Author: Prathik Desai

Original title: Circle Draws an Arc, Can it address the rate-cut problem?

Compiled and edited by: BitpushNews

2026 is here, and when we're making video calls with people all over the world, the delay is at most a second or two, with marginal costs practically zero. However, when it comes to transferring funds between institutions, countries, or systems, we still face deadlines, exorbitant fees, and reliance on settlement windows that close on weekends.

Cryptocurrencies promised to solve this problem with stablecoins , which have been around for over a decade. However, despite the significant, quantifiable savings that stablecoins offer, businesses and commercial institutions have not fully embraced them for fund transfers.

We've discussed this issue before, and how inherent privacy concerns in public blockchains can become an obstacle here. We also list privacy infrastructure as a top cryptocurrency topic to watch in 2026.

Stablecoin issuer Circle has seized this opportunity to address the industry’s need for privacy and stablecoin infrastructure through its first-layer blockchain, Arc.

In this in-depth analysis, I will explain why Circle is now building an L1 blockchain, what its biggest challenges are, and how this move may change the stablecoin ecosystem.

The story begins...

Why launch L1 blockchain now?

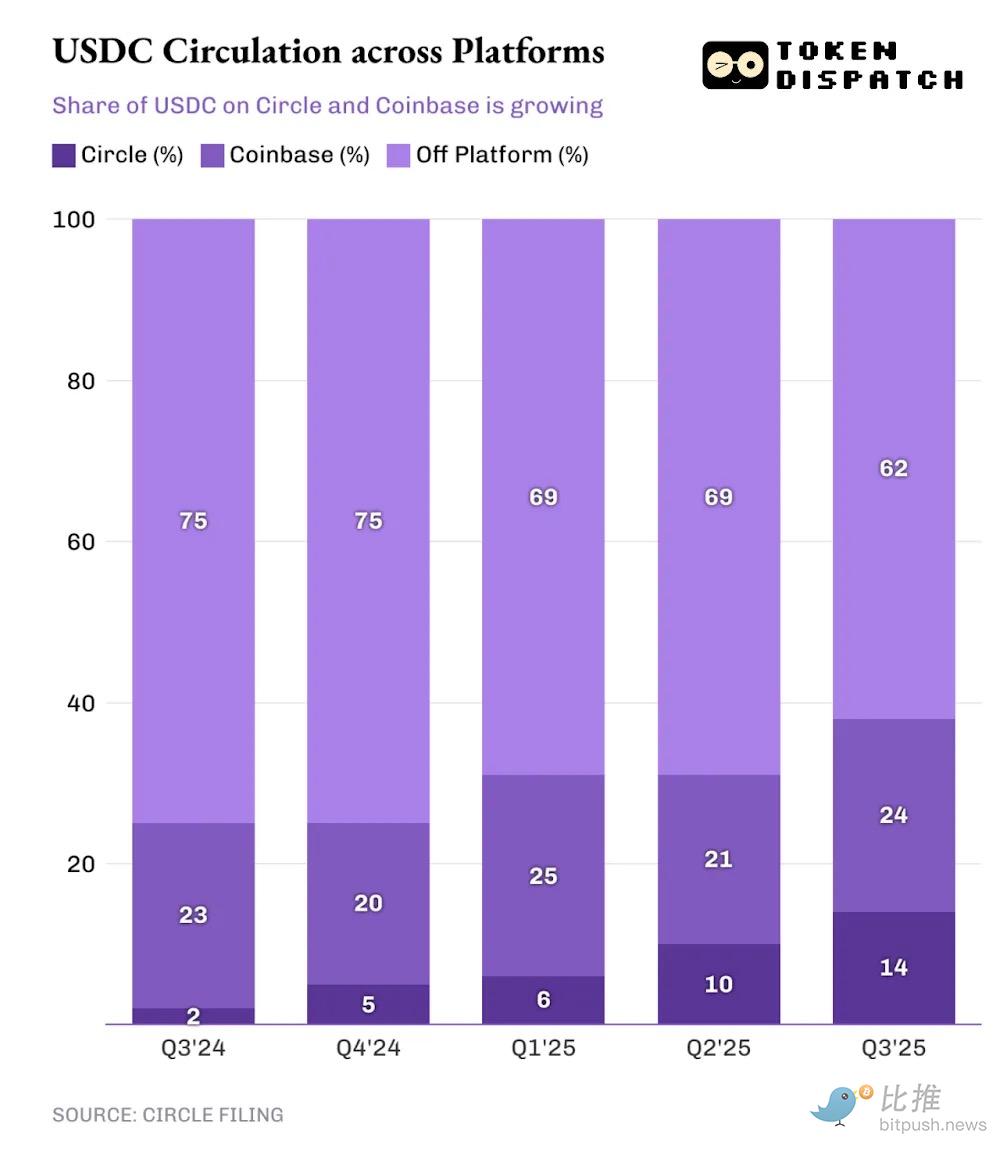

Currently, stablecoin issuance is entirely driven by interest income and heavily reliant on distribution channels. This has become even clearer since its launch last June, through public reports from USDC issuers.

