As a crypto trader or investor, you should always be wary of any exchange that promises safety without offering any transparency. If you can’t really tell where customer assets sit or how the exchange manages them, that is indeed a cause for concern. After all, issues like opaque asset handling, confusing position systems, and sudden withdrawal restrictions are more common in the industry than they should be.

Zoomex says it has answers to all of these concerns. The platform claims that transparency, settlement clarity, and simplified design are its core principles rather than being marketing jargon.

In this quick review, we explore how Zoomex approaches user-first trading, from interface design to asset custody and withdrawals, and what that approach says about the direction crypto exchanges now take.

What is Zoomex?

Zoomex is a cryptocurrency exchange launched in 2021 that offers spot and derivatives trading, plus features such as copy trading.

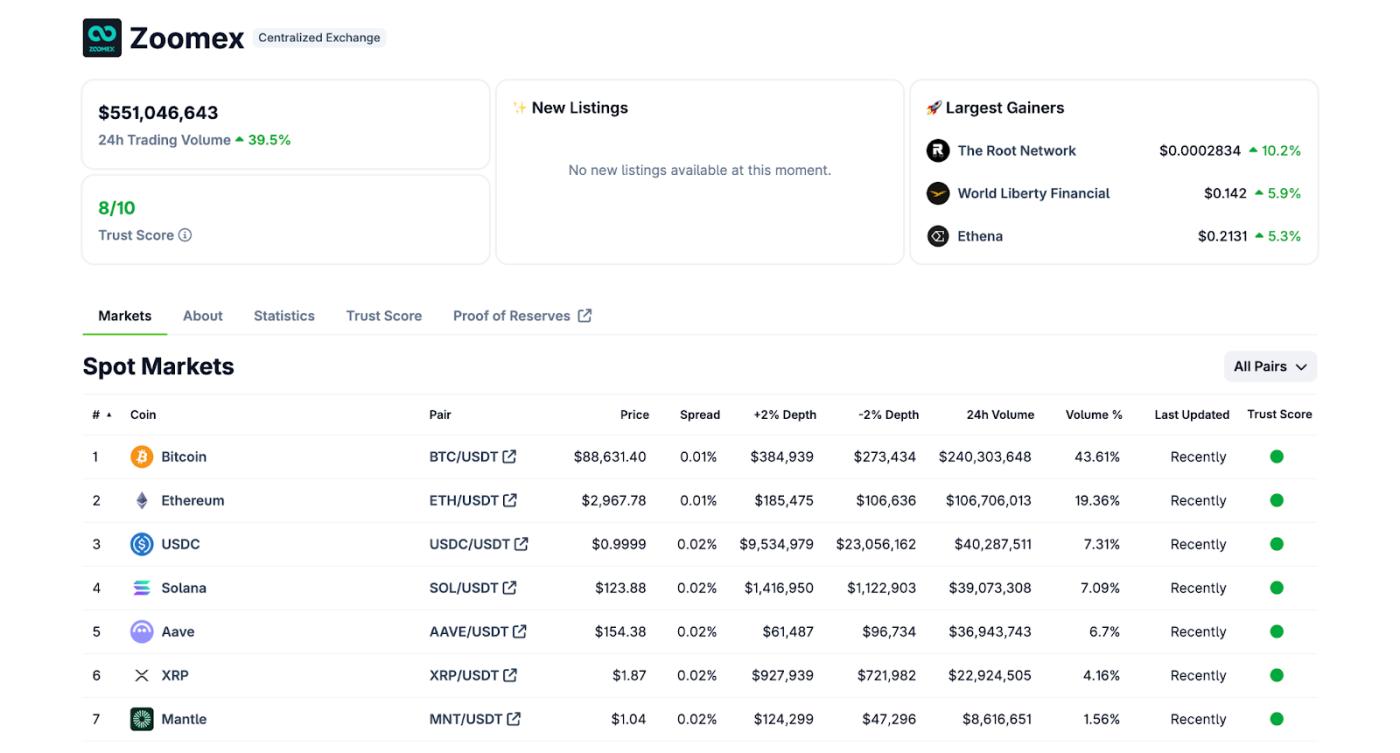

| Zoomex in a nutshell:➤ Launch year: 2021➤ Users: 3M+➤ Countries or regions: 35+➤ Trading pairs: 600+➤ Spot 24h volume: $878.4 million*➤ Trust score (CoinGecko): 8/10➤ Futures available pairs: 642➤ Futures 24h volume: $8.8 billion*➤ Security testing (Hacken): 0 critical, 0 high (web pentest)* Spot and futures 24h volume: CoinGecko data as of Dec. 16, 2025. |

The platform combines a minimalist interface and fast execution with transparency tools such as Transparent Vault, profit flow visibility, and a “Position = Account” layout. Zoomex also underwent security audits by Hacken and holds registrations in several jurisdictions, including MSB and AUSTRAC frameworks.

