Bitcoin continued trading within a narrow range on the 4-hour chart, signaling a pause after its recent rebound. The leading cryptocurrency showed reduced volatility, as buyers and sellers remained cautious near key technical levels. Market participants appeared focused on structure rather than momentum, with price stability reflecting indecision instead of weakness.

Consequently, short-term direction depended more on positioning and flows than sudden speculative demand. Besides that, broader market conditions encouraged traders to wait for confirmation before committing capital aggressively.

Tight Range Defines Near-Term Price Structure

On the 4-hour timeframe, Bitcoin held above the Ichimoku cloud, which kept the short-term structure constructive. However, price struggled to build strong follow-through, suggesting limited conviction among buyers.

The $92,300 region acted as a firm ceiling, repeatedly capping upside attempts. Hence, traders treated this level as the main trigger for a breakout scenario.

On the downside, support developed between $91,200 and $90,900, where buyers defended pullbacks. Additionally, the $90,500 area emerged as a pivotal zone, closely watched by short-term participants.

Related: Ethereum Price Prediction: Bitmine Stakes $4B as Tom Lee Forecasts Recovery

A sustained move below this range would likely weaken bullish positioning. Consequently, attention shifted toward deeper supports near $89,200 and $86,300 if selling pressure increased.

Derivatives Activity Signals Rising Volatility Risk

Bitcoin futures data pointed to growing participation in derivatives markets. Open interest expanded steadily during consolidation phases, showing that traders maintained exposure rather than exiting positions. Significantly, periods of rising open interest aligned with previous price advances, reinforcing trend-following behavior.

During corrective phases, open interest declined briefly, indicating leverage reductions instead of broader structural stress. Moreover, the recent rebound in open interest toward the $60 billion area suggested renewed confidence among futures traders. Hence, the combination of stable prices and increasing derivatives exposure raised the likelihood of sharper moves ahead.

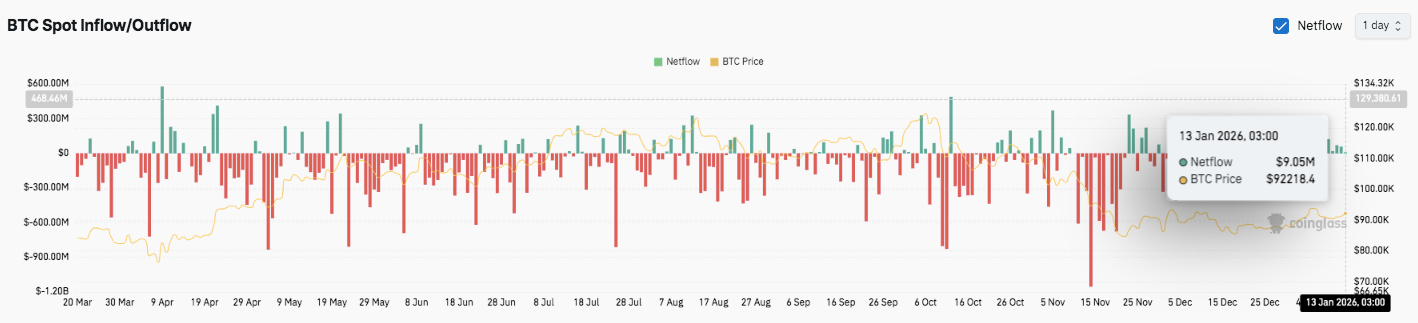

Spot Flows Reflect Defensive Market Positioning

Spot market flow data painted a more cautious picture. Persistent net outflows dominated recent sessions, highlighting defensive capital rotation by larger holders.

Although brief inflow spikes appeared during short recoveries, they failed to establish sustained accumulation. Consequently, the market showed signs of selling into strength rather than long-term buying interest.

Related: Chiliz Price Prediction 2026: FIFA World Cup and $100M U.S. Re-Entry Target $0.10-$0.15

Notably, stronger outflow surges often matched local price pullbacks, reinforcing risk-managed behavior. Additionally, recent inflows remained modest, suggesting selective participation from buyers. Overall, the flow structure emphasized liquidity preservation over aggressive positioning at current levels.

Technical Outlook for Bitcoin (BTC) Price

Key levels remain clearly defined for Bitcoin as it trades inside a tight consolidation zone.

Upside levels include $92,337 as the immediate resistance, followed by $94,654 as the major ceiling that bulls must reclaim to restart trend expansion. A confirmed breakout above $92,337 could accelerate momentum toward the mid-$94,000 region.

On the downside, initial support rests between $91,200 and $90,900, aligned with short-term structure. Below that, $90,517 remains a critical pivot, while $89,239 serves as deeper demand. Failure to hold these levels risks a move toward $86,380.

The technical picture suggests Bitcoin is compressing after its recent rebound, often a precursor to volatility expansion. Price holding above key structure supports a constructive bias, but conviction remains limited.

Will Bitcoin move higher?

The near-term Bitcoin price outlook hinges on whether buyers can defend the $90,500 area long enough to challenge $92,337. Stronger inflows and follow-through could push BTC toward $94,654.

However, a breakdown below $90,500 would weaken the structure and expose lower supports. For now, Bitcoin remains in a pivotal zone, with confirmation needed to define the next directional leg.

Related: Shiba Inu Price Prediction: SHIB Trades in a Cooling Phase After Early-Month Rally

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.