Worm.wtf optimizes for speed, accessibility, and long tail relevance rather than maximum pricing efficiency.

Its core innovations reduce friction but introduce new forms of risk rather than eliminating them.

Prediction markets are fragmenting into specialized platforms rather than converging toward a single winner.

WHY PREDICTION MARKETS ARE REENTERING THE SPOTLIGHT

Prediction markets are not a new invention. They have existed for more than a decade and have repeatedly failed to reach mass adoption. The reason was never a lack of interest. It was structural friction. High transaction costs, slow settlement, ambiguous resolution rules, and weak liquidity incentives made early onchain prediction markets difficult to use and even harder to trust.

The environment of 2025 to 2026 looks materially different. Information itself has become abundant, fragmented, and increasingly unreliable. AI generated content, real time social media narratives, and geopolitical uncertainty have pushed markets to search for new ways to price probability rather than opinion. In this context, prediction markets are no longer framed as novelty betting platforms. They are increasingly treated as alternative information instruments.

Platforms like Polymarket have already demonstrated that there is sustained demand for onchain probability markets, particularly around elections and macro events. At the same time, their limitations remain visible. Market creation is narrow. Event coverage is concentrated. User experience still reflects the constraints of earlier blockchain infrastructure.

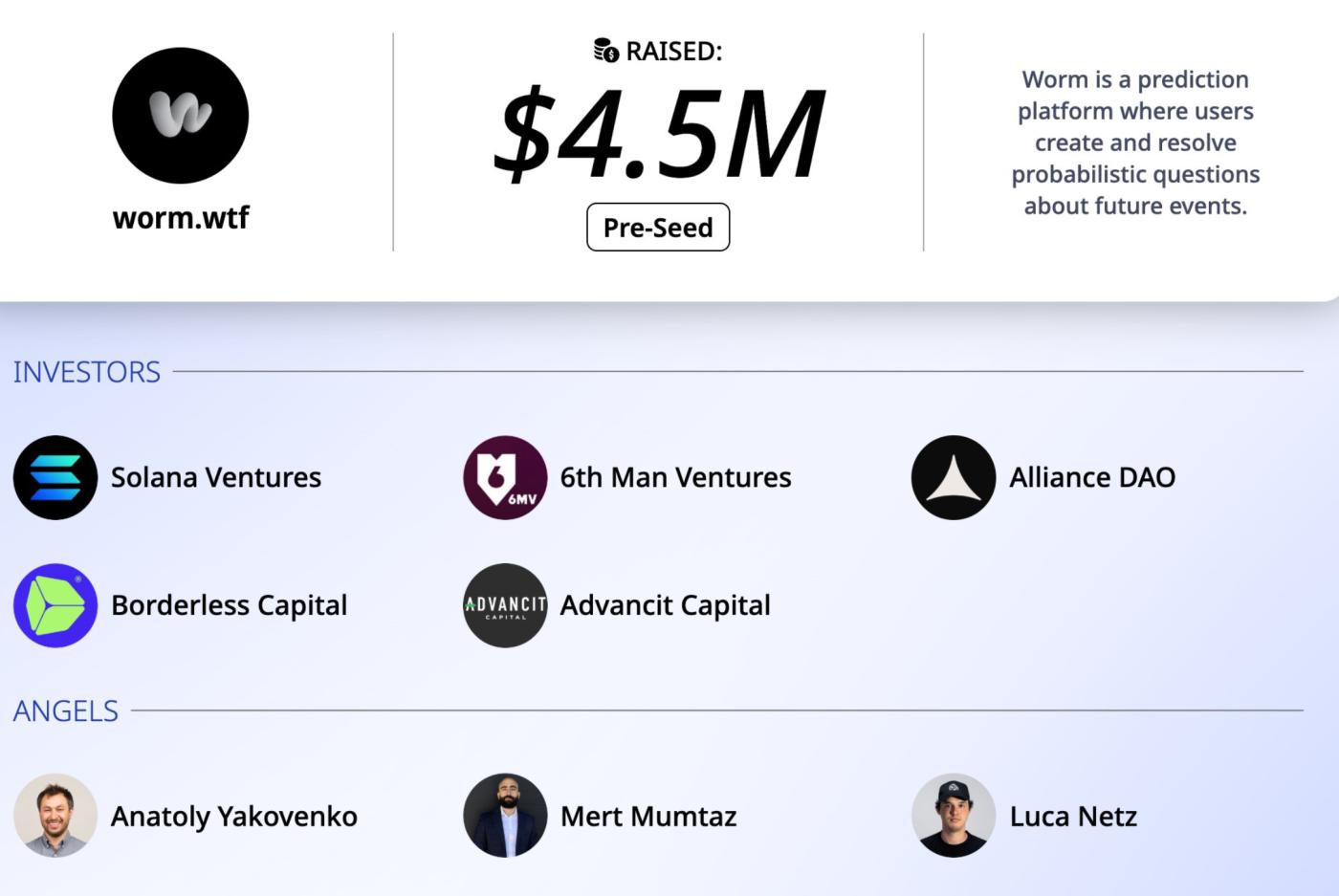

Worm.wtf enters this landscape not as the first mover, but as a response to these constraints. Its core question is not whether prediction markets should exist, but what they look like when optimized for speed, long tail events, and social distribution rather than institutional caution.

INFRASTRUCTURE CHOICE AND ITS CONSEQUENCES

Worm.wtf is built natively on Solana, a decision that shapes nearly every aspect of the product. Prediction markets are unusually sensitive to latency and cost. Many events have short half lives. A delay of seconds can determine whether a market captures attention or misses it entirely.

Solana’s low transaction fees and near instant confirmation make frequent interaction economically viable. Micro sized positions, rapid rebalancing, and high frequency participation are structurally feasible in ways that remain difficult on Ethereum or its scaling layers. This allows Worm.wtf to support smaller and more numerous markets, including events that would never justify listing on a higher cost chain.

However, infrastructure advantages are not free. Solana’s history includes network outages and stability concerns that are largely irrelevant for slow moving financial primitives but become more consequential for real time markets. Speed also does not address regulatory exposure, nor does it guarantee durable liquidity. Infrastructure lowers friction, but it does not automatically create trust.

In this sense, Solana is better understood as an enabling condition rather than a moat. Worm.wtf gains flexibility and responsiveness, but it also inherits the operational and reputational tradeoffs of a high performance chain.

MECHANISM DESIGN AND TRADEOFFS

Bonding Curves and the Cold Start Problem

One of the persistent failures of earlier prediction markets was the empty order book. Markets without early participants simply never formed. Worm.wtf addresses this through a bonding curve based pre sale phase that allows markets to exist before two sided liquidity emerges.

This mechanism ensures that the first participant can always trade against the protocol itself. Price adjusts automatically as supply changes, allowing early conviction to be expressed even in the absence of counterparties. For long tail events, this significantly lowers the barrier to market creation.

The tradeoff is price distortion risk. Early prices are shaped by limited participation and are vulnerable to manipulation by bots or coordinated actors. While this phase improves market availability, it does not guarantee efficient price discovery. It optimizes for activation, not accuracy.

Optimistic Resolution via UMA

For settlement, Worm.wtf relies on the optimistic oracle model provided by UMA. Rather than verifying outcomes onchain by default, the system assumes correct reporting unless challenged. Disputes trigger an economic arbitration process.

This design is well suited to prediction markets, where many outcomes are qualitative or context dependent. It avoids the rigidity of fixed data feeds and allows human judgment to intervene when needed.

The cost is governance overhead. If disputes become frequent or contentious, resolution times lengthen and confidence erodes. The model works best when disagreement is rare. Its effectiveness depends on social and economic alignment rather than pure cryptography.

AI Assisted Market Creation

Worm.wtf also introduces AI assisted market drafting. The AI does not predict outcomes. Its role is to translate informal human questions into structured, resolvable conditions.

This lowers the cognitive burden of market creation and makes participation more accessible. At the same time, it risks scaling low quality or ambiguous markets if incentives favor quantity over clarity. Automation accelerates both good and bad inputs.

POSITIONING WITHIN A FRAGMENTING MARKET

Prediction markets are no longer converging toward a single dominant model. They are diverging based on audience and use case.

