Source: Artemis Analytics

Author: Mario Stefanidis

Original title: Stablecoins Are a Rail, Not a Brand

Compiled and edited by: BitpushNews

Stablecoins are penetrating the traditional financial sector in a mixed but undeniable way.

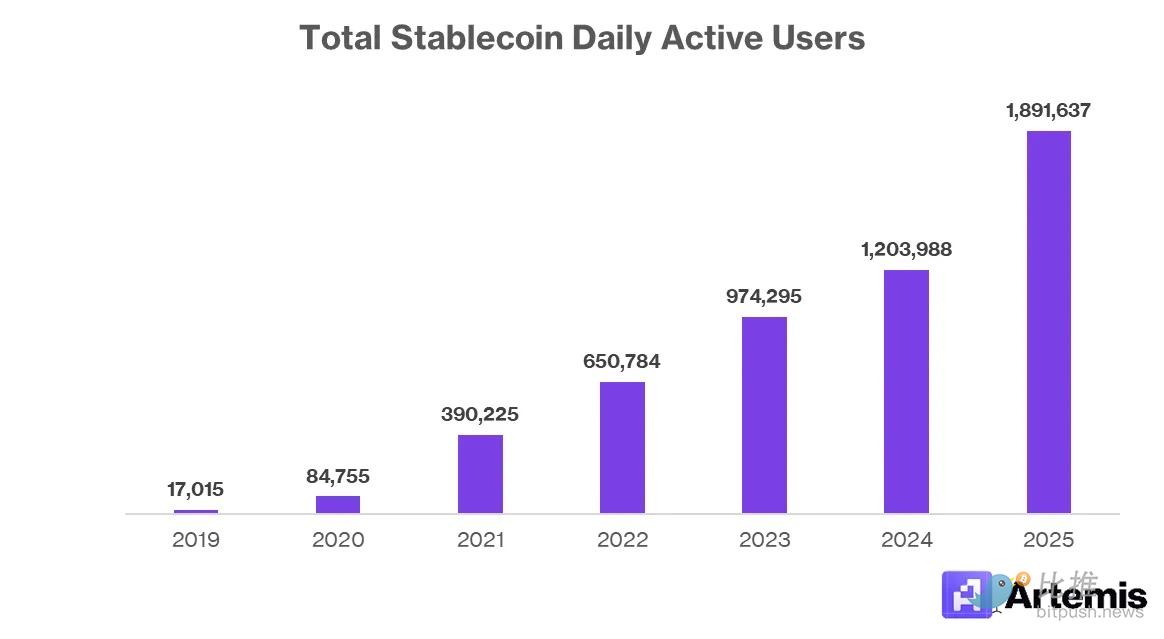

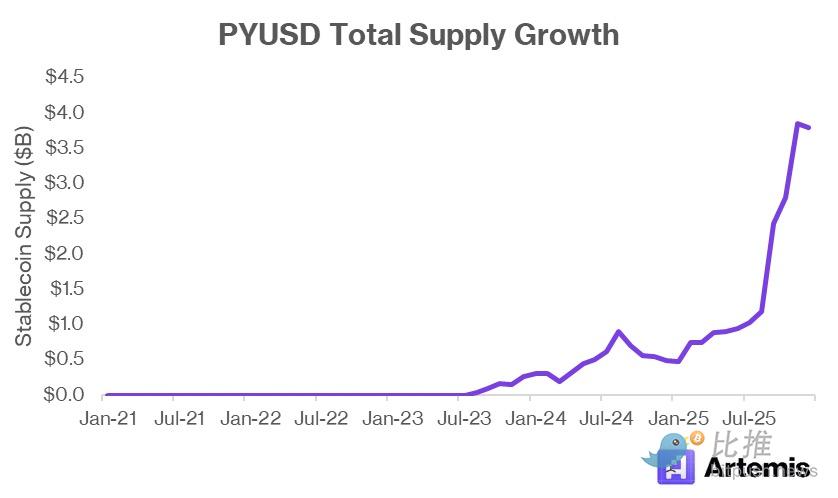

Klarna has just launched KlarnaUSD on Tempo , Stripe's first-layer network built specifically for payments; PayPal 's PYUSD, issued on Ethereum, has tripled in market capitalization in three months, surpassing 1% of the stablecoin market share and with a supply approaching $4 billion; Stripe has now begun accepting USDC for payments to merchants; and Cash App expanded its services from Bitcoin to stablecoins in early 2026, allowing its 58 million users to seamlessly send and receive stablecoins within their fiat currency balances.