We will break down how these ideas work, but first, let’s have a quick look at why traders started to demand more transparency in the first place.

The move toward transparent, user-first exchanges

Historically speaking, most crypto trading platforms could not keep up with the pace at which the digital assets market matured.

For years, platforms chased growth with more products, more leverage, and more complex interfaces, while transparency lagged behind. That gap became hard to ignore once users started to test exchanges during sharp market moves and stressful withdrawal periods.

After major blowups such as Mt. Gox and the very real pain of frozen withdrawals, traders worldwide started asking questions that actually matter:

- Where does your fund actually go once you deposit it with an exchange?

- How does a trade settle once you close it?

- What happens when the market turns hyper volatile, or if you hit a big profit and try to cash out?

These questions essentially changed what “a good exchange” means. Exchanges that fail to answer these questions started facing growing skepticism.

On the other hand, platforms that emphasize visibility and user control started gaining more traction, not because they promise higher returns, but because they reduce uncertainty at critical moments.

Complexity became a liability in crypto trading

While the “trust factor” reshaped what a “good exchange” means, interface complexity also played a big role.

For a long time, many crypto platforms seemingly equated sophistication with dense design. Multiple balance types, layered margin views, and abstract position logic became standard features on these exchanges. Such was the level of complexity that even experienced traders had to be hyper vigilant on these platforms. For newer traders, it often led to costly mistakes.

Put simply, unclear interfaces magnify risk during volatile market conditions. Traders misjudge exposure, misunderstand available balance, or exit positions too late.

While these errors may sometimes stem from poor strategy, they often start with systems that hide important information behind jargon or fragmented views.

As user expectations started growing, complexity inevitably lost its appeal.

Traders now began to value platforms that explain outcomes clearly and reflect reality in real time. A low-barrier exchange does not remove depth. It removes ambiguity, which allows users to focus on decisions rather than interpretation.

How Zoomex approaches low-barrier trading through minimal design

Zoomex’s answer to this “complexity” challenge is a deliberately minimal interface.

The goal is not to simplify markets, but to simplify how users interact with them. For instance, key information appears in a single, coherent view, which reduces the need to switch between screens or reconcile multiple balances.

Zoomex Spot Markets Trading Interface

Zoomex Spot Markets Trading Interface

This approach lowers cognitive strain during fast-moving conditions. When profit, loss, and exposure remain visible without translation, traders trust what they see. That trust supports steadier decision-making and reduces hesitation during entry or exit.

Minimal design also reduces accidental errors. Fewer layers mean fewer misclicks and fewer assumptions.

In this context, interface design functions as a risk-control layer. It shapes behavior by keeping feedback immediate and clear, which sets the foundation for deeper transparency across the platform’s systems.

Transparent Vault: How it changes custody visibility

A clean interface helps, but it does not answer the bigger worry many traders now carry: Can you verify that assets remain there when you need them?

After years of headlines around mismatched reserves and delayed withdrawals, many users look for exchanges that show clearer signals around custody and readiness.

Zoomex presents Transparent Vault as its answer to that trust gap. Based on our early impression of the platform, the concept centers on visibility, auditability, and settlement readiness.

The message overall is simple: user assets should not feel like a black box. Zoomex frames this feature as a way to make asset status easier to inspect, with an emphasis on clearer risk management and readiness for settlement.

Digital profit flow: How Zoomex approaches fairness and traceability

Zoomex also emphasizes what it calls digital profit flow. The positioning here focuses on traceable movement of profits and a rules-based distribution model, which aims to reduce the feeling that outcomes depend on opaque routing or internal preferences.

In other words, Zoomex frames this as a fairness story: profits should follow clear logic, with visibility into how value reaches a user’s account.

Zoomex describes its model as transparent by design, including clear fee handling and no opaque execution layers. This matches what traders are increasingly calling for: processes they can verify (and not claims that they would have to take on face value).

A practical issue still remains, though. Even if profit flow stays traceable, traders still face a common point of confusion: the gap between a position’s result and what the account balance shows. That leads directly into the “Position = Account” concept we discuss next.

Turning positions into accounts: Settlement clarity explained

Clear profit rules still leave one common pain point: many exchanges split what you see across a position view, a wallet view, and several balance types.

