Bittensor started 2026 on a high note, with the price of TAO surging dramatically in its first week of trading. This surge followed Grayscale's application to launch Bittensor's first dedicated ETF in the US.

As altcoin ETFs become a major trend, this development has Vai as a powerful catalyst, drawing renewed attention to decentralized AI assets.

The increase in TAO price reflects optimistic investor sentiment, and the participation of institutions through legally regulated products often helps increase liquidation and credibility for the market.

Bittensor's retail investor profits are increasing.

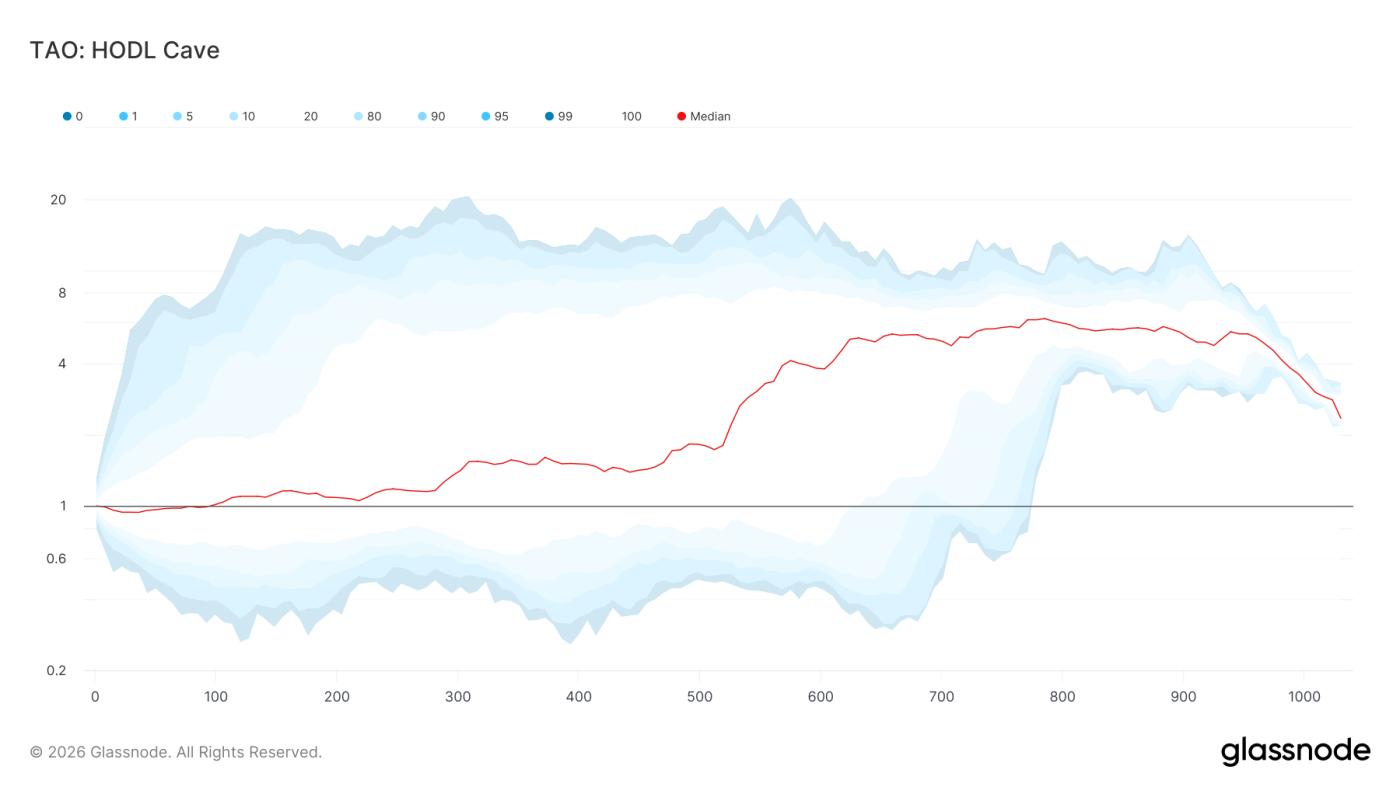

Token holders' behavior remains supportive despite TAO's 27% increase in just the past week. According to data from HODL Caves, investors are unlikely to rush to sell at such a high price. Most wallets that have accumulated TAO over the past seven months have yet to achieve significant profits or are still experiencing slight losses at the current price.

Want to stay updated on Token like these? Sign up for editor Harsh Notariya's Daily Crypto newsletter here .

TAO HODL Cave. Source: Glassnode

TAO HODL Cave. Source: GlassnodeThis cost allocation method weakens short-term selling pressure. Typically, investors only start taking profits when they have made significant gains. Therefore, the current selling pressure is not high, paving the way for TAO to recover without being heavily Dump at the start of its price increase.

TAO is detecting potential buying pressure.

Momentum indicators show an improving trend, but further confirmation is needed. The Money Flow Index – a measure of buying/selling pressure based on price and volume – is approaching a neutral level. If it breaks through and holds above this level, it will confirm an increase in Capital inflow.

When it breaks out of the neutral line, it indicates that buyers are gradually gaining the upper hand after a period of accumulation. For TAO, this signal is crucial . A strong influx of money will increase liquidation and support a more sustained price increase for TAO in the current cycle.

TAO MFI. Source: TradingView

TAO MFI. Source: TradingViewMacroeconomic trends often signal a shift in direction. If the MFI actually turns positive, this would align with holding behavior and positive expectations from the ETF. Combining these factors would help TAO maintain its upward momentum and break through short-term resistance levels.

What are the highlights of TAO's past?

The price history also reinforces the positive outlook. TAO has repeatedly recovered strongly whenever it reached the $217 support zone. In previous cycles, price rebounds from this area often led to rallies near or exceeding $500.

This recurring pattern reflects long-term investor confidence. When TAO maintains an upward trend driven by accumulation, the price typically extends to higher levels. Currently, market conditions bear many similarities to the past, despite changes in the macroeconomic environment.

TAO Price Past Performance. Source: TradingView

TAO Price Past Performance. Source: TradingViewIf investors continue to hold the Token instead of selling them, TAO could repeat its previous bull cycle. With institutional interest and reduced selling pressure, the Token has a strong chance of reaching higher targets in this cycle.

TAO still has a long way to go.

TAO is currently trading around $278 at the time of writing, after a slight 5% correction in the last 24 hours, but has gained a total of 27% in one week. The nearest resistance level is $312. This is the main hurdle preventing TAO from breaking through, and also the first challenge in this upward trend.

Although the overall trend is still toward the $500 target, stronger confirmation is needed in the short term. TAO needs to break above $312 and maintain this level as a new support zone. If a higher support zone is established at $335 or $412, the signal for continuation of the uptrend will be clearer. This is also a condition for TAO to reach $500, which is approximately 79.4% away from this target.

TAO Price Analysis. Source: TradingView

TAO Price Analysis. Source: TradingViewDownside risks remain if market sentiment reverses. If selling pressure increases, TAO could lose the $263 mark. A sharp drop to the $217 region would wipe out all recent gains, shattering the bullish scenario and forcing TAO to restart its recovery from scratch.