Although each company takes a different approach, they are all responding to the same trend: stablecoins make the flow of funds extremely simple.

Data source: Artemis Analytics

Market narratives often jump straight to "everyone will issue their own stablecoin." But this conclusion is illogical. A world with a few dozen widely used stablecoins is manageable, but with thousands, chaos ensues. Users don't want their dollars (yes, the dollar, which dominates over 99%) scattered across a long tail of numerous branded tokens, each on its own blockchain with different liquidity, fees, and exchange paths. Market makers earn spreads, cross-chain bridges collect fees— this multi-layered profit-taking by intermediaries is precisely the problem stablecoins attempt to solve.

Fortune 500 companies should realize that stablecoins are extremely useful, but issuing stablecoins is not a guaranteed win. A select few companies will be able to gain distribution channels, reduce costs, and strengthen their ecosystems. Many others, however, may incur operational burdens without receiving clear returns.

The real competitive advantage comes from how to embed stablecoins as a "payment track" into products , rather than simply putting your own brand label on the token.

Why are stablecoins gaining popularity in traditional finance?

Stablecoins have solved specific operational problems that legacy payment systems failed to address for traditional companies. These benefits are easy to understand: lower settlement costs, faster fund arrivals, wider cross-border coverage, and fewer intermediaries. When a platform processes millions of transactions daily, with an annual transaction volume (TPV) of billions or even trillions of dollars, small improvements can compound into significant economic benefits.

1. Lower settlement costs

Most consumer platforms accept card payments and pay an exchange fee for each transaction. In the US, these fees can amount to about 1%-3% of the transaction amount, in addition to the fixed transaction fees of about $0.10-$0.60 per transaction from the three major card organizations (American Express, Visa, and Mastercard). If payments remain on-chain, stablecoin settlement can reduce these fees to just a few cents. This is a highly attractive leverage for companies with high transaction volumes and low profit margins. Note that they don't need to completely replace card payments with stablecoins; they only need to cover a portion of their transaction volume to achieve cost savings.

Data source: A16z Crypto

Some companies choose to partner with service providers like Stripe to accept stablecoin payments settled in USD. While not a necessary step, most businesses want zero volatility and instant fiat currency arrival. Merchants typically prefer USD to go into their bank accounts rather than managing crypto escrow, private keys, or handling reconciliation issues. Even Stripe's 1.5% floating fee is significantly lower than credit card alternatives.

It's conceivable that large enterprises might initially partner with stablecoin processing solutions before weighing the capital expenditures required to build their own fixed infrastructure. Ultimately, this trade-off will also become reasonable for small and medium-sized enterprises (SMEs) that wish to retain almost all of their output's economic benefits.

2. Global accessibility

Stablecoins can flow across borders without the need to negotiate with banks in each country. This advantage is attractive to consumer apps, marketplace platforms, gig economy platforms, and remittance products. Stablecoins allow them to reach users in markets where financial relationships have not yet been established.

Credit card end-user foreign exchange (FX) fees are typically an additional 1%-3% per transaction, unless a card that does not charge such fees is used. Stablecoins do not charge cross-border fees because their payment layer does not recognize national borders at all; USDC sent from a New York wallet arrives in Europe in exactly the same way as a local send.

For European merchants, the only additional step is deciding how to handle the dollar-denominated assets they receive. If they want euros in their bank accounts, they must exchange them. If they prefer to hold dollars on their balance sheets, no exchange is necessary, and they might even earn returns if they leave the balance idle on exchanges like Coinbase.

3. Instant settlement

Stablecoins settle transactions within minutes, often in seconds, while traditional payment transfers can take days. Furthermore, they operate 24/7, unaffected by bank holidays, deadlines, and other inherent barriers of the traditional banking system. By eliminating these limitations, stablecoins can significantly reduce operational friction for companies handling high-frequency payments or managing tight cash flow cycles.

