Editor's Note: Amidst the clamor surrounding geopolitics, electoral maneuvering, and macro narratives, Arthur Hayes (co-founder of the crypto exchage BitMEX) deliberately avoids moral judgments and value judgments. Instead, he uses a trader's detached perspective to compress complex issues into a few core variables that can be verified by the market: nominal GDP, oil prices, credit expansion, and the resulting pricing of risky assets.

As one of the most controversial and "trader-representative" voices in the crypto market, Hayes consistently analyzes the trading implications behind political events from the perspectives of power, liquidity, and price. In this article, he narrows down the US election, energy prices, and the logic of money printing into a single, stark question: Will money printing continue, and will risk assets continue to rise?

The following is the original text:

An overheard conversation

Scene: U.S. President Donald Trump connects via video link to a plane that is transporting Venezuelan President Pepe Maduro from Caracas to New York.

Trump: Pepe Maduro, you're a real bastard. Your country's oil is mine now. USA! USA! USA!

Pepe Maduro: You son of a bitch! You crazy American.

I can imagine that right now, a group of Venezuelans living abroad are completely letting loose in Miami, the "drug finance capital" of the Western Hemisphere, dancing energetically to songs like Elvis Crespo's "Suavemente".

As a qualified "armchair strategist" in macroeconomics, I naturally have to offer my thoughts on this historic, game-changing, authoritarian, militarized—you can fill in any superlative or derogatory adjective you like—the "kidnapping/legal arrest" of a sovereign nation's leader by the United States.

I'm sure countless authors using AI will produce "text salads" worth millions of tokens, attempting to characterize, model, and predict these events. They'll judge these actions from a moral high ground, telling you "how other countries should respond."

I will not do any of those things.

I only care about one question: Will the US colonization of Venezuela cause the price of Bitcoin/cryptocurrency to rise or fall?

As a ski bum, I need the simplest possible analytical framework to understand this chaotic universe. Let me reiterate: for all politicians elected democratically, the sole core objective at all times is re-election.

Glory to God, loyalty to the country, or any lofty ideal must take a backseat to winning votes. Because if you're not in power, you can't make any changes. In this sense, this obsession with re-election is "rational."

For US President Trump, there are two elections that are truly important: the midterm elections in November and the presidential election in 2028.

Although he himself will neither run for re-election in 2026 nor for a third presidential run in 2028, the loyalty and obedience of his political supporters depend on their individual success in re-election. Currently, people are constantly "leaving" the dilapidated tent of MAGA precisely because they fear that continuing to act according to Trump's demands will bleak their future electoral prospects.

So the question is: what can Trump do to ensure that undecided voters—those who are neither entirely "blue team Democrats" nor entirely "red team Republicans"—go to the polls in 2026 and 2028 and vote "the right way"?

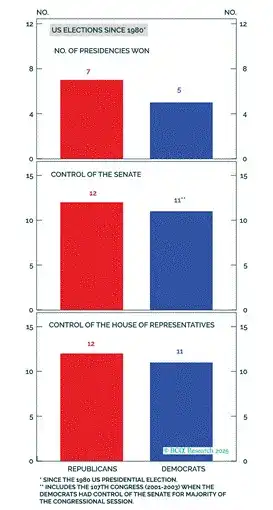

As of now, the blue team (Democrats) will regain control of the House of Representatives. If Trump wants to remain a winner, he needs to get things sorted out quickly; time is running out for policy reversals and getting voters to switch sides.

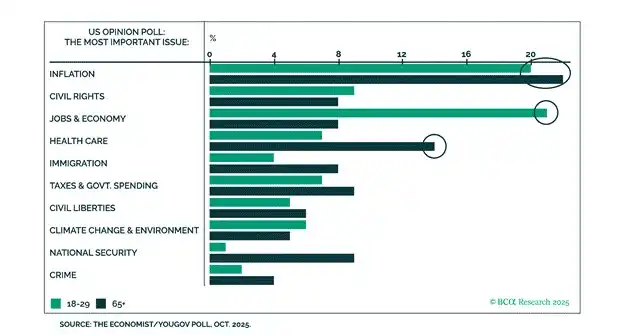

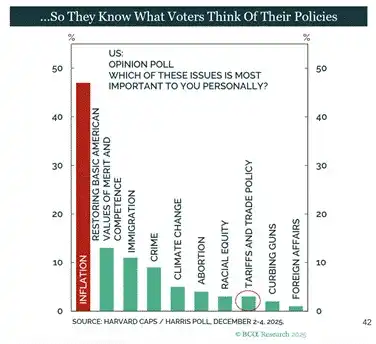

Most importantly, I will use statistics and charts to demonstrate that the only issue median voters truly care about is the economy. The cultural issues that Trump's opponents and supporters are obsessed with on social media (although the memes are indeed quite good) are utterly insignificant compared to whether voters feel "richer or poorer" the moment they walk into the polling station and pull the curtain.

