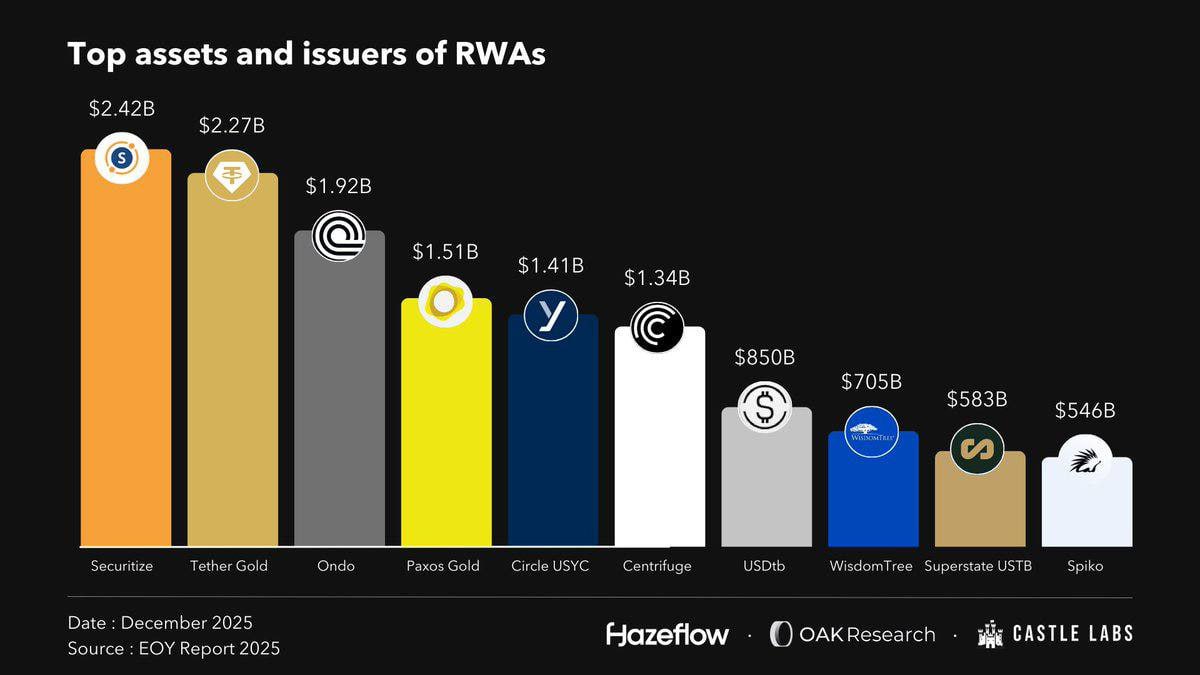

📈 RWA 2026: THE ERA OF INSTITUTIONAL CAPITAL DOMINATING ON-CHAIN FINANCE 2026 marks a historic turning point as major financial institutions officially move away from speculative altcoins to focus on RWAs. This is no longer a fleeting trend but has become the new "backbone" of the digital economy thanks to its efficiency and transparent legal framework. 📊 The explosion of factual numbers: - Rapid growth: The RWA market size has jumped from $3 billion (in 2022) to $36 billion by the end of 2025. - Leading "giants": According to a report from the end of 2025, the top RWA issuers include Securitize ($2.42B), Tether Gold ($2.27B), and Ondo ($1.92B). - Other top contenders include Paxos Gold ($1.51B), Circle USYC ($1.41B), and Centrifuge ($1.34B), which are also capturing significant market share. 🏛 4 Strategic Pillars of RWA in 2026 - Stablecoins: Play a vital role as a liquidation lifeline with a massive user base of up to 200 million people. - Tokenize US bonds: Reached a size of $9 billion, dominated by large funds such as BlackRock (BUIDL) and Ondo. - Private credit: Shifting traditional corporate loans onto on-chain through Securitize and Centrifuge. - Tokenize stocks: A groundbreaking combination of traditional securities and Derivative protocols like Hyperliquid.

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content