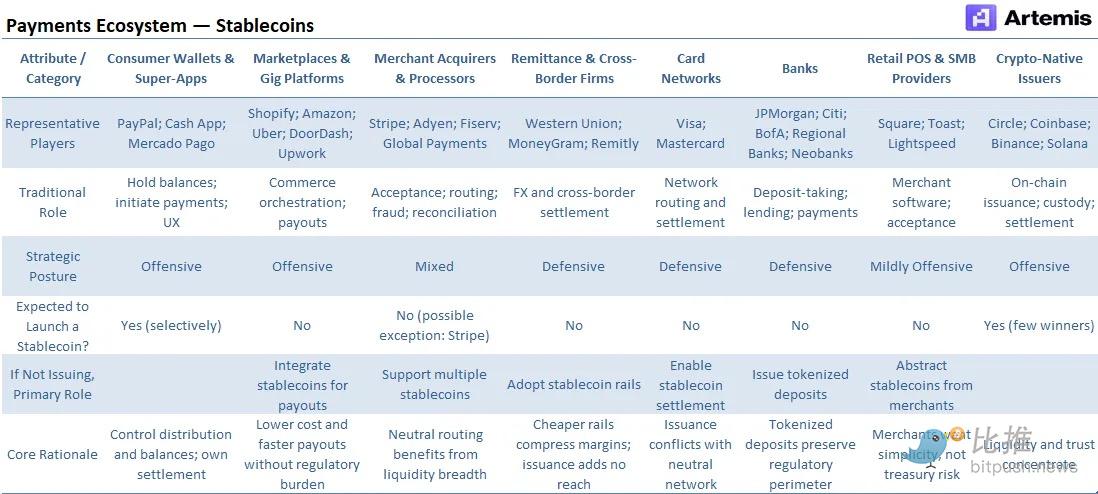

How should traditional companies treat stablecoins?

Stablecoins present both opportunities and pressures. Some companies can leverage them to expand product reach or reduce costs, while others risk losing some of their economic benefits if users migrate to cheaper or faster alternatives. The right strategy depends on a company's revenue model, geographic distribution, and how much its business relies on legacy payment infrastructure.

Some companies benefit from adding stablecoin tracks because it strengthens their core products. Platforms already serving cross-border users can settle funds faster and avoid the friction of building relationships with local banks. If they handle millions of transactions, settlement costs can be reduced as payments remain on-chain.

Many large platforms operate on extremely thin profit margins. If stablecoins allow platforms to bypass even 1-3 basis points of cost on certain cash flows, the savings would be substantial. With a total annual transaction volume of $1 trillion, a 1 basis point reduction in costs would be worth $100 million. Companies taking the initiative primarily include fintech-native, low-capital-intensive payment platforms such as PayPal, Stripe, and Cash App.

Other companies adopt stablecoins because competitors might use them to circumvent parts of their business models. For example, banks and custodians face significant risks with stablecoins, which could siphon off market share from traditional deposits, depriving them of low-cost funding. Issuing tokenized deposits or offering custody services may provide them with an early line of defense against new entrants.

Stablecoins also reduce the cost of cross-border remittances, which means the remittance business is at risk. Defensive adoption is more about preventing the erosion of existing revenue than about growth. Companies on the defensive side are diverse, ranging from Visa and Mastercard, which charge exchange fees and provide settlement services, to Western Union and MoneyGram at the front lines of remittances, and banks of all sizes that rely on low-cost deposits.

Given that in the payments sector, whether on the offensive or defensive, being too slow to adopt stablecoins could pose an existential threat, the question facing Fortune 500 companies has shifted to: Issuing their own stablecoins or integrating existing tokens—which makes more sense?

Data source: Artemis Analytics

It is not a sustainable equilibrium for every company to issue stablecoins. Users expect their stablecoin experience to be frictionless, and if they have to pick and choose from dozens of branded tokens in their wallets, even if they are all denominated in the same currency, they may turn to fiat currency instead.