When the markets start moving fast during volatile periods, that split can confuse you about what counts as available funds (versus what stays tied to exposure).

Zoomex’s “Position = Account” layout is a fix for that gap. The idea is simple: when a position closes in profit, the result should show up in your account view with less ambiguity. Zoomex also links this layout to fewer user mistakes, since you spend less time reconciling separate screens.

Zoomex Futures Markets Trading Interface

Zoomex Futures Markets Trading Interface

Note that this design choice matters less for casual spot buys and more for leveraged futures, where small misreads can lead to bad decisions.

After profit flow becomes measurable, the next expectation feels obvious: the result should become withdrawable cash, not a number that stays stuck inside a position view.

Withdrawal integrity under pressure: what happens after big wins

For many users, the real trust test arrives at withdrawal time, especially after a large profit.

Across the industry, some traders describe extra checks, delays, or sudden restrictions once a payout request looks “too big.” Unfortunately, that fear can (and does) affect how you trade, even when your activity stays legitimate.

Earlier in December 2025, Zoomex highlighted a case where a futures user reached $280,000 in profit and withdrew the full amount. The account reportedly saw no extra document requests, no manual delay, and no special review path beyond a normal withdrawal flow.

Zoomex also tied the story to a broader principle: profit withdrawal should remain a user right when activity stays legitimate and compliant.

In all fairness, this example does not guarantee every case will match since compliance-related issues can trigger extra checks. However, it does give a glimpse of how effortless Zoomex wants its withdrawal process to be irrespective of the amount.

Intent alone is not enough, though, because consistency needs infrastructure. Handling one large withdrawal smoothly is one thing; doing it consistently depends on security controls, monitoring, and compliance rules.

Security, monitoring, and compliance as structural enforcement

Zoomex has 24/7 risk monitoring, and it uses anomaly detection to watch for suspicious trading behavior. It also cites hot and cold wallet separation and multi-layer network defenses as part of its security setup.

On the audit side, Zoomex goes through routine evaluations by Hacken as an external check on its security posture.

On the compliance side, Zoomex holds registrations or licenses under Canada MSB, U.S. MSB, U.S. NFA, and Australia AUSTRAC frameworks, which allows it to operate under defined standards across markets.

This combination matters because it shapes the line between legitimate activity and abuse.

Users want controls that stop fraud without turning routine withdrawals into a negotiation. Once that foundation exists, Zoomex ties the story back to a broader identity: a performance-first culture where speed matters, but precision and discipline matter more.

Performance culture and the logic behind Zoomex’s F1 alignment

If there’s one thing crypto trading and motorsport have in common, it’s that both reward disciplined execution under pressure.

You can make the right decision and still lose if the system reacts slowly or if feedback arrives too late. That parallel explains why exchanges often borrow language from high-performance sports, even when the product itself has nothing to do with racing.

Zoomex uses its partnership with the MoneyGram Haas F1 Team to underline a set of values it repeats across its platform messaging: speed, precision, and trust. The F1 association supports that narrative because the sport runs on tight margins, constant measurement, and fast decision cycles.

Zoomex extends this performance theme through its ambassador partnership with Emiliano Martínez.

This branding does not replace technical proof, but it signals how Zoomex wants users to interpret its priorities.

Privacy-first access and optional verification

A user-first platform still needs entry paths that feel flexible, especially around privacy and verification. Most users typically prefer a quick start, but they also want control over what they share and when they share it.

Zoomex has an optional KYC model that aims to keep onboarding flexible while still supporting compliance requirements across markets. This approach fits the simple reality that not all users have the same risk tolerance, privacy preference, or use case.

Some, for example, want basic access with minimal friction. Meanwhile, there are also those who want higher limits and a clearer compliance posture. Optional verification gives you a choice, which can reduce early drop-off without forcing a one-size-fits-all path.

Is Zoomex the right fit for you?

Based on what we have discussed so far in this quick Zoomex review, the practical takeaway is simple. You should ideally pick only those platforms that:

- Show measurable processes,

- Explain outcomes in plain terms,

- Treat profit withdrawal as a normal part of compliant use

As of December 2025, Zoomex appears to fit that profile just fine.

It claims to address these expectations through Transparent Vault, traceable profit flow, a “Position = Account” layout, and an optional verification path, supported by audits and stated registrations.

To cut a long story short, Zoomex is an option worth considering if you care about clear answers on custody, settlement, and withdrawals, plus rules that stay consistent when markets get rough. You may also prefer it if you want an interface that keeps things simple and practical.