U.S. Congressman Byron Donalds publicly registered to purchase $100,000 worth of Bitcoin this week. This move came as a surprise, given his current position as a member of the Subcommittee on Digital Assets in the U.S. Congress.

This incident occurred at a time when the stock trading activities of lawmakers are being more tightly scrutinized. It also fueled speculation that a bill on the structure of the crypto market might be about to be passed – and if that happens, it could be a catalyst for a sharp rise in Bitcoin prices.

What does Congress's Bitcoin purchase signal?

The Subcommittee on Digital Assets, Financial Technology, and Artificial Intelligence is responsible for researching and drafting legislation related to the digital economy.

As the crypto market develops rapidly, this subcommittee is playing an increasingly important Vai in building a clear legal framework for digital assets and financial technologies in general.

Given Donalds' Vai on this subcommittee, the timing of his Bitcoin purchase raised concerns that lawmakers might have access to sensitive information before it was made public.

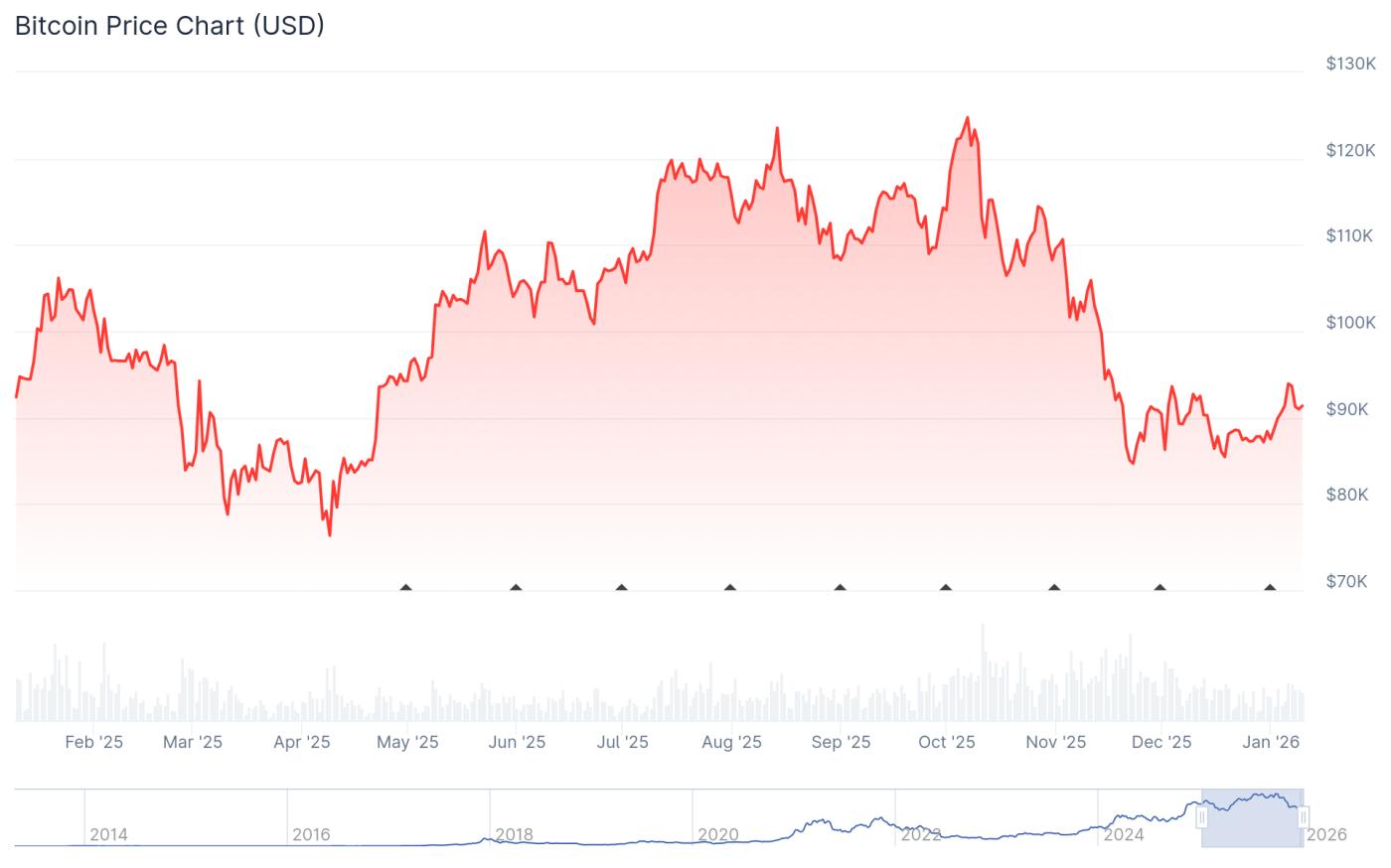

This buying spree further fueled market speculation about Bitcoin's future direction as the new year began. At the time of writing, Bitcoin was trading at $91,370, after months of volatility during which the price plummeted to as low as $84,000 and repeatedly failed to regain the $100,000 mark.

Market analysts are also concerned that declining demand for Bitcoin could be a sign it has entered a bear market. In a recent interview with BeInCrypto, CryptoQuant analyst Julio Moreno predicted that Bitcoin could bottom Dip at $56,000 sometime in 2026.

Bitcoin price chart. Source: CoinGecko .

Bitcoin price chart. Source: CoinGecko .Nevertheless, there are still positive signs for Bitcoin. The fact that a key congressman bought a large amount could indicate that many people expect the price to recover before major market pressures emerge.

The crypto market structure bill currently being debated in Congress could be exactly what Bitcoin needs for a stronger recovery.

Why is the Clarity Act important for Bitcoin?

In July 2024, the House of Representatives passed the Clarity Act – a bill aimed at regulating the crypto market. Since then, the Senate has also been developing its own version called the Responsible Financial Innovation Act.

This draft is currently under XEM by the Senate Agriculture Committee and the Senate Banking Committee. The Agriculture Committee has already released a draft for discussion, but the Banking Committee has yet to release any further information.

