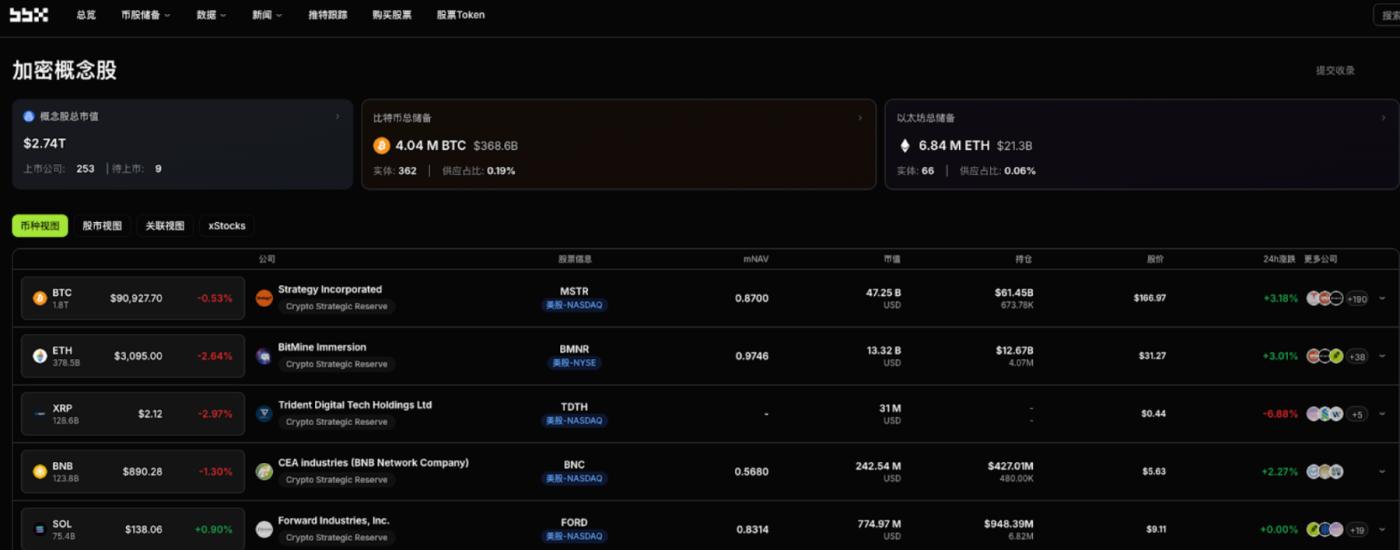

According to ME News, on January 9th (UTC+8), BBX Crypto Concept Stock Information reported that yesterday's listed companies' cryptocurrency activities focused on expanding their business scope through equity acquisitions and signing strategic agreements to explore the tokenization of Real-World Assets (RWA), demonstrating that institutions are deepening their participation in the digital asset ecosystem through various paths.

Acquisition of exchange and asset management businesses

Coincheck Group NV (NASDAQ: CNCK) announced yesterday that it has signed an agreement with major shareholder Monex Group to acquire approximately 97% beneficial ownership of Canadian digital asset management company 3iQ Corp. in an all-stock transaction. This transaction values 3iQ at approximately $111.8 million and is a key step in Coincheck Group's strategy to expand its global and institutional business.

Strategic cooperation and investment intentions

AGM Group Holdings Inc. (NASDAQ: AGMH) announced the signing of a Memorandum of Understanding (MOU) with Amber Premium, a global digital wealth management platform. The two companies intend to explore strategic collaboration opportunities in the tokenization of real-world assets (RWAs).

Vystar Corporation (OTCQB: VYST) has filed a binding letter of intent to acquire an equity stake in GoPaid.com LLC, a company focused on commemorative tokenization. Under the terms, the acquisition will include a portion of GoPaid's proprietary cryptocurrency, or valued at no more than $10 million. This move is intended to invest in GoPaid's commemorative tokenization business.

Market perspective

Yesterday's developments showcased two complementary strategies employed by listed companies in their cryptocurrency strategy. Coincheck's acquisition of a mature asset management company reflects the institution's intention to quickly gain compliant product capabilities and market share by integrating professional resources. Meanwhile, the actions of AGM Group and Vystar indicate that more companies are attempting to enter promising niche markets like RWA through strategic partnerships or equity investments, applying cryptocurrency technology to a broader range of assets. (Source: ME)