The price of Pi Coin has attempted a short-term recovery after the recent weakness, showing a slight increase. Although buying pressure has improved, the overall picture remains cautious.

Technical indicators suggest that the recent rally is merely a correction, putting this altcoin at risk of falling back down if the buying momentum is not sustained.

Pi Coin investors are showing an optimistic trend.

On the chart, Pi Coin is forming a hidden bearish divergence signal. From December 19th to January 3rd, the price recorded a lower high while the Relative Strength Index recorded a higher high. This suggests that the current uptrend is not truly solid.

Hidden bearish divergence often appears when prices correct upwards within a general downtrend. Despite short-term optimism, selling pressure remains dominant below the surface.

This signal suggests that if buying pressure temporarily weakens, the main downtrend of Pi Coin could continue, increasing the risk of a price drop for Pi Coin .

Want more Token analysis? Sign up for editor Harsh Notariya's daily Crypto newsletter here .

RSI divergence of Pi Coin. Source: TradingView

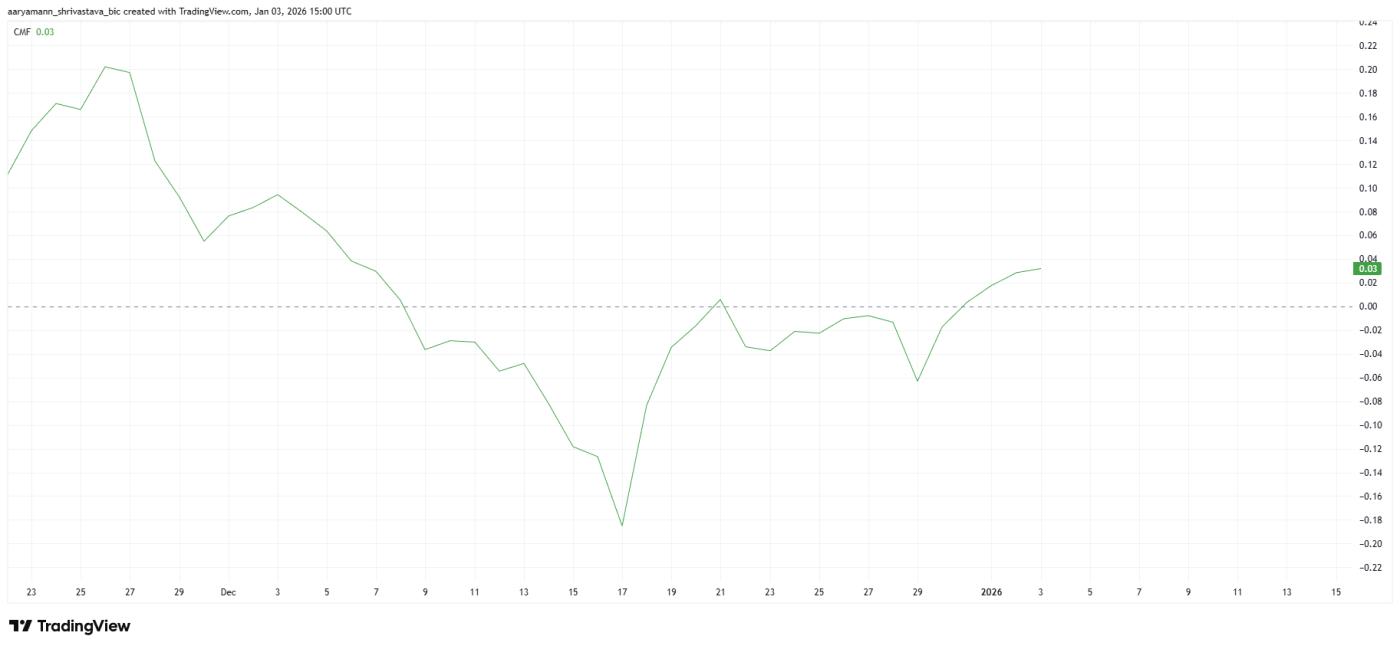

RSI divergence of Pi Coin. Source: TradingViewThe overall data also provides a more balanced picture. The Chaikin Money Flow indicator is moving above zero, nearing its monthly peak. The CMF tracks Capital flows that take volume into account, making it a fairly reliable tool for assessing investor commitment during periods of uncertain market trends.

When the CMF rises, it indicates sustained accumulation rather than just short-term price increases driven by speculation. Investors seem willing to continue Capital, despite conflicting technical signals. As a result, the price of Pi Coin has recently remained stable and avoided a sharp decline, providing Pi Coin with short-term cushion against broader market volatility.

Pi Coin's CMF indicator. Source: TradingView

Pi Coin's CMF indicator. Source: TradingViewPI price faces resistance.

Pi Coin's immediate challenge remains the resistance zone of $0.214. This level coincides with the 23.6% Fibonacci retracement, thus attracting even more investor attention. The repeated rejections of Pi Coin's upward movement in this area indicate that selling pressure from those seeking to protect their high entry prices remains significant.

To reverse the downtrend, a clearer catalyst is needed. If Pi Coin closes steadily above $0.214, it will likely break the downtrend line. At that point, the price could head towards the $0.226 region, and if volume also increases along with improved market sentiment, the price could rise further.

Pi Coin price analysis. Source: TradingView

Pi Coin price analysis. Source: TradingViewConversely, if Pi Coin fails to maintain its upward momentum, the price could fall even more sharply. A drop below $0.207 could accelerate the sell-off. In that case, the price could retest the crucial support level at $0.199. If this area is not defended by buyers, the downtrend will become even more pronounced for Pi Coin .