Macro context: Risk back on, structure improving

Bitcoin began the year by breaking out of a month-long range, moving higher alongside equities and precious metals. With year-end positioning distortions now cleared, crypto is again trading as part of the broader risk complex rather than in isolation. The specific geopolitical headlines matter less than the underlying signal: reduced inflation pressure, improving risk appetite, and a continued decline in forced selling as large holders shift from liquidation toward accumulation.

Alongside cyclical drivers, longer-dated structural topics are gaining attention, such as the theoretical “quantum threat” to Bitcoin’s cryptography. While distant, this debate reinforces the importance of protocol adaptability rather than near-term risk. Zooming out, 2025 laid constructive groundwork through regulatory easing and tokenization, positioning Bitcoin as the reserve asset within a more disciplined crypto system.

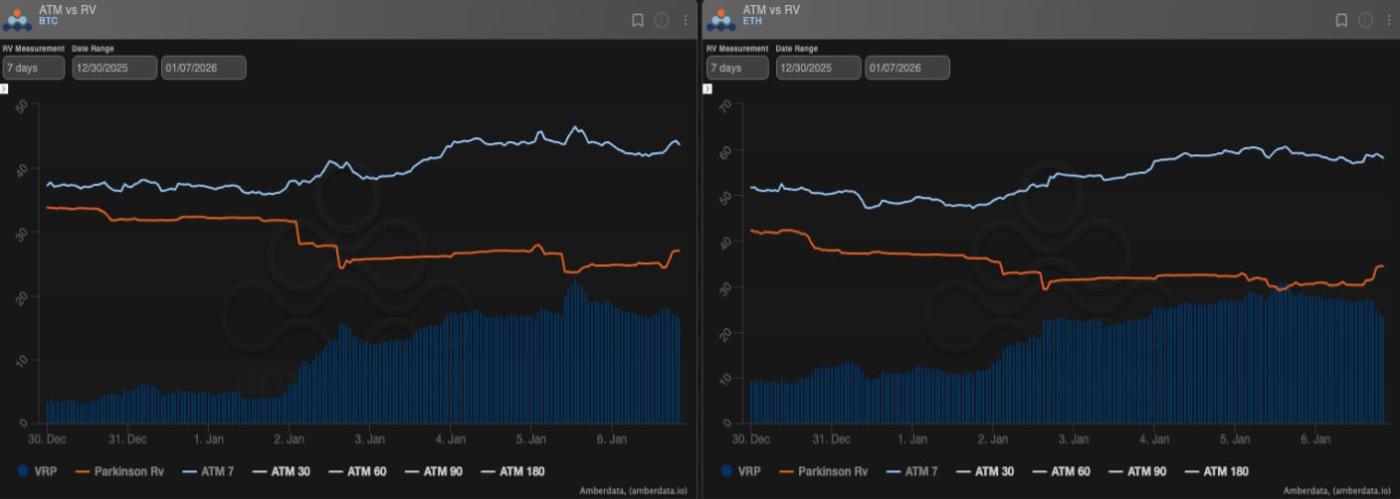

Realized vs implied volatility: Carry remains attractive

Realized volatility stayed compressed over the holiday period, with BTC in the low-20s and ETH around 30. Implied volatility has been broadly stable to slightly higher in BTC, while the entire ETH curve shifted lower by roughly 3–5 vols. This has rebuilt a very favorable volatility risk premium, with around 20 vol points of carry available in both assets. Implied ranges largely held into year-end, but recent upside breaches suggest momentum is finally returning after crypto lagged other risk assets.

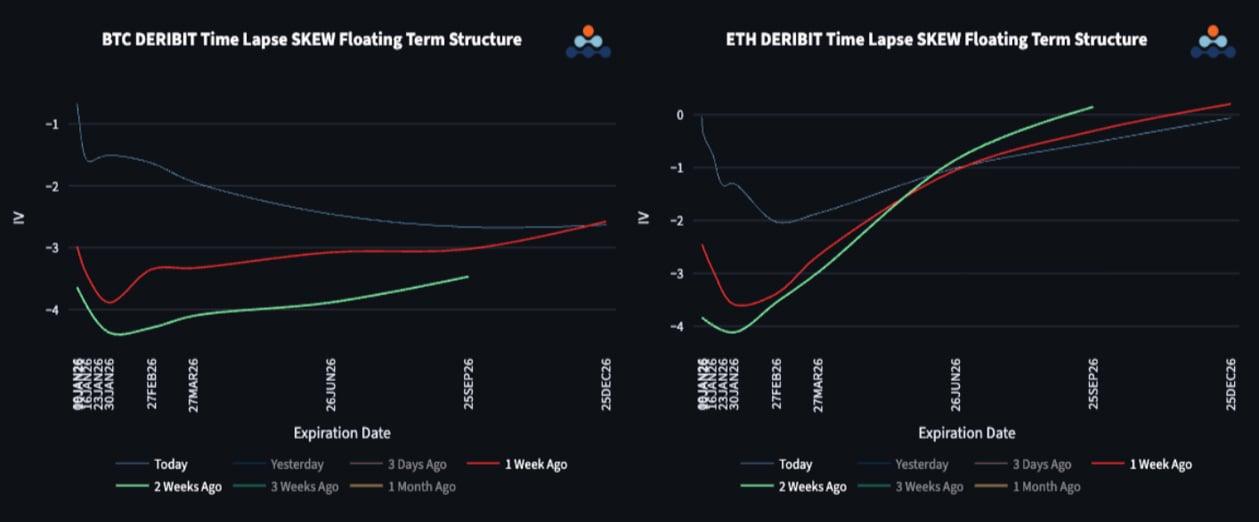

Term structure and skew: Downside fears easing at the front end

Skew was largely unchanged into New Year, but the past week saw a rapid normalization at the front end. In BTC, put skew has compressed across most tenors, leaving a slight inversion. ETH shows a front-end inversion through February, where downside concern is most pronounced, before skew normalizes further out. This points to modest near-term downside sensitivity in ETH, while preserving a more constructive upside narrative later in the year.

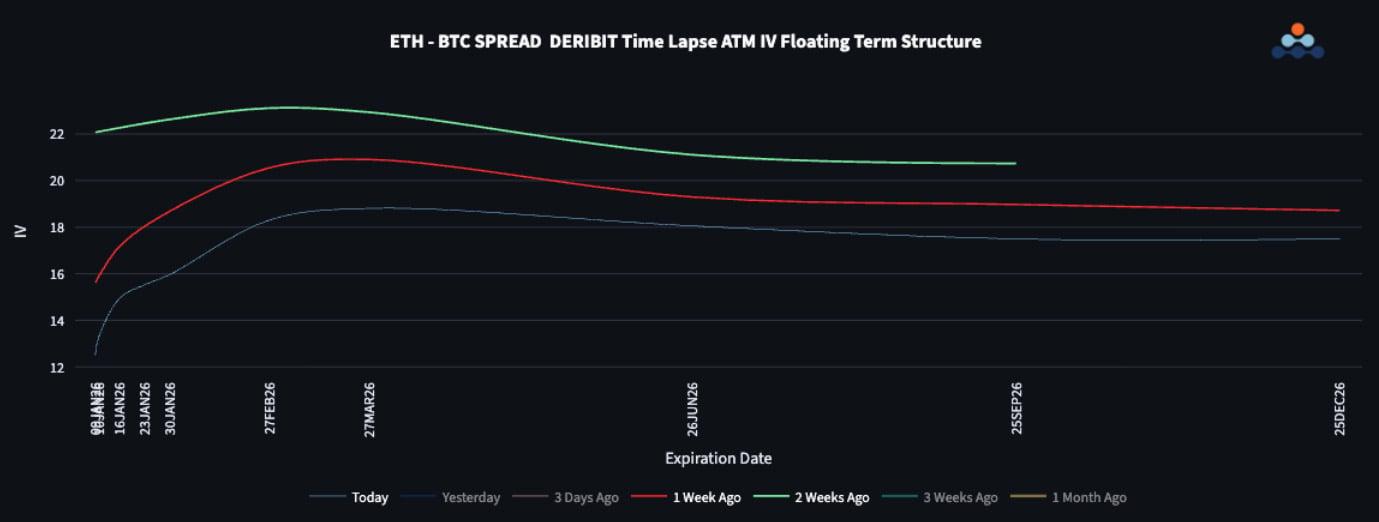

ETH/BTC dynamics: Optionality shifting back to ETH

The ETH/BTC cross has reclaimed key technical support, holding both a downward trend line and the 200-day moving average. This suggests improving relative strength and scope for an upside break if ETH benefits from supportive news flow. At the same time, the ETH-over-BTC volatility spread has compressed sharply, particularly at the front end. Cheaper relative vol means those expecting ETH to have an upside breakout could use BTC calls to fund ETH calls.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)

Imran Lakha is an expert at using institutional options strategies to capitalize on investment opportunities across global macro asset classes. Learn more here.

RECENT ARTICLES

From Compression to Expansion: Signals in Crypto Options

Imran Lakha2026-01-08T09:04:59+00:00January 8, 2026|Industry|

Crypto Derivatives: Analytics Report – Week 2

Block Scholes2026-01-07T08:16:09+00:00January 7, 2026|Industry|

Crypto Derivatives: Analytics Report – Week 52

Block Scholes2025-12-25T12:43:01+00:00December 25, 2025|Industry|

The post From Compression to Expansion: Signals in Crypto Options appeared first on Deribit Insights.