XRP price is struggling to maintain its recent recovery momentum. The Token saw a slight increase over the past week but is now under downward pressure.

The main reasons stem from short-term selling and investor skepticism, which could worsen if the overall market deteriorates.

XRP is back in the red.

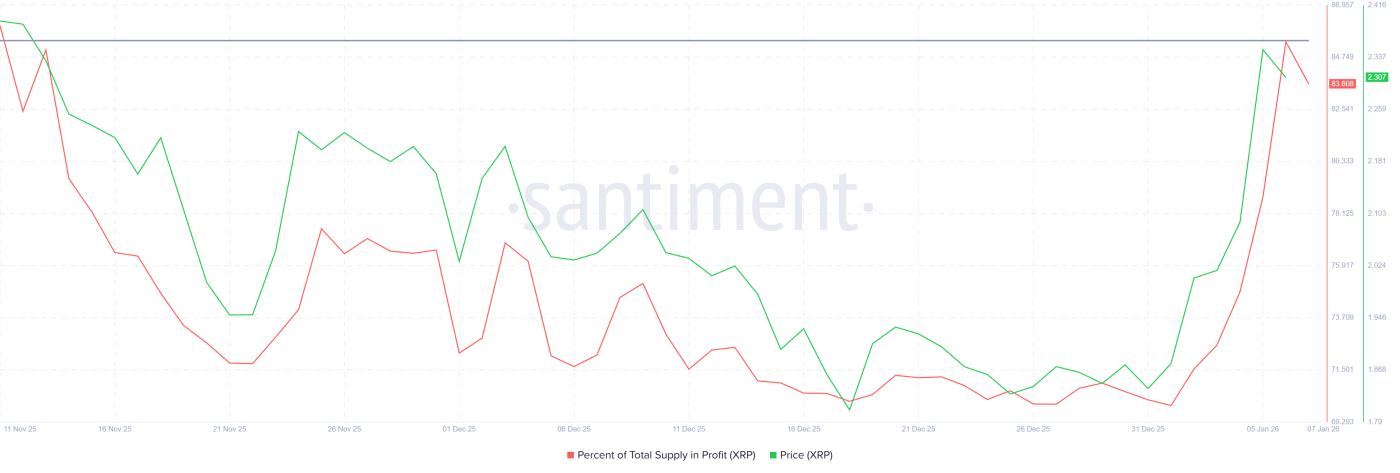

on-chain data shows that approximately 83% of the circulating XRP supply has returned to a profitable state. This number even increased to 85% in the last 24 hours before slightly decreasing. This is the highest level in the last 1.5 months, indicating that the majority of investors are currently profitable.

Want more Token information like this? Sign up for the daily Crypto newsletter with editor Harsh Notariya here .

Ethereum Supply In Profit. Source: Santiment

Ethereum Supply In Profit. Source: SantimentAs returns increase, investor behavior often changes. When more people have made a profit, selling pressure increases as many choose to take profits after a period of sideways price consolidation. This creates a challenge for XRP as selling pressure increases at resistance levels.

Investors holding XRP remain true to their principles.

