Welcome to the US Crypto News Morning Roundup—your quick update on the most important developments in the crypto market today.

Make yourself a cup of coffee and sit down. January is truly testing the patience of retail XRP investors. While there's been a flurry of news about Ripple preparing to unlock $1 billion in its escrow fund, the real story might not be in those numbers, but in how the market reacts to them.

Crypto news of the day: Ripple unlocks 1 billion XRP as 2026 begins.

Ripple plans to unlock 1 billion XRP from its escrow fund on January 1, 2026, marking the first release of the new year .

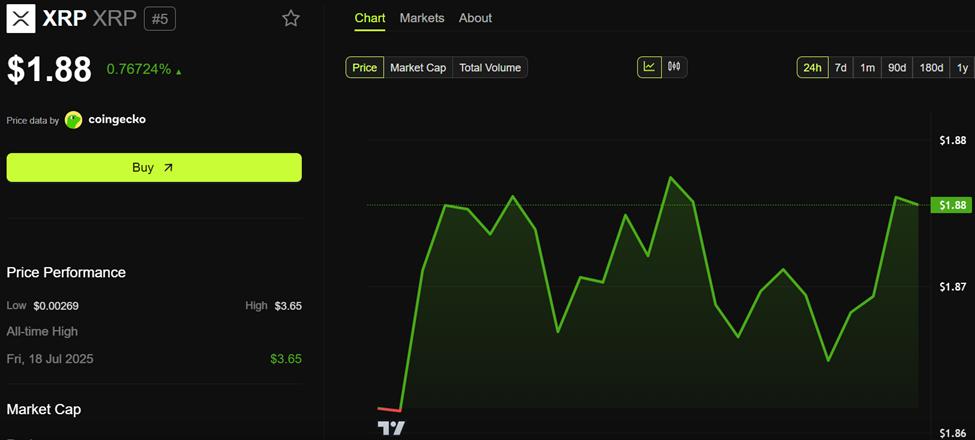

With XRP currently priced at $1.88, its total value is approximately $1.9 billion, attracting considerable attention from traders and analysts.

XRP price performance. Source: BeInCrypto

XRP price performance. Source: BeInCryptoHowever, looking at the history, the actual impact on the market may not be as significant as the headline suggests. This unlocking is part of Ripple's established supply control mechanism, and not something unexpected for the market.

The escrow system was established in 2017 to increase the transparency and predictability of the XRP supply.

According to this plan, Ripple will issue 1 billion XRP each month , but typically lock up 60% to 80% of these Token , retaining only a small portion for operations or liquidation purposes.

For example, by December 2025, approximately 70% of the unlocked XRP had been returned to the escrow fund, leaving the actual amount of XRP on the market likely to be just under 300–400 million XRP.

If January continues to follow this pattern, retail investors may find that the actual increase in supply is not as large as the initially perceived massive figures.

Nevertheless, the market is closely watching developments. XRP is currently under continuous selling pressure , even facing the risk of a sharp decline of up to 41% . However, structural demand remains fairly stable, as evidenced by the inflow of funds into XRP ETFs in the US.

Capital into XRP ETFs and supply volatility highlight Ripple's price outlook for 2026.

Data from SoSoValue shows that XRP ETFs have received investment inflows for over 30 consecutive days, with $15.55 million inflows recorded on December 30 alone. The total assets held by these ETFs have now reached $1.27 billion.

Cash flow into XRP ETFs since launch. Source: SoSoValue

Cash flow into XRP ETFs since launch. Source: SoSoValueThese inflows demonstrate institutional investors' confidence in XRP 's long-term position, despite short-term market volatility.

