Altcoins have now underperformed Bitcoin for four consecutive years, according to analyst and Into The Cryptoversefounder Benjamin Cowen.

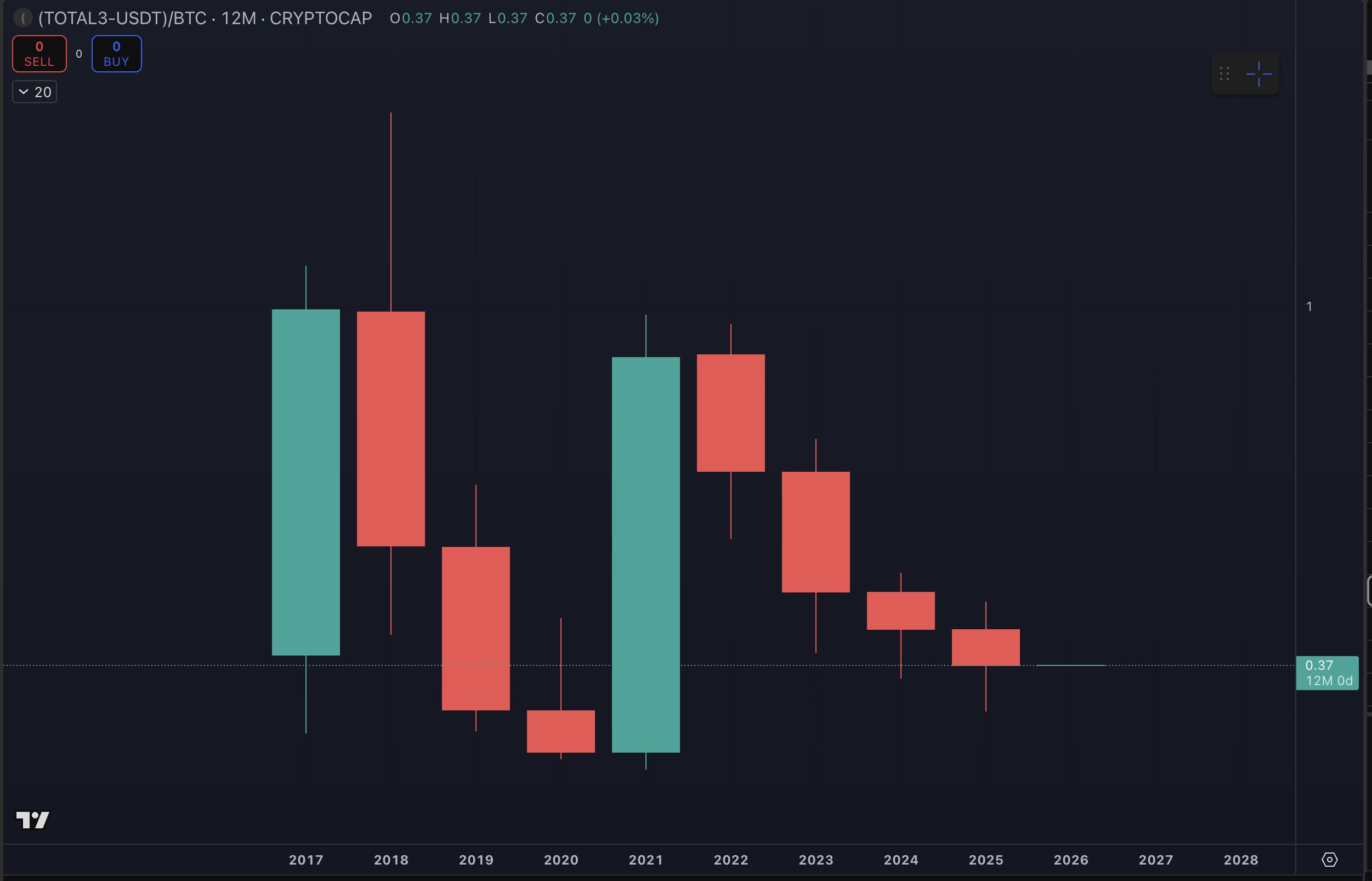

The observation highlights one of the longest relative bear markets for the sector. Cowen pointed to long-term chart data showing the TOTAL3 market cap—which tracks all altcoins excluding Bitcoin and Ethereum—measured against Bitcoin.

Each yearly candle since 2022 has closed red. The latest instance came at the end of 2025 with another red close. This indicates that altcoins have consistently lost value relative to Bitcoin, even during periods of price rallies in dollar terms.

Underperformance Hidden by USD Gains

While many altcoins recorded short-term pumps over the past few years, the data suggests those gains failed to keep pace with Bitcoin’s performance. In relative terms, investors holding altcoins instead of Bitcoin continued to lose ground.

This helps explain why Bitcoin dominance has remained elevated. The data suggests capital has largely stayed parked in Bitcoin rather than rotating meaningfully into the altcoin market. As of today, Bitcoin dominance stands at 59.58%, with Bitcoin trading above $87,000.

Over the past year, dominance has increased by 2.58%. Meanwhile, over the past five years, it has declined by 16%.

Notably, altcoin underperformance relative to Bitcoin is also reflected in the CoinMarketCap Altcoin Season Index. It currently sits at 20/100, meaning Bitcoin has outperformed 80% of the top 100 crypto assets by market cap over the last 90 days.

Community Reacts

The observation sparked discussion within the crypto community. Some commentators say the extended underperformance could set the stage for a future rotation. In particular, X user Grabowski Dylan suggested that 2026 could finally mark a turning point for altcoins.

Bitcoin pundit Castillo Trading argues that four years of relative losses already represent a full cycle, suggesting a relief is due.

However, some critical voices noted that most assets trend lower against Bitcoin over the long run. “Everything drops against Bitcoin over the long term,” X user Decondejar remarked.

The Outlook for Altcoins

Ultimately, Cowen’s main point is that altcoins usually outperform only for short periods, typically after Bitcoin has already had a major run. At press time, Bitcoin is trading at $87,865, with no meaningful price change over the past day or week.

Meanwhile, popular altcoins such as PUMP, PENGU, APT, ENA, and ASTER are all down between 60% and 70% over the past three months.

Still, some believe a relief rally is due. Industry leaders like Arthur Hayes have begun a massive accumulation of DeFi coins such as LDO, as The Crypto Basic reported. Researchers at Citibank and Bernstein have also forecast a BTC price of up to $200,000 in 2026, which could help many altcoins recover.