The real demand for Monero has consistently been far higher than its price reflects.

Written by: PerpetualCow.hl

Compiled by: AididiaoJP, Foresight News

A few days ago, I exposed the multi-billion dollar instant exchange industry, and today I'm going to connect the clues that no one on crypto Twitter has yet pieced together.

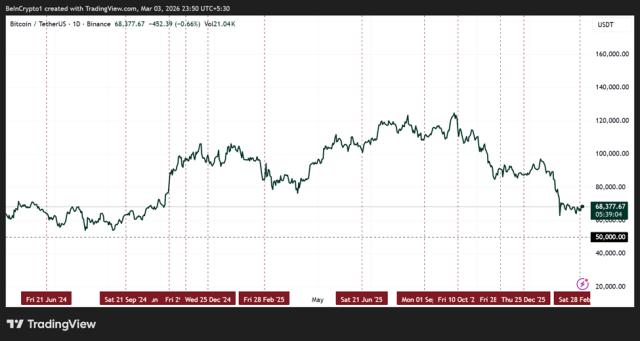

Since 2018, while almost all other cryptocurrencies have been soaring, Monero (XMR) has remained trapped in a certain range.

Most people attribute this to exchange delisting, regulatory pressure, or the notion that "privacy coins are dead."

They were all wrong.

To understand what's happening, you must first delve into the history of Monero (XMR), including all the delisting events on exchanges and how most people actually buy this coin.

Real demand for Monero (XMR)

People have always wanted Monero, not just for privacy, but also because it is seen as an alternative to Bitcoin as a store of value, much like a 21st-century Swiss bank account.

Its purpose has not changed despite exchanges being forced to remove it due to fear of regulation.

This can be compared to the illicit drug trade: when addicts cannot buy drugs from legitimate pharmacies, they will seek out more dubious channels, even at higher prices, to obtain what they need.

As a result, demand for Monero flowed to instant exchange services rather than centralized exchanges.

Think about it from the perspective of an average user in 2024:

You want to buy Monero, but Binance just delisted it, and Coinbase is too afraid to touch it. Other smaller exchanges that still trade Monero are likely to freeze your funds because they deal with this coin.

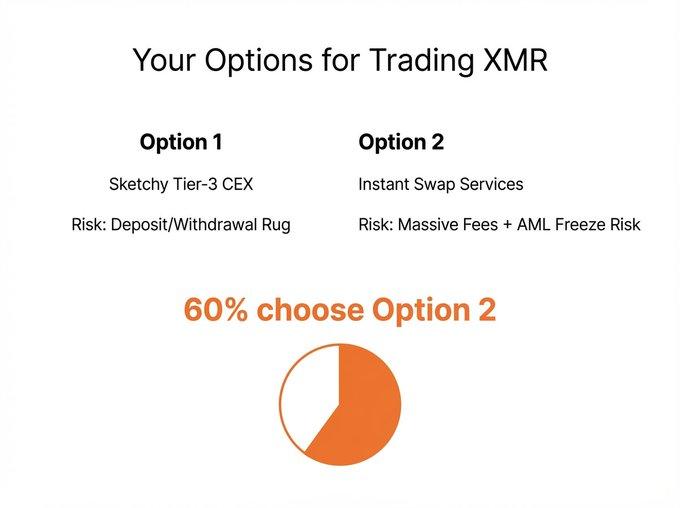

You only have two choices:

- Find a third-rate exchange that still lists Monero and pray they don't run away with your money.

- Pay hefty fees for instant exchange services and pray they don't freeze your funds indefinitely under the pretext of "anti-money laundering audits".

More than 60% of users chose the second option.

These services have become the de facto gateways for deposits and withdrawals within the Monero ecosystem.

They are certainly not legitimate, and their exchange rates are terrible, but users have no other choice.

After all the major exchanges abandoned Monero, the instant exchange industry became the only channel, taking over all the Monero trading volume.

Tracking fund flows

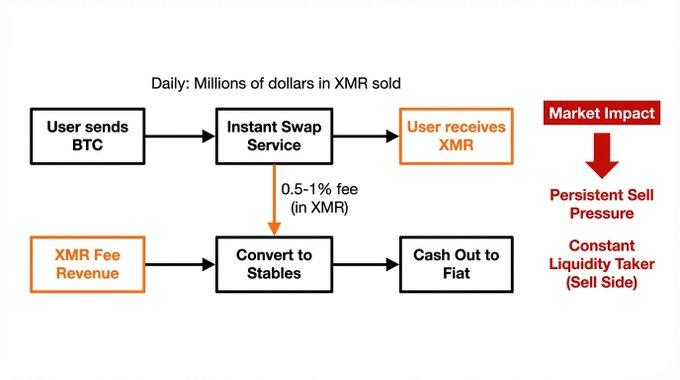

All instant redemption services operate on the same model:

When a user sends Bitcoin and receives Monero, the service provider secretly charges a 3-4% fee (while officially charging only 0.5-1%).

However, these fees are denominated in Monero.

So how do these service providers handle the Monero they receive?

They won't hold it for long; they're not believers at all. These are offshore companies seeking profits in fiat currency; they'll immediately convert Monero into stablecoins and cash out.

In this way, millions of dollars worth of Monero coins are dumped onto the market every day.

In market microstructure terms, this results in a continuous one-way outflow of funds. Regardless of the overall market conditions, these service providers are constantly selling. While this is simply part of their business model, its impact on prices is devastating.

Quantitative capital outflow

In my previous article, I estimated that the instant exchange industry processes approximately $150 billion in transactions annually (across all chains), and that's only the portion that is verifiable on-chain.

Monero transaction volume is not visible due to its privacy features, but industry estimates suggest it accounts for approximately 20% of total instant exchange traffic.

Assume that $30 billion worth of Monero is exchanged through these services annually.

Conservative estimates suggest the actual figure could be half that, around $15 billion.

Based on an average fee of 0.75% (most actually charge 1%), the annual Monero fees collected are worth approximately $112.5 million.

All of these Monero coins will be dumped on the market.

This means there's over $300,000 in passive selling pressure every day. It's like an invisible pump is constantly draining Monero's value.

This is just a conservative estimate. If Monero really does account for 20% of the trading volume and charges a 1% fee, then that's $300 million annually, close to $1 million in selling pressure per day.

But that's not all; there's also the "anti-money laundering trap."

Anti-money laundering traps

This is the "dirty secret" I revealed in my previous article: these services advertise "no KYC required," but they arbitrarily freeze users' funds under the pretext of "anti-money laundering verification."

It is estimated that 2-5% of transactions processed through the instant redemption service will be frozen. The rate of freezing is even higher for large transactions.

This creates a vicious cycle:

- Small transactions can be approved, but fees are charged 10-20 times higher than normal.

- Large transactions are frozen completely, usually permanently.

- Only a small fraction of the actual buying demand actually reaches the market.

This creates the most brutal barrier to price discovery: buyers who can truly influence prices are systematically excluded from the market.

The real demand for Monero has consistently far exceeded the level reflected by its price. The instant exchange industry either exploits this demand or blocks it altogether.

Markets in captivity

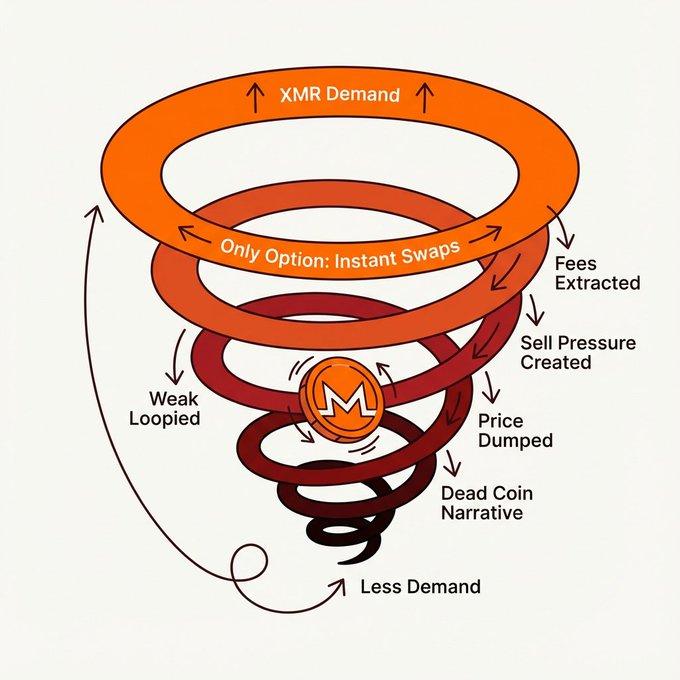

Let me explain this vicious cycle:

The instant exchange industry did not win the market through competition. When all exchanges delisted Monero, they gained a monopoly and then exploited users who had nowhere else to go.

A 1% fee, plus a terrible exchange rate, and random fund freezes.

Users tolerate it because they have no other choice, and these service providers know this all too well.

This is what happens when an entire asset class is forced into a single channel controlled by anonymous offshore operators: they extract profits with uncompetitive products.

Every penny they extracted became selling pressure on Monero.

Wagyu's solution

Wagyu v2 was launched two days ago.

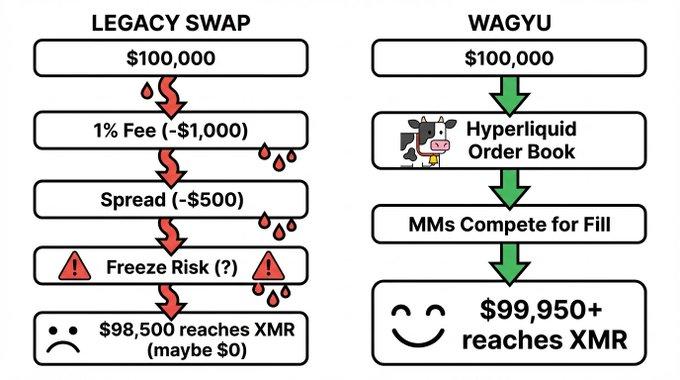

The core idea is simple: to allow Monero users to enjoy the same pricing levels as exchange traders.

When you redeem through Wagyu, your order will be routed to @Hyperliquidx—where the crypto space’s most competitive market makers vie for orders.

These market makers also provide liquidity to Binance, Bybit, and OKX, with extremely small spreads.

The result is that you can trade at exchange-level prices and fees, no longer 1% or 0.5%, but at extremely low rates like those for professional traders.

This is the first time since Monero was delisted from exchanges that users have not been "fleeced" for using their assets.

A single $100,000 transaction can prevent more than $1,000 in selling pressure from impacting the market.

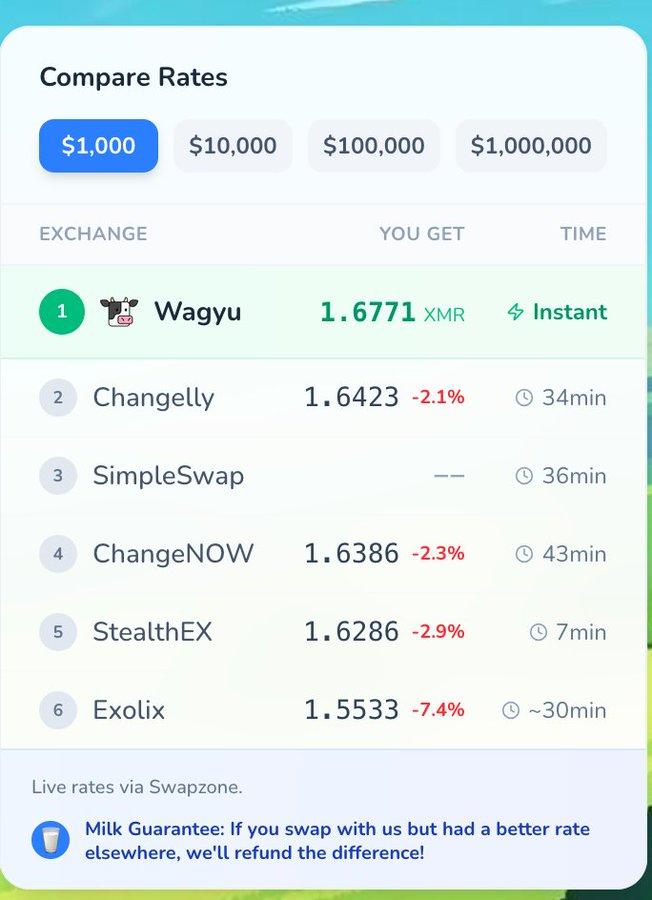

Wagyu v2 has processed millions of dollars in exchanges within 48 hours of its launch, offering the best prices on the market:

Transactions that would otherwise be conducted through traditional services, incurring fees of 1% or more and causing the market to experience a sudden sell-off of tens of thousands of dollars, are now being carried out through Wagyu.

- The $1 million exchange rate via traditional services equals $10,000 worth of Monero coins being dumped.

- The same $1 million exchange through Wagyu = zero forced sell-off

Multiply this effect by each Monero buyer who discovers they no longer need to be "robbed".

The vicious cycle that is being reversed

For years, Monero has been trapped in a negative cycle:

The instant exchange industry, acting as a value-extracting layer, lies between buyers and the true price. They intercept demand, extract profits, and distort price signals. Users cannot bypass them because they have no other choice.

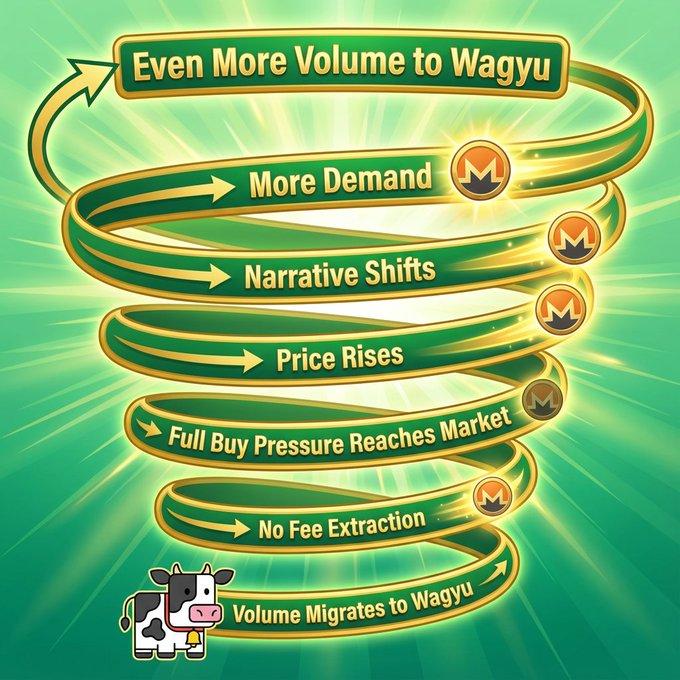

Now, all of that has changed.

Within just two days of its launch, trading volume began migrating to Wagyu. People realized they could secure Binance-level pricing for this asset, which wasn't even listed on Binance, and the news was spreading rapidly.

The cycle is reversing:

Monero's breakthrough of $600 and the initiation of its first price discovery in years is no accident.

Wagyu is saving Monero

On this point, I'm not going to be modest:

Every exchange made through Wagyu, rather than through traditional services, represents a genuine buy order reaching the market.

Every million-dollar transaction that flows through us means that more than $10,000 will not be sold to other holders.

We are not exploiting the Monero ecosystem, but rather directly connecting it to real liquidity.

The parasitic layer that has suppressed Monero for years has finally met its match. And we're not competing under their rules—we're making their entire model obsolete.

When users can obtain exchange-level pricing through Wagyu with zero risk of funds being frozen, who would still pay 1% to anonymous offshore service providers who might freeze funds?

Nobody will.

what does that mean

I'm not here to make a price prediction. I don't know if Monero will rise to $1,000, $2,000, or fall back to $400.

But I know for sure that for the first time since being delisted from exchanges, demand for Monero has been able to truly translate into price.

We've only been online for two days and we're already processing millions of dollars in transactions—transactions that would otherwise have been draining the market.

Even after the "ceiling" was removed, Monero at $600 is still undervalued. At least for now, the market will truly determine its value.

Price discovery has finally become possible, and Wagyu is making it happen.