Only when both committees have completed their work will the bill be brought to a vote in the Senate. If it receives sufficient support, the bill will return to the House of Representatives for final approval before being signed into law by President Donald Trump.

Despite recent political delays, some sources indicate that the Clarity Act is likely to be passed as early as March. If this happens, it could significantly impact the price of Bitcoin.

The passage of the GENIUS Act in July 2023 is proof of the powerful impact of legal events on the market. After Trump signed the law , the price of Bitcoin surged to as high as $119,000 — and many expect a similar surge if the CLARITY Act is passed.

For a long time, the crypto market has developed under pressure from an unclear legal framework, so a large-scale bill like this will give investors and users more confidence. It would also be a strong legal catalyst if the bill is passed.

Meanwhile, Donald's recent Bitcoin purchases have further fueled the debate over banning lawmakers from trading stocks.

Congress faces the issue of insider trading.

Donalds is not the only one in Congress under scrutiny for his investment activities, as many lawmakers hold privileged positions related to finance.

In October 2023, BeInCrypto reported that Louisiana Congressman Cleo Fields had made several well-timed stock transactions related to IREN – a Bitcoin mining company. As a member of the House Financial Services Committee, Fields' investment subsequently increased by 233%.

Later that month, Congressman Jonathan Jackson – a member of the Subcommittee on Commodity Markets, Digital Assets, and Rural Development – made his first purchase of Robinhood stock .

The debate about stock trading isn't limited to the crypto sector; it encompasses all types of assets in the market.

Although this is a long-standing issue, for the past year lawmakers have been continuously pushing through bills aimed at preventing members of Congress from conducting transactions based on non-public insider information.

On Saturday, Congressman Ritchie Torres confirmed plans to introduce legislation banning federal officials and executive branch employees from trading forecast contracts when they have knowledge of unpublicized information. Like Donalds and Jackson, Torres is also a member of the Subcommittee on Digital Assets.

In October 2023, Congressman Ro Khanna also introduced a bill prohibiting the President, members of the President's family, and members of Congress from trading crypto or stocks, as well as receiving money from foreign countries.