Welcome to the US Crypto News Morning Briefing—a quick summary of the most important developments in the US crypto market today.

Get your coffee ready and tune in! 2025 was expected to be a year of significant Bitcoin breakouts. Many bold predictions suggested Bitcoin would reach six figures, even $500,000. However, as the year ended, reality proved quite different, highlighting the clash between expectations, market cycles, and practical factors.

Crypto News Today: How a Bold Prediction for Bitcoin in 2025 Failed to Come True

Bitcoin began 2025 with extremely high expectations , with experts, investors, and institutions all predicting a price exceeding $100,000, and at times even dreaming of reaching half a million dollars within the year.

However, by the end of the year, Bitcoin closed around $87,000, showing a significant gap between speculative forecasts and market reality.

Bitcoin (BTC) price movement. Source: TradingView

Bitcoin (BTC) price movement. Source: TradingViewThis difference reflects the influence of factors such as liquidation, financial leverage , and the increasingly complex Bitcoin market structure in 2025, leading to a significant shift in expectations.

Among the prominent predictors, Eric Trump confidently predicted that the price of Bitcoin would surpass $175,000 in 2025. The son of the US President XEM this as an inevitable outcome due to currency devaluation.

Similarly, Michael Saylor—a prominent supporter of MicroStrategy— set a target of $150,000 , based on business adoption of Bitcoin and a dwindling supply. Financial expert Robert Kiyosaki predicted a price range of $180,000–$200,000 , highlighting Bitcoin's Vai as a hedge against inflation and debt pressure.

Many market strategists are also optimistic. Tom Lee from FundStrat predicts that Bitcoin's price could reach $250,000 thanks to ETF inflows and a favorable policy environment in the US. Similarly, BitMEX co-founder Arthur Hayes believes Bitcoin could fluctuate between $200,000 and $250,000 .

Venture capitalist Chamath Palihapitiya boldly mentioned a $500,000 target by October 2025, based on the scarcity narrative and Capital shifts. Tim Draper reiterated his $250,000 forecast by the end of the year, arguing that this is closely tied to Bitcoin adoption and the devaluation of fiat currencies.

Institutional investors are optimistically placing big bets on Bitcoin in 2025.

Large institutions are also very confident about Bitcoin's prospects. Geoff Kendrick from Standard Chartered once set a target of $200,000, according to a previous US Crypto News article.

“The amount of money flowing into Bitcoin ETFs has now reached $58 billion, with $23 billion of that coming in in 2025 alone. I predict at least another $20 billion by the end of the year, which makes my $200,000 year-end forecast more realistic,” he Chia with BeInCrypto via email.

However, Geoff later significantly reduced this forecast as the market stalled. Bitwise also maintained its $200,000 target, emphasizing support from regulatory factors and ETF growth. VanEck predicted $180,000, while Bernstein believed in the $200,000 target, and also suggested Bitcoin would aim for a long-term target of $1 million.

Matrixport has set a target of $160,000, based on the macroeconomic outlook and the maturity of the crypto market.

Altcoin analysts are similarly optimistic. Altcoin Daily predicts Bitcoin will reach $145,000 due to its thriving ecosystem, while Plan C's Bitcoin Quantile Model suggests the price will range from $150,000 to $300,000 based on historical trends.

Some experts, such as Liz Alden, estimate that Bitcoin could reach between $200,000 and $444,000 if strong Capital from ETFs and liquidation continue. Many other KOLs on social media, such as Ash Crypto, MMCrypto, and Stock Money, also emphasize that Bitcoin could absolutely surpass $200,000 this year.

However, these forecasts are based on the expectation that the market will experience explosive growth like in 2021—a period marked by sharp price increases, extreme financial leverage, and highly euphoric retail investors.

The case for Bitcoin's price increase in 2025 is based on the narrative, not liquidation.

In fact, 2025 will once again be a test of market maturity.

- The inflow of money into ETFs is real, but it's not a continuous upward trend . This money is only absorbing the supply, and not enough to create a chain reaction that would push the price of Bitcoin above $150,000–$300,000.

- Global liquidation has never shifted to a significantly loosened state. Interest rate cuts have been slower than expected , balance sheets remain tight, and risk-on Capital flows remain highly selective.