Supply Track

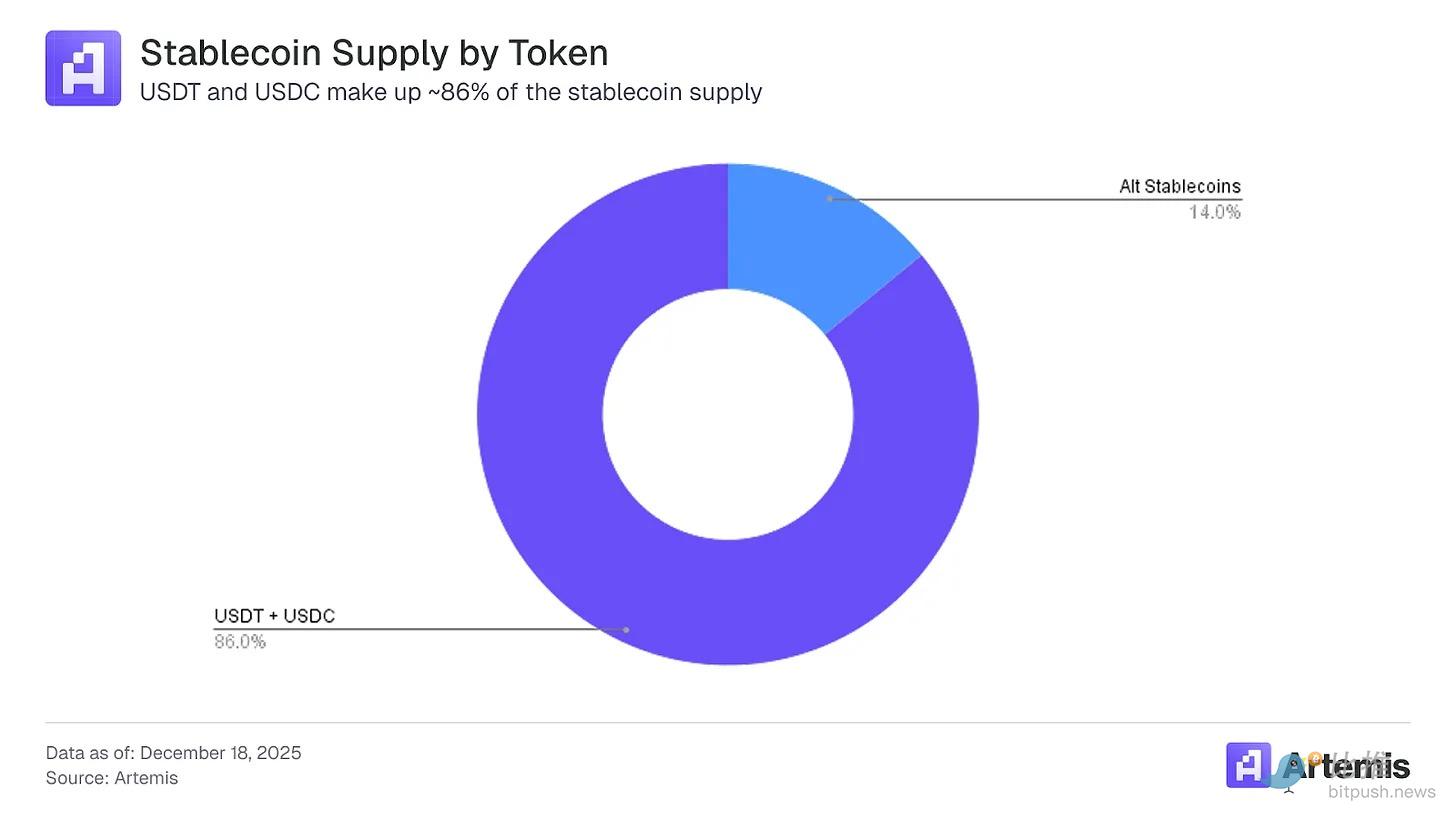

Companies should assume that only a small fraction of stablecoins can maintain deep liquidity and widespread acceptance. However, this is not a “winner-takes-all” industry. For example, Tether’s USDT, the first fiat-backed stablecoin, debuted on Bitcoin’s Omni Layer in October 2014. Despite the emergence of competitors, including Circle’s USDC launched in 2018, its dominance in the stablecoin market peaked in early 2024, exceeding 71%.

As of December 2025, USDT dominated the total stablecoin supply with 60%, followed by USDC at 26%. This means that other alternatives controlled 14% (approximately $43 billion) of the total market size of about $310 billion. While this may not seem like much compared to the trillions of dollars in the stock or fixed-income markets, the total stablecoin supply has grown 11.5 times from $26.9 billion in January 2021, representing a compound annual growth rate of 63% over the past five years.

Even at a more modest annual growth rate of 40%, the stablecoin supply will reach approximately $1.6 trillion by 2030, more than five times its current value. 2025 will be a pivotal year for the sector, thanks to significant regulatory clarity from the GENIUS Act and large-scale institutional adoption driven by clear use cases.

By then, the combined dominance of USDT and USDC may also decline. At the current rate of decline of 50 basis points per quarter, other stablecoins could account for 25% of the space by 2030, amounting to approximately $400 billion based on our supply projections. This is a considerable figure, but clearly insufficient to support tokens the size of dozens of Tether or USDC.

When a clear product-market fit exists, adoption can occur rapidly, benefiting from the tailwind of broader stablecoin supply growth and potentially wresting market share from existing leaders. Otherwise, newly issued stablecoins may get lost in a hodgepodge of stablecoins with low supply and unclear growth stories.

