Blur's third AirDrop of airdrop is one to two times that of AirDrop 2, mainly depending on the activity of bidding NFT series, the degree of proximity to the floor price, and the duration of bidding. The rarity of the AirDrop blind box continues to depend on loyalty.

By Karen, Foresight News

Blur’s third AirDrop of airdrops is the last round of AirDrop before the project launched its tokens in January. It is mainly aimed at bidders, and the AirDrop strength is one to two times that of AirDrop 2.

Blur stated in the operating rules of AirDrop 3 published early this morning that the points reward for AirDrop 3 mainly depends on the activity of bidding NFT series, the degree of proximity to the floor price, and the duration of bidding.

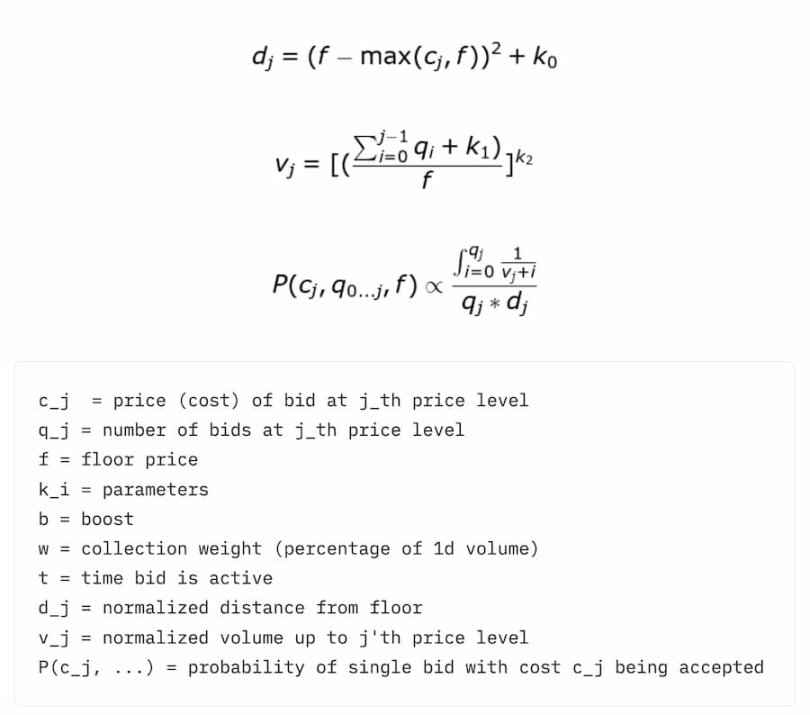

Specifically, Blur rewards users with points for their bidding activity based on the 24-hour trading volume of the NFT series. In a series, the bid that takes the highest risk will get more points, that is, the closer the bid is to the floor price, the more points the bid lasts. The longer the time, the more points are earned, and when the bid is accepted by the NFT holder, the bid stops earning points. The specific calculation method is:

Although the Blur AirDrop 3 has little to do with the amount of ETH bid, if it is a relatively active NFT series, as long as it is close to the floor price, that is, bear the highest risk, you can get more points. However, based on the 24-hour trading volume, the first two NFT series are BAYC and MAYC, and the floor prices are 62 ETH and 13.31 ETH respectively. Seven of the top 10 NFT series have a floor price of more than 5 ETH, and only one series has a floor price of more than 5 ETH. The floor price is less than 0.1 ETH. 7 of the top 10 NFT collections had top bids above the floor, suggesting that Blur's bidding incentives are working.

Of course, users can also reuse their ETH deposited in the bidding pool across series. In addition, Blur also set up a rolling 24-hour leaderboard, providing the top 100 bidders with a point boost multiplier of up to 2.5 times.

The rarity of the Package in AirDrop 3 also uses the same loyalty factor as AirDrop 2, that is, as long as the price set by the user when listing NFT on other NFT markets is lower than the price set in Blur, it will not affect the loyalty score. Loyalty has nothing to do with the number of blind boxes obtained.

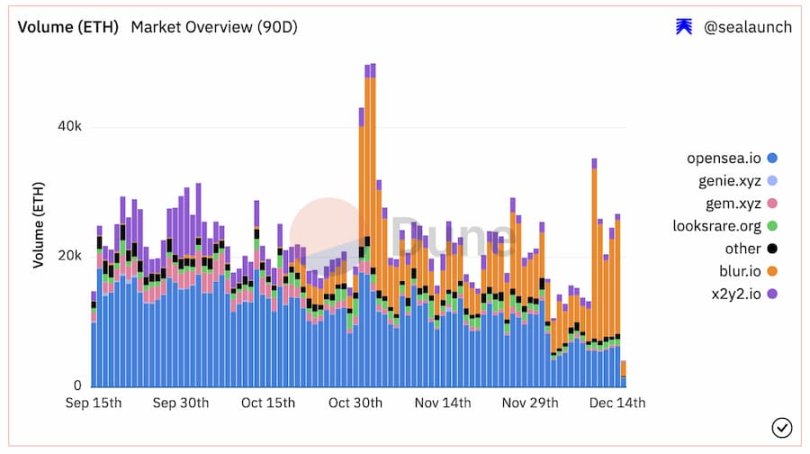

As of writing, the Blur bidding pool has accumulatively deposited 18,000 ETH, or about $23.2 million. According to Dune data, in the first half of December, Blur's transaction volume exceeded OpenSea's on about half of the dates. On December 10, Blur's transaction volume reached 4.6 times that of OpenSea to 26,000 ETH. As of now, Blur has a 56% market share in the NFT market by volume.

Trading volume data of each NFT market, source: Dune

To sum up, Blur’s third AirDrop is mainly for bidders. Although it does not encourage brushing transactions, it can increase the depth and liquidity of buyers to a large extent. The token economic system after the token launch in January next year is worth looking forward to.