This article is machine translated

Show original

Some folks have asked why I focus on data and trends in my analysis, but my trades look short-term. Actually, that's a misunderstanding.

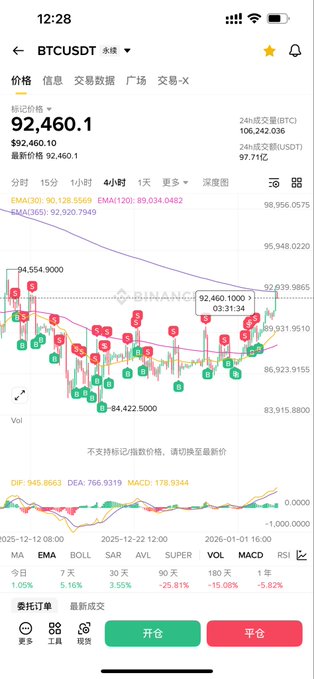

All my spot positions are based on data analytics and my own interpretation of the market trend (see Chart 1). When I expect the market to enter a prolonged consolidation range, I’ll allocate some funds for intraday scalping. But as soon as we get a clear breakout or breakdown and the price starts trending in one direction, those range trades are closed—either stopped out or taking profit (see Chart 2).

The freed-up capital is then used for breakout trades. Just like I’ve said in my posts yesterday and the day before, using both on-chain data and K-line indicators, the odds of a “real rebound” are much higher than a “fake breakout.”

So, after BTC closed above the descending trendline at $90,588 on the daily, I decided to add to my position and set my stop-loss at the strong support level of $87,000, aligning my actions with my analysis.

My current spot position is up to 80%. But if you ask me if I’m bullish for a full-on bull run? Unfortunately, my answer is: Nope. Not now, and honestly, I don’t expect to see a real bull market before Q2 2026.

My purpose in scaling up is clear: I’m playing for the rebound. If BTC hits my target zone, goes against my expectations, or the data signals it’s time, I’ll reduce my position (but never go all out).

I always leave room for flexibility in my trades—plan ahead and allow space for errors. Especially with 2026 on the horizon—IMO, the turning point in the next 2-3 years is right there—so it’s crucial to be prepared, both mentally and with enough ammo.

Sponsored by @Bitget|

Bitget VIP—lower fees, bigger perks

Murphy

@Murphychen888

01-04

链上数据有2个关键信号点出现:

1、筹码集中度下降

在2026.1.1 BTC现货价格5%范围内的筹码集中度达到14.9%,距离我们说的波动性高风险区仅一步之遥。但此后在1月2日和1月3日两天不增反降,目前已降至14.5%。同时,BTC的价格在缓慢上涨。

(图1) x.com/Murphychen888/…

I'll wait for a better spot and then...

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content