Please note that of the 90 stablecoins currently tracked by Artemis, only 10 have a supply exceeding $1 billion .

Corporate Case Studies

Companies venturing into stablecoins are not following a single script. Each company is addressing pain points in its own business, and these differences are more important than similarities.

PayPal: Defending its core business while testing new tracks

PYUSD is primarily a defensive product, and only secondarily a growth product. PayPal's core business still operates on card and bank transfers, which are the primary source of its revenue. Branded checkouts and cross-border transactions command significantly higher fees.

Stablecoins threaten this stack by offering cheaper settlements and faster cross-border flows. PYUSD allows PayPal to participate in this shift without losing control of its user relationships. As of Q3 2025, the company reported 438 million active accounts—defined as users who have transacted with the platform in the past 12 months.

PayPal already holds user balances, manages compliance, and operates a closed-loop ecosystem. Issuing a stablecoin naturally fits this structure. The challenge lies in adoption, as PYUSD competes with USDC and USDT, which already have deeper liquidity and wider acceptance. PayPal's advantage lies in distribution, not price. PYUSD will only be effective if PayPal can integrate it into the PayPal and Venmo workflows.

Data source: Artemis Analytics

Like Venmo, PYUSD serves as a growth engine for PayPal, but it is not a direct revenue generator. In 2025, Venmo will generate approximately $1.7 billion in revenue, representing only about 5% of its parent company's total revenue. However, the company is successfully monetizing its services through the Venmo debit card and the "Pay with Venmo" product.

PYUSD currently offers users a 3.7% annualized reward rate for holding the stablecoin in PayPal or Venmo wallets, meaning that from a net interest margin perspective (holding US Treasury bonds as collateral for the supply), PayPal is at best breaking even. The real opportunity lies in **cash flow**, not in stagnant funds. If PYUSD reduces PayPal's reliance on external channels, lowers settlement costs for certain transactions, and keeps users within the ecosystem rather than flowing off the platform, PayPal will be a net beneficiary.

Furthermore, PYUSD supports a defensive economy. The "disintermediation" of open stablecoins like USDC poses a real risk, and by offering its own stablecoin, PayPal reduces the likelihood that its services will become an external layer that must be paid for or bypassed.

Klarna: Reducing Payment Friction

Klarna's focus with stablecoins is on control and cost. As a "buy now, pay later" provider, Klarna sits between merchants, consumers, and card networks. It pays exchange and processing fees at both ends of the transaction. Stablecoins offer a way to reduce these costs and streamline settlement.

Klarna helps consumers finance short-term and long-term purchases. For payment plans of a few months, Klarna typically charges a fee of 3-6% per transaction plus approximately $0.30. This is the company's largest revenue stream, compensating for processing payments, assuming credit risk, and increasing merchant sales. Klarna also offers longer installment plans (such as 6, 12, and 24 months), charging consumers interest rates similar to credit cards.

In both cases, Klarna's focus is not on becoming a payment network, but on managing its internal cash flow. If Klarna can settle accounts with merchants faster and cheaper, it can improve profit margins and strengthen merchant relationships.

The risk lies in fragmentation—unless Klarna's branded token gains widespread acceptance outside its platform, holding that token balance long-term offers no benefit to Klarna. In short, for Klarna, stablecoins are a tool, not a product.

Stripe: Serves as a settlement layer, does not issue tokens.

Stripe's approach is arguably the most disciplined. It chooses not to issue its own stablecoin, instead focusing on using existing stablecoins for payments and receipts. This distinction is significant because Stripe doesn't need to win liquidity, but rather the flow of funds.

Stripe's annual transaction volume is projected to grow by 38% year-over-year to $1.4 trillion in 2024; at this rate, despite being founded more than a decade later, the platform could surpass PayPal's $1.8 trillion annual transaction volume. The company's recently reported valuation of $106.7 billion reflects this growth.

The company's support for stablecoin payments reflects clear customer demand. Merchants want faster settlements, fewer bank restrictions, and global coverage. Stablecoins address these needs. By supporting assets like USDC, Stripe improves its product without requiring merchants to manage another balance or assume issuer risk.

Stripe solidified this strategy with its $1.1 billion acquisition of Bridge Network earlier this year. Bridge focuses on stablecoin-native payment infrastructure, including deposit and withdrawal channels, compliance tools, and global settlement tracks. Stripe's acquisition of Bridge was not about issuing tokens—but about internalizing the pipeline. This move gives Stripe more control over its stablecoin strategy and improves integration with existing merchant workflows.

