Feels like people are still sleeping on how specific the “banking chain” lane is that @RaylsLabs is carving out.

🔷 Rayls in one glance

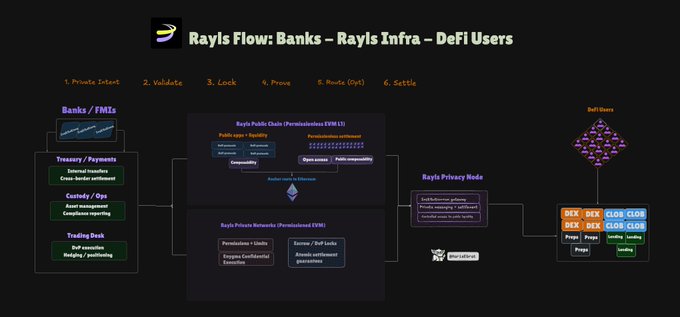

➤ Purpose-built EVM infra for banks, FX, RWAs and CBDC-style rails

➤ Hybrid design: public L1 plus private institutional networks for regulated players

➤ Already tied into real pilots in Brazil around Drex and receivables tokenization

🔷 $RLS token angle

➤ Fixed 10B supply with 50% of all network fees burned

➤ Value lines up with real settlement volume, not just emissions

If bank-grade RWAs and CBDCs really scale onchain, something like Rayls is probably in the flow.

twitter.com/HarisEbrat/status/...

make Rayls the best

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content