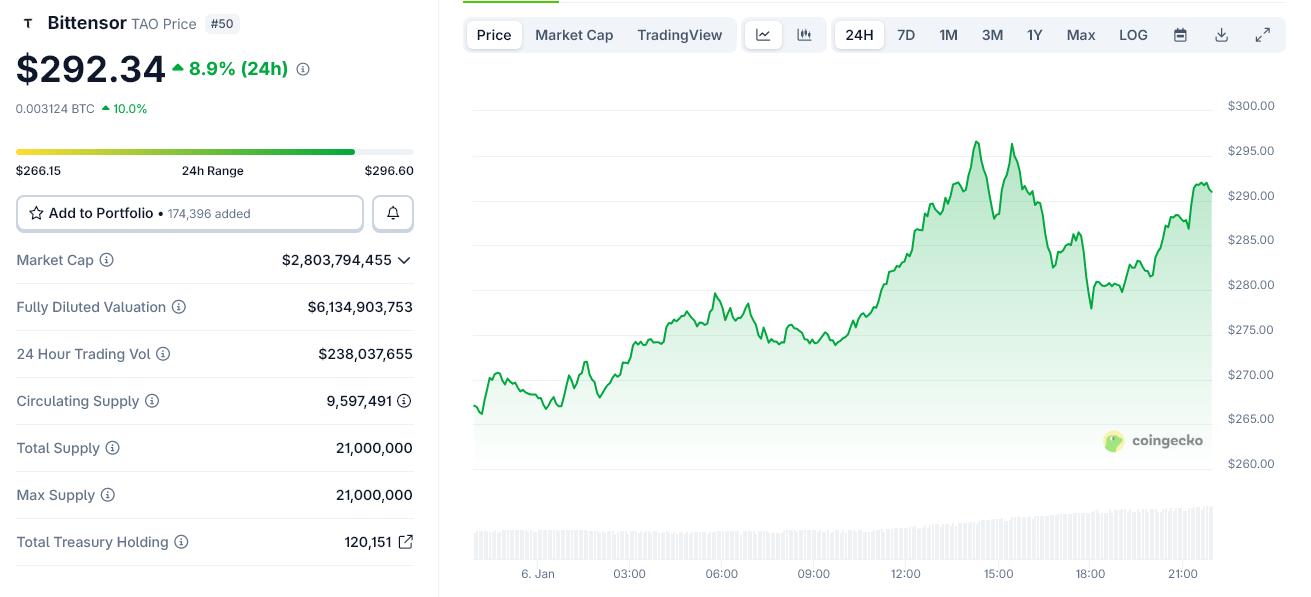

Bittensor (TAO) surged nearly 10% on Tuesday, surpassing $290, after Grayscale officially launched the Grayscale Bittensor Trust (GTAO). This is one of the first managed investment products, giving investors access to a decentralized AI network.

This price surge has pushed TAO to its highest level in weeks, with 24-hour volume exceeding $230 million. This event occurred as investors reacted positively to a wave of interest from large institutions in AI-related crypto assets, especially those with slowing supply growth.

Grayscale launches product to help retail investors access TAO legally.

Grayscale stated that this fund allows investors to access Bittensor's TAO Token through a traditional securities format, without having to directly purchase or hold the asset themselves.

The Fund's shares are currently traded on the OTC Markets under the ticker symbol Grayscale Bittensor Trust (GTAO).

According to Grayscale, GTAO aims to closely track the market price of TAO based on Coin Metrics Real-Time Bittensor Reference Rate, after deducting fees and other expenses.

As of January 5, 2024, the Fund reported an expense ratio of 2.5% and a net asset value of $7.96 per share.

Daily TAO price chart. Source: CoinGecko

Daily TAO price chart. Source: CoinGeckoThis launch follows a series of changes within the Bittensor ecosystem. In mid-December, the Bittensor network completed its first halving, reducing the daily TAO issuance by approximately 50%.

This helped control inflation and made the supply of TAO scarcer. This structure led to Bittensor being compared to Bitcoin's scarcity model.

On the other hand, Grayscale has also filed with US regulators to convert the Bittensor Trust into a spot ETF. This is part of Grayscale Investments ' efforts to diversify its managed crypto investment products beyond Bitcoin and Ethereum.

Although the approval timeline remains unclear, this submission has helped increase the attention of large organizations to TAO access.

Bittensor operates as a decentralized marketplace for machine intelligence, where contributors receive TAO by providing computing power and AI services to the network.

This project is gaining increasing attention as both retail and institutional investors seek blockchain solutions to replace centralized AI infrastructure.

With declining issuance, increased Staking activity, and new regulated access channels, recent TAO price movements suggest the market is reassessing the long-term position of this asset.