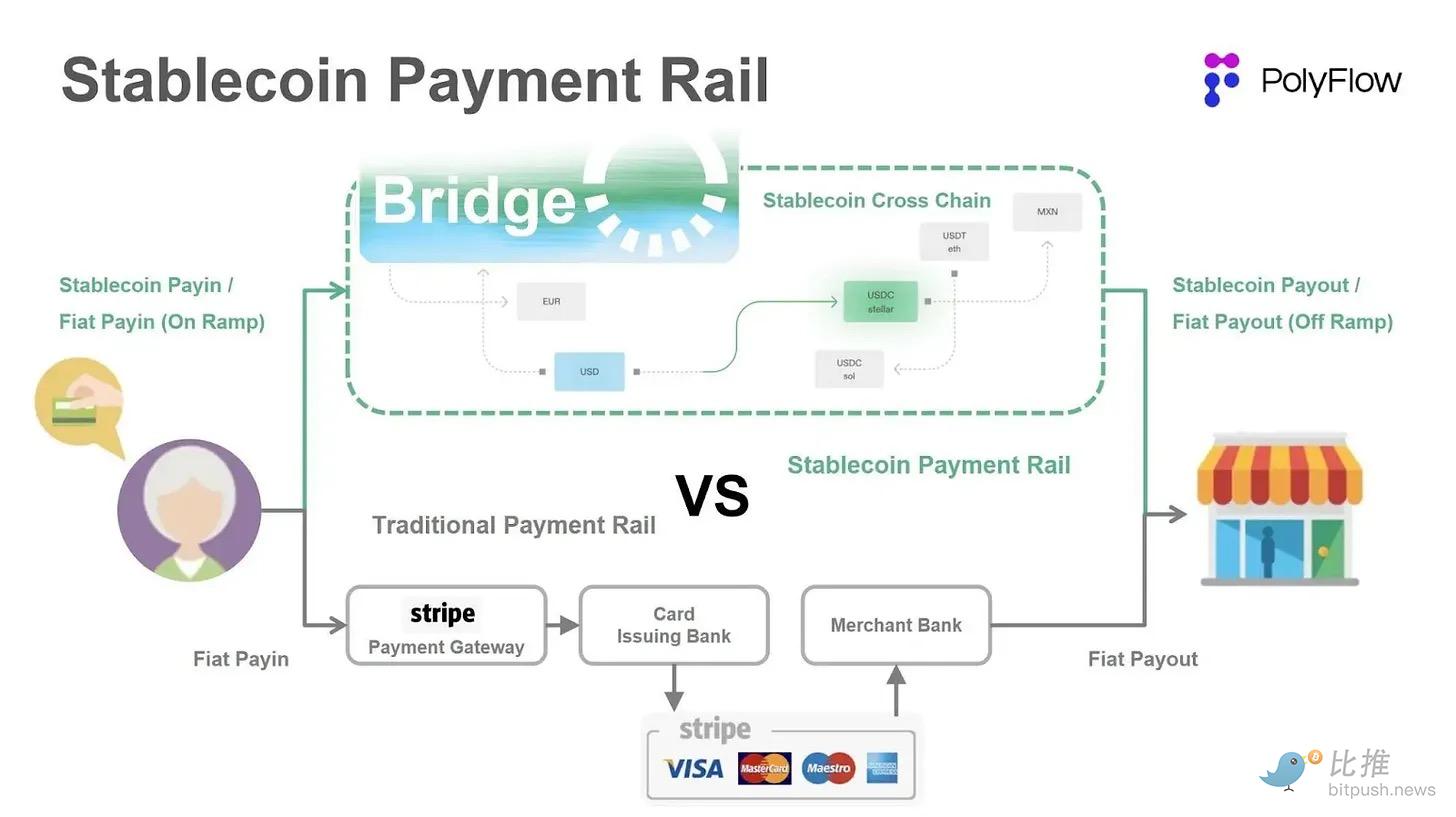

Data source: PolyFlow

Stripe succeeds by becoming the interface to stablecoins. Its strategy reflects its market position, handling trillions of dollars in transaction volume and maintaining double-digit annual growth. Regardless of which token dominates, Stripe remains neutral and charges fees based on transaction volume. Given the extremely low transaction costs of the underlying stablecoins, any fixed fees Stripe can collect in this new market will boost its profits.

The pain point for merchants: Simplicity is justice

Merchants are interested in stablecoins for a simple reason: the cost of receiving payments is high, and these costs are obvious.