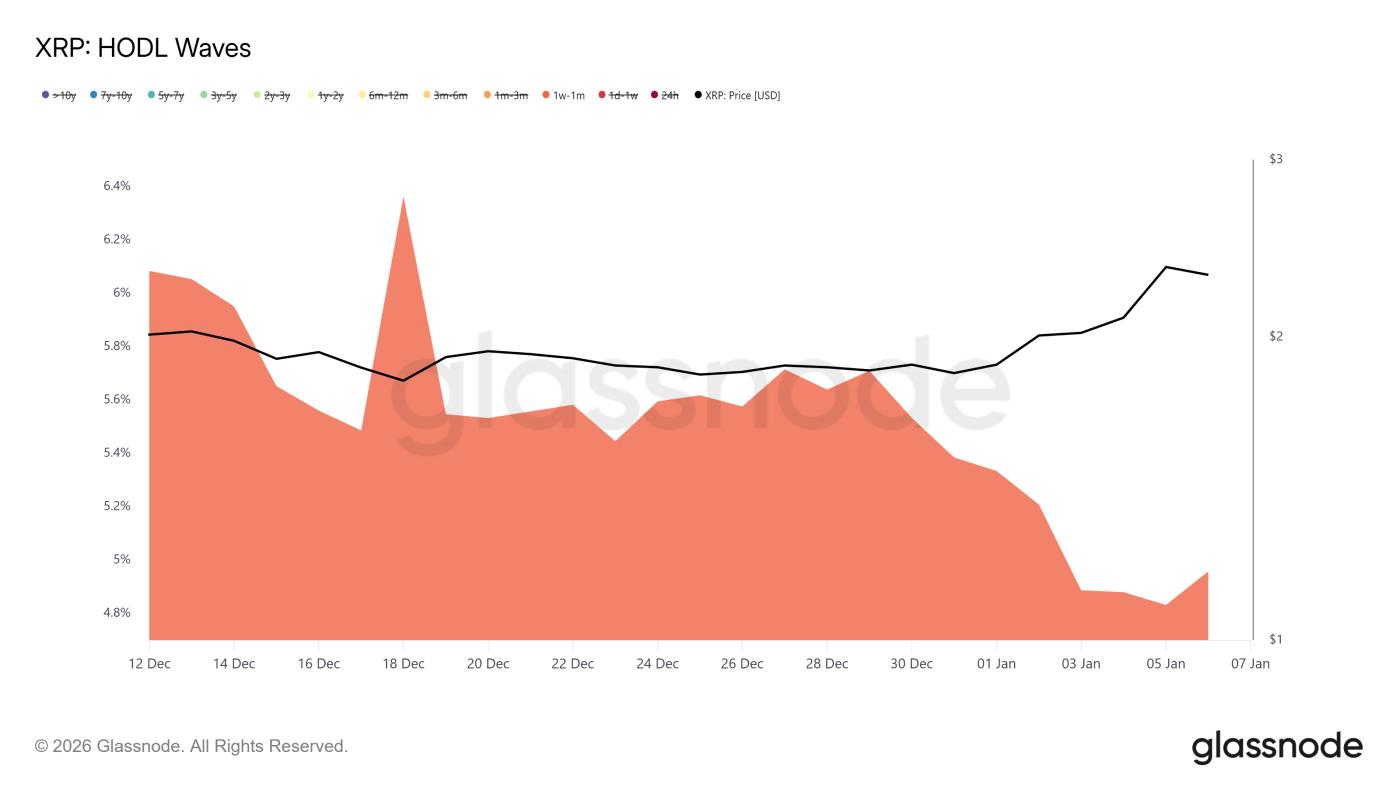

Short-term investors appear to be reacting strongly to this signal. Wallets that had accumulated XRP over the past week or month have significantly reduced their holdings. Their share of the total supply has dropped from 5.7% to 4.9% in just 7 days.

This group of investors typically reacts most quickly to market developments and often sells off their holdings promptly when profits are made. The continued decrease in their Token holdings indicates that the distribution trend remains strong. If the price attempts to rise further without sufficient demand, this selling trend could persist.

XRP HODL Waves. Source: Glassnode

XRP HODL Waves. Source: GlassnodeThese actions reduce the likelihood of continued price increases. When short-term investors consistently sell, price rallies are often quickly reversed. XRP is currently facing the challenge of absorbing this supply without experiencing a further sharp decline.

The overall sentiment remains worrying.

