Author: zhou, ChainCatcher

2025 will be a year of dramatic divergence in global asset markets.

Geopolitical conflicts, recurring inflation, the explosion of AI technology, and large-scale purchases by central banks have driven a strong comeback for traditional hard assets, while cryptocurrencies are under pressure amid the tug-of-war between institutional expectations and macroeconomic realities.

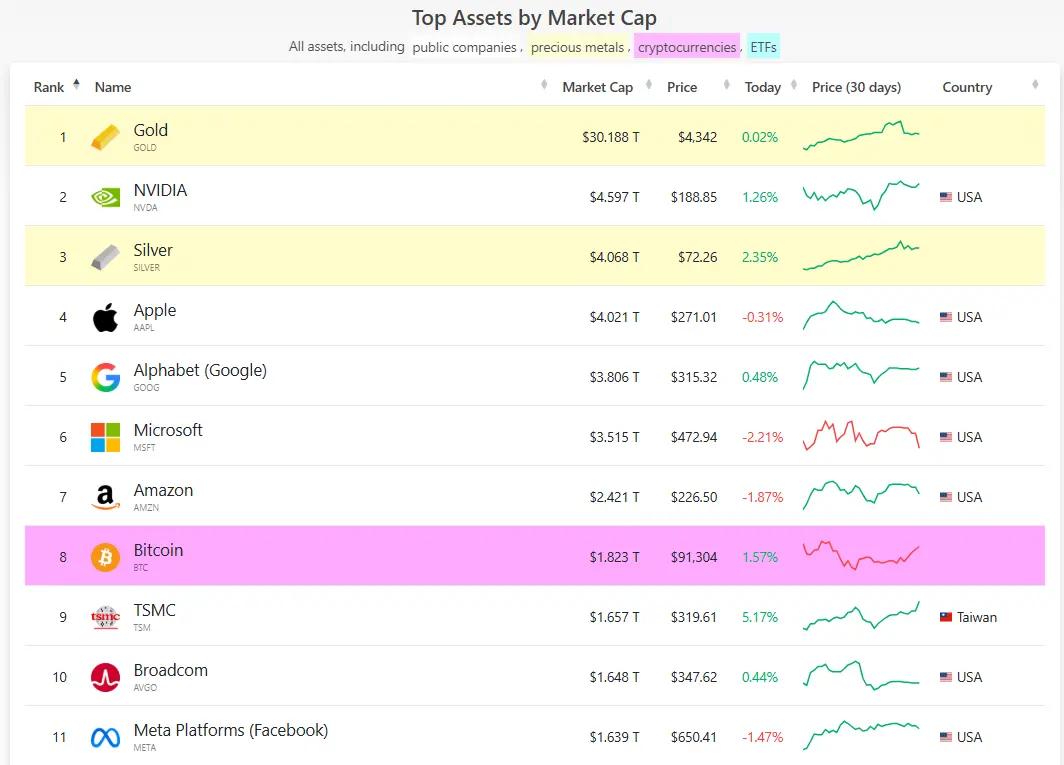

Changes in the world's top ten assets in 2025 : Gold dominates the list, silver rises, and Bitcoin surges and then falls back.

According to data from CompaniesMarketCap , the ranking of the world's top ten assets in 2025 will show a profound structural adjustment. Gold will lead by a wide margin with a theoretical market capitalization of approximately $ 30 trillion, while silver's market capitalization will approach $ 4 trillion and enter the top three. Technology stocks occupy the middle of the rankings, while Bitcoin's market capitalization of approximately $ 1.8 trillion will slip to eighth place.

Hard assets gold and silver dominated the year-end narrative

As a safe-haven asset, gold prices surged from $ 2,630 at the beginning of the year to $ 4,310 at the end, a more than 65% increase, marking its biggest gain in 46 years. Driven by central bank purchases and geopolitical risk aversion, its market capitalization nearly doubled, surpassing the combined market capitalization of all listed companies. Silver, on the other hand, became the biggest dark horse of the year, with its price soaring from $ 29 at the beginning of the year to $ 72 , a 150% increase, far exceeding that of gold. In addition to its safe-haven attributes, the explosive growth in industrial demand, such as photovoltaics and AI computing power, propelled silver from a marginal asset into the top three globally.