In 2024, U.S. merchants paid $187.2 billion in processing fees to accept $11.9 trillion in payments from customers. For many small and medium-sized enterprises, these fees represent the third-largest operating expense after labor and rent. Stablecoins offer a viable way to alleviate this burden in specific use cases.

In addition to lower fees, stablecoins offer predictable settlements and faster fund arrivals. On-chain transactions provide finality, whereas credit cards or traditional payment processing solutions can result in refunds or disputes. Merchants also don't want to hold cryptocurrency or manage wallets, which is why early pilots appear to be "stablecoins in, dollars out."

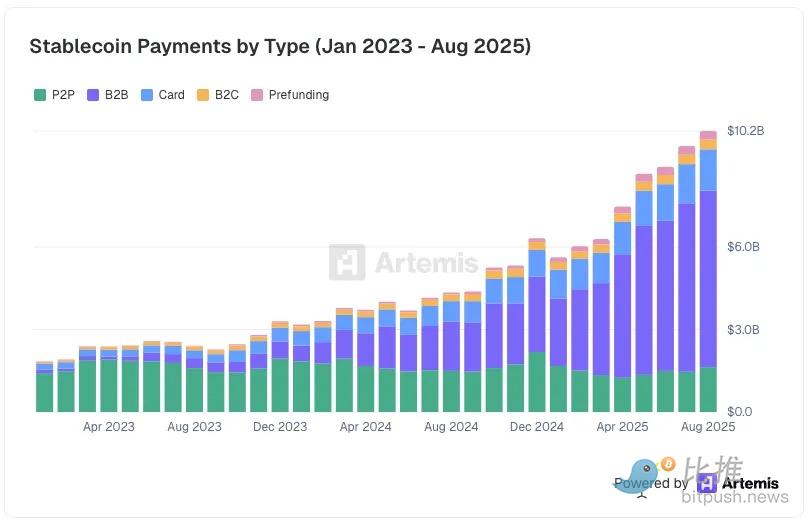

According to Artemis' latest survey in August 2025, merchants are already processing $6.4 billion in inter-enterprise stablecoin payments, 10 times the amount processed in December 2023.

Data source: Artemis Analytics

This dynamic also explains why merchant adoption has become so concentrated. Merchants don't want to support dozens of tokens, each with different liquidity conditions, conversion costs, and operational characteristics. Each additional stablecoin introduces complexity and reconciliation challenges from market makers or cross-chain bridges, which undermines the initial value proposition.

Therefore, merchants favor stablecoins with a clear product-market fit. Stablecoins that lack the characteristic of making transactions easier than fiat currency will gradually disappear. From a merchant's perspective, accepting a long-tail stablecoin offers no significant advantage over not accepting any stablecoin.

