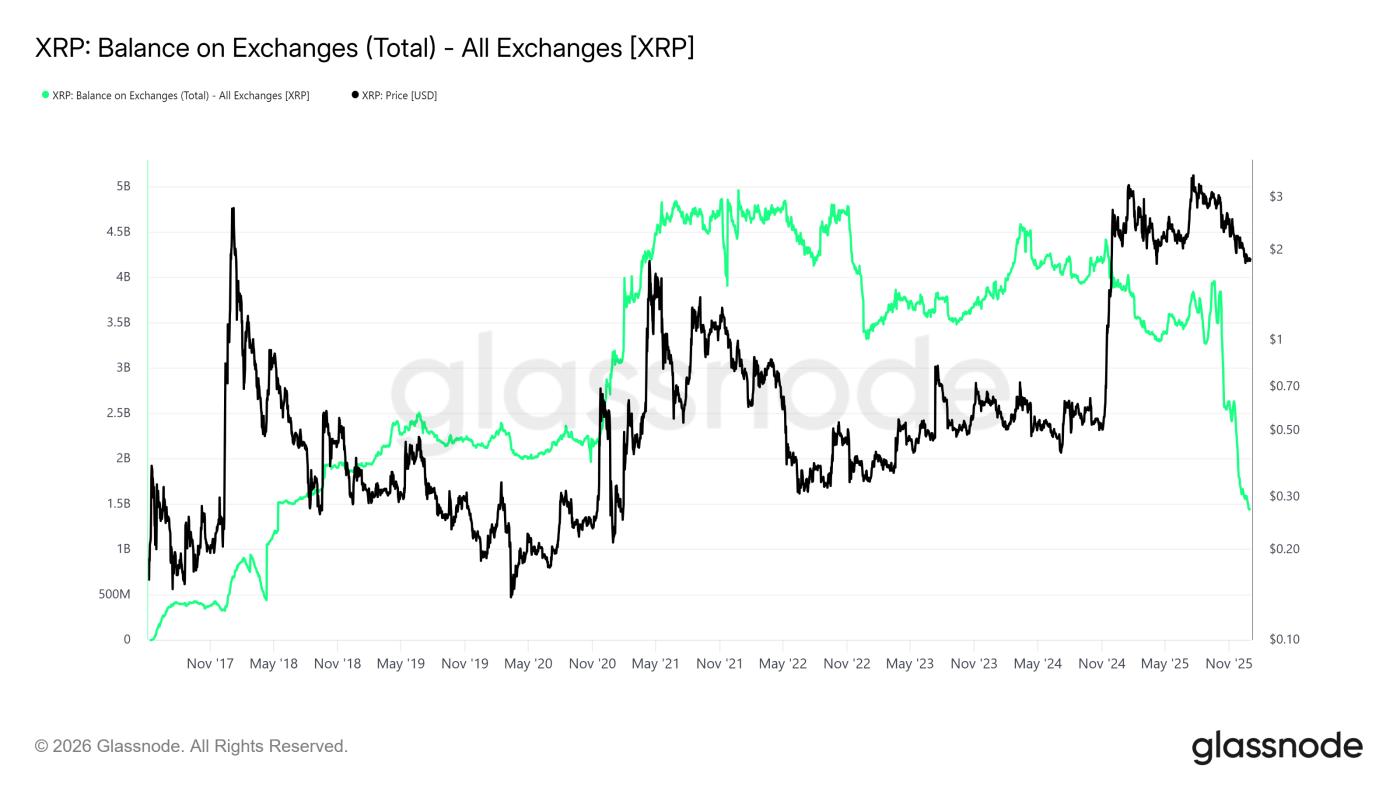

XRP reserves on centralized exchanges (CEXs) plummeted in 2025, from around 4 billion Token at the beginning of the year to approximately 1.6–1.7 billion by December. This is the lowest level since 2018, leading many to speculate whether a supply shock will occur in 2026.

However, experts also note that a low XRP balance on exchanges does not necessarily mean the price will increase immediately or trigger a long-term rally.

XRP balances on exchanges have decreased amid historical trends.

Data from Glassnode shows that the amount of XRP on the exchange decreased from 3.76 billion on October 8, 2025, to 1.6 billion at the end of December, leading to speculation that a short-term supply shortage may occur.