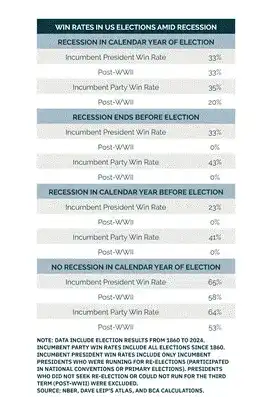

Stimulating the economy is actually quite easy; I'm referring to nominal GDP. It's essentially just a matter of how much credit Trump is willing to create. Rising nominal GDP will drive up financial asset prices; the wealthy will also "dutifully" hand over their "bribes"—cough, cough—campaign donations to the Red Team as a token of gratitude. But in the United States, the rule is one person, one vote. If rising nominal GDP is accompanied by soaring inflation, the lower classes have every right to drag the entire party down.

Trump and Treasury Secretary Bill Bessant have indicated they will keep the economy running at full speed. I believe they will, but the question is: how do they intend to control inflation?

The inflation that will truly jeopardize his re-election prospects is food and energy inflation. For Americans, the most critical indicator is gasoline prices, because for most people, convenient and affordable public transportation is virtually nonexistent. In America, if you're a working-class person and don't own a car, you can barely live a normal life—it's unfortunate, but it's the reality. This is precisely why Trump and his advisors went to "colonize" Venezuela for oil.

When discussing Venezuelan oil, many immediately point out that the country possesses the world's largest proven oil reserves. But the question is, who cares how much oil is buried underground? The key question is: can this oil be extracted profitably?

I don't know the answer to that question, but Trump clearly believes that as long as he turns the tap, Venezuelan oil will flow continuously to refineries along the Gulf Coast, and cheap gasoline will appease the lower classes by suppressing energy inflation. I can't say whether Trump is right or wrong, but the WTI and Brent crude oil markets will be a real "truth serum."

The question is: when nominal GDP and the supply of dollar credit increase, will oil prices rise or fall?

If GDP and oil prices rise together, the blue team, the Democrats, win; if GDP rises but oil prices remain flat or fall, the red team, the Republicans, win.

The most ingenious aspect of this analytical framework is that oil prices will reflect the reactions of all other oil-producing countries and military powers—especially Saudi Arabia, Russia, and China—to the US “colonization” of Venezuela.

Another advantage is that markets are reflexive. We all know that Trump adjusts his policies based on the stock market, Treasury bonds, and oil prices. As long as the stock market continues to rise and oil prices remain low, he will continue to print money, expand, and take action around oil.

As investors, we can react on a timescale almost in sync with Trump's—which is the best we can hope for. This approach reduces the need to predict the ultimate trajectory of an extremely complex geopolitical system. Look at the charts, adjust accordingly, gamblers.

Below are some charts and statistics that clearly demonstrate that if Trump wants to win the election, he must boost nominal GDP while drastically reducing oil prices.

The red team and the blue team are evenly matched.

Only a small percentage of Americans decide which side should control the government.

The economy and inflation are the two issues that voters care about most, and nothing else matters.

The "10% rule" states that if the national average gasoline price rises by 10% or more in the three months leading up to an election compared to the average price in January of the same calendar year, then one or more branches of government will likely experience a change of ruling party.

Bitcoin Mooning

Because Proof-of-Work (PoW) mining consumes a large amount of energy, Bitcoin is the purest abstract form of currency. Therefore, energy prices themselves are not directly related to Bitcoin prices—because whether energy prices rise or fall, all miners will face the same cost changes simultaneously.

The real significance of oil prices lies in whether they will force politicians to stop printing money. If oil prices rise too quickly and too high due to economic expansion (which itself is a derivative variable of energy), then politicians must find ways to bring oil prices down—for example, by "getting oil from other countries" or slowing down credit creation—or risk being ousted from office by voters.

The 10-year US Treasury yield and the MOVE index, which measures volatility in the US bond market, will tell us whether oil prices are already unbearably high.

Investors face a difficult choice: invest in financial assets or invest in physical assets.

When energy costs are low and stable, investing in financial assets such as government bonds is reasonable; however, when energy costs are high and fluctuate wildly, it is more prudent to store wealth in energy-related commodities.

Therefore, when oil prices rise to a certain level, investors will demand higher returns from government bonds, especially 10-year U.S. Treasury bonds. U.S. politicians cannot stop spending on the fiscal deficit because "giving away money for free" is always a winning strategy in elections.

When oil prices rise and the 10-year Treasury yield approaches 5%, politicians are forced to change their behavior. The reason is that as the 10-year yield nears 5%, the massive leverage embedded in this dirty fiat currency financial system begins to spiral out of control, and bond market volatility (measured by the MOVE index) increases dramatically.

The entire fiat currency system is essentially a highly leveraged arbitrage transaction. When volatility rises, investors must sell assets, or they might lose even their custom-made Savile Row suit.

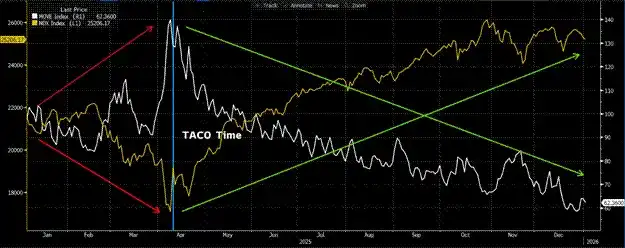

A recent example is the "Liberation Day" on April 2nd last year, and the "Trump TACO" incident seven days later on April 9th.

