Zcash price has been trading sideways for the past few days, forming a consolidation zone after recent sharp fluctuations. While this stagnation might be considered a negative sign, it often demonstrates strength after a period of growth.

The fact that ZEC price is holding steady around its current level indicates that buyers are holding their position, and recent investor activity further strengthens the positive outlook for ZEC.

Investors holding Zcash are buying.

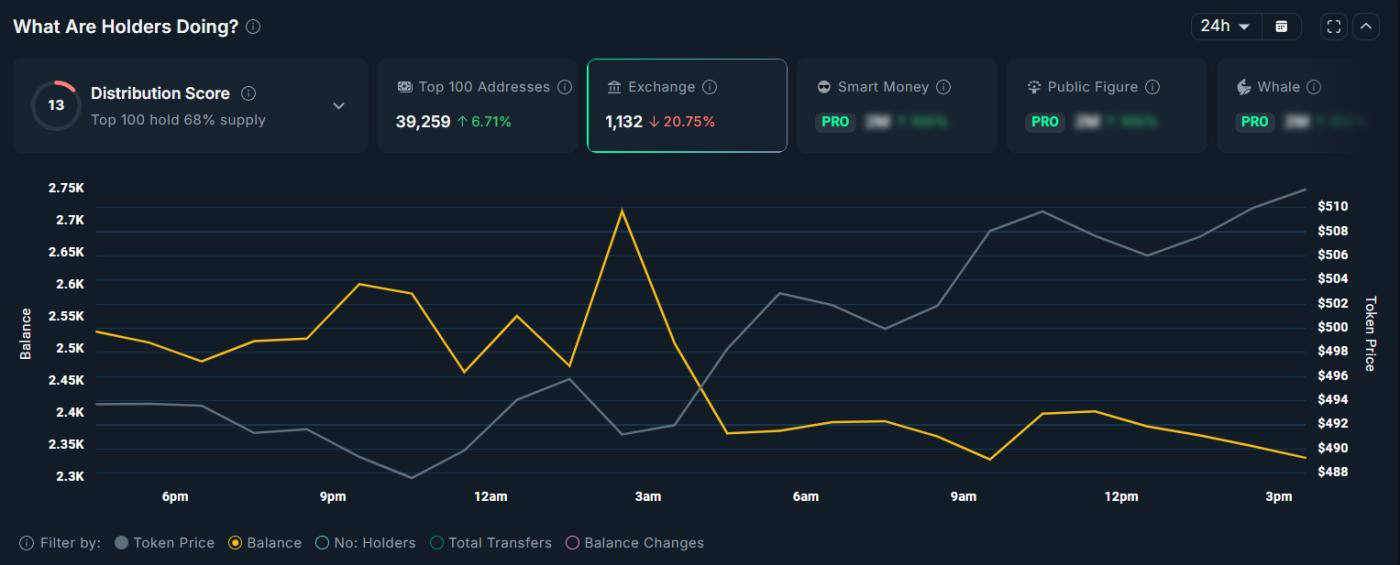

Data from exchanges shows that the available supply of ZEC has decreased sharply. According to Nansen, the amount of Zcash on centralized exchanges has decreased by 20.75% in the past 24 hours. This decline represents a significant outflow of funds, which is usually a sign that investors are accumulating, not distributing.

When coins are delisted from exchanges, selling pressure usually decreases. Investors tend to transfer assets to private wallets when they expect the price to rise. This reflects increasing confidence in ZEC , as most holders choose to hold the coins rather than sell at the current price.

Want to receive more information about Token like this? Sign up for the daily Crypto newsletter from editor Harsh Notariya here .

Amount of ZEC traded on the exchange. Source: Nansen

Amount of ZEC traded on the exchange. Source: NansenContinuous withdrawals from exchanges are often a sign that the price will surge in the future. When the supply on the exchange decreases, the price can react strongly if demand increases. In the case of Zcash, this accumulation trend further strengthens the prediction of a price surge in the current accumulation phase.

ZEC traders also became optimistic.

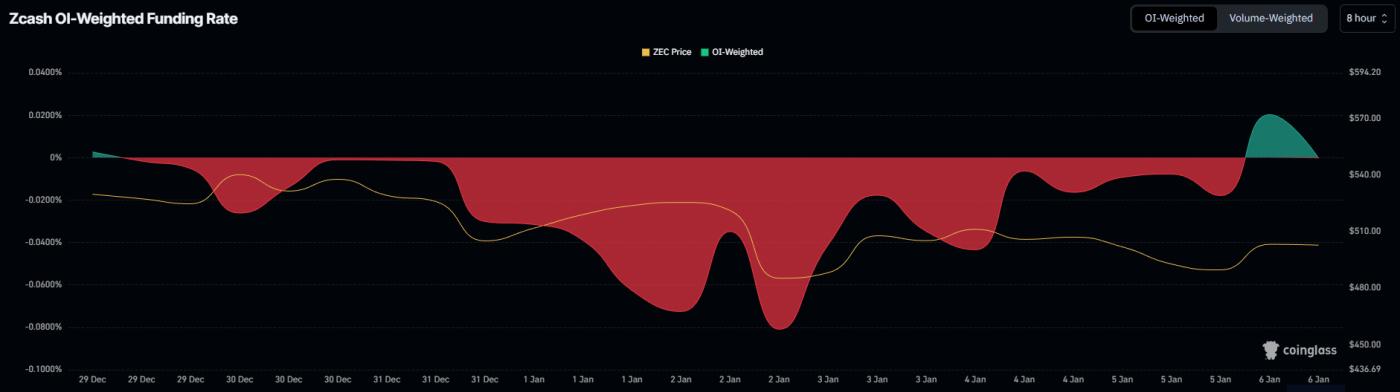

Derivative market data reveals a significant shift in trader positions. For nine consecutive days, ZEC Futures Contract have been predominantly Short, keeping funding rates in negative territory—reflecting the negative sentiment of leveraged traders.

However, in the last 24 hours, the trend has reversed. The funding rate has turned positive, indicating that Longing positions are now dominant. This shift suggests that traders are beginning to believe the price may rise and are betting on an upward trend rather than a further decline.

ZEC's funding rate. Source: Coinglass

ZEC's funding rate. Source: CoinglassA positive funding rate indicates improved market sentiment and a willingness to pay premiums to hold Longing positions. When sentiment in the futures market and accumulation in the spot market align, upward momentum is usually stronger. This reinforces the view that ZEC is likely poised for a new rally.

ZEC price poised for a breakout.

ZEC is currently trading around $512 at the time of writing, moving within a rising wedge pattern. Typically, this pattern ends with a breakout. If it breaks above the resistance zone, ZEC could rise nearly 38%, aiming for a target of $802.

The likelihood of a breakout is increasing after ZEC recently tested and successfully bounced back at the lower trendline. The technical support zone has held, indicating buyer control. Accumulation and positive sentiment in the Derivative market further increase the possibility of a continued upward move. However, to confirm a breakout, the price needs to break above and hold the $600 support Vai .

ZEC price analysis. Source: TradingView

ZEC price analysis. Source: TradingViewDownside risk remains if the market reverses unexpectedly. If selling pressure emerges or a breakout fails, the price could fall. If ZEC breaks below $500, the bullish structure will weaken. In that case, Zcash could drop to around $442, invalidating the current optimistic outlook.