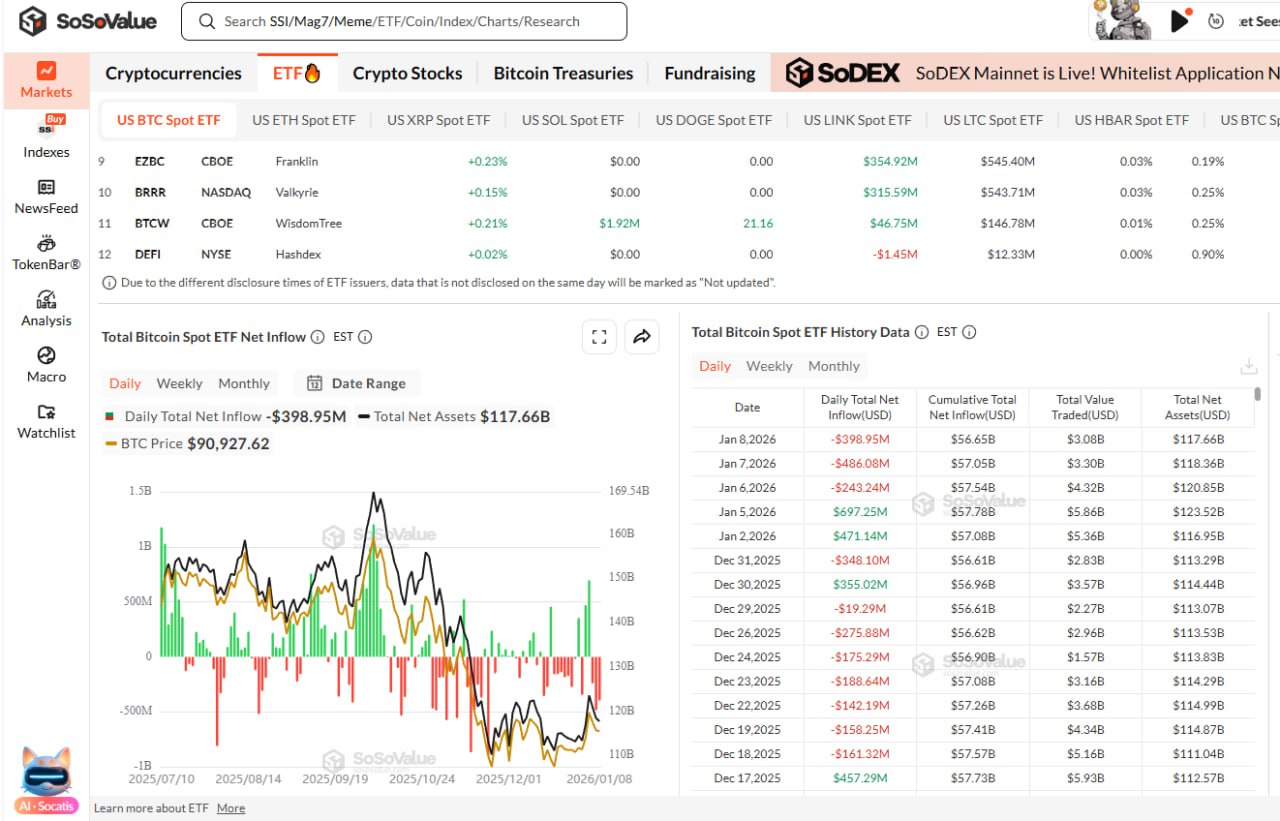

Crypto ETF flows are mixed: Bitcoin and Ethereum continue to experience Capital, while Solana and XRP attract investment. Yesterday, January 8th, the flow of money in the crypto ETF market showed a clear divergence among major assets. Spot Bitcoin ETFs witnessed net Capital of up to $399 million, indicating investor caution in the face of short-term market volatility. Similarly, spot Ethereum ETFs also recorded net Capital of $159 million, reflecting profit-taking pressure after the previous price surge. Conversely, some altcoins attracted significant inflows. The Solana spot ETF recorded net Capital of $13.64 million, while the XRP spot ETF attracted an additional $8.72 million. This development suggests that investors are diversifying their portfolios, shifting some Capital from Bitcoin and Ethereum to assets with higher short-term growth potential. This divergence in ETF inflows is XEM as an important signal reflecting a shift in risk appetite in the crypto market at the beginning of the year. Bitcoin is currently trading at $90,400, leaving room for further growth despite general market expectations of future price increases.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content