This might be the last window of opportunity to escape.

Recently, many people have asked me the same question: Has Bitcoin peaked after rebounding from 80,000? Is it still a good time to long? Is it a good time to short? My conclusion is: This rebound is more like "the last chance for you to get out."

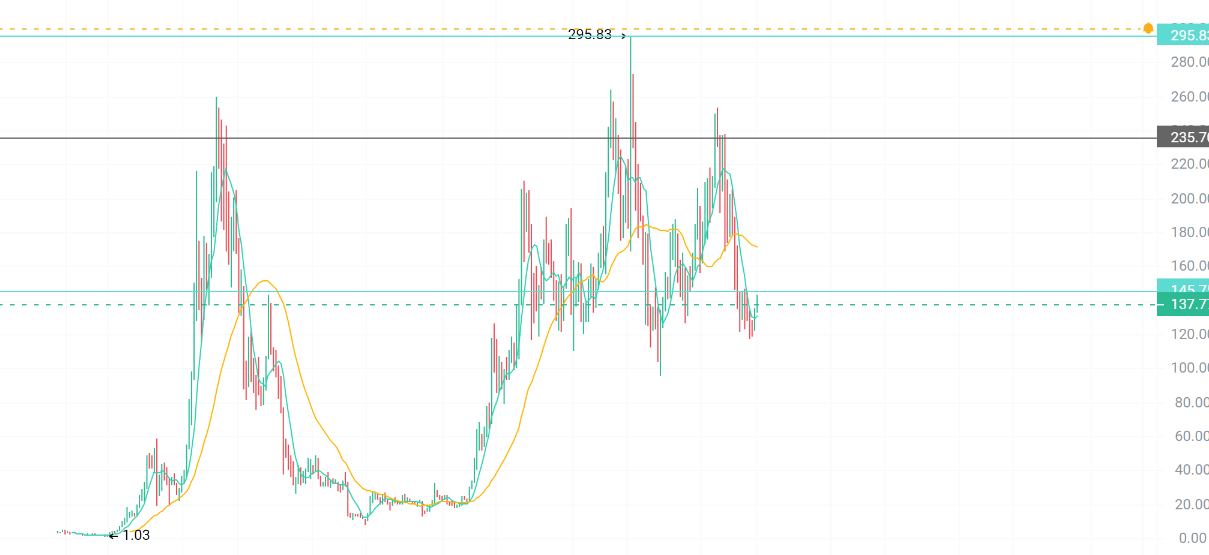

First, the current market situation is almost exactly the same as in 2022.

I've been repeatedly comparing the market trend of 2022 with that of 2022, and to put it bluntly—the structure is almost a carbon copy. Back then, it was the same: two bottoms; the bottoms gradually rose, and the second rebound was slightly higher than the first, creating a false impression of a "reversal" in the market before a direct collapse (3500 → 880). Not only is the candlestick structure similar, but even the MACD momentum rhythm is highly consistent. This kind of trend is not essentially bullish, but rather a very typical—downtrend continuation pattern. The rebounds are merely a prelude to an even steeper fall.

II. My next assessment of the market.

In my opinion, this round of BTC rebound is nearing its end. ETH will likely rebound to the 3400-3500 range before entering a new round of decline. Therefore, my trading advice is simple: if you have long positions, remember to exit. You don't necessarily have to short, but at least lock in profits first. If you short: you don't need high leverage; 2-3 times is enough for a medium- to long-term position, giving you sufficient room for error.

Third, the timing is already quite clear.

The real window for a decline is likely to open about two weeks before the interest rate meeting. There's almost a 100% chance of no rate cut on January 27th, and the probability of a rate cut in March is also very low. Most retail investors are completely unaware of this negative factor. But the market always trades in advance based on expectations.

Fourth, smart money has already started to withdraw.

One detail many have overlooked: Spoofy, who had disappeared for a long time, has recently resurfaced. He still holds 70,000 BTC, but has recently begun to significantly reduce his holdings. Adding to this, another top trader publicly stated that 94,000 is his target price, and he has already taken substantial profits and exited the market. Smart money is choosing to withdraw at this level. Do you think this is a coincidence?

Fifth, the data is also giving "market top signals".

The Bitcoin premium index has reversed. What does this mean? Premium → Market overheating. Overheating → Rebound entering its later stages, often followed by a decline. BTC has now officially entered overbought territory. This state usually lasts for a few days, and another surge or false breakout cannot be ruled out. But remember this: the best entry point for short is when the price breaks through and then falls back. I personally pay close attention to the Fibonacci resistance around 98,000. If it reaches that level, I will decisively take a short position.

VI. After the decline, where are the opportunities?

Once the market sentiment truly collapses, my top pick for buy the dips remains SOL. Here are a few key points to know: In 2025, SOL's on-chain transaction volume reached $1.5 trillion, surpassing Ethereum's stablecoin scale and continuing to grow. On-chain funds exceeded $14 billion, yet the price was consistently suppressed by the overall market trend. This is a classic example of a severe divergence between price and fundamentals. Looking at historical elasticity: SOL rose 200 times in the last bull market and has risen over 40 times in this one. ETH rose 50 times in the last bull market and is now less than 6 times. It's not difficult to judge which has more elasticity for the next bull run. Additionally, I'm also continuously tracking some smaller on-chain coins with solid fundamentals. I'll share my findings as soon as the true bottom appears.

VII. In Conclusion

This bear market might be a window of opportunity for ordinary people to truly change their fate. But the prerequisite is: you must survive beforehand, act decisively when it's time to run, and avoid itching to trade when necessary. Missing this opportunity could truly be the end of an entire cycle. I will continue to update you on key milestones. I hope to be at the poker table with you again in the next bull market.

The opportunity will be gone in the blink of an eye, everyone gather quickly!

Don't let hesitation delay your chance to make money, and don't get burned by worthless cryptocurrencies. Join Sister Miao and let's ride this bull market together!

Contact me via WeChat: Mixm5688 or QQ: 2234099968