I mentioned this last year:

In the third quarter, although USDC circulation increased by over 100% year-over-year, reserve income only grew by 66% to $711 million. The remainder was offset by the Federal Reserve's interest rate cuts. A 96 basis point drop in average yield resulted in a $122 million decrease in Circle's reserve income.

For every $1 of reserve revenue Circle earns in the third quarter, it spends more than 60 cents on distribution and transaction costs, including wallet integrations, exchange listings, incentive programs, and revenue sharing.

The Federal Reserve has begun cutting interest rates. In December 2025, it will lower the effective interest rate by 25 basis points to 3.50%–3.75%. The central bank also announced that it will end its quantitative tightening policy on December 1st.

Recently, the US economy has also been signaling to policymakers that it's time to soften its stance in response to disappointing data.

The Institute for Supply Management's (ISM) manufacturing purchasing managers' index (PMI) for December 2025 was 47.9 (a reading below 50 indicates contraction), marking the tenth consecutive month of contraction. The December jobs report will be released later today, but data from the past few months has been lackluster.

When you put all of this together, you can explain why Circle is desperately shifting to a new business model.

This publisher hopes to reduce its reliance on short- to medium-term interest rate declines while building a second engine that can rely on a wider and more diversified distribution channel.

Arc Transformation

Arc is precisely the transformation direction that Circle relies on.