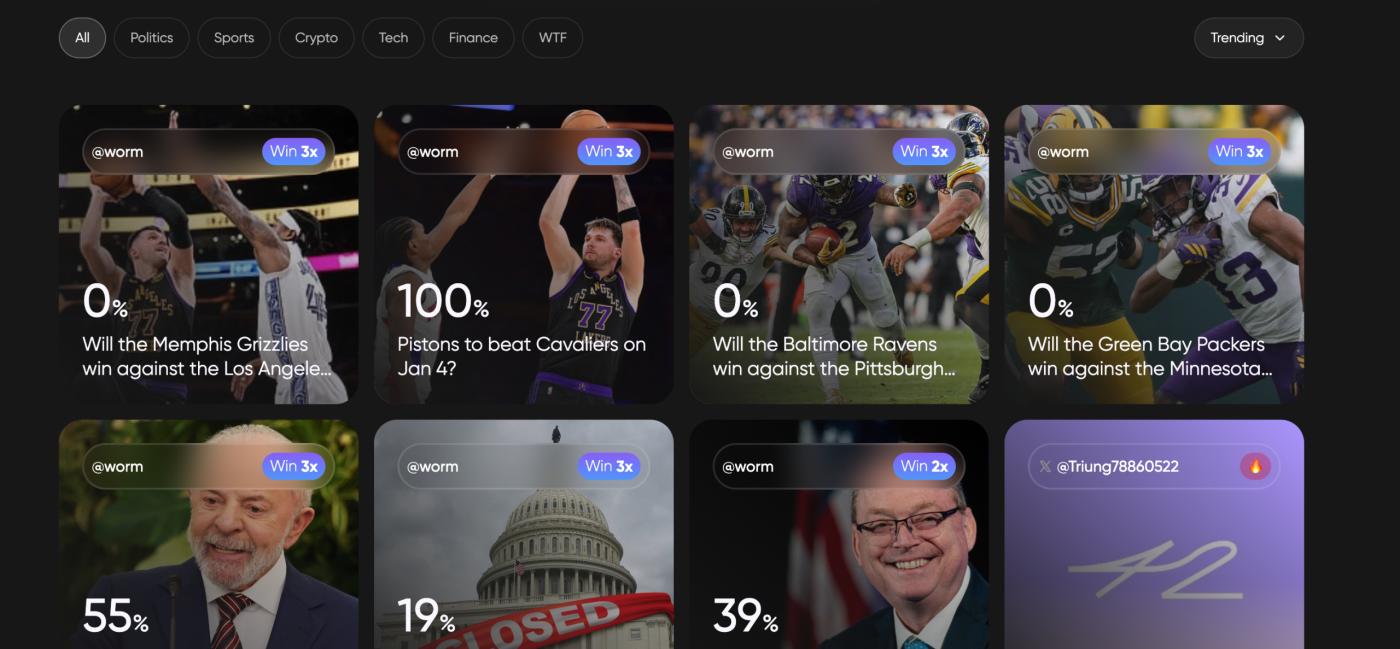

Worm.wtf prioritizes speed, social relevance, and long tail events. It performs best where attention moves quickly and where users value expressiveness over capital efficiency. Meme culture, entertainment, and short lived political narratives fit naturally into this design.

Polymarket remains better suited for large, well defined events with deep liquidity and strong reference value. Its markets are slower to expand but often more informative at scale.

Regulated platforms such as Kalshi serve a different segment entirely. Compliance enables fiat access and institutional participation, but restricts scope and flexibility.

Rather than competing directly, these platforms occupy adjacent layers. The market appears to be segmenting rather than consolidating.

WHAT WORM.WTF IS ACTUALLY BETTING ON

Worm.wtf is not betting on prediction markets as a novelty. It is betting on three assumptions.

First, that information volatility will continue to increase, creating demand for fast and expressive probability markets.

Second, that users are willing to tolerate some inefficiency and risk in exchange for immediacy and relevance.

Third, that social distribution can substitute for traditional liquidity bootstrapping in early stage markets.

If these assumptions hold, Worm.wtf can grow rapidly in volume and cultural relevance. If they fail, the platform risks becoming noisy rather than informative.

The project should be understood as an experiment in form, not a final answer. Its success will depend less on technical novelty and more on whether its tradeoffs align with how people actually want to engage with uncertainty.

〈Worm.wtf and the New Economics of Prediction Markets〉這篇文章最早發佈於《CoinRank》。