AI- related tech stocks are strong but are entering a consolidation phase.

Nvidia, the chip industry leader, saw its market capitalization grow by 30% to $ 4.6 trillion, briefly surpassing the $ 5 trillion mark earlier this year. TSMC and Broadcom benefited from increased computing power demand, with their market capitalizations both climbing from $ 1 trillion to $ 1.6 trillion, representing a 60% increase. Although the AI sector as a whole reached a record high, its growth rate has stabilized, reflecting a more cautious market assessment of the realization of productivity.

Bitcoin surged and then retreated, showing relative weakness.

Although Bitcoin briefly surged to $ 126,000 mid-year, entering the top five globally in market capitalization, a flash crash and volatility in the fourth quarter brought its price back to around $ 88,000 by the end of the year. With a negative 8% return for the year, this marks the first time Bitcoin has recorded a negative return in the year following a halving cycle.

Established tech giants have performed steadily but generally lack explosive growth potential.

Alphabet saw a 52% increase thanks to the integration of Gemini AI , pushing its market capitalization to $ 3.8 trillion. Amazon, Microsoft, and Apple saw gains ranging from 14% to 33% , although their overall growth has slowed significantly despite their continued dominance in search, cloud computing, and consumer electronics. Meta's market capitalization rose to $ 1.67 trillion, thanks to its Llama model and record engagement on its social platform, narrowly competing with Broadcom for tenth place at the end of the year.

It's worth noting that in the 2025 asset ranking reshuffle, several traditional giants were squeezed out of the top ten. Eli Lilly , which previously led the market thanks to the weight-loss drug boom, saw its growth slow due to the siphon effect of AI- related stocks, slipping to around 15th place. Furthermore, companies like Tesla and Saudi Aramco , which approached or briefly entered the top ten at the beginning of the year, saw their rankings decline to between 15th and 20th for the entire year due to intensified competition in the EV market, oil price volatility, and the explosive growth of technology / precious metal assets. This series of changes highlights a structural shift in global capital flows between the foundation of AI computing power and the demand for safe-haven assets in hard assets.

Overall, the turning point for global asset markets in 2025 lies in the suppression of technology stocks by the market capitalization of hard assets. Technology stocks faced bubble concerns at historical highs, while Bitcoin experienced a shift from frenzy to exhaustion after a high opening and subsequent decline, becoming the relative loser of the year.

Why has Bitcoin underperformed compared to previous years? The narrative has shifted from fervor to weariness.

Bitcoin's performance in 2025 exhibited a typical pattern of initial rise followed by a decline. At the beginning of the year, driven by expectations of pro-crypto policies, large-scale inflows into institutional ETFs , and macro-easing policies, its price started from the $ 90,000 mark and reached an all-time high of $ 126,000 in October , with its market capitalization once exceeding $ 2.4 trillion.

However, the situation took a sharp turn for the worse in the fourth quarter, with a dramatic flash crash pushing prices down to a low of $ 84,000 . Bitcoin ultimately closed at around $ 88,000 , recording a negative return of about 8% for the year. Compared to gold's 70% gain and silver's over 140% gain, Bitcoin's relative weakness reflects its vulnerability in a complex macroeconomic environment.

The reasons for this performance come from multiple dimensions.

First, there was the pressure of tightening macro liquidity and the redistribution of funds. The Federal Reserve's slower-than-expected rate cuts in the second half of the year, coupled with the Bank of Japan's continued rate hikes, led to a tightening of global liquidity. Funds were forced to withdraw from highly volatile assets and flow into safe-haven assets like gold and silver, or productivity-oriented equity markets. Meanwhile, the correlation between Bitcoin and US stocks surged from 0.23 at the beginning of the year to over 0.86 by the end, gradually diminishing its appeal as an independent asset allocation.