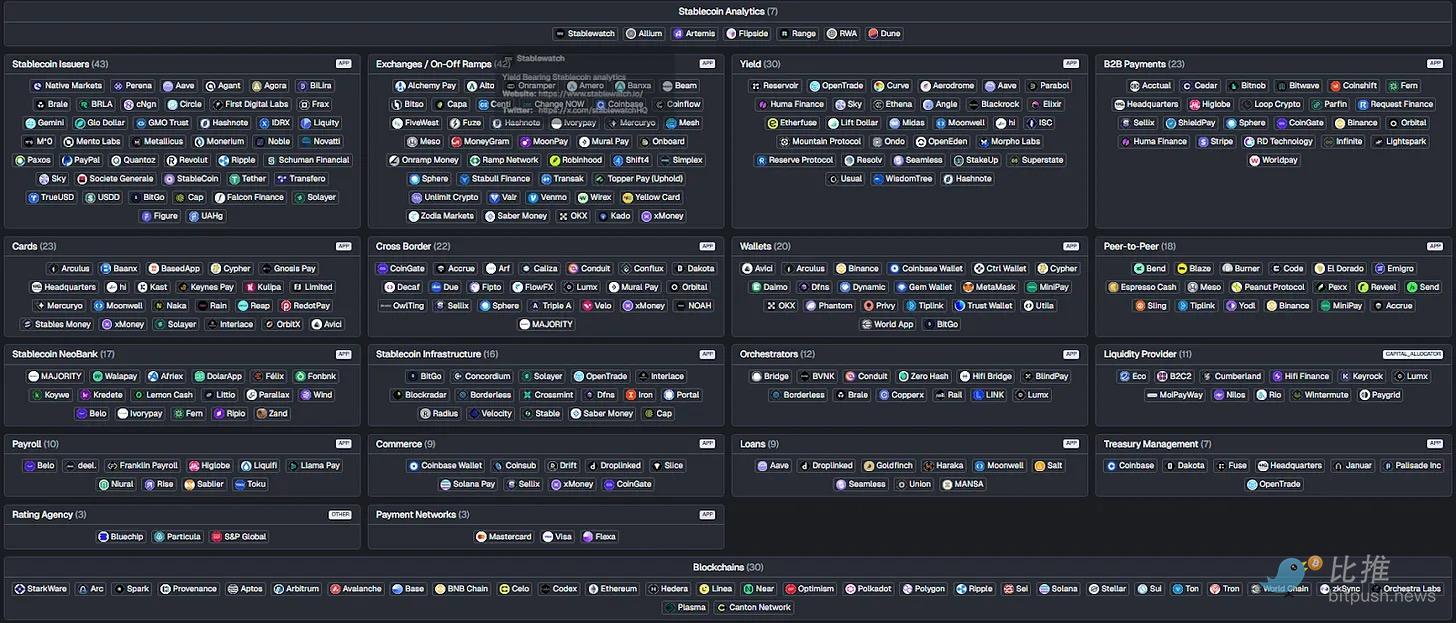

The Artemis stablecoin map illustrates just how chaotic the current landscape is. Merchants simply aren't going to deal with dozens of deposit and withdrawal channels, wallets, and infrastructure providers just to convert their earnings into fiat currency.

Data source: Artemis (stablecoinsmap.com)

Data source: Artemis (stablecoinsmap.com)

Merchants reinforce this outcome by standardizing the use of effective tools. Processors reinforce this outcome by supporting only the assets that customers actually use. Over time, the ecosystem will aggregate around a limited number of tokens worth the integration costs.

Why this is actually important

All of these implications are unsettling for a large part of the stablecoin ecosystem: simply “issuing” is not a sustainable business model.

A company whose main product is "we mint stablecoins" is betting that liquidity, distribution, and usage will arise naturally. In reality, these things only emerge when a token is embedded in real-world payment flows. The "you mint, they'll come" mentality doesn't apply here, as consumers face a choice among hundreds of issuers.

This is why companies like Agora or M0, which only handle issuance, struggle to justify their long-term advantage unless they significantly expand their operations beyond minting. Without control over wallets, merchants, platforms, or settlement channels, they are downstream in the value they are trying to capture. If users can hold USDC or USDT just as easily, there's no reason for liquidity to be dispersed to another brand's dollar token.

In contrast, companies that control distribution, cash flow, or integration points become more powerful. Stripe benefits without issuing a stablecoin; it sits directly on the merchant settlement path, earning revenue regardless of which token dominates. PayPal can justify PYUSD because it owns the wallet, user relationships, and checkout experience. Cash App can integrate stablecoins because it already aggregates balances and controls the user experience. These companies derive leverage from usage.

The real revelation is that if you're at the top of the stack but only have a bare token, then you're in a market destined for high consolidation.

Stablecoins reward you for your position within the architecture, not for novelty.

in conclusion

Stablecoins change the way money flows, not the nature of money itself. Their value stems from reducing settlement friction, not from creating new financial instruments. This fundamental difference explains why the adoption of stablecoins occurs within existing platforms, rather than alongside them. Businesses use stablecoins to optimize existing business processes, not to disrupt their own business models.

This also explains why issuing stablecoins should not be the default choice. Liquidity, acceptance, and integration capabilities are far more important than brand. Without sustained use cases and clear demand, new tokens will only increase operational burdens rather than create advantages. For most companies, integrating existing stablecoins is more scalable than issuing their own—the market naturally favors a few assets that can be used everywhere, rather than a large number of tokens that are only applicable to narrow scenarios. Before minting a stablecoin that is destined to fail, its offensive or defensive strategic positioning must be clearly defined.

Merchant behavior further reinforces this trend. Merchants consistently prioritize simplicity and reliability. They will only adopt payment methods that reduce costs without adding complexity. Stablecoins that seamlessly integrate into existing workflows will be favored; while tokens requiring additional reconciliation, exchange steps, or wallet management will be phased out. Over time, the ecosystem will filter out and retain a small number of stablecoins with clear product-market fit.

In the payments sector, simplicity determines adoption. Only stablecoins that facilitate the flow of funds will survive; the rest will eventually be forgotten.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush