Asset manager Grayscale has revealed the latest update to its “Assets Under Consideration” list for the first quarter of 2026.

The list includes a diverse array of altcoins that could likely shape the firm’s future offerings. As part of its review process, the investment manager updates its product catalog around 15 days after the end of each quarter.

Grayscale Updates Crypto Asset Watchlist for Q1 2026

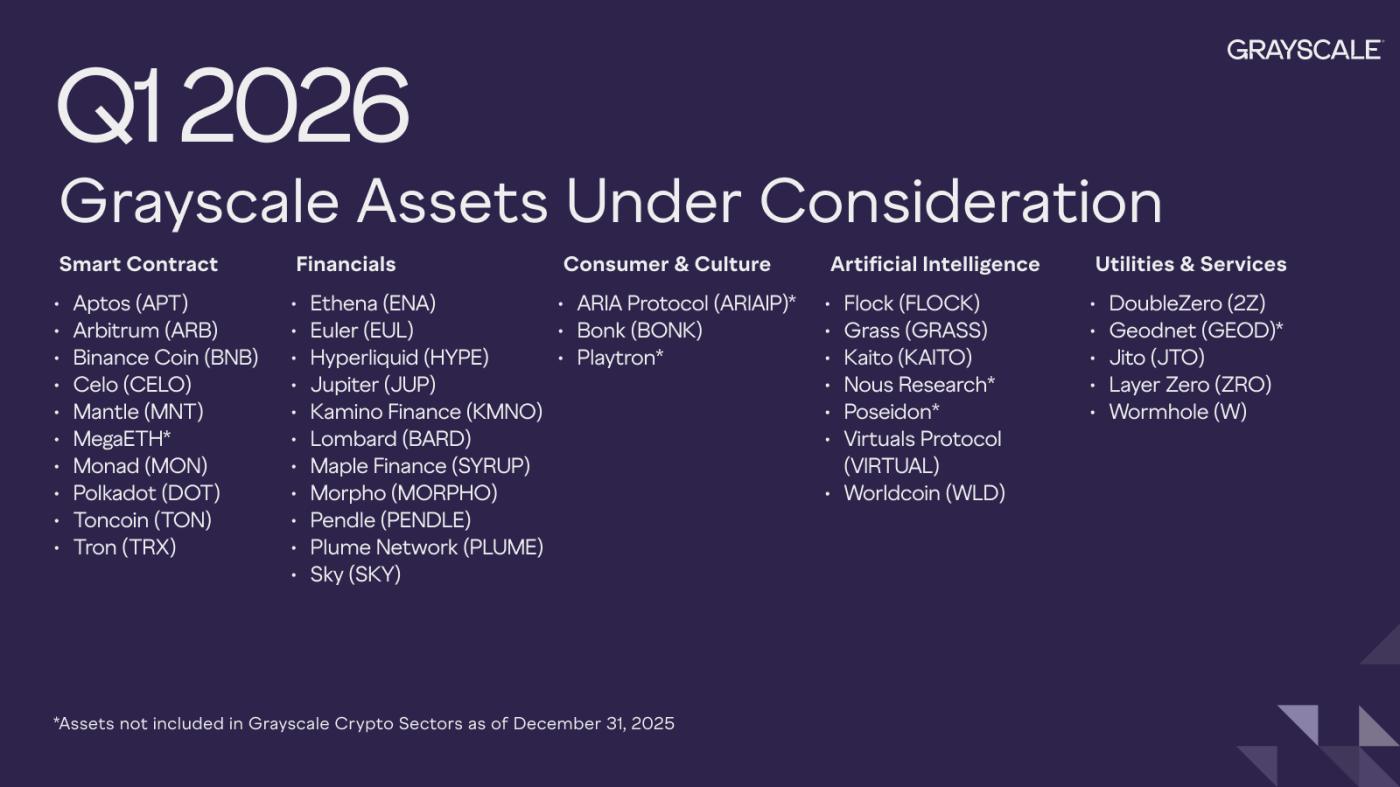

In its latest update, Grayscale revealed 36 altcoins in its “Assets Under Consideration” list. Being listed does not guarantee asset inclusion, but it signals active evaluation.

The Q1/2026 candidates span five sectors. These include Smart Contract, Financials, Consumer & Culture, Artificial Intelligence, and Utilities & Services. Smart contract platforms and financials stand out with the highest number of assets.

“Assets Under Consideration lists digital assets not currently included in a Grayscale investment product but identified by our team as possible candidates for inclusion in a future product,” the blog read.

Grayscale List of Potential Investible Assets. Source: X/Grayscale

Grayscale List of Potential Investible Assets. Source: X/GrayscaleGrayscale’s latest list shows a modest refresh from Q4 2025, which featured 32 assets. The firm has made a handful of additions and one removal across categories. In smart contracts, Grayscale added Tron (TRX).

Consumer and culture category expanded with the inclusion of the ARIA Protocol (ARIAIP). The ARIA Protocol is a platform that tokenizes intellectual property (IP) rights as liquid, crypto-based assets. It enables investors, creators, rights holders, and fans to access, trade, and earn from these assets on-chain.

The artificial intelligence segment added Nous Research and Poseidon but dropped Prime Intellect. Utilities and services also grew slightly, adding DoubleZero (2Z).

DoubleZero is a Decentralized Physical Infrastructure Network (DePIN) that provides high-performance, low-latency network infrastructure for blockchains and distributed systems.

These additions show that Grayscale is paying attention to tokenization, DePIN, and AI. Outside of these updates, the remaining assets across smart contracts, financials, AI, and utilities stayed consistent quarter over quarter.

The updated list comes as Grayscale recently took its first steps toward launching BNB and HYPE exchange-traded funds (ETFs). The firm registered statutory trusts for both products with the Delaware Division of Corporations, a procedural move that signals early groundwork for potential ETF offerings.