- Institutional investors primarily allocate Capital rather than speculate. Bitcoin is XEM as a hedge against risk, rather than an asset that leads a rapid upward trend.

- Financial leverage stifles price increases . Repeated account liquidations cause price surges to stall and prevent them from lasting long.

- The market cycle has changed. Bitcoin is now larger, more tightly controlled, and subject to more structural constraints than during previous periods of rapid growth, rendering old predictive models inaccurate.

By the end of 2025, the gap between predictions and reality became apparent. The market's failure to meet the optimistic targets set by experts and organizations showed that strong belief or expectations alone were not enough to drive market growth.

Bitcoin's performance in 2025 reflected a more mature market, where macroeconomic factors, cash flows, and market structure played a far more significant Vai than optimistic narratives or media coverage.

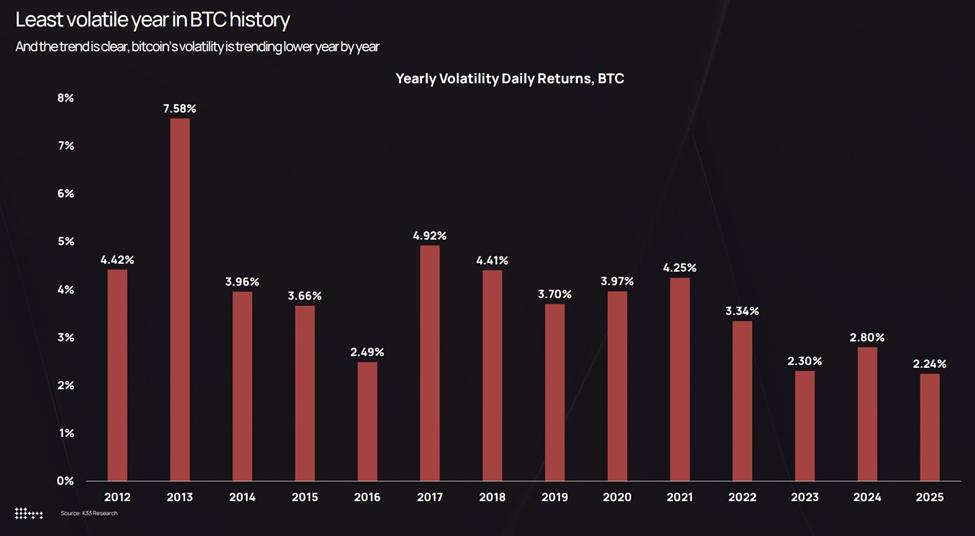

Perhaps that's why the latest report from K33Research suggests 2025 will be the year of lowest volatility for Bitcoin. This is also an important lesson for retail investors: Thorough research and investigation are essential, rather than simply following expert predictions.

Chart of the day

Annual Bitcoin price fluctuation chart. Source: K33Research

Annual Bitcoin price fluctuation chart. Source: K33ResearchBrief alpha information

Here are some of the most prominent US crypto news stories you might be interested in today:

- MicroStrategy's stock has fallen more than 49% in 2025: Will 2026 be another difficult year?

- The supply shock narrative is being questioned as XRP reserves on exchanges have fallen to their lowest level in eight years.

- Experts explain why 2026 could be the yearEthereum surprises the market .

- Just $1 for access? A Dark Web post is selling Kraken admin access.

- XEM why Coinbase's vision for 2026 wasn't well-received .

- Analysts point to three indicators that could signal altcoin season in 2026 .

- PEPE surged 20% thanks to a bold prediction from James Wynn for 2026.

Overview of the cryptocurrency and stock markets before the market opens.

| Company | Closing price on January 1st | Overview before opening |

| Strategy (MSTR) | 151.95 USD | 155.95 USD (+2.63%) |

| Coinbase (COIN) | 226.14 USD | 231.00 USD (+2.15%) |

| Galaxy Digital Holdings (GLXY) | 22.36 USD | 22.91 USD (+2.46%) |

| MARA Holdings (MARA) | 8.98 USD | 9.24 USD (+2.90%) |

| Riot Platforms (RIOT) | 12.67 USD | 13.03 USD (+2.84%) |

| Core Scientific (CORZ) | 14.56 USD | 14.79 USD (+1.58%) |