XRP balances on exchanges. Source: Glassnode

XRP balances on exchanges. Source: GlassnodeThis sudden drop coincides with Ripple's scheduled unlocking of 1 billion XRP from escrow on January 1, 2026.

However, historically, a decrease in XRP reserves on exchanges does not automatically lead to a sharp price increase.

At the end of 2018, the amount of XRP on exchanges also dropped to a similar low as it is now, but the price continued to fall. Similarly, at the end of 2022, although exchange reserves decreased significantly, the price only began to recover noticeably at the end of 2024.

"People often focus on price, but in reality, major fluctuations occur silently behind the scenes… liquidation in the market is being withdrawn. The market therefore becomes thinner, more sensitive, and more prone to volatility when there is buying demand," Chia to a market analyst from Web3Niels.

In other words, the reduction in XRP supply on exchanges mainly helps to alleviate short-term selling pressure rather than causing a sudden surge in demand.

Limitations on the scope of data and reports from the exchange.

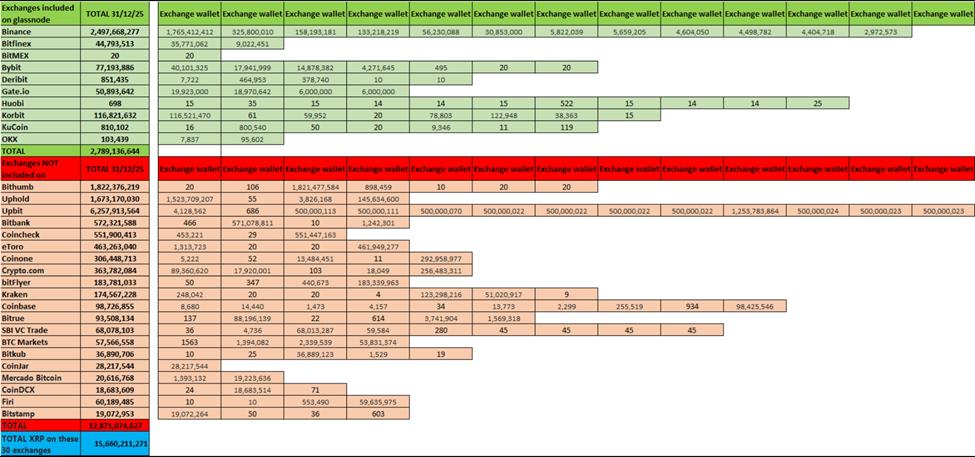

The narrative of a “supply shock” is also being questioned due to incomplete data. The on-chain analytics service Glassnode only tracks about 10 exchanges. However, analyst Leonidas expanded the scope to 30 platforms and found that nearly 14 billion XRP remained on exchanges by the end of 2025 – significantly higher than the widely cited figure of 1.6 billion.

“ Glassnode chart only updates data from 10 exchanges and only counts verified wallets belonging to those exchanges… If we aggregated data from more exchanges, especially those holding billions of XRP, the results would better reflect the reality and provide a clearer picture of the trend,” Leonidas Chia .

XRP supply across 30 exchanges. Source: Leonidas on X

XRP supply across 30 exchanges. Source: Leonidas on XThis shows that looking at data from only a few exchanges can be misleading. XRP is a highly liquidation , so the Token Migration up and down exchanges is constant; therefore, the reserve figures at any given time will not be an accurate basis for predicting market fluctuations.

“The amount of XRP listed for sale on the Order Book is very volatile… Sometimes just buying $10 million can push the price up, but other times buying $100 million can still cause the price to fall,” Vet_X0 analyzed .

Ripple's monthly XRP unlocking also affects the market supply. On January 1, 2026, Ripple unlocked 1 billion XRP , but in reality, only about 200–300 million XRP are actually in circulation, while the remaining 60–80% are typically locked.

This event was Capital anticipated, so most retail and institutional investors didn't consider it a big deal, and it didn't cause any significant price fluctuations.

Factors such as funding from XRP ETFs , institutional acceptance, and the legal landscape in the US – particularly the impending passage of the CLARITY Act – could have a greater impact on XRP demand than fluctuations in exchange reserve figures.

XRP price movement. Source: BeInCrypto

XRP price movement. Source: BeInCryptoAlthough XRP reserves on exchanges are currently at their lowest level in eight years, the overall supply is constantly changing, and the possibility of a "supply shock" in 2026 remains a big question mark.