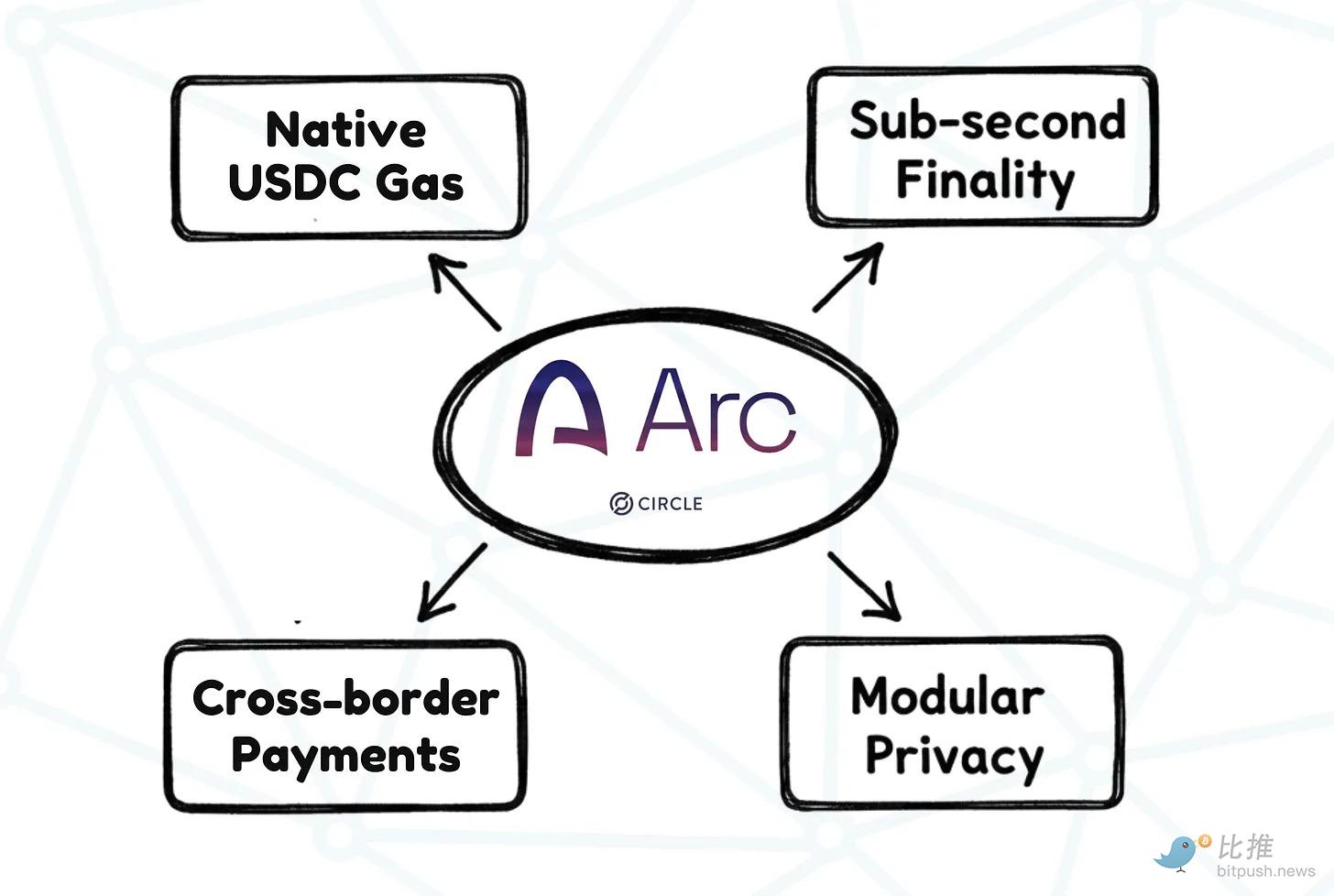

Circle builds Arc as an open, Layer 1 blockchain designed specifically for cross-border payments between businesses via stablecoins. It also aims to provide sub-second finality (transaction final confirmation speed) and configurable privacy options, allowing businesses to shield confidential payment data by choosing to enable privacy features.

By transforming itself from a stablecoin issuer into a stablecoin settlement stack operator, Circle aims to establish its business model that allows funds to flow in a way that businesses care about.

During the testnet phase, Circle's Arc has already established partnerships with over 100 companies, including traditional financial and technology giants such as BlackRock, Amazon Web Services, HSBC, Standard Chartered Bank, and Visa.

Although Arc is still in the testnet phase and will face a number of challenges before it succeeds (which I will discuss later), I think it's an interesting move given the timing of its launch and the problems it aims to solve.

First, gas fees (network fees) are collected in the native token. Arc is designed to collect low, predictable, and dollar-denominated transaction fees in USDC. This eliminates the need for corporate finance departments to hold ETH, SOL, or any other cryptocurrency simply to pay transaction fees.

Secondly, Arc offers sub-second finality and a 24/7 open settlement window. CFOs don't care about cutting milliseconds like traders do, but they'd lose sleep if a payment couldn't be settled after clicking "send" due to a weekend or a cross-border intermediary chain.

Third, and perhaps most importantly, Arc offers configurable privacy. By explicitly providing optional privacy features, it bridges the gap between the built-in transparency of public blockchains and the need for businesses to ensure the confidentiality of sensitive information such as B2B supplier invoices, fund transfers, and payroll settlements.

Most interestingly, none of these features require stakeholders to accept the ideology of cryptocurrency. Instead, Arc removes cryptographic features that businesses dislike, such as absolute transparency, fluctuating fees, and uncertain settlements, enabling blockchain to be used in mainstream business.

But can't Circle build these functionalities on an existing chain? Why build its own blockchain?

Circle has always been "renting space." On other people's chains, Circle is forced to inherit their fee tokens, compete with other participants for network resources and face congestion, follow their governance rules, and be subject to their network outage risks. It also loses its entire revenue stream if it cannot collect fees in USDC. Circle has already paid distribution costs for expanding USDC's reach on other platforms. By launching its own chain, it hopes to own the "space" and earn "rent" by providing "space" to everyone who uses its infrastructure.

However, this was not an easy victory. Circle had no shortage of formidable competitors lurking in their wake.

On the issuer side, Tether remains the biggest threat, boasting the highest liquidity globally. It has also launched the regulatory-friendly stablecoin USAT to strengthen its presence in the US market.

Besides publishers, players like Stripe also pose a threat, as they are building something similar to what Circle is doing through Arc.

In September 2025, Stripe and Paradigm announced Tempo, a payment-first blockchain built around stablecoins. Tempo's architecture allows gas fees to be paid using any stablecoin and is also designed to achieve sub-second finality.

Besides external threats, Arc itself may also encounter many problems.

It may face cold start difficulties in attracting liquidity and developers. Businesses won't choose Circle's Arc just because it looks best on paper. Many businesses are already using traditional payment platforms, such as PayPal , and will prefer platforms that already have counterparties and integration services.

Arc's "configurable privacy" will be a controversial topic. The optional feature gives businesses what they want, but it will also attract the attention of regulators. Arc must prove to the market that privacy here means "auditable trade secrets," and not just a blind spot that could create new vulnerabilities.

Despite these obstacles, I am optimistic about Circle's opportunities for two reasons.

First, there's its distribution channels and reputation . Circle doesn't need to prove to the market that USDC is a genuine US dollar token. It's already embedded in countless exchanges, wallets, and fintech processes, and increasingly entering institutional pipelines. Now that Circle is a publicly traded company, its actions appear unlike any other crypto company. Its public reputation lends credibility to its products. This also compels Circle to structure Arc in a way that can be clearly explained to its compliance and finance teams on board.

The second is the Circle payment network . Combined with Arc, it can establish a network of institutions and payment gateways to execute real-world transactions within a compliant framework.

Arc could still fail. But does it have any other options? With the era of interest rate cuts officially underway, and more cuts likely in the new year, this is the only reasonable choice for a publisher facing fierce competition.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush