Patrick Liou, Director of Institutional at Gemini, predicts 2026 will be a pivotal year for the crypto market. He believes that long-held views on the Bitcoin cycle, regulation, and Capital flows will give way to a new phase, driven by large financial institutions and macroeconomic trends.

In five key takeaways Chia this past week, Liou explains why 2026 could change how investors, policymakers, and even nations view Bitcoin and crypto infrastructure.

Bitcoin's four-year cycle is no longer relevant.

Liou argues that if Bitcoin ends 2026 with negative returns, it would refute the long- Capital "four-year cycle scenario ."

Instead of plummeting by 75–90% like in previous cycles, Bitcoin's price is now only about 30% below its peak , indicating that the market structure is gradually maturing.

This reality is consistent with recent market volatility. Capital flows from ETFs, the depth of the Derivative market, and institutional custody solutions are helping the market absorb supply and demand shocks, rather than creating the extreme price swings seen previously.

The options market also clearly demonstrates this trend, with estimated volatility remaining in the 25–40% range, significantly lower than its historical peak around 80%.

Therefore, Bitcoin currently behaves more like a macro asset. The price of BTC is strongly influenced by liquidation and investor position adjustments, and is no longer heavily dependent on halving cycles.

The 2026 US midterm elections will see bipartisan support for cryptocurrency.

Gemini leaders predict that crypto will become a central theme of bipartisan policy in the US ahead of the 2026 midterm elections.

Previously, the Republican Party spearheaded efforts to reach crypto-savvy investors, but recently the Democratic Party has also become increasingly involved, as proposals for market restructuring are being pushed forward.

This assessment aligns with recent developments. The market structure bill, also known as the Clarity Act , remains controversial, but bilateral negotiations are progressing well.

Many experts predict that the US Senate could pass this bill in early 2026, when there is enough bipartisan support to reduce the risk of it being blocked.

Crypto policy has also become a campaign issue in "battleground" states like Arizona, Georgia, and Michigan. Candidates from both parties are beginning to express their views on legislation, innovation, and protecting small investors.

Many exchanges are predicted to operate using crypto.

Liou predicts that crypto-based prediction markets will boom from 2026 onwards, thanks to their ability to aggregate real-time data more accurately and efficiently than traditional surveys.

This trend has already begun to emerge. The Polymarket platform has experienced strong growth over the past year, attracting many new projects, including large exchanges, to enter the field of legitimate and regulated forecasting.

Crypto companies like Coinbase are also ramping up their activity in the prediction market. This expansion reflects the real demand for market-based forecasting tools directly related to politics, macroeconomic events, and the economy.

Digital asset reserves will consolidate in order to survive.

Liou argues that after a difficult market cycle, digital asset treasury funds (DATs) will see a wave of consolidation. Following the boom in DAT launches, many companies are now trading below the value of the crypto assets they hold, causing NAV to be compressed.

In recent months, DAT-listed companies have faced significant pressure, including falling stock prices, the risk of dilution, and unstable financial balance sheets.

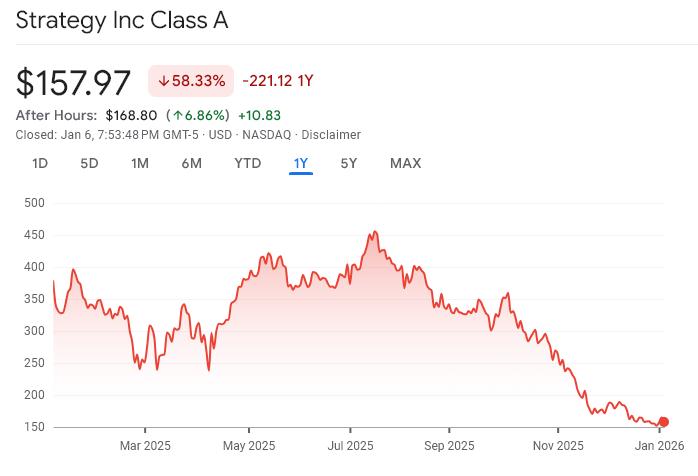

MSTR stock price chart for 2025. Source: Google Finance

MSTR stock price chart for 2025. Source: Google FinanceMicroStrategy , the world's largest Bitcoin holder, recorded a massive loss in the fourth quarter of 2025. MSTR shares ended 2025 down as much as 60%.

By 2026, a simple buy-and-hold strategy may no longer be suitable. This will force many weaker entities to merge or exit the market.

The country is selling its gold reserves to buy Bitcoin.

Finally, Gemini representatives suggest that at least one country will sell off its gold reserves to buy Bitcoin, officially recognizing BTC as "Digital Gold."

This idea is no longer a far-fetched prospect. The US has already developed a strategic framework for digital assets through the seizure of Bitcoin.

At the same time, many countries such as Germany, Sweden, and the Czech Republic have also openly discussed the possibility of including Bitcoin in their national reserves.

For countries looking to diversify their reserves or reduce their reliance on the US dollar, Bitcoin's convertibility and transparency are becoming an attractive alternative.

Overall, Liou's prediction suggests that 2026 will be the year the crypto market enters a new phase, no longer dominated by hype, but instead by the participation of large institutions, clear policies, and Capital from governments.