If you recall, Trump threatened to impose extremely high tariffs, high enough to genuinely reduce global trade and financial imbalances—which would be highly deflationary on a macro level. The market reacted sharply, with the MOVE index surging to a high of 172 at one point during the session.

The day after the volatility spiked, Trump backed down (TACO) and announced a "pause" of tariffs, which caused the market to bottom out and rebound strongly.

MOVE Index (white line) vs. Nasdaq 100 Index (yellow line)

Trying to use historical data to determine at what level oil prices and 10-year US Treasury yields Trump will tighten the Fed's printing press is meaningless. We'll know when it actually happens; if oil prices and yields start to rise sharply, it means it's time to be cautious about risky assets.

The baseline scenario is that oil prices remain low, or even fall, while Trump and "Buffalo Bill" Bessant print money like they did in 2020. This is because the market initially believes that US control over Venezuelan oil will lead to a significant increase in daily crude oil production. Whether these optimistic predictions of a surge in crude oil supply will ultimately materialize once engineers actually bring millions of barrels per day of production capacity online remains to be seen.

But that doesn't matter. You only need to remember one thing: Trump will print money faster than Israeli Prime Minister Benjamin Netanyahu keeps changing his rhetoric about "why Iran deserves another military strike."

If this logic isn't enough to convince you that now is the time to long on all risky assets because of America's aggressive money printing, then remember—Trump is the most "socialist" US president since Roosevelt.

He has printed trillions of dollars, and unlike previous presidents, in 2020 he distributed the money directly to everyone. You'd better believe that he will not lose the election because he "didn't print enough money."

Mamdani and Trump are both New Yorkers, you know—birds of a feather flock together.

True traders must stop projecting their emotions onto terms like "socialism," "communism," and "capitalism." No government truly acts in the pure form of these "isms"; everyone is merely distorting and piecing together these concepts for their own political purposes.

Don't be a sucker, just buy it directly.

If we interpret the situation according to what Trump and his aides say, then one thing is certain: credit will expand.

Red Team Republican lawmakers will continue to spend through fiscal deficits; the Treasury Department, led by "Buffalo Bill" Bessant, will issue bonds to finance it; and the Federal Reserve, led by "beta coward" Jerome Powell and his successor, will print money to buy those bonds.

This self-indulgent cycle truly began in full swing in 2008. As Lyn Alden put it, "Nothing can stop this train."

As the amount of US dollars continues to expand, the price of Bitcoin and some cryptocurrencies will skyrocket.

The rise of Bitcoin (digital gold) stems directly from money printing. This can be clearly seen in my constructed US Dollar Liquidity Conditions Index (Bloomberg code: .USDLIQ U Index).

Trading Tactics

Before discussing Maelstrom's current position, I'd like to do a quick review of my trading performance last year.

I say "my performance" because I made all the trading decisions myself. Last year, my liquidity steering wheel was generally profitable. My goal was to cover daily expenses with trading profits, and I've achieved that multiple times. While ultimately profitable, I also wasted a significant amount of PNL on a few bad trades.

My biggest single loss came from trading PUMP tokens immediately after their launch. Furthermore, I must stay away from meme coins—the only meme coin I've ever made money on is Trump.

On the bright side: my most profitable trades came from HYPE, BTC, PENDLE, and ETHFI.

Last year, only 33% of my trades were profitable, but my position management was correct: the average return of profitable trades was 8.5 times the average loss of losing trades.

This year, I will improve performance by focusing on what I truly excel at: building large medium-term positions based on a clear macro liquidity logic, and this logic must be able to support a plausible Altcoin narrative. As for those shit coin or meme coins that I gamble on purely for fun, I will significantly reduce the size of my positions.

Looking ahead, the core market narrative this year will revolve around privacy. ZEC will become the beta in the privacy sector, and we have already established a very large long position in ZEC at an excellent price in the third quarter of 2025.

The Maelstrom team's current focus is on finding at least one leading Altcoin within the privacy narrative that can truly stand out and deliver excess returns to the portfolio over the next few years.

By 2026, Maelstrom's risk exposure will be almost at its maximum. We will continue to invest idle cash generated from various financing transactions into Bitcoin, resulting in a very low USD stablecoin position.

To achieve excess returns relative to BTC and ETH: I would sell BTC to increase my holdings of privacy-related assets; I would sell ETH to increase my holdings of DeFi. In both cases, provided I choose correctly, as fiat currency credibility continues to expand, my Altcoin holdings should outperform mainstream assets.

If/when oil prices rise and cause credit creation to slow down, I hope to take profits then, stock up on more SATs, and buy some METH.

What a fulfilling day!

I finished writing this article on a day off from backcountry skiing. Now it's time to head to the gym and work out some heavy weights to make sure I'm still incredibly muscular when I emerge from hibernation in March.