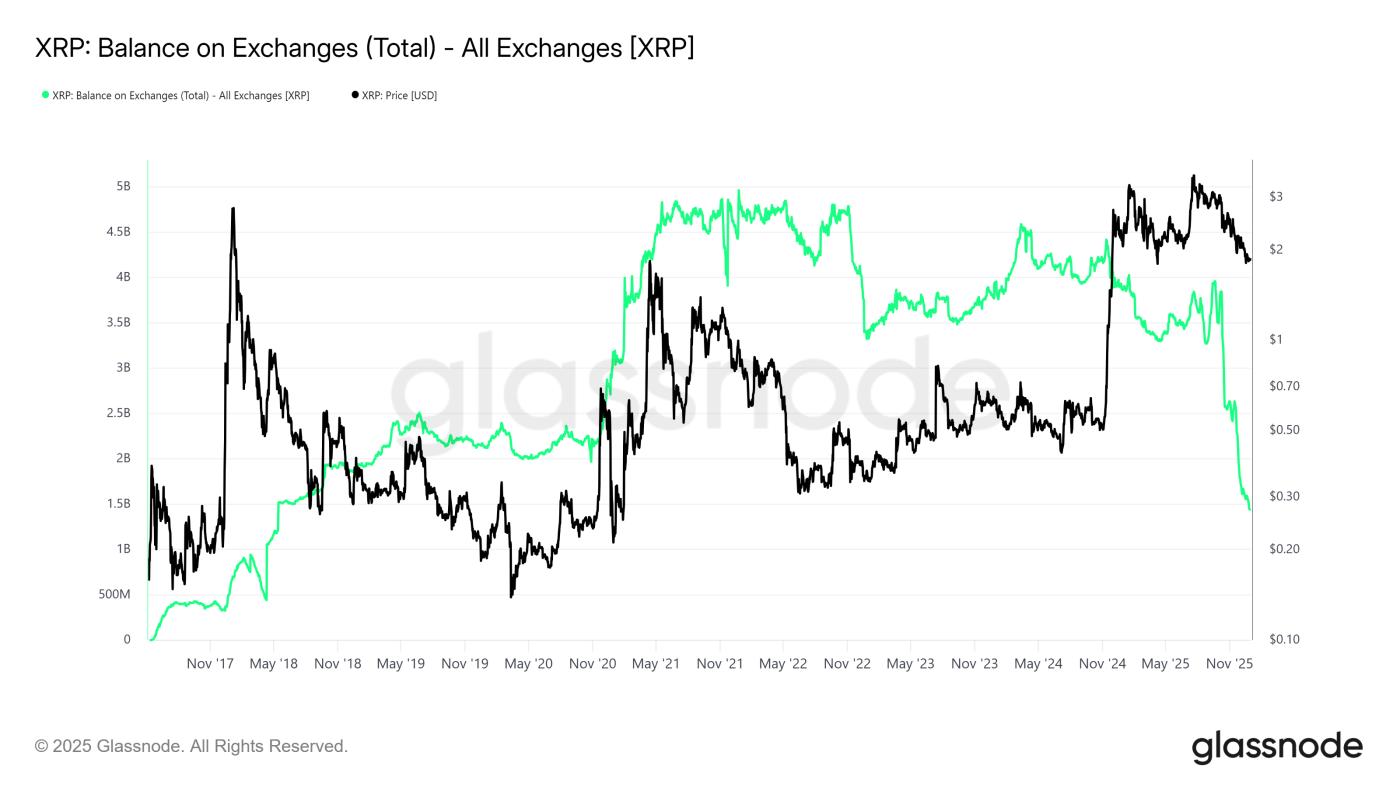

The amount of XRP held on exchanges also plays a significant role in the supply story. According to experts, the amount of XRP held on exchanges has plummeted from around 4 billion to below 1.5 billion in just the past year, indicating that the actual supply is becoming increasingly limited.

“The amount of XRP on exchanges has dropped from around 4 billion to below 1.5 billion in just 12 months. This is how the real supply shocks begin,” one expert commented .

Combined with the unlocking of escrow funds and the accumulation of XRP by ETFs, this development helped to reduce market volatility, although the large numbers still attracted attention.

This January unlocking also coincides with legal changes. The CLARITY Act, confirmed to be XEM by the US Senate in January 2026 , clearly defines how banks and financial institutions can participate in the digital asset market, including XRP.

Having clear regulations could impact Ripple's decision on the percentage of XRP that is relocked into its escrow fund. When financial institutions are allowed to participate transparently, Ripple may not need to retain as many Token for hedging purposes.

Conversely, if regulations remain unclear or become stricter, Ripple may lock up more Token to avoid legal compliance issues.

At the same time, legal transparency can also contribute to a more positive market sentiment and attract more participation from large organizations.

XRP is transforming from a speculative asset to a financial infrastructure.

Beyond short-term price movements, 2025 marks a major turning point in XRP's journey. Ripple is no longer simply a payment company, but is becoming a financial infrastructure platform for organizations.

XRPL is highly regarded in the stablecoin, custody, and payment system sectors , and with the increasing popularity of ETFs and regulatory compliance products, the story of XRP has shifted from speculation to practical application.

This shift means that XRP unlocks are no longer XEM as risks, but rather as signals of large-scale expansion and increasingly rapid adoption.

The XRP unlocking is imminent, but how much XRP will actually be put into circulation, and how will institutions react? While headlines may lead many to fear a sudden surge in supply, the reality is that history, on-chain data, and how major players are preparing indicate that this release will be controlled and largely predictable.

Daily chart

XRP balances on exchanges. Source: Glassnode

XRP balances on exchanges. Source: GlassnodeAlpha is concise.

Here are some of the top crypto news stories in the US today that you should keep an eye on:

- Five tariff moves by Trump could significantly impact Bitcoin prices in 2026.

- Despite losing up to 80% of its value, South Korean retail investors continue to invest in Tom Lee's BitMine .

- Ethereum Price Prediction : What Awaits ETH in 2026?

- The Fed injected $40 billion into the market in December as global liquidation reached record highs .

- Pi Network has temporarily suspended the payment request feature after discovering a scam that resulted in 4.4 million Pi coins being withdrawn.

- Bitcoin's price ended 2025 down 5%, with many investors selling off in disappointment .

- Lighter's value surpasses Pump.fun and Jupiter : Can LIT overtake Hyperliquid?

Overview of the crypto stock market before trading begins.

| Company | Closed on December 30th | Situation before opening time |

| Strategy (MSTR) | 155.60 USD | 156.59 USD (+0.64%) |

| Coinbase (COIN) | 231.60 USD | 232.08 USD (+0.21%) |

| Galaxy Digital Holdings (GLXY) | 22.78 USD | 22.82 USD (+0.18%) |

| MARA Holdings (MARA) | 9.33 USD | 9.34 USD (+0.11%) |

| Riot Platforms (RIOT) | 12.70 USD | 12.70 USD (0.00%) |

| Core Scientific (CORZ) | 14.61 USD | 14.58 USD (-0.21%) |