Crypto exchange-traded funds are entering 2026 with faster approval timelines, a pipeline of new products, and growing institutional attention despite a bit of late-year market weakness.

Bitcoin and ether ETFs continued to dominate flows in 2025, while a wave of altcoin-linked products expanded investor choice without materially shifting where assets are concentrated.

That gap between approvals and assets is now shaping expectations for rapid growth and eventual consolidation in the year ahead.

Bitcoin and ether still the core of demand

U.S. spot bitcoin ETFs posted positive net flows for seven months of 2025. While December has seen roughly $140 million in net outflows as of Dec. 22, bitcoin ETFs still recorded about $22 billion in net inflows over the year, according to The Block data.

Those flows unfolded against a volatile year for bitcoin itself. The asset opened 2025 trading around $93,000, surged to a new all-time high above $126,000 in October, then slid back to the low-$80,000s roughly five weeks later. At its current price near $87,000, bitcoin is down about 7% on the year.

By comparison, traditional markets delivered steadier gains. The S&P 500 rose roughly 17% over the same period, while gold, another asset often framed as a hedge, climbed more than 60%.

Ether ETFs also logged positive flows in nine out of the 12 months, totaling just under $10 billion. Momentum accelerated sharply over the summer following the passage of the GENIUS Act, legislation that clarified the regulatory framework for dollar-backed stablecoins and allowed U.S. banks and financial institutions to issue and custody regulated digital dollars.

That shift reinforced a growing view on Wall Street that Ethereum would serve as a primary settlement layer for stablecoin activity. In July and August alone, investors poured $9.3 billion into ether ETFs. August marked the first time monthly ether ETF inflows overtook bitcoin’s, with Ethereum products attracting $3.87 billion while bitcoin ETFs saw roughly $750 million in net outflows.

Ether has followed a similar path as bitcoin, down nearly 11% from its 2025 opening price of around $3,320 after giving back gains made earlier in the year.

Expanding altcoin ETF universe

Beyond bitcoin and ether, 2025 saw a major expansion of ETFs tied to alternative digital assets, including Solana, XRP, Dogecoin, and Chainlink. While the launches broadened exposure options, the market has yet to determine which products will see long-term demand.

Ben Slavin, global head of ETFs at BNY Asset Servicing, said altcoin ETF launches are likely to continue accelerating and that early data shows clear investor appetite. However, he noted that while bitcoin ETFs now hold roughly 7% of global bitcoin supply, altcoin ETFs are unlikely to scale at the same level.

"These products remain sensitive to market cycles, so near-term demand will ebb and flow with price," Slavin told The Block, adding that the longer-term case rests on continued expansion in crypto investor interest.

Asset manager Bitwise projected that more than 100 new crypto ETFs could launch in the U.S. as approval timelines compress, a forecast it attributes to regulatory changes and growing issuer confidence.

In a recently published thread of 2026 predictions, Bitwise said ETFs could become the dominant source of incremental demand for major digital assets, projecting that U.S.-listed ETFs may absorb more than 100% of new issuance of bitcoin, ether, and solana by 2026.

The firm framed ETFs as a structural demand engine rather than a speculative on-ramp, arguing that institutional flows through regulated vehicles could reshape market dynamics even during periods of price volatility.

A crowded pipeline and risks of attrition

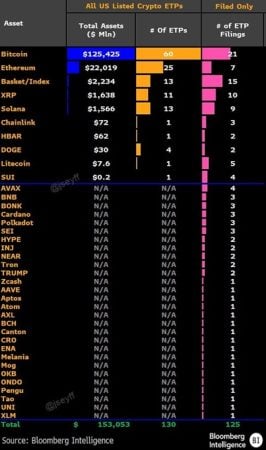

The filing pipeline is showing no signs of slowing. Bloomberg Intelligence analyst James Seyffart said at least 126 additional crypto ETP filings are pending, amid issuers “throwing a lot of product at the wall.”

ETF filings in the pipeline. Source: Bloomberg Intelligence/James Seyffart

While approvals are expected to continue, Seyffart has warned that the surge could ultimately lead to liquidations. He said closures may emerge toward the end of 2026 or into 2027 as under-subscribed products fail to attract durable assets.

Slavin said the market has so far demonstrated strong absorption capacity, pointing to a record pace of ETF product development in 2025.

While volatility and liquidity can create short-term friction, he said the investor base continues to broaden and that he has not seen structural constraints that would overwhelm and prevent the market from handling the current pace of issuance.

Easier approvals

Much of the confidence behind aggressive 2026 forecasts traces back to a regulatory shift finalized in September. The U.S. Securities and Exchange Commission approved new generic exchange listing standards for crypto exchange-traded products on an accelerated basis, allowing eligible funds to list without undergoing the full 19b-4 rule-change process.

The move shortened potential approval timelines from as long as 240 days to as little as 75 days and brought crypto ETFs closer to the framework used for commodity-based trust products.

Analysts at the time said the change could significantly expand the universe of crypto ETFs able to reach the market.

The SEC also approved the listing and trading of the Grayscale Digital Large Cap Fund, a multi-asset product composed primarily of bitcoin and ether but also including allocations to assets such as Solana, Cardano, and XRP, signaling that the agency was getting more comfortable with diversified crypto exposures.

The institutional bridge

Ripple president Monica Long told The Block that crypto ETFs still make up a relatively small share of the U.S. ETF market, even after more than 40 launches this year. She said their growth has been meaningful, but noted that digital-asset funds continue to represent only a low single-digit percentage of total U.S. ETF assets.

Long said wider ETF adoption could accelerate corporate and institutional engagement with digital assets, citing growing interest among large companies in formal digital-asset treasury strategies and exposure to tokenized assets.

She added that recent regulatory developments, including the passage of the GENIUS Act, have helped lay the groundwork for a U.S. digital-dollar framework. Under the legislation, banks and financial institutions can issue and custody regulated stablecoins, creating a compliant, around-the-clock payment and collateral standard that could further support institutional adoption.