Secondly, the selling and leveraged liquidation by long-term holders amplified market volatility. In 2025 , a record-breaking 1.6 million Bitcoins were sold by whales, creating sustained supply pressure. The flash crash on October 10th wiped out months of gains in a very short time, triggering a chain reaction in the derivatives market. Matrixport points out that since the peak in October 2025 , the leverage corresponding to the open interest in BTC and ETH futures contracts has been cleared by nearly $ 30 billion, and excessive leverage made it difficult for the market to quickly restore confidence after the crash.

Furthermore, the slowdown in institutional adoption further exacerbated downward pressure. Although Bitcoin ETFs maintained net inflows throughout the year, billions of dollars were withdrawn in the fourth quarter. Corporate buying was also significantly limited, with some companies holding digital assets ( DAT ) experiencing stock price declines, leading to a period of Bitcoin selling. The cooling of institutional sentiment directly suppressed market performance at the end of the year, preventing Bitcoin from continuing its previous successes in 2025 .

The future of Bitcoin?

Despite Bitcoin recording negative returns in 2025 and breaking the traditional four-year cycle expectation, the consensus among institutional investors remains optimistic. The market generally believes that this year's deep correction is paving the way for a more sustainable and institutionally driven upward trend in the future.

With the arrival of 2026 , global macro liquidity is gradually improving and the regulatory environment is becoming clearer. Bitcoin is expected to end its current period of volatility and return to a growth trajectory, and may even challenge new historical highs.

According to multiple media reports, publicly available forecasts show that analysts such as Tom Lee , Standard Chartered, and Bernstein are generally bullish, but there are also differing opinions.

Most mainstream target prices fall between $ 140,000 and $ 170,000 , for example:

JP Morgan, using a volatility-adjusted gold ratio model, calculated a theoretical fair value of approximately $ 170,000 for Bitcoin, suggesting that it still has significant upside potential.

Standard Chartered and Bernstein set a target of around $ 150,000 by the end of 2026 , emphasizing that ETF inflows, structural support following a slowdown in corporate treasury adoption, and long-term institutional capital inflows will dominate the cycle.

Grayscale defines 2026 as the dawn of the institutional era, predicting that Bitcoin will reach a new all-time high in the first half of the year, ending the traditional four-year cycle and turning to a steady upward trend driven by sustained institutional demand.

Bitwise believes ETFs will absorb more than 100% of the new supply, further strengthening price support, and predicts 2026 will be a bullish year. Citigroup's baseline scenario is $ 143,000 , with a bullish scenario reaching $ 189,000 .

Beyond these mainstream views, there are also more radical perspectives. For example, Cardano founder Charles Hoskinson predicts that Bitcoin's price could reach $ 250,000 , arguing that the fixed supply of Bitcoin and the continued growth in institutional demand will create a strong driving force.

However, there are also significant bearish voices in the market. Mike McGlone of Bloomberg Intelligence is the most pessimistic, believing that in a deflationary macroeconomic environment, Bitcoin could fall back to $ 50,000 or even $ 10,000 , and he particularly emphasizes the mean reversion risk faced by speculative assets.

Matrixport believes 2026 will be a year of high volatility rather than a stable trend. The market will face a dense window of risk events, influenced by changes in Federal Reserve leadership, a weak labor market, and policy risks associated with an election year. The firm advises investors to remain flexible and actively manage their positions, accurately assessing market exposure before and after key policy events.

Overall, despite significant discrepancies in forecast data, mainstream institutions generally agree that 2026 will be a year of structural rebound for Bitcoin. ETFs as a permanent demand engine, regulatory clarity, and accelerated corporate / institutional allocation will be key catalysts. In the short term, Bitcoin prices may bottom out in the $ 80,000 to $ 100,000 range, but with the macroeconomic shift and capital inflows, the probability of an upward breakout is significantly increasing.