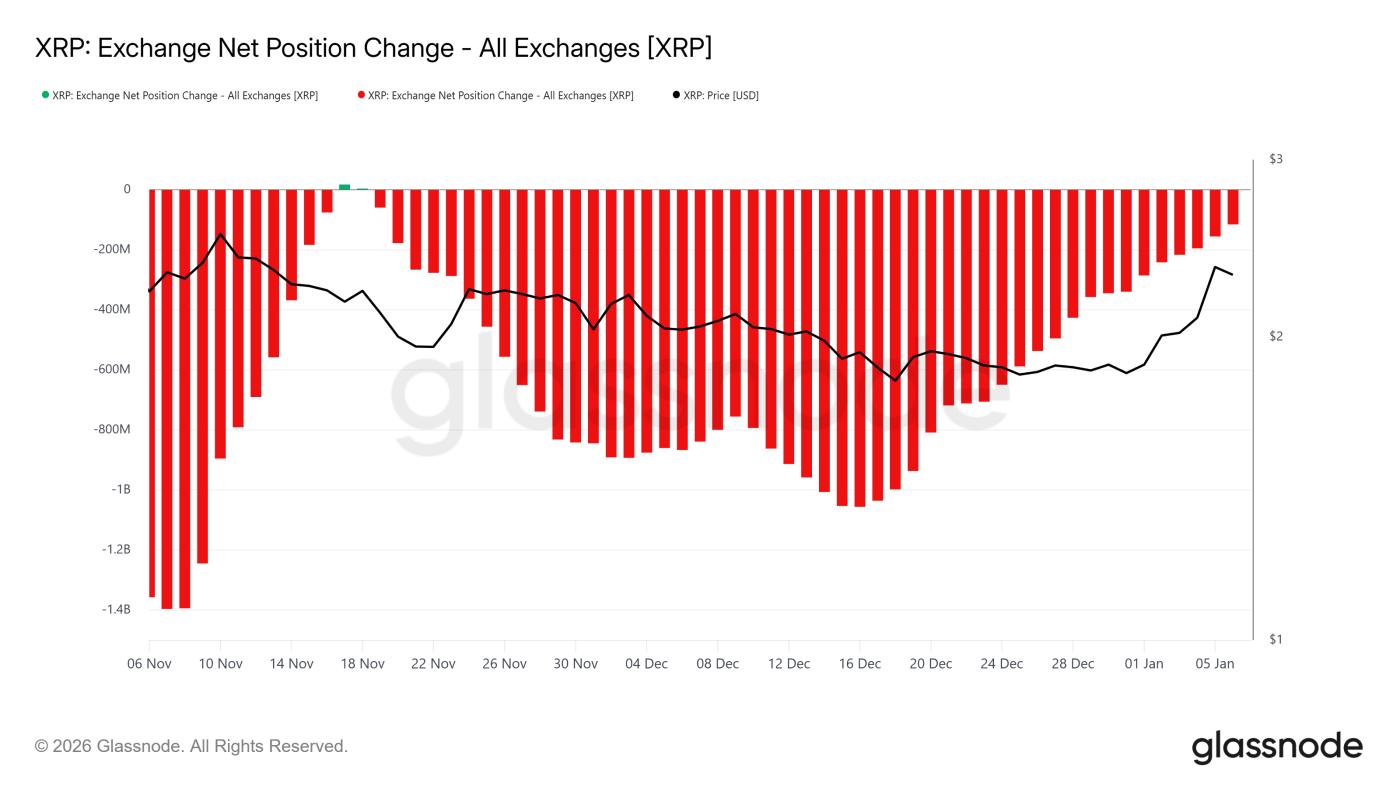

Macro indicators also reinforce a cautious view. Net position change data on exchanges shows that XRP withdrawals from exchanges remain quite high. Although the withdrawal rate has slowed down recently, deposits have not yet exceeded withdrawals.

This imbalance suggests that the sellers are still in control. If XRP inflows increase again, selling pressure could intensify. XRP 's structure remains quite weak under these conditions, especially if market sentiment deteriorates or volatility increases sharply.

XRP Net Position Change. Source: Glassnode

XRP Net Position Change. Source: GlassnodeHigh trading activity on the exchange is often a sign of a potential price correction. Without a clear consolidation phase, XRP may struggle to establish higher support levels in the short term.

XRP price could repeat history.

XRP is currently trading around $2.25 at the time of writing, just below the $2.36 resistance level. The Money Flow Index is showing signs of overbought conditions, combining volume and price to assess buying and selling pressure.

When the MFI crosses above 80.0, historical data often indicates an increased likelihood of an upward correction. Even if XRP holds its position in the short term , the price could still fall below $2.19. A deeper correction could lead to a retest of the $1.80 support zone—an area that has proven effective in previous dips.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingViewThe negative outlook could change if selling pressure eases. If investors stop selling, XRP could bounce from the $2.19 region. A strong breakout above $2.36 could even push towards the $2.64 area, breaking the current downtrend.