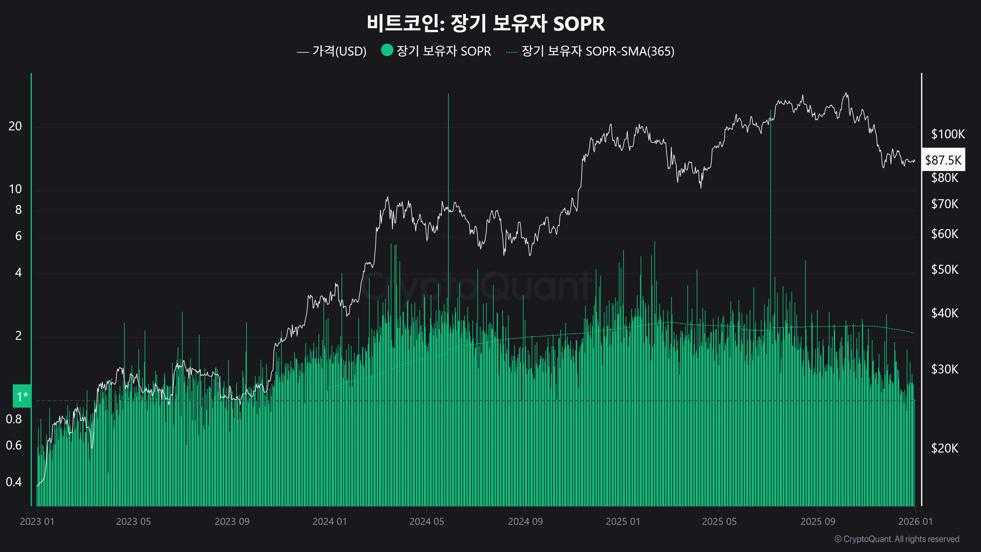

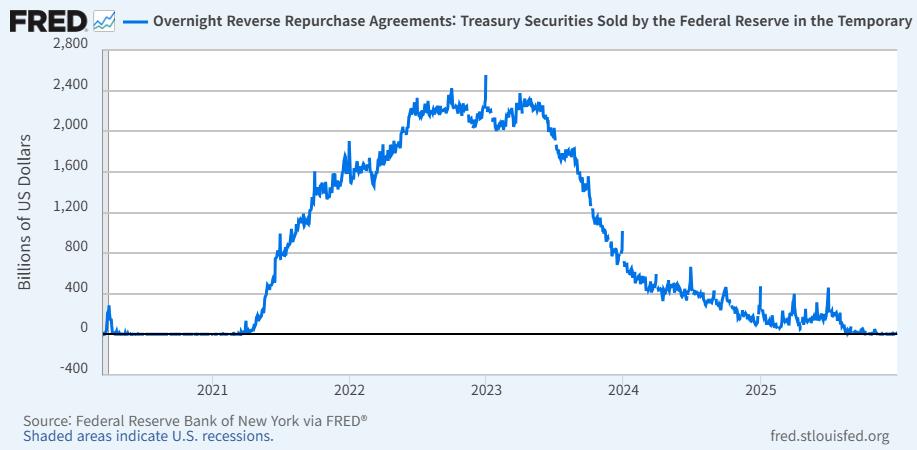

On the surface, the era of tightening may seem to continue, but in reality, the Federal Reserve has injected the largest amount of funds since the COVID-19 pandemic into the repurchase market to combat market shocks. While this "implicit liquidity injection" is a desperate measure to address the banking sector's funding shortage, its result has flowed into the digital asset market, becoming a powerful fuel for price increases. Furthermore, the selling pressure from "long-term investors" who have held their assets for more than 155 days and are supporting the market has effectively ceased, a fact that foreshadows the explosive potential of a liquidity influx under conditions of limited supply.

The political environment is also developing in a direction favorable to the market. This year is the second year of the Trump administration and also a midterm election year, which coincides with the historical "political seasonality" pattern that maximizes asset market returns. Historical statistics show that the S&P 500's average return exceeds 20% in midterm election years during a US president's second term. Economic stimulus policies aimed at winning votes and the relaxation of regulations friendly to digital assets are expected to inject unprecedented vitality into the market. In particular, the current mention of the possibility of the government strategically storing Bitcoin demonstrates that the status of digital assets has fundamentally changed.

However, the window of opportunity for investors is not long, and the imminent "taxation moment" of 2027 must be faced squarely. The government recently postponed the taxation of virtual assets to January 2027 again, but this is by no means an absolution, but rather a final preparatory period for full taxation. In particular, the OECD-led digital asset information sharing framework, which will be officially launched next year, will transparently share investment information among 48 countries worldwide. my country's tax authorities also plan to launch a borderless and comprehensive taxation network based on this framework. Ultimately, 2026, before the institutional control and monitoring system is perfected, will be the last "golden time" to maximize asset value and restructure investment portfolios without a tax burden.

Global investment strategist Howard Marks once emphasized, "The most important investment principle is to have courage at the bottom of the cycle, when others are fearful," highlighting the importance of decisiveness in the current turning point. If investors fail to discern the underlying liquidity reversal hidden behind the current vague economic indicators and the policy implications of the "Digital Asset Fundamental Law," they will miss a once-in-a-lifetime opportunity for asset class advancement. While the government is accelerating legislation to stabilize the market, investors should also seriously recognize the significance of this final year before the major tax reforms of 2027, and dedicate themselves to in-depth research and strategic responses.