For investors who feel lost amidst the noise of the cryptocurrency market, " TokenPost Academy ," with its eight years of field expertise, presents a true investment benchmark. We invite you to embark on a seven-step masterclass journey that will help you achieve your goal of joining the top 1%, relying on data instead of intuition and skill instead of luck. [Editor's Note]

"I woke up to find that Bitcoin had crashed and I was forced to liquidate my position."

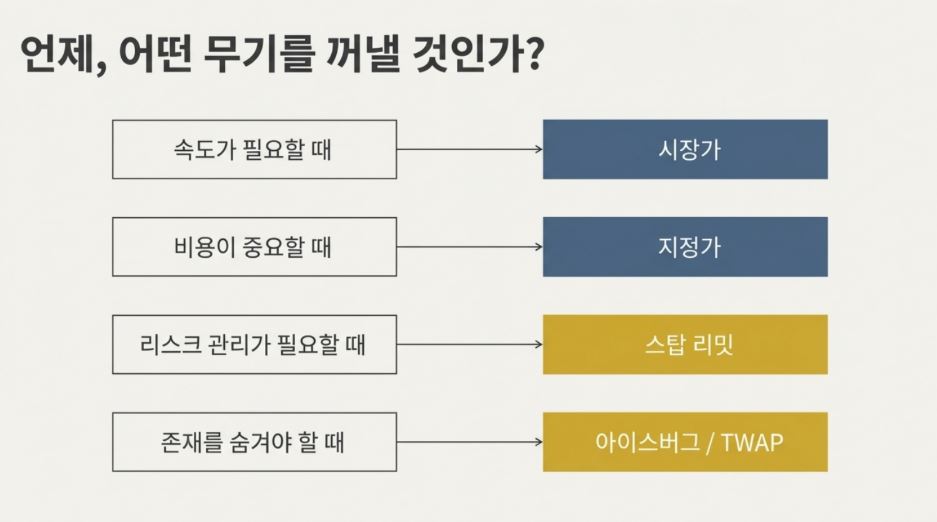

The cryptocurrency market operates 24 hours a day. You never know what might happen while you're asleep. But you can't just watch the 24-hour charts. That's why "smart orders" are so crucial.

It's not simply "buy at this price" or "sell right now." It's about setting conditional statements (if-thens) like "if the price falls to this level, sell." Just knowing this will help you stop brain trading and trade systematically.

1. A shield to protect my assets: Stop-Limit

This is the most essential order. It's used for "stop loss" and "breakout trading." The principle is simple: "When the price reaches A (trigger), place an order at B (order price)."

Usage example (stop loss): Bitcoin is currently at $50,000. I'd place a stop loss order saying, "If $49,000 is broken (Trigger), a larger decline is expected, so sell all positions at $48,900 (Limit Order)." This way, even if the market crashes, my losses will be capped at that point.

2. Whale Stealth: Iceberg

Have you ever seen someone selling continuously on the order book, even though there aren't many items for sale? It's called an "iceberg order," showing only a small portion of the order, like the tip of an iceberg, while hiding a huge amount of inventory behind it.

If whales put 1,000 units up for sale at once, the ants will panic and throw them away first, causing the price to plummet. So, they split the order into 10-unit increments and automatically place orders. If you're wondering, "Someone's still taking them?", it's likely an iceberg hoarding operation.

3. The Magic of Averages: TWAP (Time Weighted Average Price)

"I need to buy 1 billion won worth, but if I buy it all at once, the price will go up too much." In cases like this, the 'TWAP (Time Weighted Average Price)' order is used.

The system automatically divides purchases into small amounts every minute for an hour. This allows for the accumulation of volume at the "average price" for that time period without shocking the market (preventing slippage). This is a method commonly used by institutional investors to enter large positions.

"Ordering is also a strategy."

Even a single buy button hides a hidden strategy. While beginners focus solely on price, experts consider "how" to buy. Choosing the right order method for the situation is the beginning of smart trading.

👉 [Practical Trading] From setting stop limits to OCO (One Cancel Other) orders, learn the pros' know-how to fully utilize HTS functionality in TokenPost Academy 's "Step 4: The Trader" course.

(Click here to register for classes: https://academy.tokenpost.kr )

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.