Bitcoin momentum is positive, but negative futures outflows over multiple periods suggest caution for short-term traders.

Bitcoin (BTC) has seen a measured gain of 1.4%, trading around $88,761. Over the last 24 hours, BTC moved between a low of $87,489.65 and a high of $88,979.05, with the price trading at the upper end of its range.

Zooming out, Bitcoin has shown modest gains of 1.6% over the past 14 days. These figures indicate that the crypto firstborn is potentially preparing for a breakout. Despite short-term stability, the longer-term trend still shows a cautious market, with 30-day and 1-year declines of 5.2% and 7.0%, respectively.

Key levels to watch are the 24-hour low at $87,489.65 as immediate support and the intraday high at $88,979.05 as short-term resistance. If buyers can push BTC above this range with conviction, a stronger bullish phase could unfold.

Bitcoin Price Analysis

On the technical end, the 9-day SMA at $87,891 is providing near-term support, while resistance at the daily high of $89,011 is a key level BTC must surpass for a potential continuation of the bullish trend. Trading activity is steady, with momentum indicators showing mixed signals as buyers and sellers weigh in.

The MACD indicates weakening bearish momentum. Ultimately, a break above $89,011 could open the path toward $90K, while a drop below the SMA support may test $87K and further downside levels.

Traders should watch these key zones closely, as short-term direction will likely hinge on BTC maintaining support or breaching resistance in the coming sessions.

Bitcoin Liquidation Data

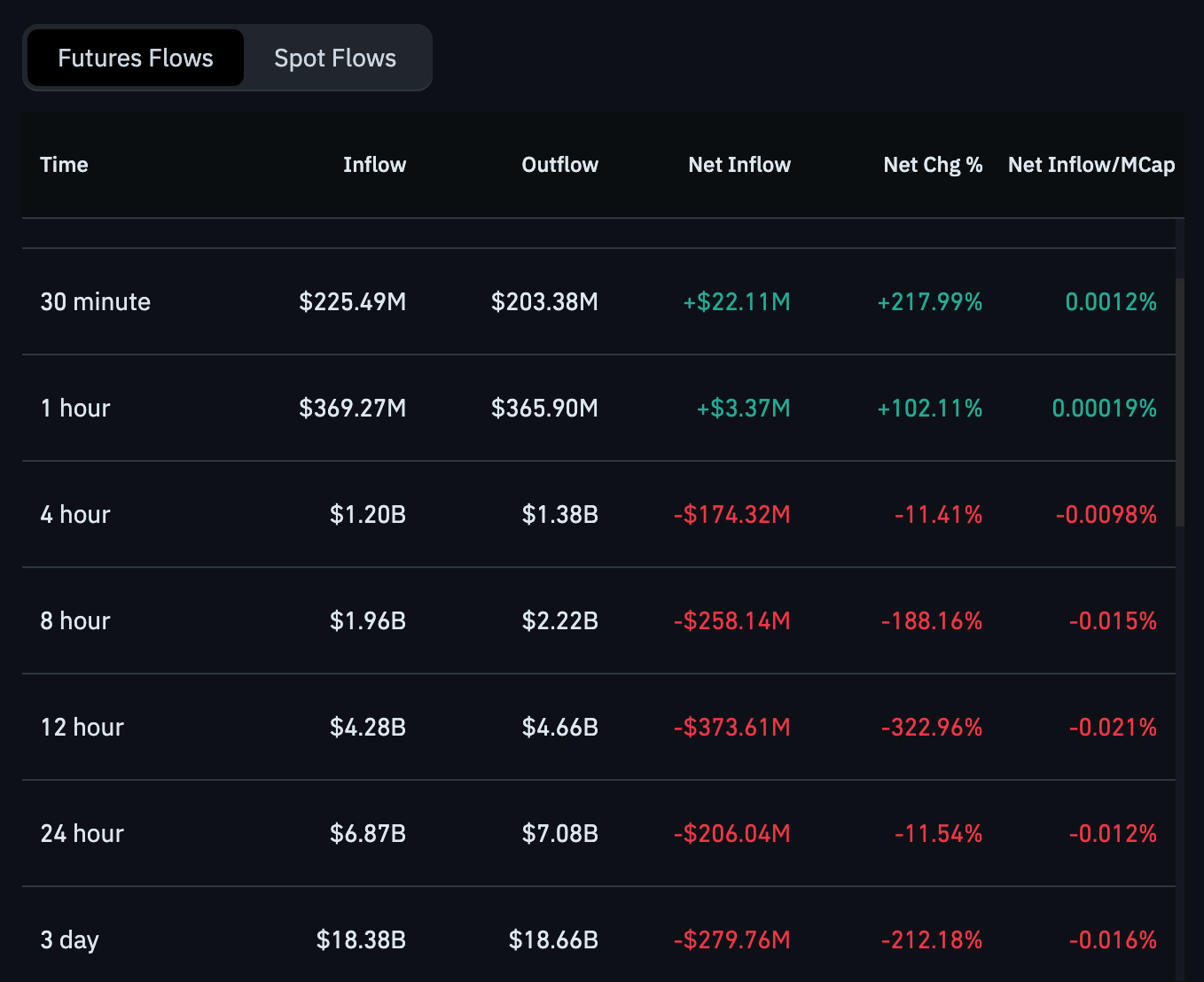

Meanwhile, the recent futures flow data for Bitcoin highlights mixed short-term sentiment and some profit-taking pressure over longer periods. In the last 30 minutes and 1 hour, there were modest net inflows of $22.11M and $3.37M, respectively.

However, over the 4-hour to 3-day horizons, net outflows dominate. Specifically, the 4-hour period saw a net outflow of $174.32M, the 8-hour period $258.14M, and the 12-hour period $373.61M. Meanwhile, the 24-hour and 3-day periods showed net outflows of $206.04M and $279.76M, respectively.